DEF 14A: Definitive proxy statements

Published on April 5, 2019

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ |

Preliminary Proxy Statement |

¨ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x |

Definitive Proxy Statement |

¨ |

Definitive Additional Materials |

¨ |

Soliciting Material under §240.14a-12 |

National Storage Affiliates Trust

(Name of Registrant as Specified In Its Declaration of Trust)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x |

No fee required. |

¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

1) |

Title of each class of securities to which transaction applies: |

2) |

Aggregate number of securities to which transaction applies: |

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

4) |

Proposed maximum aggregate value of transaction: |

5) |

Total fee paid: |

¨ |

Fee paid previously with preliminary materials: |

¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

1) |

Amount previously paid: |

2) |

Form, Schedule or Registration Statement No.: |

3) |

Filing Party: |

4) |

Date Filed: |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 23, 2019

To the Shareholders of National Storage Affiliates Trust:

We invite you to attend the 2019 annual meeting of shareholders (the "Annual Meeting") of National Storage Affiliates Trust, a Maryland real estate investment trust (the "Company," "we," "our" or "us").

Meeting Date: |

May 23, 2019 |

Time: |

8:00 a.m., local time |

Location: |

8400 East Prentice Avenue, 2nd Floor, Greenwood Village, Colorado 80111 |

Record Date: |

March 29, 2019 |

Items of Business: |

1. Election of Nine Trustees to the Company's Board of Trustees |

2. Ratification of Appointment of KPMG LLP as Independent Registered Public Accounting Firm for 2019 |

|

3. Non-Binding Advisory Resolution to Approve Executive Compensation |

|

4. Transaction of Other Business that Properly Comes Before the Annual Meeting |

|

Method of Access: |

We are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our common shareholders of record as of the close of business on the record date. The Notice contains instructions on how to access our proxy statement and annual report over the Internet, how to authorize your proxy to vote by Internet, telephone or mail, and how to request a paper copy of the proxy statement and annual report. |

How to Vote: |

If you are a registered holder of our common shares as of the close of business on the record date, the Notice was sent directly to you and you may vote your common shares in person at the Annual Meeting or by submitting your proxy to the Company using the instructions in the Notice. If you hold our common shares in "street name" through a brokerage firm, bank, broker-dealer or other intermediary, the Notice was forwarded to you by that intermediary and you must follow the voting instructions provided by the intermediary. |

Your proxy is being solicited by our board of trustees.

We hope that all shareholders who can do so will attend the Annual Meeting in person. Whether or not you plan to attend, we urge you to promptly submit your proxy or voting instructions to help the Company avoid the expense of follow-up mailings and ensure the presence of a quorum at the Annual Meeting.

Our board of trustees recommends that you vote:

ü |

FOR Each Trustee Nominee |

ü |

FOR the Ratification of KPMG LLP as our Independent Registered Public Accounting Firm for 2019 |

ü |

FOR the Advisory Approval of our Executive Compensation |

By Order of the Board of Trustees, |

|

|

|

Tamara D. Fischer |

|

President, Chief Financial Officer, Treasurer and Secretary |

|

Greenwood Village, Colorado

April 5, 2019

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 23, 2019. The Proxy Statement, our 2018 Annual Report to Shareholders, and the means to vote in person or by Internet, telephone or mail are available at: www.proxyvote.com. You will need to enter the control number found on your proxy card to access these materials via the Internet.

TABLE OF CONTENTS |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

5

|

PROXY STATEMENT SUMMARY |

This summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information that you should consider. You should carefully read this entire Proxy Statement before voting.

VOTING PROPOSALS AND RECOMMENDATIONS

Voting Matter |

Board Recommendation |

Vote Required |

1. Election of Trustees |

FOR each of the nominees

|

Majority of votes cast |

2. Ratification of Appointment of Independent Registered Public Accounting Firm |

FOR |

Majority of votes cast |

3. Non-Binding Vote to Approve Executive Compensation |

FOR |

Majority of votes cast |

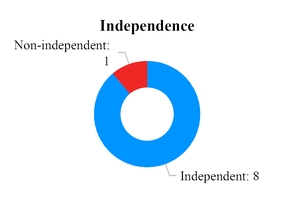

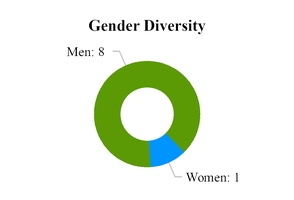

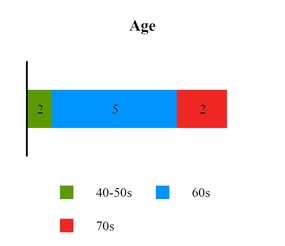

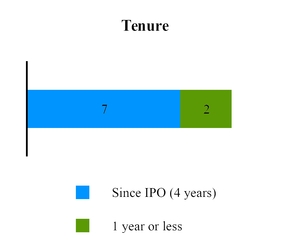

SNAPSHOT OF BOARD COMPOSITION

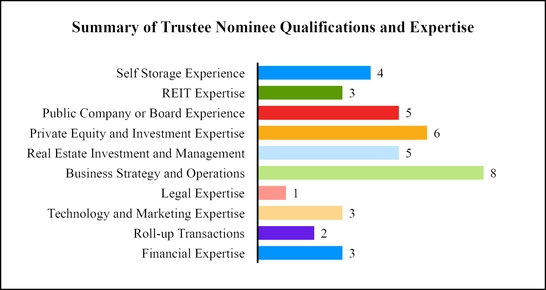

Our trustee nominees represent a mix of independence, age, gender, tenure, skills and experience:

Skills and Experience Supporting Our Growth Strategy | ||||

Self Storage Experience |

REIT Expertise |

Technology and Marketing Expertise |

Public Company or Board Experience |

Private Equity and Investment Expertise |

Financial Expertise |

Legal Expertise |

Real Estate Investment and Management |

Business Strategy

and Operations

|

Roll-up Transactions |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

6

|

CORPORATE GOVERNANCE HIGHLIGHTS

We have a strong corporate governance framework which we believe is important to promoting the long-term interests of our shareholders. Our corporate governance framework includes the following elements:

ü |

8 of 9 trustee nominees are independent |

ü |

Equityholders may amend bylaws |

ü |

Lead independent trustee |

ü |

Majority voting in uncontested elections |

ü |

Annual election of all trustees |

ü |

Robust minimum equity ownership guidelines |

ü |

Elected first female trustee in 2018 |

ü |

Active shareholder outreach program |

ü |

Three Audit Committee financial experts |

ü |

No poison pill |

ü |

Clawback policy for previously paid executive compensation |

ü |

Prohibition against hedging the value of Company securities |

|

ü

|

No excise tax gross-ups on payments made in connection with a change of control |

ü

|

Opted out of Maryland's control share acquisition statute and unsolicited takeover act |

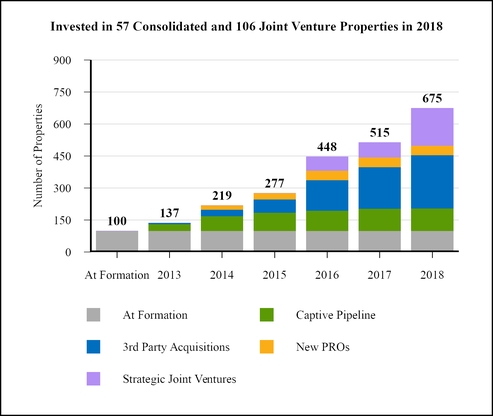

2018 BUSINESS HIGHLIGHTS

Core FFO Per Share(1) Increased 11.3% in 2018

|

2018 Same Store Total Revenue Growth of 4.0% |

2018 Same Store NOI Growth of 4.7%(1)

|

5th largest self storage property owner and operator in U.S. with 675 properties(2)(3)

|

2018 Dividend Growth of 11.5% |

Approximately 43 million rentable square feet(3)

|

|

$1.325 billion Simply Self Storage Acquisition through New 2018 Joint Venture

4th Largest Transaction in History of Self Storage Sector(4)

| ||

(1) Our same store portfolio is defined in our annual report on Form 10-K filed with the SEC on February 26, 2019. Core FFO and Net Operating Income ("NOI") are defined and reconciled to their most directly comparable U.S. generally accepted accounting principles ("GAAP") measure in Appendix A to this Proxy Statement.

(2) Source: 2019 Self-Storage Almanac, based on number of properties with company ownership.

(3) Property information as of December 31, 2018. Includes 176 properties NSA manages through its joint ventures, in which NSA has a 25% ownership interest.

(4) Source: Bank of Montreal, S&P Global, Inc., Thomson Reuters Corporation, by enterprise value.

Our environmental and social initiatives include:

¸ |

Commenced LED lighting conversion evaluation and replacement initiative |

Ï |

Together with Arlen D. Nordhagen, our chairman and chief executive officer, funding $500,000 toward a college scholarship endowment for self storage sector employees through the Self Storage Association Foundation |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

7

|

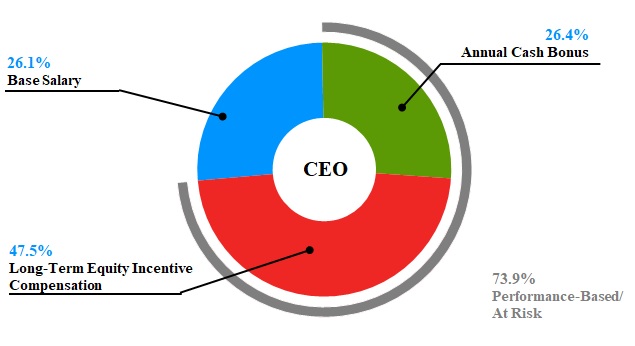

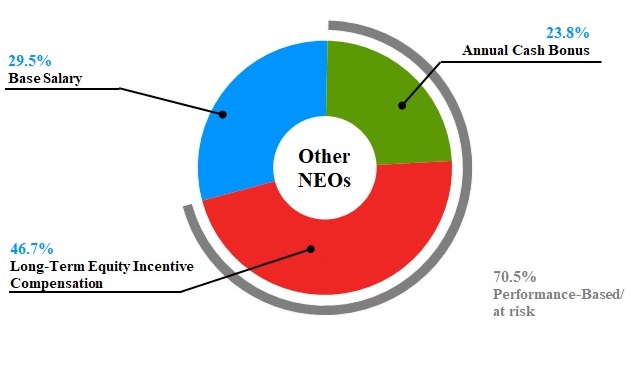

EXECUTIVE COMPENSATION HIGHLIGHTS

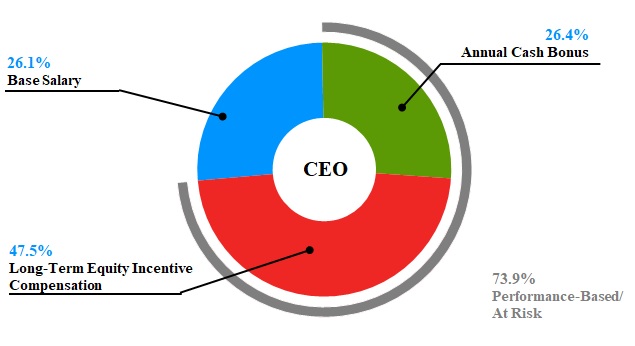

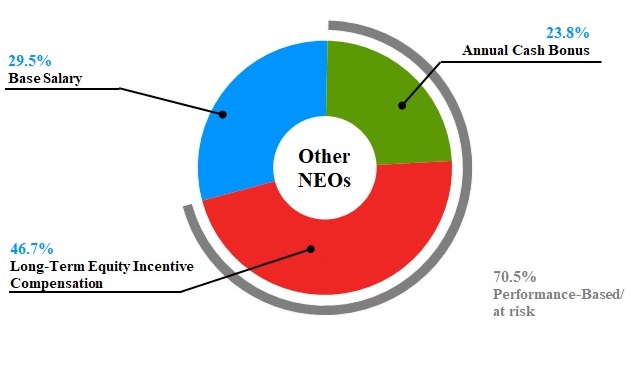

A significant portion of our Named Executive Officers' compensation is variable or performance-based compensation, which aligns their interests with those of our shareholders. In 2018, more than 70% of our Named Executive Officers' target pay was at risk. For more information on our Named Executive Officers and our compensation philosophy, see "Information Regarding Our Named Executive Officers" and "Compensation Discussion and Analysis."

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

8

|

GENERAL MEETING INFORMATION |

We are providing this Proxy Statement on behalf of the board of trustees of National Storage Affiliates Trust, a Maryland real estate investment trust (the "Company," "we," "our" or "us"), to solicit your proxies for use at the Annual Meeting. Our common shares of beneficial interest, par value $0.01 per share (the "Common Shares"), are listed on the New York Stock Exchange (the "NYSE") under the symbol "NSA".

This Proxy Statement, the Notice of Annual Meeting of Shareholders and the related proxy card are first being made available to shareholders on or about April 5, 2019.

VOTING INFORMATION

Meeting Date, Time and Location

The Annual Meeting will be held at 8400 East Prentice Avenue, 2nd Floor, Greenwood Village, Colorado 80111, on May 23, 2019, at 8:00 a.m., local time, or at any postponements or adjournments thereof.

Record Date

The record date is March 29, 2019.

Who Can Vote

Holders of our Common Shares on the close of business on the record date are entitled to vote. For all matters submitted for a vote at the Annual Meeting, each Common Share is entitled to one vote. As of March 29, 2019, we had 56,699,541 Common Shares that are issued, outstanding and entitled to vote at the Annual Meeting (including unvested restricted Common Shares).

Proxy Materials Provided Through Internet

Pursuant to the rules adopted by the Securities and Exchange Commission (the "SEC"), we have provided access to our proxy materials over the Internet, and we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our common shareholders of record who are entitled to vote at the Annual Meeting. We believe that posting these materials on the Internet enables us to provide shareholders with the information that they need more quickly. It also lowers our costs of printing and delivering these materials and reduces the environmental impact of the Annual Meeting. The Notice and this Proxy Statement summarize the information you need to know to vote by proxy or in person at the Annual Meeting.

Shareholders of Record and Holders in "Street Name"

If you are a registered holder of Common Shares as of the close of business on the record date, the Notice was sent directly to you and you may vote your Common Shares in person at the Annual Meeting or by proxy. If you hold Common Shares in "street name" through a brokerage firm, bank, broker-dealer or other intermediary, you are a beneficial owner, and the Notice was forwarded to you by that intermediary and you must follow the instructions provided by the intermediary regarding how to instruct the intermediary to vote your Common Shares.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

9

|

Recommendations of our Board of Trustees

Our board of trustees recommends that your vote:

ü |

FOR the Election of Nine Trustees to Serve on our Board of Trustees |

ü |

FOR the Ratification of KPMG LLP as our Independent Registered Public Accounting Firm for 2019 |

ü |

FOR the Advisory Approval of our Executive Compensation |

The board of trustees knows of no other matters that may properly be brought before the Annual Meeting. If other matters are properly introduced, the persons named in the proxy as the proxy holders will vote on such matters in their discretion.

Quorum Required

The presence, in person or by proxy, of holders of Common Shares entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting on any matter to be considered at the Annual Meeting shall constitute a quorum. Abstentions and broker non-votes are each included in the determination of the number of shares present at the Annual Meeting for the purpose of determining whether a quorum is present.

A broker non-vote occurs when a nominee holding shares for a beneficial owner (i.e., a brokerage firm, bank, broker-dealer or other intermediary) delivers a properly-executed proxy but does not vote on a particular proposal because the nominee does not have discretionary voting power for that particular matter and has not received instructions from the beneficial owner.

Vote Required

If a quorum is present, then the affirmative vote required to approve the proposals described in this Proxy Statement are as follows:

Proposal |

Vote Required |

Election of a Trustee |

A majority of votes cast for and against the election of such nominee |

Ratification of KPMG LLP as Independent Registered Public Accounting Firm for 2019 |

A majority of votes cast on the proposal |

Non-Binding Vote to Approve Executive Compensation |

A majority of votes cast on the proposal |

The vote on compensation is advisory and not binding on our board of trustees. However, our board of trustees and the Compensation, Nominating and Corporate Governance Committee of our board of trustees (our "CNCG Committee") value all shareholder feedback and will consider the outcome of the vote in reviewing executive compensation.

How Proxies will be Voted

Common Shares represented by properly submitted proxies received by us prior to the Annual Meeting will be voted according to the instructions specified on those proxies.

If you are a registered holder of Common Shares and have given a properly authorized proxy without specifying any voting instructions, and the proxy is not revoked prior to the Annual Meeting, then the Common Shares represented by such proxy will be voted:

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

10

|

•FOR the election of the nominees named in this Proxy Statement as trustees;

•FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019; and

•FOR the approval of the compensation of the Named Executive Officers as described in this Proxy Statement.

As to any other business which may properly come before the Annual Meeting or any postponements or adjournments thereof, the persons named as proxy holders on your proxy card will vote the Common Shares represented by properly submitted proxies in their discretion.

If your hold your Common Shares in "street name" through a brokerage firm, bank, broker-dealer or other intermediary, then under NYSE rules, your nominee may vote your Common Shares without receiving instructions from you only with respect to the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. All other matters that are to be voted upon at the Annual Meeting are considered to be "non-routine" matters. If you hold your shares in street name and do not give the intermediary specific voting instructions on the election of trustees or the advisory vote regarding the compensation of our Named Executive Officers, your shares will not be voted on those items, and a broker non-vote will occur. Broker non-votes and abstentions will have no effect on the voting results for any of the proposals.

How to Vote

You can vote in any of the following ways:

•By Internet: To use the Internet to transmit your voting instructions and for electronic delivery of information, have your proxy card in hand when you access the website at www.proxyvote.com, and follow the instructions to obtain your records and to create an electronic voting instruction form. If you hold your shares in street name, you should follow the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. Voting instructions transmitted by Internet must be received by 11:59 P.M. Eastern Time on May 22, 2019.

•By Phone: To transmit your voting instructions by telephone, use any touch-tone telephone to dial 1-800-690-6903. Have your proxy card in hand when you call and then follow the instructions. If you hold your shares in street name, you should follow the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. Voting instructions transmitted by telephone must be received by 11:59 P.M. Eastern Time on May 22, 2019.

•By Mail: To transmit your voting instructions by mail, mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. If you hold your shares in street name, you should follow the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. Your proxy card must be received by May 22, 2019.

•In Person at the Annual Meeting: If you are registered holder of Common Shares and attend the meeting, you may vote in person at the Annual Meeting. If you hold your Common Shares in street name, you must obtain a proxy form from your brokerage firm, bank, broker-dealer or other intermediary in order to vote your Common Shares at the Annual Meeting. To vote in person at the Annual Meeting, you will be required to present a valid form of identification.

Even if you plan to attend the Annual Meeting, your plans may change, so we recommend you vote in advance of the meeting.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

11

|

How to Revoke a Proxy

Any common shareholder of record submitting a proxy retains the power to revoke such proxy at any time prior to its exercise at the Annual Meeting by (i) delivering at or prior to the Annual Meeting a written notice of revocation to our secretary at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111, (ii) submitting a later-dated proxy or (iii) voting in person at the Annual Meeting. Attending the Annual Meeting will not automatically revoke your previously submitted proxy unless you vote in person at the Annual Meeting.

ANNUAL REPORT

This Proxy Statement is accompanied by our annual report on Form 10-K, as supplemented by our Form 10-K/A, for the year ended December 31, 2018 (collectively, our "Form 10-K"), which is our Annual Report to Shareholders for the year ended December 31, 2018.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

12

|

PROPOSAL 1: ELECTION OF TRUSTEES |

BOARD OF TRUSTEES

Our board of trustees is currently comprised of nine trustees. Kevin M. Howard, one of our current trustees, has elected to retire from the Board effective May 23, 2019, the date of our Annual Meeting. Accordingly, Mr. Howard is not standing for re-election at the Annual Meeting. Upon the recommendation of our CNCG Committee, our board of trustees has determined to maintain the size of our board at nine trustees, has nominated our other current trustees for re-election, and has also nominated J. Timothy Warren to stand for election at the Annual Meeting. As a result, the trustee nominees standing for re-election or election, as the case may be, at the Annual Meeting are listed below.

Arlen D. Nordhagen |

Chad L. Meisinger |

Rebecca L. Steinfort |

George L. Chapman |

Steven G. Osgood |

Mark Van Mourick |

Paul W. Hylbert, Jr. |

Dominic M. Palazzo |

J. Timothy Warren |

Each trustee elected will hold office until our next annual meeting of shareholders and until a successor has been duly elected and qualifies, or until the trustee's earlier resignation, death or removal.

We seek highly qualified trustee candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. The CNCG Committee considers diversity of gender, age, experience and skills as important factors in choosing the most qualified candidates. We believe that, as a group, the nominees bring a broad range of perspectives that contribute to the effectiveness of our board of trustees as a whole. The procedures and considerations of the CNCG Committee in recommending qualified trustee candidates are described below under "Corporate Governance–Identification of Trustee Candidates" in this Proxy Statement. The CNCG Committee and our board of trustees concluded that each of our trustee nominees should be nominated for election based on the qualifications and experience described in the biographical information below under "–Information Regarding Nominees for Election as Trustees."

It is intended that the Common Shares represented by properly submitted proxies will be voted by the persons named therein as proxy holders FOR the election of Messrs. Nordhagen, Chapman, Hylbert, Meisinger, Osgood, Palazzo, Van Mourick and Warren and Ms. Steinfort as trustees, unless otherwise instructed. If the candidacy of any trustee nominee should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidates (if any) as shall be nominated by our board of trustees. Our board of trustees has no reason to believe that, if elected, any of the nominees will be unable or unwilling to serve as a trustee.

INFORMATION REGARDING NOMINEES FOR ELECTION AS TRUSTEES

The following information is furnished as of March 15, 2019 regarding the nominees for re-election or election, as the case may be, as trustees.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

13

|

|

ARLEN D. NORDHAGEN

Age: 62

Chairman of the Board and Chief Executive Officer

|

Mr. Nordhagen is the founder of our Company and has served as our chief executive officer since inception and chairman since the closing of our IPO in April 2015. Prior to the closing of our IPO, he was the chairman of the board of managers of our Company's sole trustee. He has also served as president and chief executive officer of SecurCare Self Storage, Inc. ("SecurCare"), one of our participating regional operators ("PROs"), from 2000 to 2014. He co-founded SecurCare in 1988, is a majority owner and currently serves as its chairman. Since Mr. Nordhagen became president of SecurCare in 1999, the company rapidly grew to over 150 self storage properties. In addition, Mr. Nordhagen was a founder of MMM Healthcare, Inc., the largest provider of Medicare Advantage health insurance in Puerto Rico. He has also served as managing member of various private investment funds and held various managerial positions at DuPont and Synthetech, Inc. Mr. Nordhagen graduated with high distinction from Harvard University with a masters in business administration and graduated summa cum laude from the University of North Dakota with a bachelor of science degree in chemical engineering. Mr. Nordhagen has over 25 years of experience in the self storage industry. We believe that Mr. Nordhagen will continue to bring to our board of trustees valuable perspective as the founder and chief executive officer of our company and his experience, leadership skills and extensive knowledge of our company qualify him to serve as one of our trustees. |

|

GEORGE L. CHAPMAN

Age: 71

Chairman of CNCG Committee

|

Mr. Chapman has served as one of our independent trustees since the closing of our IPO in April 2015, including as the chairman of the CNCG Committee. Mr. Chapman has also served as the chief executive officer and a member of the board of ReNew REIT LLC since 2017 and as the chairman and chief executive officer of Health Care REIT, Inc. ("HCN"), which is now Welltower Inc. (NYSE: WELL), from 1995 to 2014, and as president of HCN from 2009 to 2014. Mr. Chapman also served on the board of the National Association of Real Estate Investment Trusts ("Nareit") on two separate occasions, most recently until his retirement from HCN in April of 2014, when he served on the executive committee of Nareit. He has also been involved in various community charitable organizations, including as vice chair of the Toledo Museum of Art and the Toledo Symphony until 2018. Mr. Chapman graduated from the University of Chicago with a juris doctor and graduated from Cornell University with a bachelor of arts degree. We believe that Mr. Chapman will continue to bring valuable experience from his time with HCN and Nareit to our board of trustees and his experience and extensive knowledge of the REIT industry qualify him to serve as one of our trustees. |

|

PAUL W. HYLBERT, JR.

Age: 74

Lead Independent Trustee

|

Mr. Hylbert currently serves as NSA's lead independent trustee, presiding over the regularly scheduled executive sessions of the independent trustees and has served as one of our independent trustees since the closing of our IPO in April 2015. Mr. Hylbert has also served as an officer and/or director of a number of companies over the past 40 years. Mr. Hylbert has served since 2011 and continues to serve as chairman of Kodiak Building Partners, LLC, and was the chief executive officer from 2011 to 2014. Prior to this role, from 2007 to 2010, Mr. Hylbert served as the president and chief executive officer of ProBuild Holdings Inc., a national fabricator and distributor of building products and a subsidiary of Fidelity Capital. From 2000 until 2006, Mr. Hylbert served as the president and chief executive officer of Lanoga Corporation, one of the top U.S. retailers of lumber and building materials, until it was acquired by Fidelity Capital. Mr. Hylbert also served as the president and co-chief executive officer of PrimeSource Building Products, a national fabricator, packager and distributor of building products from 1991 to 1997, after which the company was sold and Mr. Hylbert served as president from 1997 to 2000. Earlier in his career, Mr. Hylbert served as the chief executive officer of the Wickes Europe, Wickes Lumber, and Sequoia Supply subsidiaries of Wickes, Inc. before leading a leveraged buy-out of Sequoia Supply to form PrimeSource Building Products in 1987. Mr. Hylbert graduated from the University of Michigan with a masters in business administration and graduated from Denison University with a bachelor of arts degree. We believe Mr. Hylbert's extensive experience in synergistic corporate acquisitions and "roll-ups" in the building products industry will continue to bring valuable perspective to our board of trustees and his experience and leadership qualify him to serve as one of our trustees. |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

14

|

|

CHAD L. MEISINGER

Age: 51

|

Mr. Meisinger has served as one of our independent trustees since the closing of our IPO in April 2015. Mr. Meisinger is the chief executive officer of Over The Top (OTT) Marketing, which he founded in 2006. OTT Marketing provides multi-location businesses with large scale, inbound digital customer acquisition services that are delivered through a proprietary software platform. Mr. Meisinger was the president and chief executive officer of IP Dynamx, which he founded in 2015, until 2017. In addition, Mr. Meisinger co-founded Thinique Medical Weight Loss in 2013 and built it to over 200 franchised units within a year before selling ownership interests to one of his co-founders. Mr. Meisinger also had the regional development rights for The Joint Corp. between 2011 and 2014, where he was developing more than 40 chiropractic clinics throughout Los Angeles County. Prior to founding OTT, Mr. Meisinger served as head of affiliate sales and marketing for Google Radio from 2006 to 2009. He joined Google Radio after serving as a key investor and chief marketing officer of dMarc Broadcasting, which was acquired by Google Radio in February of 2006 for $1.2 billion in cash and performance incentives. Mr. Meisinger also served as co-founder, chairman and chief executive officer of First MediaWorks from 1999 to 2005, which provided the radio industry with a proprietary software platform and marketing services to help increase ratings and revenue. First MediaWorks was sold to Mediaspan in 2005. Beginning in 1995, Mr. Meisinger served as co-founder, chief executive officer and board trustee of First Internet Franchise Corporation, the first Internet Service Providers (ISP) franchisor in the world with hundreds of franchise territories licensed worldwide. We believe Mr. Meisinger's unique experiences in digital marketing, technology and franchising, along with his strong entrepreneurial character will continue to bring valuable perspective to our board of trustees and his leadership, experiences, and unique business knowledge qualify him to serve as one of our trustees. |

|

STEVEN G. OSGOOD

Age: 62

Chairman of Investment Committee

|

Mr. Osgood has served as one of our independent trustees since the closing of our IPO in April 2015. Mr. Osgood currently serves on the board of directors of Hannon Armstrong Sustainable Infrastructure Capital, Inc. as an independent director and chair of the audit committee. In addition, he serves on the compensation committee. He has also served as the chief executive officer of Square Foot Companies, LLC, a Cleveland, Ohio based private real estate company focused on self storage and single tenant properties since 2008. Mr. Osgood was a manager of All Stor Storage, LLC, a company that has been liquidated. From 2007 to 2008, Mr. Osgood served as chief financial officer of DuPont Fabros Technology, Inc., a Washington, DC based real estate investment trust that owned, operated and developed data center properties, which merged with Digital Realty Trust Inc. in 2017. From 2006 to 2007 Mr. Osgood served as chief financial officer of Global Signal, Inc., a Sarasota, Florida based real estate investment trust that was acquired by Crown Castle International Corp. in 2007. Prior to Global Signal, Mr. Osgood served as president and chief financial officer of U-Store-It Trust (now CubeSmart), a Cleveland based self storage real estate investment trust, from the company's initial public offering in 2004 through 2006. Mr. Osgood served as chief financial officer of the Amsdell Companies, the predecessor of U-Store-It, from 1993 until 2004. Mr. Osgood also serves as treasurer on the National Board of Directors of the Alzheimer's Association. Mr. Osgood is a former Certified Public Accountant and was a member of the auditing staff of Touche Ross & Co. from 1978 to 1982. Mr. Osgood graduated from the University of San Diego with a masters in business administration and graduated from Miami University with a bachelor of science degree. We believe Mr. Osgood will continue to bring valuable experience to our board of trustees and his real estate, self storage, and public company experience qualify him to serve as one of our trustees. |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

15

|

|

DOMINIC M. PALAZZO

Age: 63

Chairman of Audit Committee

|

Mr. Palazzo has served as one of our independent trustees since the closing of our IPO in April 2015, including as the chairman of the Audit Committee (as defined below). Mr. Palazzo has more than 34 years of combined experience in public accounting and industry, including 29 years at PricewaterhouseCoopers LLC ("PwC"). Mr. Palazzo most recently held the position of audit partner at PwC until his retirement in 2011. While at PwC Mr. Palazzo was responsible for the real estate practice in their Denver, Colorado office. His expertise is in due diligence, mergers and acquisitions, public equity and debt offerings, corporate restructurings and financings. While at PwC his clients included Chateau Communities, Affordable Residential Communities, and other private real estate companies. He also served real estate clients that developed a number of different types of real estate assets, including multi-family, office, hotels and resort properties. As a partner at PwC he was responsible for the initial public offering of Affordable Residential Communities in 2004. In addition, Mr. Palazzo served in the PwC National Accounting and SEC Directorate in New York City where he performed technical accounting consultations and research for PwC. Mr. Palazzo was also the past president of the Executive Real Estate Roundtable and a former member of the Colorado Society of CPAs and the American Institute of Certified Public Accountants. Mr. Palazzo graduated from DePaul University with a bachelor of science degree in accounting. We believe Mr. Palazzo's public accounting experience with PwC will continue to provide valuable experience and perspective to our board of trustees and his experience and knowledge of real estate public accounting qualify him to serve as one of our trustees. |

|

REBECCA L. STEINFORT

Age: 49

|

Ms. Steinfort has served as one of our independent trustees since May 2018. Since July 2017, she has also served as an independent director on the board of Milacron Holdings Corp. (NYSE: MCRN), a leading industrial technology company serving the plastics processing industry, where she also is a member of the audit committee. Additionally, Ms. Steinfort served on the board of directors of Nature’s Sunshine Products, Inc. (NASD: NATR) as an independent director from February 2015 to May 2018, where she chaired the compliance committee and served as a member of the audit committee. Ms. Steinfort is currently the President of Eating Recovery Center, a national healthcare services provider focused on treating patients suffering from eating disorders and related behavioral health conditions, and prior to November 2018, Ms. Steinfort served as Chief Operating and Business Development Officer. Prior to this role, she served as the Chief Executive Officer of Hero Management LLC, a leading provider of healthcare practice management services for dental, orthodontic and vision care practices that serve the pediatric Medicaid population, from 2015 to 2016. Prior to joining Hero Management LLC in 2015, Ms. Steinfort held various positions at DaVita Healthcare Partners ("Davita") beginning in 2009, including Co-Founder and Chief Operating Officer of DaVita's primary-care subsidiary and Chief Strategy and Marketing Officer of DaVita's dialysis business unit. Ms. Steinfort held various leadership positions at QIP Holder, LLC (parent company of Quiznos, a multinational sandwich franchise, "Quiznos") between 2007 and 2009, including Chief Marketing Officer. Prior to Quiznos, Ms. Steinfort held various senior executive positions at Level 3 Communications, LLC from 2001 to 2006 and served as a consultant at Bain & Company from 1997 to 1999. Ms. Steinfort graduated from Harvard University with a masters in business administration and graduated from Princeton University with a bachelor of arts degree. We believe that her valuable experience in marketing, technology and strategic planning will continue to bring valuable experience and perspective to our board of trustees and her experience and knowledge qualify her to serve as one of our trustees. |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

16

|

|

MARK VAN MOURICK

Age: 62

|

Mr. Van Mourick has served as one of our trustees since the closing of our IPO in April 2015. Mr. Van Mourick is a co-owner of Optivest Properties, LLC ("Optivest"), one of our PROs, which he co-founded in 2007. He is also the founder, and was the chief executive officer until 2018, of Optivest Wealth Management, an SEC registered wealth management firm serving wealthy families in southern California since 1987. In addition, Mr. Van Mourick currently serves as the chairman of the board of Optivest Foundation and serves on the board of Northrise University. Mr. Van Mourick has been a principal, general partner, managing member and/or agent in more than 80 real estate syndications since 1991. Prior to founding Optivest and Optivest Wealth Management, Mr. Van Mourick was a senior vice president and principal at Smith Barney, Harris, Upham. Mr. Van Mourick graduated from the University of Southern California with a dual bachelor of science degree in international finance and management. We believe his unique combination of real estate, self storage and financial experience will continue to bring valuable perspective to our board of trustees and his experience and knowledge qualify him to serve as one of our trustees. |

|

J. TIMOTHY WARREN

Age: 64

|

Mr. Warren has been nominated to serve as one of our trustees and would qualify as an independent trustee. Mr. Warren has served as a member of our PRO advisory committee since our IPO in April 2015. Since 1996, Mr. Warren has served as president of Three Oaks Development Co., a commercial real estate development company specializing in building and leasing industrial business parks in Portland, Oregon. During this time, Mr. Warren has also played an active role in developing and acquiring over 33 self storage facilities in conjunction with Northwest Self Storage, one of the Company’s PROs. Prior to joining Three Oaks Development Co. in 1995, Mr. Warren founded JTW Computer Systems in 1976, which provided hardware, software and a time share computing environment for small to medium sized companies nationwide. Mr. Warren served as president of JTW Computer Systems until the company was sold in 1995. Mr. Warren has also served on the board of directors and as president of the Portland Chapter of NAIOP (National Association of Industrial and Office Properties), and as an elected official on the Board of Supervisors of Multnomah County Drainage District #1. Mr. Warren graduated from the University of Oregon with a bachelor of science degree in computer science and a minor in accounting. We believe that Mr. Warren's background in self storage, real estate, technology and strategic planning bring valuable experience and perspective to our board of trustees and qualify him to serve as one of our trustees.

|

A summary of the experience of our trustee nominees is set forth below.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

17

|

Our board of trustees recommends a vote FOR the election of Messrs. Nordhagen, Chapman, Hylbert, Meisinger, Osgood, Palazzo, Van Mourick and Warren and Ms. Steinfort as trustees.

We have not received notice of any additional candidates to be nominated for election as trustees at the Annual Meeting and the deadline for notice of additional candidates has passed. Consequently, the election of trustees will be an uncontested election and the provisions of our Second Amended and Restated Bylaws (the "Bylaws") providing for majority voting in uncontested elections will apply. See "Corporate Governance–Majority Vote and Trustee Resignation Policy" below. Under majority voting, to be elected as a trustee, a nominee must receive votes "FOR" his or her election constituting a majority of the total votes cast for and against such nominee at the Annual Meeting at which a quorum is present. If a nominee who currently is serving as a trustee does not receive sufficient "FOR" votes to be re-elected, Maryland law provides that the trustee would continue to serve on our board of trustees as a "holdover" trustee. Under our Bylaws and corporate governance guidelines (the "Guidelines"), he or she must submit his or her resignation to our board of trustees. Our CNCG Committee will consider such tendered resignation and recommend to our board of trustees whether to accept it. Our board of trustees will decide whether to accept any such resignation within 90 days after certification of the election results and will publicly disclose its decision. If the resignation is not accepted, the trustee will continue to serve until the trustee's successor is duly elected and qualifies or until the trustee's earlier death, resignation, retirement or removal. If a trustee’s offer to resign is accepted by our board of trustees, or if a nominee for trustee is not elected and the nominee is not an incumbent trustee, then our board of trustees, in its sole discretion, may fill any resulting vacancy pursuant to the Bylaws. Proxies solicited by our board of trustees will be voted FOR Messrs. Nordhagen, Chapman, Hylbert, Meisinger, Osgood, Palazzo, Van Mourick and Warren and Ms. Steinfort, unless otherwise instructed. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

In accordance with our declaration of trust (the "Declaration of Trust") and our Bylaws, any vacancies occurring on our board of trustees, including vacancies occurring as a result of the death, resignation, or removal of a trustee, or due to an increase in the size of the board of trustees, may be filled only by the affirmative vote of a majority of the remaining trustees in office, even if the remaining trustees do not constitute a quorum, and any trustee elected to fill a vacancy will serve for the remainder of the full term of the trusteeship in which the vacancy occurred and until a successor is duly elected and qualifies.

There is no familial relationship, as defined under SEC regulations, among any of the trustees or our Named Executive Officers. See "Corporate Governance–Trustee Independence."

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

18

|

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The audit committee of our board of trustees (the "Audit Committee") has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2019. Our board of trustees is requesting that our shareholders ratify this appointment of KPMG LLP.

KPMG LLP has audited our consolidated financial statements since the Company's formation. KPMG LLP has also provided certain other services to us.

Neither our Bylaws nor other governing documents or law require shareholder ratification of the Audit Committee's appointment of KPMG LLP as our independent registered public accounting firm. However, our board of trustees is submitting the appointment of KPMG LLP to the shareholders for ratification as a matter of good corporate practice. If the ratification of this appointment is not approved at the Annual Meeting, the Audit Committee will review its future selection of our independent registered public accounting firm. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests.

Representatives of KPMG LLP are expected to be present at the Annual Meeting and will be provided with an opportunity to make a statement if so desired and to respond to appropriate inquiries from shareholders.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

The following table summarizes the aggregate fees billed to us for professional services provided by KPMG LLP for the years ended December 31, 2018 and 2017.

2018 |

2017 |

||||||

Audit Fees(1)

|

$ |

903,169 |

$ |

1,092,500 |

|||

Audit-Related Fees |

- |

- |

|||||

Tax Fees |

- |

- |

|||||

All Other Fees |

- |

- |

|||||

Total |

$ |

903,169 |

$ |

1,092,500 |

|||

(1) |

Audit Fees include fees related to the annual audit of the Company included in our annual report on Form 10-K, the review of the consolidated financial statements included in our quarterly reports on Form 10-Q, accounting consultations attendant to the audit, and for services associated with our public offerings, including review of registration statements and prospectuses and related issuances of comfort letters and consents and other services related to SEC matters. Audit fees also include costs related to the audit of the Company’s internal control over financial reporting based on criteria established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission. |

In accordance with the Audit Committee charter, the Audit Committee reviews and pre-approves the engagement fees and the terms of all audit and non-audit services to be provided by the external auditors and evaluates the effect thereof on the independence of the external auditors.

A majority of all of the votes cast on this proposal at the Annual Meeting is required for its approval. Proxies solicited by our board of trustees will be voted FOR this proposal, unless otherwise instructed. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

Our board of trustees recommends a vote FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2019.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

19

|

PROPOSAL 3: NON-BINDING VOTE ON EXECUTIVE COMPENSATION |

We are requesting that our shareholders approve, on an advisory (non-binding) basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement.

We believe that our compensation policies and practices are strongly aligned with the long-term interests of our shareholders. Shareholders are urged to read the Compensation Discussion and Analysis section of this Proxy Statement, which discusses our compensation philosophy and how our compensation policies and practices implement our philosophy.

As described more fully in that discussion, our compensation programs are designed to attract and retain the best executive talent in a way that allows us to align the interests of our Named Executive Officers with those of our shareholders. We seek to encourage the achievement of our business strategies, the creation of company growth, and the retention of our Named Executive Officers in a manner that is consistent with appropriate risk-taking and based on sound corporate governance practices.

In furtherance of this philosophy, the CNCG Committee has implemented a pay for performance compensation framework to compensate our Named Executive Officers for favorable shareholder returns, the Company’s competitive position within its segment of the real estate industry and each Named Executive Officer's contributions to the Company.

We are requesting your non-binding vote on the following resolution:

"RESOLVED, that our shareholders approve, on an advisory basis, the compensation of our Named Executive Officers as described in this Proxy Statement for the 2019 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and narrative disclosure."

Because your vote is advisory, it will not be binding upon us or our board of trustees. However, the CNCG Committee, which is responsible for designing and administering our executive compensation programs, values your opinion and will take into account the outcome of the vote when considering future executive compensation arrangements.

If a quorum is present, the affirmative vote of a majority of the votes cast on the proposal at the Annual Meeting is required to approve, on an advisory basis, the compensation of our Named Executive Officers. Proxies solicited by our board of trustees will be voted FOR this proposal, unless otherwise instructed. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purposes of determining the presence of a quorum.

Our board of trustees recommends a vote FOR approval of the compensation of the Named Executive Officers as described in the Compensation Discussion and Analysis, the compensation tables and other narrative disclosure in this Proxy Statement.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

20

|

BOARD OF TRUSTEES AND COMMITTEE MATTERS |

BOARD OF TRUSTEES

Our board of trustees is responsible for overseeing our affairs. Our board of trustees conducts its business through meetings and actions taken by written consent in lieu of meetings. Our board of trustees intends to hold at least four regularly scheduled meetings per year and additional special meetings as necessary. During 2018, our board of trustees held eight meetings. All of our trustees attended at least 75% of the meetings of our board of trustees and of the Audit Committee, CNCG Committee and Investment Committee on which they served during this period, either in person or telephonically. Our board of trustees' policy, as set forth in our Guidelines, is to encourage and promote the attendance by each trustee at all scheduled meetings of our board of trustees and all meetings of our shareholders.

COMMITTEES OF THE BOARD OF TRUSTEES

Our board of trustees has three standing committees: the Audit Committee, the CNCG Committee and the Investment Committee. The membership, roles and responsibilities of each committee are described below.

AUDIT COMMITTEE |

|

Members: |

Dominic M. Palazzo (Chair)

Steven G. Osgood

Rebecca L. Steinfort

Subject to his election at the Annual Meeting, Mr. Warren will join the Audit Committee as its fourth member.

|

Number of Meetings in 2018: |

7 |

Independence and Financial Experts: |

Each Audit Committee member is independent as required by NYSE listing standards, SEC rules, our Guidelines and Independence Standards (as defined below), and our Audit Committee charter.

Our board of trustees has also determined that Mr. Palazzo, Mr. Osgood and Ms. Steinfort qualify and serve as "audit committee financial experts" for purposes of, and as defined by, the SEC rules and are financially literate, with the requisite accounting or related financial management expertise required by NYSE listing standards.

|

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

21

|

AUDIT COMMITTEE |

|

Roles and Responsibilities: |

The Audit Committee's responsibilities are set forth in its written charter and include:

–

Engaging, reviewing the plans and results of the engagement with, and approving the services provided by, our independent registered public accounting firm;

–

Reviewing the independence of the independent registered public accounting firm and considering the range of audit and non-audit fees;

–

Reviewing the adequacy of our internal accounting controls;

–

Approving, after reviewing with management and external auditors, our quarterly earnings releases and supplemental financial information and our interim and audited annual financial statements prior to each filing of our quarterly reports on Form 10-Q and annual reports on Form 10-K;

–

Meeting with officers responsible for certifying our annual reports on Form 10-K or any quarterly report on Form 10-Q prior to any such certification;

–

Reviewing with such responsible officers disclosures related to any significant deficiencies in the design or operation of internal controls; and

–

Periodically discussing with our external auditors such auditors' judgments about the quality, not just the acceptability, of our accounting principles as applied in our consolidated financial statements.

|

|

The Audit Committee also works to discharge our board of trustees' responsibilities relating to:

–

Our and our subsidiaries' corporate accounting and reporting practices;

–

The quality and integrity of our consolidated financial statements;

–

Our compliance with applicable legal and regulatory requirements;

–

The performance, qualifications and independence of our external auditors;

–

The staffing, performance, budget, responsibilities and qualifications of our internal audit function; and

–

Reviewing our policies with respect to risk assessment and risk management, including the guidelines and policies by which these activities are undertaken, the adequacy of our insurance coverage, our interest rate risk management, our counter-party and credit risks, our capital availability and refinancing risks, and any cyber-security or environmental risks, if applicable.

|

|

Audit Committee Charter: |

Available on our website at www.nationalstorageaffiliates.com |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

22

|

COMPENSATION, NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | |

Members: |

George L. Chapman (Chair)

Paul W. Hylbert, Jr.

Chad L. Meisinger

|

Number of Meetings in 2018: |

4 |

Independence: |

Each CNCG Committee member is independent as required by NYSE listing standards, SEC rules, our Guidelines and Independence Standards, and our CNCG Committee charter. |

Roles and Responsibilities: |

The CNCG Committee's responsibilities are set forth in its charter and include:

–

Annually reviewing and approving the corporate goals and objectives relevant to the compensation paid by us to our Named Executive Officers;

–

Evaluating our Named Executive Officers' performance in light of such goals and objectives and, either as a committee or together with our independent trustees (as directed by the board of trustees), determining and approving the compensation of our Named Executive Officers based on that evaluation;

–

Overseeing our equity-based compensation plans and programs;

–

Reviewing and recommending to our board of trustees from time to time the compensation for our non-executive trustees;

–

Advising our board of trustees with respect to the organization, function and composition of the board of trustees and its committees;

–

Overseeing the self-evaluation of our board of trustees (individually and as a whole) and the board of trustees' evaluation of management and reporting thereon to the board of trustees;

–

Periodically reviewing and, if appropriate, recommending to our board of trustees changes to, our corporate governance policies and procedures;

–

Identifying and recommending to our board of trustees potential candidates for nomination;

–

Recommending to our board of trustees the appointment of each of our executive officers;

–

Assisting our board of trustees and chairman in overseeing the development of executive succession plans; and

–

Preparing CNCG Committee reports.

|

The CNCG Committee retained FPL Associates LP ("FPL"), a professional services firm focused on compensation and other consulting services as well as executive and board recruitment, to provide advice regarding the compensation program for our Named Executive Officers and independent trustees and, for 2018, recruitment services related to a new trustee nominee, which position was filled by Ms. Steinfort. FPL reports directly to the CNCG Committee on these matters. Except for the services described above, certain executive recruitment services, and immaterial proxy review services provided to us in 2019 in connection with this Proxy Statement, FPL has not performed and does not currently provide any other services to management or us. |

|

CNCG Committee Charter: |

Available on our website at www.nationalstorageaffiliates.com |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

23

|

INVESTMENT COMMITTEE | |

Members: |

Steven G. Osgood (Chair)

Chad L. Meisinger

Dominic M. Palazzo

Subject to his reelection at the Annual Meeting, Mr. Van Mourick will replace Mr. Palazzo on the Investment Committee.

|

Number of Meetings in 2018: |

5 |

Independence: |

Each Investment Committee member is independent as required by NYSE listing standards, SEC rules, and our Guidelines and Independence Standards. |

Roles and Responsibilities: |

The Investment Committee is responsible for reviewing and, where appropriate, approving, on behalf of the Company, acquisitions or dispositions of self storage properties within certain parameters.

Investment Committee meetings are designed to provide the members of the Investment Committee with an opportunity to discuss the investment rationale for certain acquisitions or dispositions, to review material background items (including due diligence reports) with respect to those acquisitions or dispositions, and to conduct any further due diligence to make an informed decision with respect to those acquisitions or dispositions.

|

REPORT OF THE AUDIT COMMITTEE

The Audit Committee has furnished the following report for the fiscal year ending December 31, 2018:

The Audit Committee is responsible for monitoring the integrity of our consolidated financial statements, our system of internal controls, our risk management, the qualifications, independence and performance of our independent registered public accounting firm and our compliance with related legal and regulatory requirements. The Audit Committee has the sole authority and responsibility to select, determine the compensation of, evaluate and, when appropriate, replace our independent registered public accounting firm. The Audit Committee operates under a written charter adopted by our board of trustees.

Management is primarily responsible for our financial reporting process including the system of internal controls and for the preparation of consolidated financial statements in accordance with accounting principles generally accepted in the United States. KPMG LLP, our independent registered public accounting firm, is responsible for performing an independent audit of our annual consolidated financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States and on the effectiveness of the company’s internal controls over financial reporting based on criteria established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission. The Audit Committee's responsibility is to oversee and review the financial reporting process. The Audit Committee is not, however, professionally engaged in the practice of accounting or auditing and does not provide any expert or other special assurance as to such financial statements concerning compliance with laws, regulations or accounting principles generally accepted in the United States or as to auditor independence. The Audit Committee relies, without independent verification, on the information provided to it and on the representations made by our management and our independent registered public accounting firm.

The Audit Committee held seven meetings in 2018. Representatives of KPMG LLP were in attendance at six of our Audit Committee meetings. These meetings were designed, among other things, to facilitate and encourage communication among the Audit Committee, management and KPMG LLP. At these meetings, among other things, the Audit Committee reviewed and discussed with management the consolidated financial statements contained in our quarterly and annual periodic reports, as applicable, as well as our earnings releases. The Audit Committee also discussed with KPMG LLP matters that independent accounting firms must discuss with audit committees under generally accepted auditing standards and standards of the Public Company Accounting Oversight Board ("PCAOB"), including, among other things, matters related to the conduct of the audit of our consolidated financial statements and the matters

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

24

|

required to be discussed by Auditing Standard No. 1301: Communications with Audit Committees, which included a discussion of KPMG LLP's judgments about the quality (not just the acceptability) of our accounting principles as applied to financial reporting. The Audit Committee met with KPMG LLP, with and without management present, to discuss the results of their audits.

The Audit Committee also discussed with KPMG LLP their independence from us. KPMG LLP provided to the Audit Committee the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent accountant's communication with audit committees concerning independence and represented that it is independent from us. The Audit Committee also received regular updates on the amount of fees and scope of audit and tax services provided by KPMG LLP.

Based on the Audit Committee's review and these meetings, discussions and reports, and subject to the limitations on the Audit Committee's role and responsibilities referred to above and in its written charter, the Audit Committee unanimously recommended to our board of trustees that our audited consolidated financial statements for the fiscal year ended December 31, 2018 be included in our annual report on Form 10-K filed with the SEC.

Dominic M. Palazzo

Steven G. Osgood

Rebecca L. Steinfort

The foregoing Report of the Audit Committee shall not be deemed under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, to be (i) "soliciting material" or "filed" or (ii) incorporated by reference by any general statement into any filing made by us with the SEC, except to the extent that we specifically incorporate such report by reference.

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

25

|

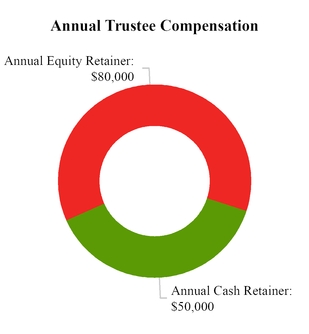

COMPENSATION OF INDEPENDENT TRUSTEES |

Independent members of our board of trustees receive compensation for their services as trustees as described below. Each independent trustee is permitted, but is not obligated, to elect to receive between 50% and 100% of the value of the total annual cash compensation described below in equity, with such election to be made annually. Members of our board of trustees who are not independent receive no compensation for their services as trustees.

COMPENSATION

For 2018, each of our independent trustees was eligible to receive annual compensation as follows:

Additional Cash Compensation |

Lead Independent Trustee: $15,000

|

Audit Committee: |

Chair: $20,000 |

Member: $7,500 |

CNCG Committee: |

Chair: $20,000 |

Member: $7,500 |

Investment Committee: |

Chair: $15,000 |

Member: $7,500 |

We also reimburse each of our trustees for travel expenses incurred in connection with attending board of trustees and committee meetings.

The table below summarizes the annual compensation received by our independent trustees during 2018.

For 2018, each independent trustee elected to receive some or all of their annual cash compensation in the form of equity |

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

26

|

Trustee Compensation Table for 2018 | ||||||||||||

Name |

Fees Paid or Earned in Cash(1) |

Stock Awards(1)

|

Total |

|||||||||

George L. Chapman |

$ |

70,000 |

$ |

80,000 |

$ |

150,000 |

||||||

Kevin M. Howard(2)(3)

|

- |

- |

- |

|||||||||

Paul W. Hylbert, Jr. |

72,500 |

80,000 |

152,500 |

|||||||||

Chad L. Meisinger |

65,000 |

80,000 |

145,000 |

|||||||||

Steven G. Osgood |

72,500 |

80,000 |

152,500 |

|||||||||

Dominic M. Palazzo |

77,500 |

80,000 |

157,500 |

|||||||||

Rebecca L. Steinfort |

57,500 |

80,000 |

137,500 |

|||||||||

Mark Van Mourick(2)(3)

|

- |

- |

- |

|||||||||

(1) |

For those trustees that elected in 2018 to receive any portion of the value of their 2018 annual cash compensation in equity, grants for the full value of such compensation were made on May 24, 2018, based on the closing price of our common shares on May 24, 2018 of $27.29. Each of Messrs. Chapman, Hylbert, Meisinger, and Osgood and Ms. Steinfort elected to receive payment of 100% of the value of his or her 2018 annual cash compensation in LTIP units which represent a class of partnership interests in our operating partnership, NSA OP, LP (our "operating partnership") and Mr. Palazzo elected to receive 50% of such value in LTIP units. Accordingly, Messrs. Chapman, Hylbert, Meisinger, Osgood and Palazzo and Ms. Steinfort were awarded 5,497, 5,589, 5,314, 5,589, 4,352, and 5,039 LTIP units, respectively. With respect to the portion of Mr. Palazzo's 2018 annual cash compensation taken in cash, Mr. Palazzo was paid three-fourths of such amount in equal quarterly installments between April 1, 2018 and December 31, 2018 and one-fourth of such amount was paid in 2018 in respect of his 2017 compensation levels. The remaining installment of Mr. Palazzo's 2018 cash compensation was paid in 2019 and is not reflected in the above table. The dollar value shown in the table above for the LTIP units taken in lieu of cash compensation represents the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification ("ASC") Topic 718. The LTIP units vest on May 24, 2019, so long as such person remains a trustee. The following table sets forth the aggregate number of outstanding compensatory LTIP units held by our non-employee trustees that had not vested as of December 31, 2018:

|

Name |

Number of LTIP units |

||

George L. Chapman |

5,497 |

||

Kevin M. Howard |

— |

||

Paul W. Hylbert, Jr. |

5,589 |

||

Chad L. Meisinger |

5,314 |

||

Steven G. Osgood |

5,589 |

||

Dominic M. Palazzo |

4,352 |

||

Rebecca L. Steinfort |

5,039 |

||

Mark Van Mourick |

— |

||

(2) |

Messrs. Howard and Van Mourick did not receive compensation as trustees because we did not consider them independent in 2018 under the NYSE listing standards and our Independence Standards (as defined below). In February 2019, our board of trustees determined that Mr. Van Mourick satisfied the qualifications to be an independent trustee under the NYSE listing standards and our Independence Standards. In addition, the board of trustees determined that Mr. Warren, who is a trustee nominee, also satisfies such standards, subject to his election at the Annual Meeting. See "Corporate Governance–Trustee Independence" below. Accordingly, in 2019, subject to their election at the Annual Meeting, Messrs. Van Mourick and Warren will be eligible to receive trustee compensation as independent trustees. |

(3) |

Excludes consideration paid to Messrs. Howard and Van Mourick or entities controlled or managed by each of them, or in which they have an ownership interest, in connection with the acquisition by us of self storage properties. For additional information see "Certain Relationships and Related Transactions–Material Benefits to Related Parties." |

Each independent trustee is subject to our minimum equity ownership guidelines. See "Compensation Discussion and Analysis–Minimum Equity Ownership Guidelines."

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

27

|

CORPORATE GOVERNANCE |

GOVERNANCE HIGHLIGHTS |

||||

ü |

Majority voting in uncontested elections |

ü |

Active shareholder outreach program |

|

ü |

Elected first female trustee to board in 2018 |

ü |

Equityholders may amend bylaws |

|

ü |

8 of 9 trustee nominees are independent |

ü |

No poison pill |

|

ü |

No staggered board of trustees; annual election of all trustees |

ü |

No excise tax gross-ups with respect to payments made in connection with a change of control |

|

ü |

Lead independent trustee |

ü |

Three Audit Committee financial experts |

|

ü |

Prohibition against hedging the value of Company securities |

ü |

Opted out of Maryland's control share acquisition statute |

|

ü |

Clawback policy that allows for the recovery of previously paid executive compensation |

ü |

Opted out of Maryland's unsolicited takeover act (which we may not opt into without shareholder approval) |

|

ü |

Robust minimum equity ownership guidelines |

|||

ROLE OF THE BOARD OF TRUSTEES AND RISK OVERSIGHT

Pursuant to our Declaration of Trust and Bylaws, our business and affairs are managed under the direction of our board of trustees. Our board of trustees has the responsibility for establishing broad corporate policies and for our overall performance and direction, but is not involved in our day-to-day operations. Members of our board of trustees keep informed of our business by participating in meetings of our board of trustees and its committees, by reviewing analyses, reports and other materials provided to them and through discussions with Mr. Nordhagen, our chairman and chief executive officer, and other Named Executive Officers.

In connection with their oversight of risk to our business, our board of trustees and the Audit Committee consider feedback from management concerning the risks related to our business, operations and strategies. The Audit Committee discusses and reviews policies with respect to our risk assessment and risk management, including guidelines and policies to govern the process by which risk assessment and risk management is undertaken, the adequacy of our insurance coverage, our interest rate risk management, our counter-party and credit risks, our capital availability and refinancing risks, and any cyber-security or environmental risks, if applicable. The Audit Committee also considers enterprise risk management. Management regularly reports to our board of trustees on our leverage policies, our asset acquisition process, any asset impairments and our compliance with applicable real estate investment trust ("REIT") rules and other regulations. Members of our board of trustees routinely meet with management in connection with their consideration of matters submitted for the approval of our board of trustees and the risks associated with such matters.

Our board of trustees believes that its composition protects shareholder interests and provides sufficient independent oversight of management. Eight of our nine trustee nominees are "independent" under NYSE standards and our Independence Standards, as more fully described under "Corporate Governance–Trustee Independence." The independent trustees meet separately from management on at least a quarterly basis and are very active in the oversight of our Company. The independent trustees oversee such critical matters as the integrity of our financial statements, the evaluation and compensation of our Named Executive Officers and the selection and evaluation of trustees. Each independent trustee has the ability to add items to the agenda of board of trustees meetings or raise subjects for discussion that are not on the agenda for that meeting.

Our board of trustees believes that its super-majority independent composition and the roles that our independent trustees perform provide effective corporate governance at the board of trustees' level and independent

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

28

|

oversight of both our board of trustees and management. The current governance structure, when combined with the functioning of the independent trustee component of our board of trustees and our overall corporate governance structure, strikes an appropriate balance between strong and consistent leadership and independent oversight of our business and affairs.

LEADERSHIP STRUCTURE OF THE BOARD OF TRUSTEES

Leadership of our board of trustees is vested in our chairman of the board and in our lead independent trustee. The CNCG Committee and the board of trustees have determined that combining the roles of chairman of the board and chief executive officer is advantageous as it enhances the understanding and communication between management and the board of trustees, allows for better understanding and evaluation of our operations, and improves the board of trustees' ability to perform its oversight role.

In recognition of the importance of the board of trustees' independent oversight role and the need to maintain a strong independence from management, our board of trustees appointed Paul W. Hylbert, Jr. as lead independent trustee during 2016. Our lead independent trustee works with Mr. Nordhagen, the chairman of our board of trustees and our chief executive officer, to establish the agenda for regular meetings of our board of trustees. Mr. Hylbert also serves as chair of regular meetings of our board of trustees when our chairman is absent, presides at executive sessions, serves as a liaison between our chairman and chief executive officer and our independent trustees, and encourages dialogue between our independent trustees and Named Executive Officers. He also establishes the agenda for meetings of our independent trustees and performs such other duties as our board of trustees may establish or delegate.

CODE OF BUSINESS CONDUCT AND ETHICS

Our board of trustees has adopted a Code of Business Conduct and Ethics (the "Code of Conduct") that applies to our trustees, officers and employees. Among other matters, the Code of Conduct is designed to deter wrongdoing and to promote, honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications, compliance with applicable governmental laws, rules and regulations, prompt internal reporting of violations of the Code of Conduct to appropriate persons identified in the code, and accountability for adherence to the Code of Conduct. Any waiver of the Code of Conduct for our trustees or officers may be made only by our board of trustees or our CNCG Committee and will be promptly disclosed as required by law or stock exchange regulations. The Code of Conduct is available for viewing on our website at www.nationalstorageaffiliates.com. We will also provide the Code of Conduct, free of charge, to shareholders who request it. Requests should be directed to Tamara D. Fischer, our president, chief financial officer, treasurer and secretary, at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111.

CORPORATE GOVERNANCE GUIDELINES

Our board of trustees has adopted Corporate Governance Guidelines that address significant issues of corporate governance and set forth procedures by which our board of trustees carries out its responsibilities, including the trustee resignation policy as described under "–Majority Vote and Trustee Resignation Policy" below. In addition, among the areas addressed by the Guidelines are the composition of our board of trustees, its functions and responsibilities, its standing committees, its PRO advisory committee, trustee qualification standards, access to management and independent advisors, trustee compensation, management succession, trustee orientation and continuing education, and the annual performance evaluation and review of our board of trustees and committees. The Guidelines are available for viewing on our website at www.nationalstorageaffiliates.com. We will also provide the Guidelines, free of charge, to shareholders who request it. Requests should be directed to Tamara D. Fischer, our president, chief financial officer, treasurer and secretary, at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111.

TRUSTEE INDEPENDENCE

The Guidelines provide that a majority of the trustees serving on our board of trustees must be independent as required by the NYSE listing standards. In addition, our board of trustees has adopted certain independence standards

NATIONAL STORAGE AFFILIATES 2019 PROXY STATEMENT |

29

|