DEFR14A: Definitive revised proxy soliciting materials

Published on April 11, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. 1 )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Declaration of Trust)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

x No fee required.

¨ Fee paid previously with preliminary materials.

¨ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Explanatory Note

This Amendment No. 1 amends and restates in its entirety the Definitive Proxy Statement and related Proxy Card that was originally filed by National Storage Affiliates Trust (the "Company") with the Securities and Exchange Commission on April 7, 2023 (the "Original Definitive Proxy Statement"). The Original Definitive Proxy Statement was filed in connection with the Company's 2023 annual meeting of shareholders to be held on May 22, 2023.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 22, 2023

To the Shareholders of National Storage Affiliates Trust:

We invite you to attend the 2023 annual meeting of shareholders (the "Annual Meeting") of National Storage Affiliates Trust, a Maryland real estate investment trust (the "Company," "we," "our" or "us").

| Meeting Date: | May 22, 2023 |

||||

| Time: | 11:00 a.m., Mountain Daylight Time (MDT) |

||||

| Location: | The Annual Meeting will be a virtual meeting. You will only be able to attend the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/NSA2023. |

||||

| Record Date: | March 23, 2023 |

||||

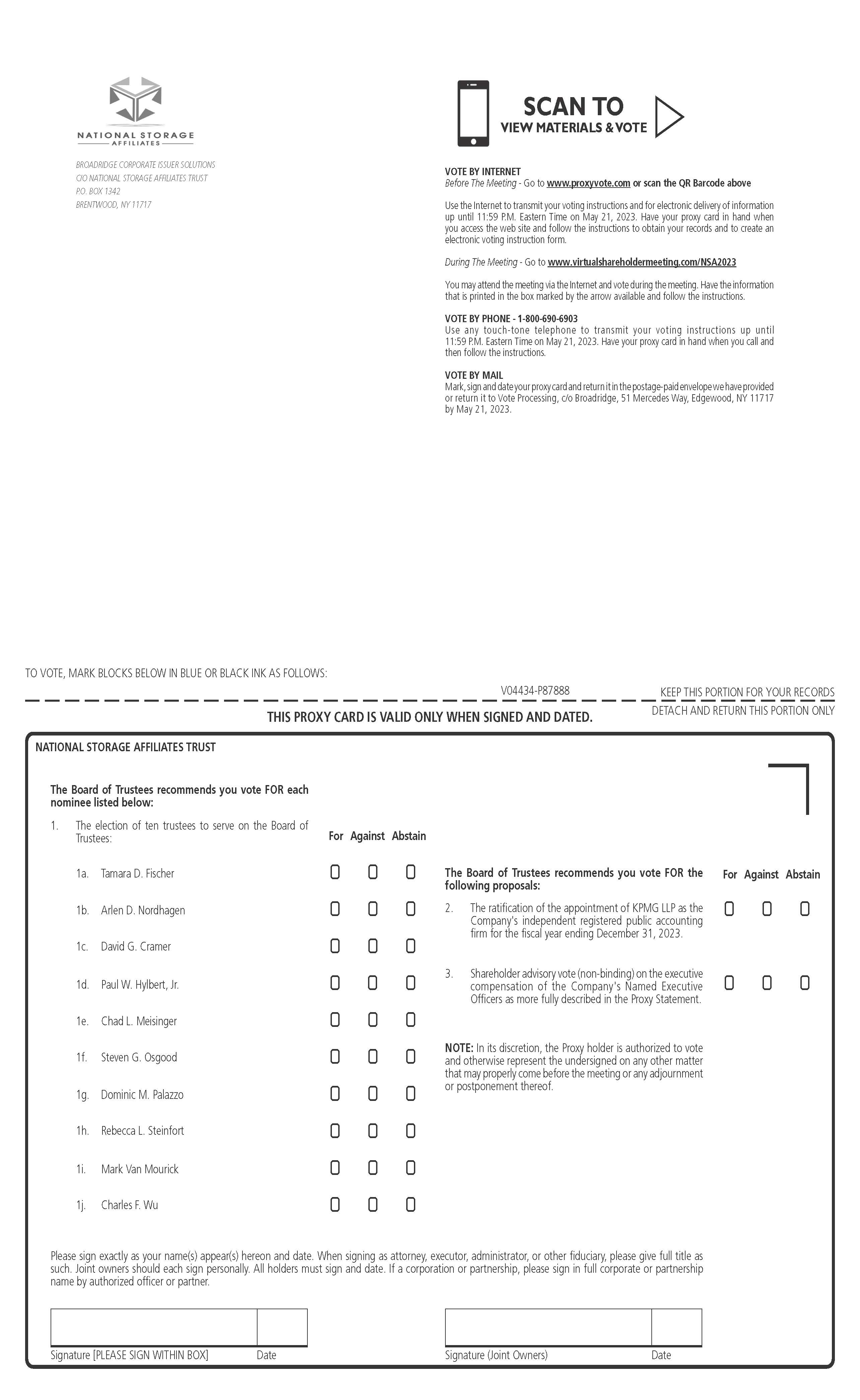

| Items of Business: | 1. Election of Ten Trustees to the Company's Board of Trustees | ||||

2. Ratification of Appointment of KPMG LLP as Independent Registered Public Accounting Firm for 2023 |

|||||

3. Non-Binding Advisory Resolution to Approve Executive Compensation |

|||||

4. Transaction of Other Business that Properly Comes Before the Annual Meeting |

|||||

| Method of Access: | We are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our common shareholders of record as of the close of business on the record date. The Notice contains instructions on how to access our proxy statement and annual report over the Internet, how to authorize your proxy to vote by Internet, telephone or mail, and how to request a paper copy of the proxy statement and annual report. | ||||

| How to Vote: | If you are a registered holder of our common shares as of the close of business on the record date, the Notice was sent directly to you and you may vote your common shares electronically at the Annual Meeting or by submitting your proxy to the Company using the instructions in the Notice. If you hold our common shares in "street name" through a brokerage firm, bank, broker-dealer or other intermediary, the Notice was forwarded to you by that intermediary and you must follow the voting instructions provided by the intermediary. You may also vote electronically at the Annual Meeting if you hold your common shares in "street name" by following the instructions provided by the intermediary. | ||||

Your proxy is being solicited by our board of trustees.

We hope that all shareholders who can do so will attend the Annual Meeting in person via the live webcast. The virtual meeting has been designed to provide the same rights to participate as you would have had at an in-person meeting. During the Annual Meeting, you may ask questions and will be able to vote your shares electronically from your home or any remote location with Internet connectivity. We will allocate up to fifteen minutes to answer questions that we deem appropriate and that are pertinent to the Company and the business conducted at the Annual Meeting, and we intend to respond to as many such inquiries at the Annual Meeting as time allows. We request that each shareholder submit no more than two questions, and we may combine similar questions and answer them at once, so that we may have an opportunity to respond to as many questions as possible in the

allotted time. If a shareholder has a question that is not appropriate for general discussion, you may contact our Investor Relations team at (720) 630-2600.

If you plan to attend the Annual Meeting via the live webcast, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 11:00 a.m., MDT. Online check-in will begin at 10:45 a.m., MDT, and you should allow ample time for the online check-in procedures.

If you experience technical difficulties with connecting to the live webcast, please contact Broadridge by telephone at 1-844-986-0822 (toll-free in the U.S. and Canada) or at 1-303-562-9302 (for international participants).

Whether or not you plan to attend, we urge you to promptly submit your proxy or voting instructions to help the Company avoid the expense of follow-up mailings and ensure the presence of a quorum at the Annual Meeting.

Our board of trustees recommends that you vote:

| ü | FOR Each Trustee Nominee | ||||

| ü | FOR the Ratification of KPMG LLP as our Independent Registered Public Accounting Firm for 2023 |

||||

| ü | FOR the Advisory Approval of our Executive Compensation | ||||

By Order of the Board of Trustees, |

|||||

|

|||||

| Tiffany S. Kenyon Executive Vice President, Chief Legal Officer, and Secretary |

|||||

Greenwood Village, Colorado

April 7, 2023

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be held on May 22, 2023. The Proxy Statement, our 2022 Annual Report to Shareholders, and the means to vote electronically at the Annual Meeting or by Internet, telephone or mail are available at www.proxyvote.com. You will need to enter the control number found on your proxy card to access these materials via the Internet.

| TABLE OF CONTENTS | ||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

3 |

||||

| PROXY STATEMENT SUMMARY | ||

This summary highlights information contained elsewhere in this Proxy Statement and does not contain all of the information that you should consider. You should carefully read this entire Proxy Statement before voting.

VOTING PROPOSALS AND RECOMMENDATIONS

| Voting Matter | Board Recommendation | Vote Required | ||||||

1. Election of Trustees |

FOR each of the nominees

|

Majority of votes cast | ||||||

2. Ratification of Appointment of Independent Registered Public Accounting Firm |

FOR | Majority of votes cast | ||||||

3. Non-Binding Vote to Approve Executive Compensation |

FOR | Majority of votes cast | ||||||

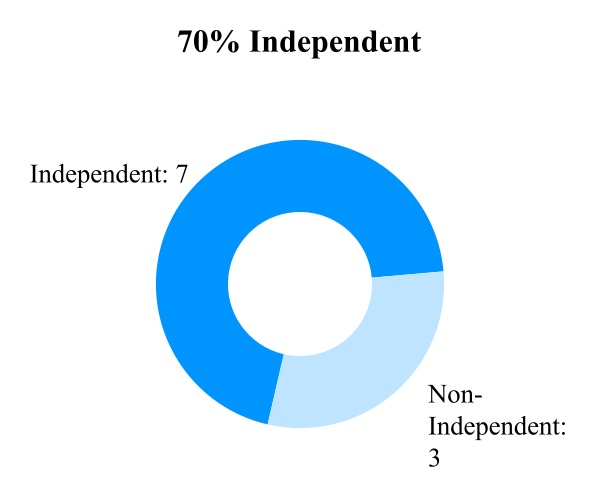

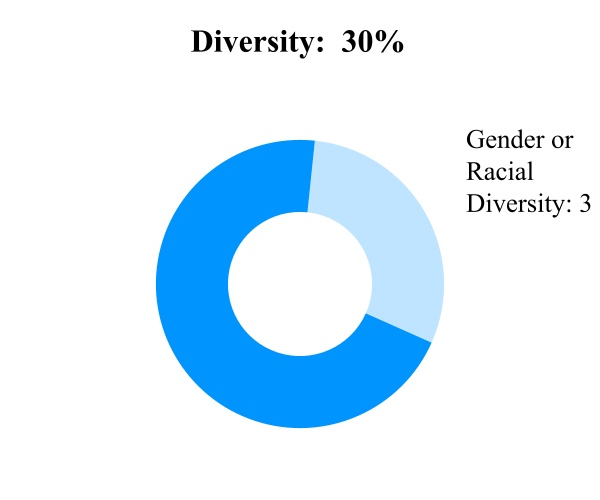

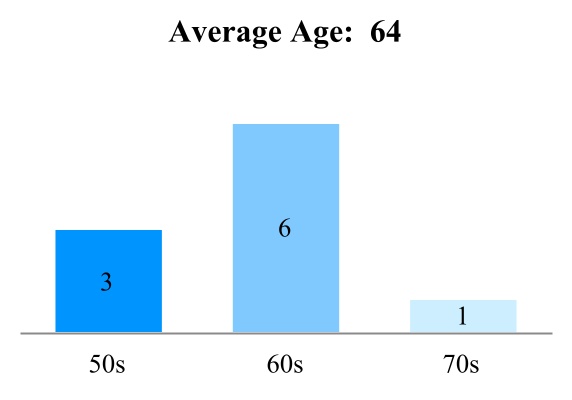

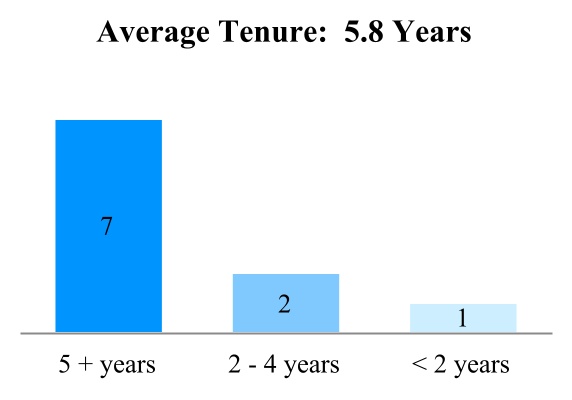

SNAPSHOT OF BOARD COMPOSITION

Our trustee nominees represent a mix of independence, age, race, gender, tenure, skills and experience. Set forth below is a snapshot of some key characteristics of our trustee nominees.

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

4 |

||||

| Skills and Experience Supporting Our Growth Strategy | ||||||||||||||

| Self Storage Experience | REIT Experience | Technology or Cybersecurity Expertise | Public Company or Board Experience | Capital Markets or Mergers and Acquisitions Expertise | ||||||||||

| Financial Expertise | Real Estate Investment and Management | Private Equity and Investment Expertise | Business Strategy and Operations |

Digital Marketing Expertise | ||||||||||

2022 BUSINESS HIGHLIGHTS

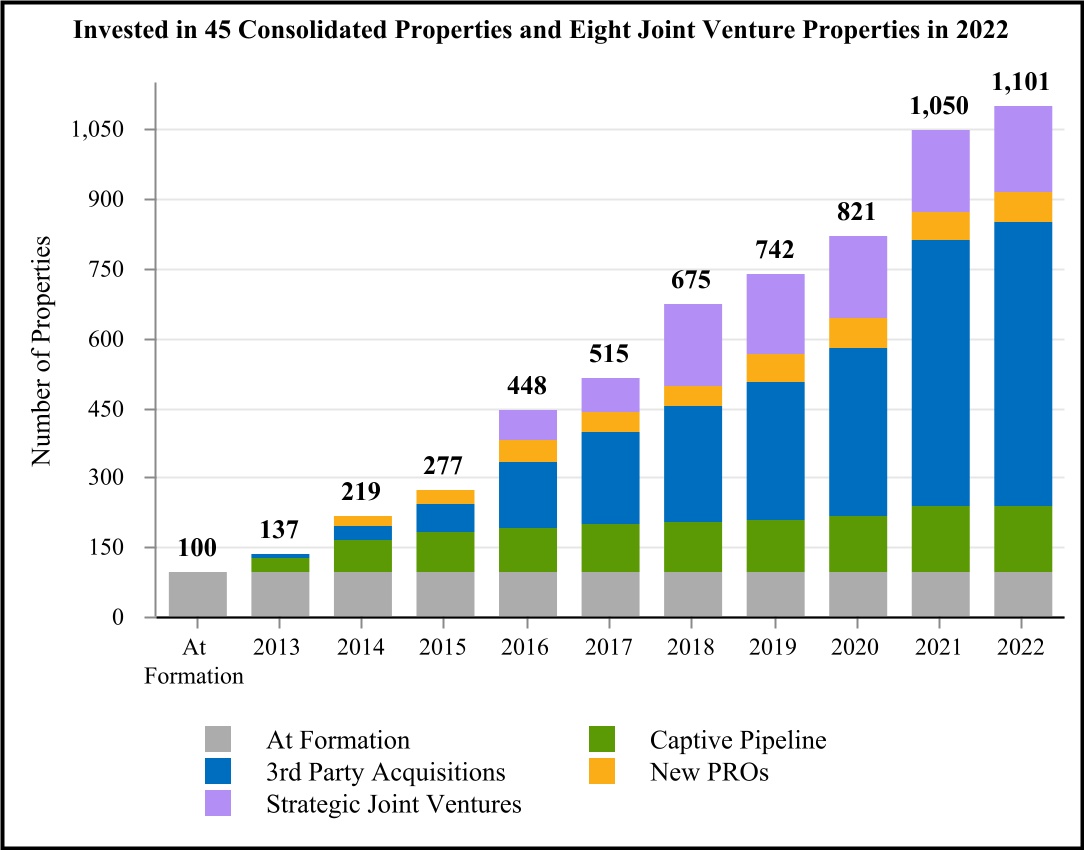

As of December 31, 2022, we held ownership interests in and operated a geographically diversified portfolio of 1,101 self storage properties, located in 42 states and Puerto Rico, comprising approximately 71.8 million rentable square feet, configured in approximately 564,000 storage units.

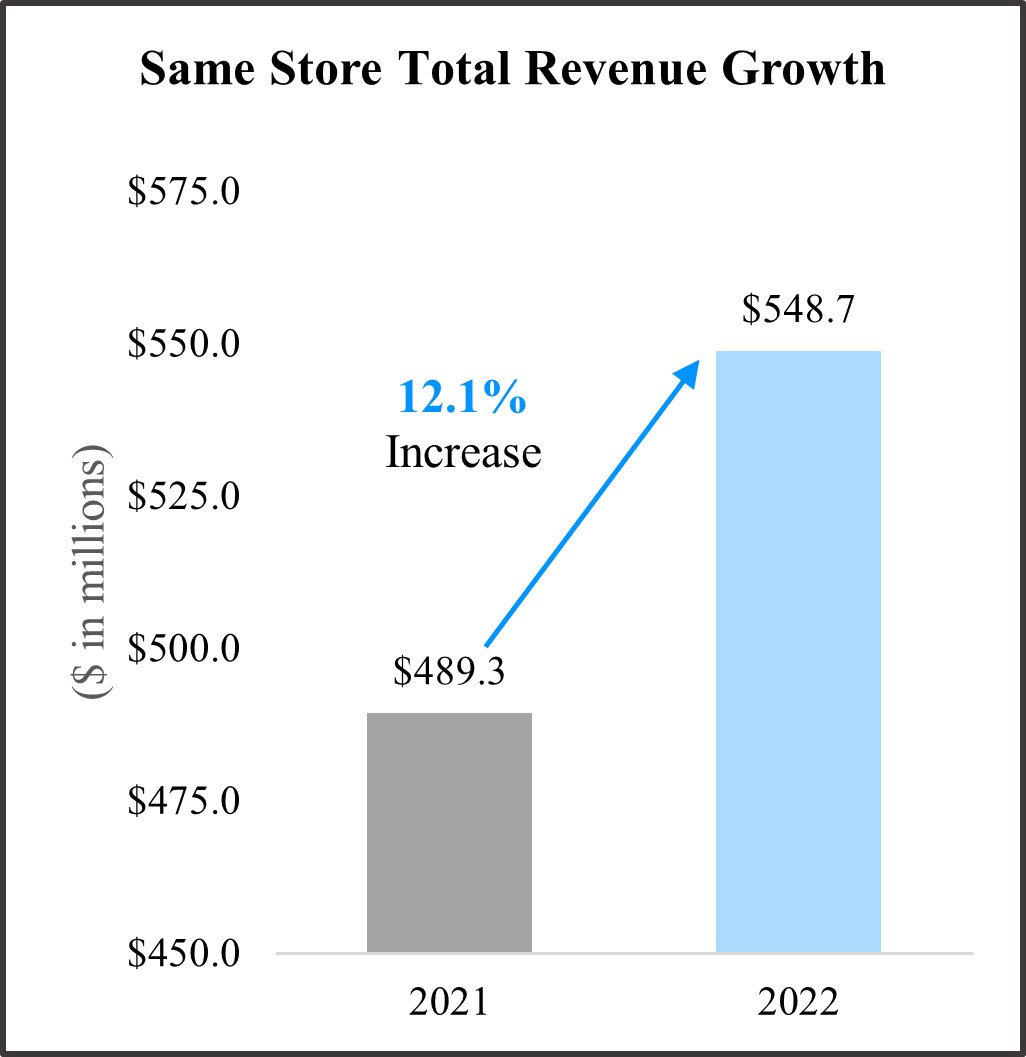

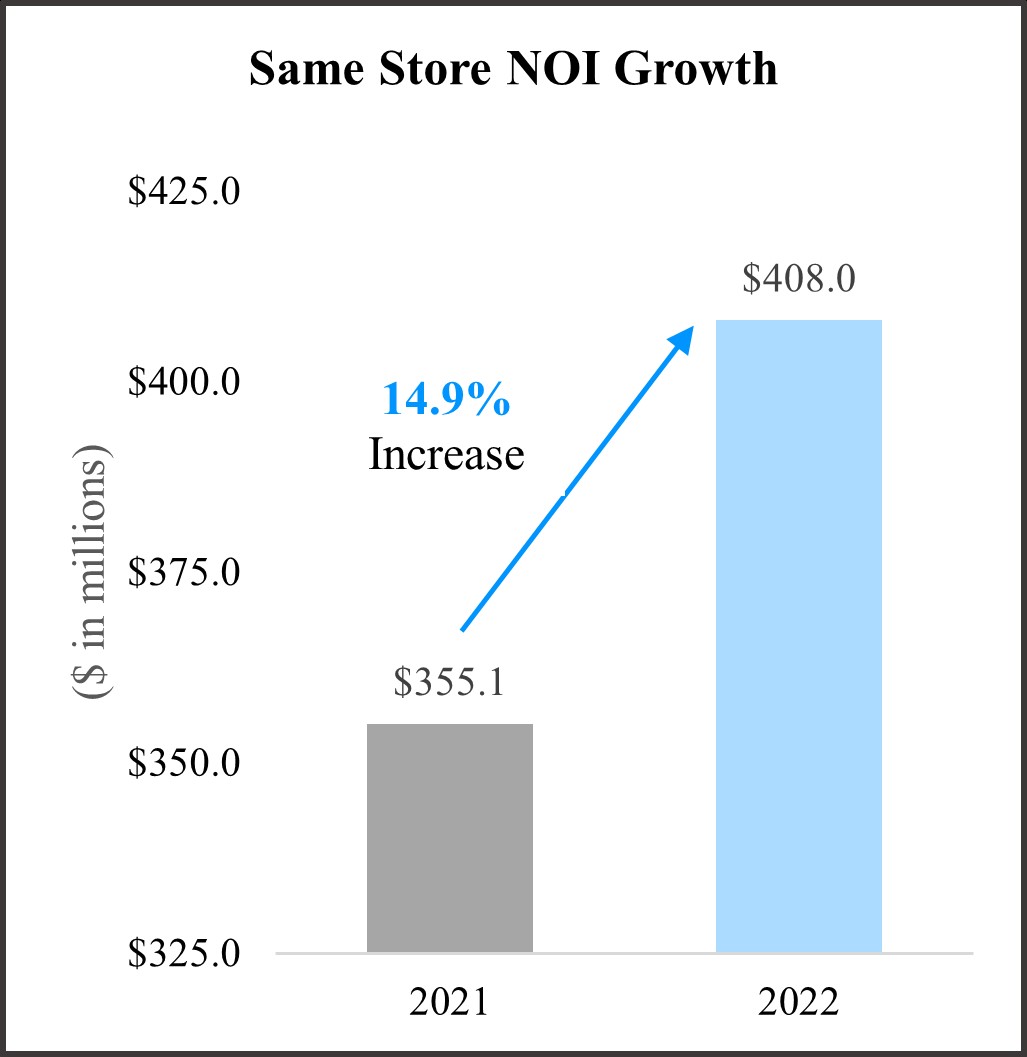

In 2022, we acquired 45 wholly-owned self storage facilities for approximately $569.2 million. We also acquired an additional eight self storage facilities through our unconsolidated real estate ventures ("joint ventures") for approximately $214.2 million, in which we have a twenty-five percent (25%) interest. We delivered another year of strong financial and operating performance in 2022, with year over year increases in Same Store Revenue, Same Store NOI and Core FFO per share of 12.1%, 14.9% and 24.3%, respectively.

In addition, one of our participating regional operators ("PROs"), Move It Self Storage, LP, doing business as Move It Self Storage ("Move It"), elected to retire as a PRO effective January 1, 2023. As a result of the retirement, on January 1, 2023, management of the properties in the Move It managed portfolio was transferred to us, the related Move It brand name and intellectual property was internalized by us, and we discontinued payment of any supervisory and administrative fees or reimbursements to Move It. In addition, on January 1, 2023, we issued a non-voluntary conversion notice to convert all subordinated performance units related to Move It's managed portfolio into Class A common units of limited partner interest in our operating partnership ("OP units"). As part of the internalization, a majority of Move It's employees were offered and provided employment by us and continue managing the same portfolio of properties as members of our existing property management platform.

We have continued to focus on our balance sheet, maintain access to multiple sources of capital, and be opportunistic with our debt and equity financings to fund our growth, including through the following:

•Issuance of $325 million of senior unsecured notes in 2022, consisting of:

◦$125 million of 2.96% senior unsecured notes due November 30, 2033; and

◦$200 million of 5.06% senior unsecured notes due November 16, 2032;

•Issuance of approximately $68.9 million of OP units, series A-1 preferred units, and subordinated performance units as consideration for property acquisitions, including $25.7 million of OP units issued at a premium of $60 per OP unit;

•Issuance of a new 7 year term loan in June 2022 in a principal amount of $285 million; and

•Recast of our credit facility in January 2023, increasing our borrowing capacity by $405 million to $1.955 billion with the ability to expand the borrowing capacity to an aggregate of $2.5 billion, and used incremental borrowings under the credit facility to retire $300.0 million of our $375.0 million of debt maturing in 2023.

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

5 |

||||

In addition, in April 2022, a nationally recognized statistical rating organization upgraded the issuer credit rating of our operating partnership to BBB+ with a Stable Outlook from BBB with a Positive Outlook.

We also implemented a share repurchase program, under which we are authorized (but not obligated) to repurchase up to $400 million of Common Shares from time to time. During 2022, we repurchased an aggregate of 1,986,175 Common Shares for approximately $90.0 million.

Our business highlights include the following:

| é |

2022 Core FFO per Share(1) Increased by 24.3%

|

é |

5 Year Average Annual Growth in Core FFO Per Share(1) of 18.1%(2)

|

|||||||||||

| é |

2022 Same Store NOI Growth of 14.9%(1)

|

é |

5 Year Quarterly Average Growth in Same Store NOI(1) of 9.4%(2)

|

|||||||||||

| é |

2022 Same Store Total Revenue Growth of 12.1%(1)

|

é |

5 Year Quarterly Average Growth in Same Store Total Revenue(1) of 7.4%(2)

|

|||||||||||

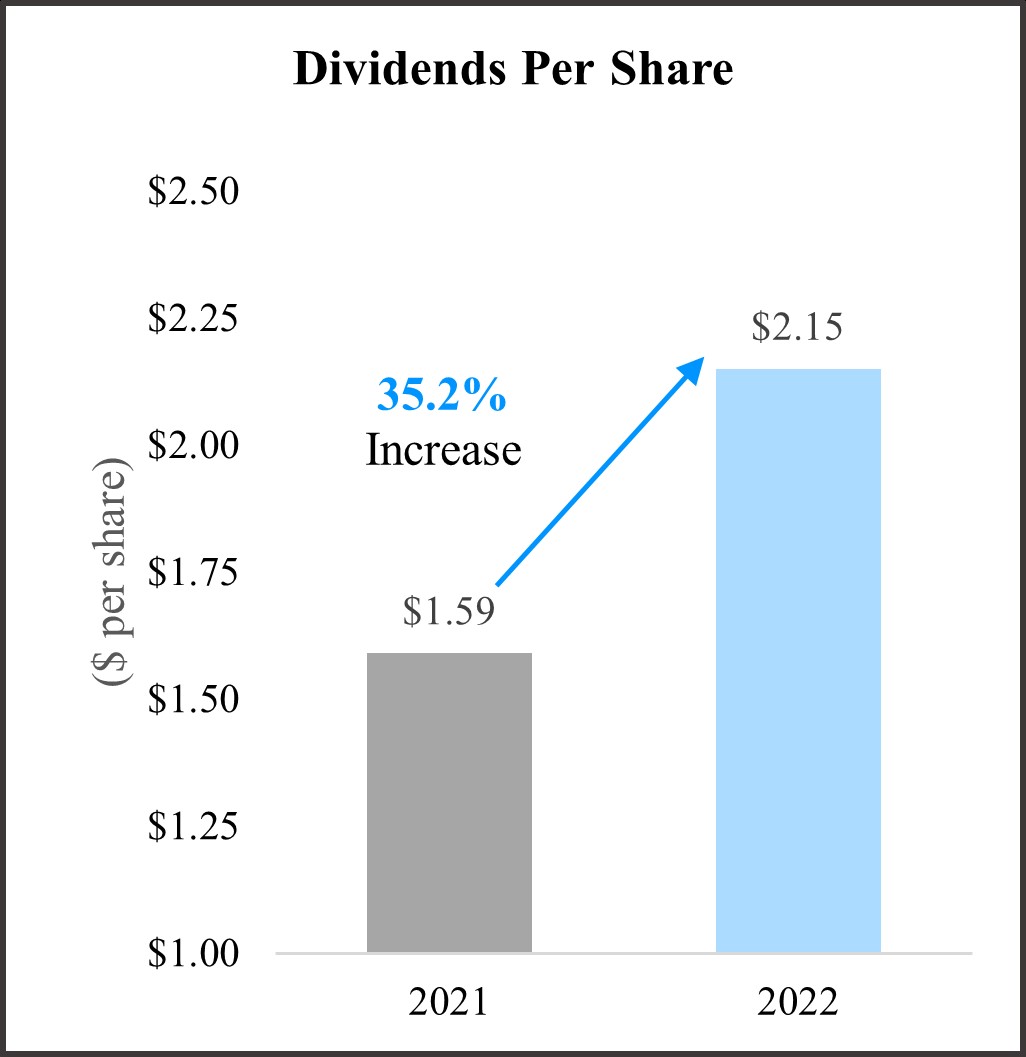

| é | 2022 Dividend Growth of 35.2% |

é |

5 Year Dividend Growth of 85.3%(2)

|

|||||||||||

| é | $783.4 million of Wholly-Owned and Joint Venture Acquisitions in 2022 |

é |

$5.6 Billion of Wholly-Owned and Joint Venture Acquisitions over 5 Years(2)

|

|||||||||||

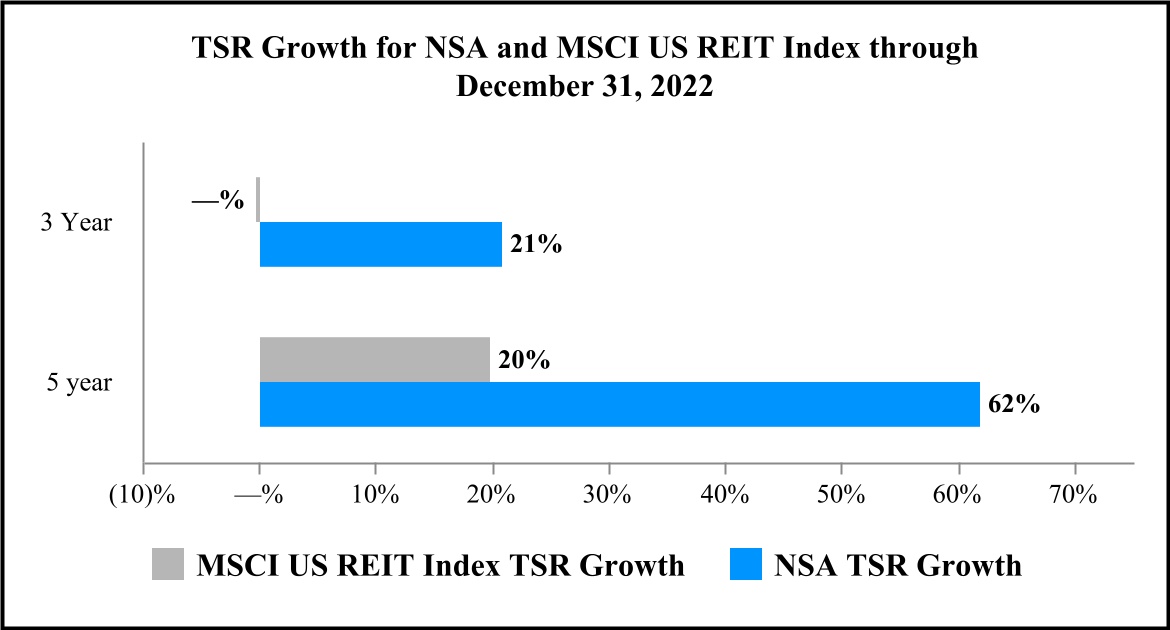

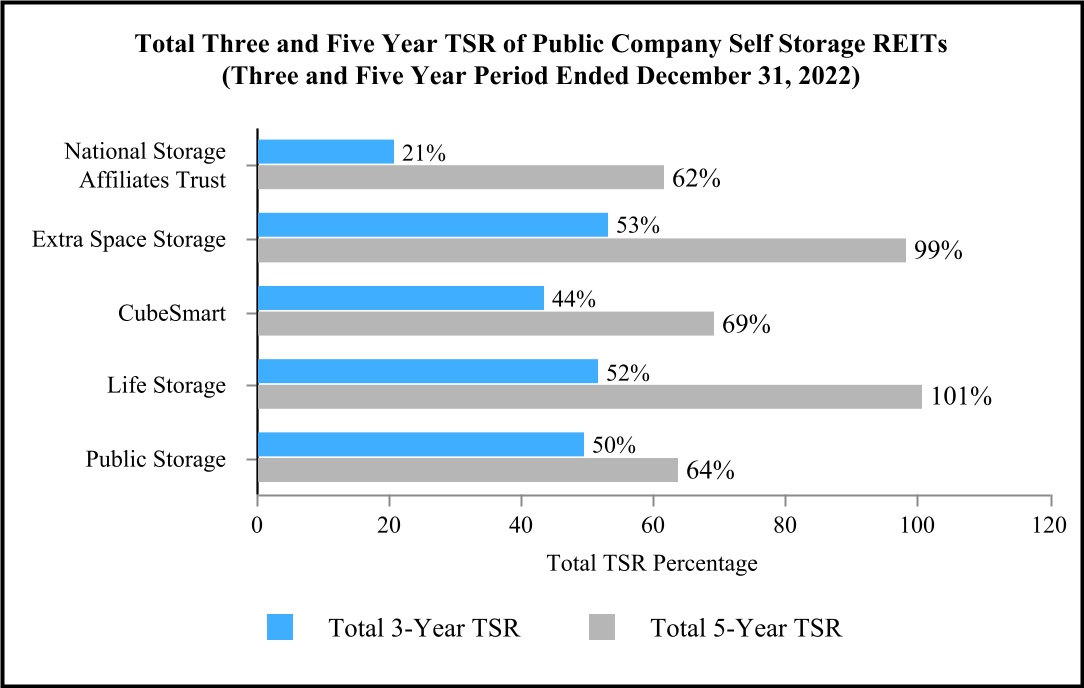

| é |

Three year total shareholder return of approximately 21%(2)(3)

|

é |

Five year total shareholder return of approximately 62%(2)(3)

|

|||||||||||

(1) Our same store portfolio is defined in our annual report on Form 10-K filed with the SEC on February 27, 2023. Core FFO and Net Operating Income ("NOI") are defined and reconciled to their most directly comparable U.S. generally accepted accounting principles ("GAAP") measure in Appendix A to this Proxy Statement.

(2) Measured over the three and five-year periods, respectively, ended December 31, 2022. For Core FFO, it is calculated as the average of the annual growth rates during this period. For Same Store NOI and Same Store Total Revenue, it is calculated as the average of the quarterly growth rates during this period.

(3) Source: S&P Global Market Intelligence.

Based on our total shareholder return ("TSR") during the three year period and five year period ended December 31, 2022, we have outperformed the Morgan Stanley Capital International US REIT Index ("MSCI US REIT Index").

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

6 |

||||

Source: S&P Global Market Intelligence

We continue to focus on maintaining a conservative and flexible balance sheet and access to multiple sources of capital to provide additional flexibility to fund our growth. Highlights as of December 31, 2022 include the following:

Debt Profile: Total principal debt outstanding: $3.6 billion(1)

| ||||||||

Weighted average maturity: 5.7 years |

Minimal interest rate risk: 83% fixed/swapped |

|||||||

Effective interest rate(2): 3.99%

|

92% debt unsecured(3)

|

|||||||

(1) Amounts give pro forma effect for the credit facility recast and debt retirements on January 3, 2023 and an interest rate swap that was effective starting February 1, 2023.

(2) Effective interest rate incorporates the stated rate plus the impact of interest rate cash flow hedges and discount and premium amortization, if applicable. For the revolving line of credit, the effective interest rate excludes fees which range from 0.15% to 0.20% for unused borrowings.

(3) Based on the principal value of the debt.

| Investment Grade Rating by a Nationally Recognized Statistical Rating Organization | ||||||||

| Our operating partnership: BBB+ with Stable Outlook | ||||||||

Our Series A preferred shares: BBB with Stable Outlook | ||||||||

Our senior unsecured notes: BBB+ with Stable Outlook | ||||||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

7 |

||||

Key Credit Metrics(1)

| ||||||||||||||

|

39% Principal

Debt/Total Enterprise

Value(2)

|

6.0x

Net Debt/

Adjusted EBITDA(3)

|

4.3x

Interest

Coverage Ratio(4)

|

||||||||||||

(1) Amounts give pro forma effect for the credit facility recast and debt retirements on January 3, 2023 and an interest rate swap that was effective starting February 1, 2023.

(2) Total Enterprise Value is defined as the sum of the Company’s debt principal outstanding plus our 6.000% Series A cumulative redeemable preferred shares of beneficial interest ("Series A Preferred Shares") and common shares (on a fully diluted basis assuming the prior conversion on a one-for-one basis of all outstanding units in our operating partnership into common shares, except that subordinated performance units are assumed to be converted as described in the following sentence) valued at the closing price per share as of December 31, 2022 of $22.35 and $36.12, respectively. Our subordinated performance units are assumed converted using the hypothetical conversion ratio for the trailing twelve months ended at each respective quarter end, which we publicly disclose each quarter. See Supplemental Schedule 4 to each of our earnings releases which are furnished with the U.S. Securities and Exchange Commission.

(3) Net debt means principal debt outstanding less cash and cash equivalents as of December 31, 2022. Adjusted EBITDA is annualized based on the fourth quarter ended December 31, 2022. Adjusted EBITDA is defined and reconciled to its most directly comparable U.S. generally accepted accounting principles ("GAAP") measure in Appendix A to this Proxy Statement.

(4) Interest coverage is computed by dividing Adjusted EBITDA by interest expense, in each case for the quarter ended December 31, 2022. Does not include loss on early extinguishment of debt.

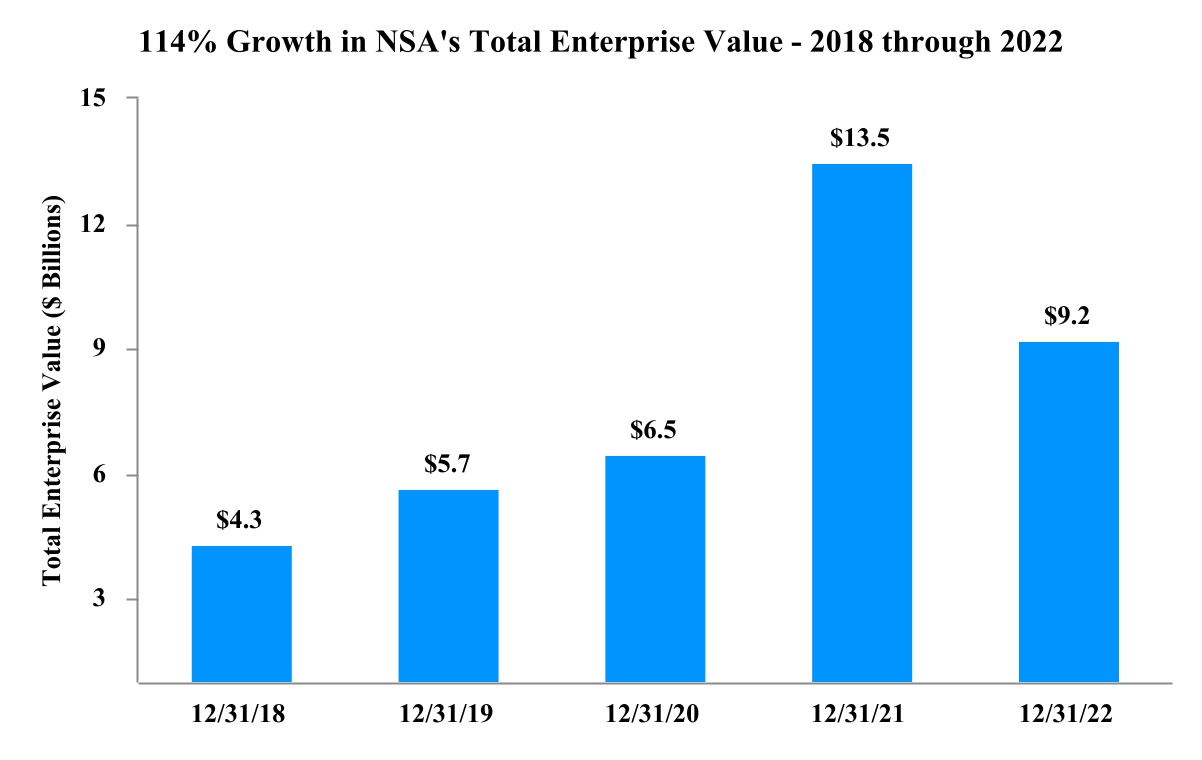

As a result of our continued growth, our Total Enterprise Value (as defined above) has grown by approximately 114% from December 31, 2018 to December 31, 2022.

(1) Total Enterprise Value is defined as set forth above and is valued at the closing price per share as of the dates referenced above in the table.

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

8 |

||||

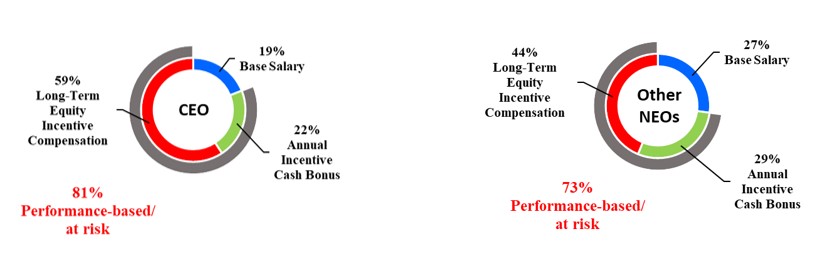

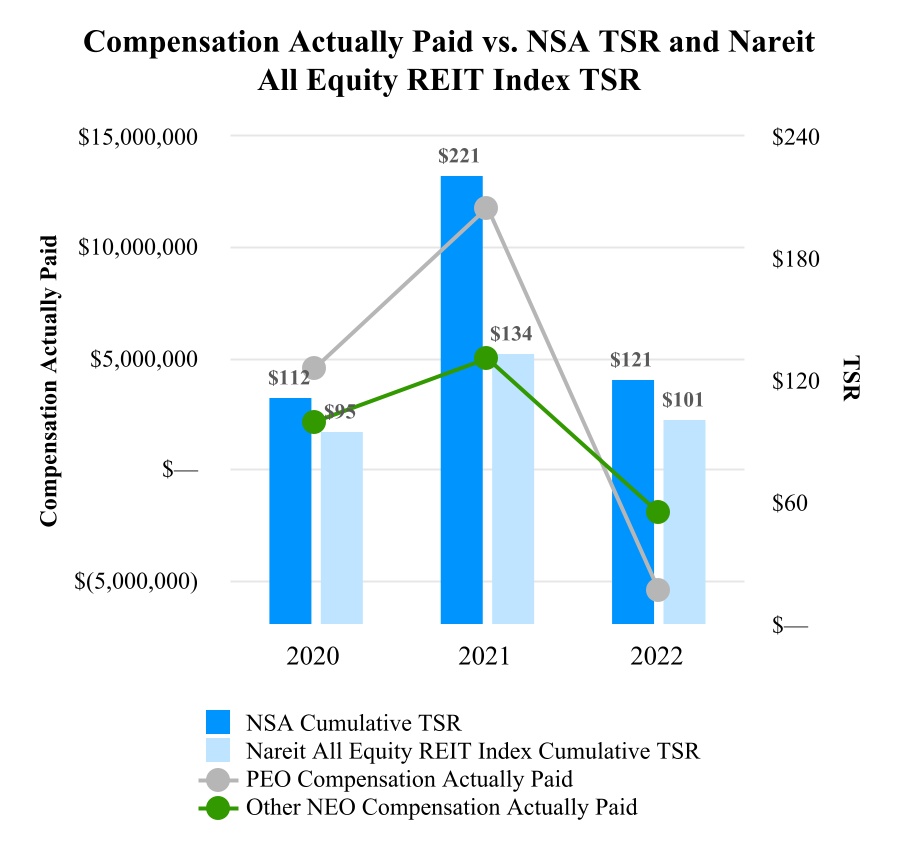

EXECUTIVE COMPENSATION HIGHLIGHTS

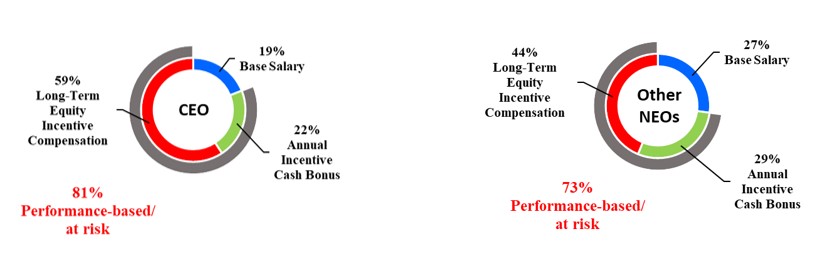

A significant portion of our Named Executive Officers' compensation is variable or performance-based compensation, which aligns their interests with those of our shareholders. In 2022, more than 80% of our chief executive officer's target pay, and more than 70% of our other Named Executive Officers' target pay, was at risk.

The key elements of our executive compensation program are base salary, annual incentive cash bonus and long-term equity compensation, as described below.

| Type | Pay Elements | Form and Purpose | ||||||

| Fixed | Base Salary |

–Paid in cash

–Fixed annually, taking into account our budgeted operating expenses

–Compensates individuals for day-to-day performance

|

||||||

| Variable | Annual Incentive Bonus |

–Paid in cash

–Based on achievement of certain quantitative and qualitative Company and individual performance objectives over the course of each year

–Objective performance metrics:

–Same Store NOI growth

–Core FFO per share

–Acquisitions volume

–PRO retirements/PROs or joint ventures signed/strategic initiatives

–Rewards short-term annual performance

–Aligned with shareholders

|

||||||

| Long-Term Equity Compensation |

–Consists of performance-based awards and time-based awards

–Performance-based awards are earned over a three-year performance period contingent upon achievement of the following performance criteria:

–3 year relative TSR as compared to the MSCI US REIT Index

–3 year relative TSR as compared to public company self storage REIT peers

–Time-based awards are earned in equal annual installments over a three-year period, subject to continued employment

–Promotes retention and encourages creation of long-term shareholder value and achievement of long-term business strategies

–Aligned with shareholders

|

|||||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

9 |

||||

Key features of our compensation program include the following:

| What we do and have.... | What we don't do and don't have.... | |||||||||||||

| ü | Pay for performance, including incentive compensation (both cash and equity) that is subject to achievement of various performance objectives | û | No excise tax gross-ups with respect to payments made in connection with a change of control |

|||||||||||

| ü | Salaries comprise a relatively modest portion of each Named Executive Officer's overall compensation opportunity | û | No non-qualified deferred compensation or supplemental retirement benefits for our Named Executive Officers | |||||||||||

| ü | Balance of short-term and long-term incentives | û | No hedging of the value of Company securities | |||||||||||

| ü | Robust minimum equity ownership guidelines for our Named Executive Officers and trustees | û | No uncapped cash and equity incentive awards | |||||||||||

| ü | Clawback policy that allows for the recovery of previously paid executive compensation |

û | No excessive perquisites to Named Executive Officers | |||||||||||

| ü | Limitations on pledging of Company securities by Named Executive Officers and trustees | |||||||||||||

| ü | Independent compensation consultant | |||||||||||||

| ü | "Double-trigger" change of control benefits | |||||||||||||

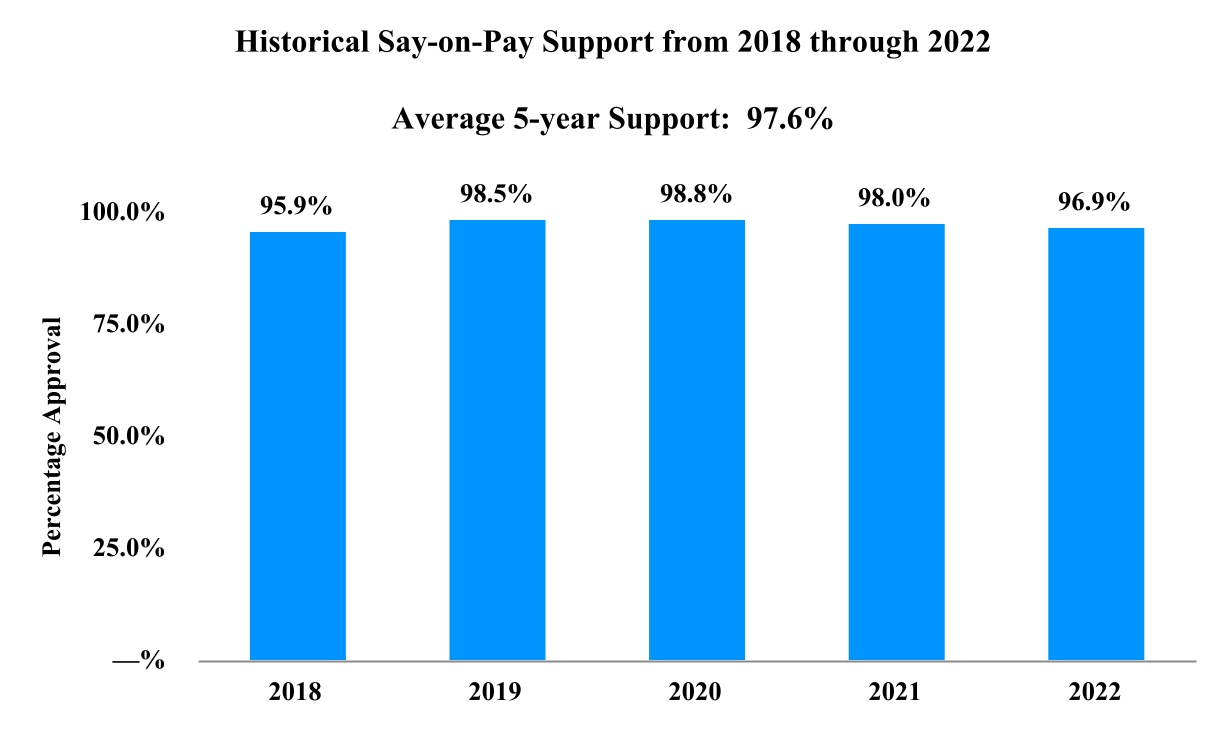

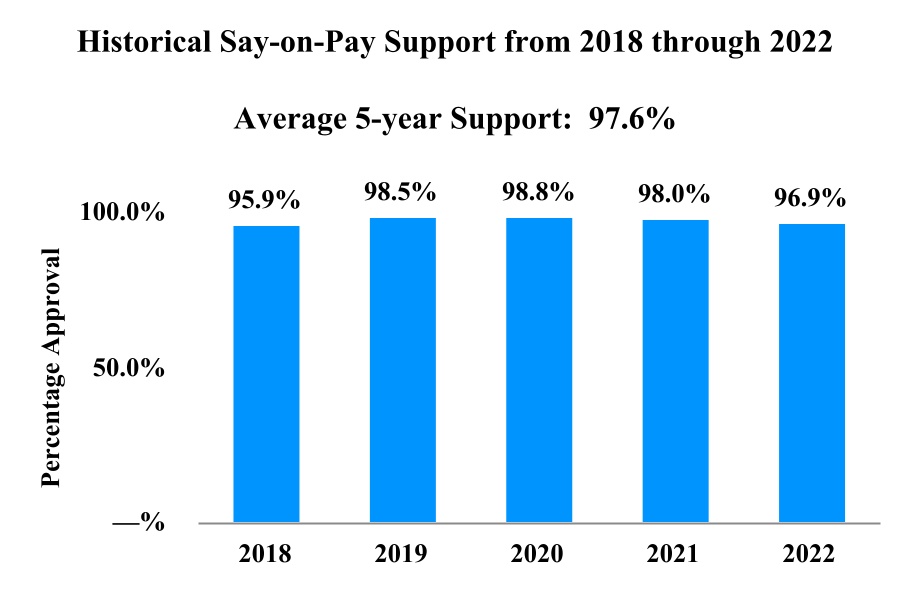

From 2018 through 2022, we have received on average 97.6% approval of our executive compensation program through our say-on-pay votes.

For more information on our Named Executive Officers and our compensation philosophy, see "Information Regarding Our Named Executive Officers" and "Compensation Discussion and Analysis."

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

10 |

||||

| CORPORATE RESPONSIBILITY INITIATIVES | ||

We strive to operate our business in a manner that is environmentally friendly and socially responsible, and we take into consideration how we interact with our customers and employees as well as the communities in which we operate. Our Environmental, Social and Governance Steering Committee ("ESG Committee"), which is overseen by our CNCG Committee and comprised of members of management, assists our board of trustees and executive management in connection with identifying, developing, implementing and monitoring corporate responsibility initiatives. Our board oversees these initiatives, including periodically reviewing and assessing policies and practices relating to environmental sustainability, social impact, diversity, equity and inclusion, and other public policy or social issues significant to the Company.

MISSION AND CORE VALUES

Our mission is to become the most rewarding self storage company for all of our stakeholders through exceptional growth, value-adding innovation and outstanding service. Our core values of integrity, humility, accountability, and compassion are integral to our company culture and success, encouraging our team members to take pride in building a climate of trust, remain teachable, celebrate our diversity, own successes and failures together, and have empathy.

ENVIRONMENTAL HIGHLIGHTS

We intend to mitigate the impact of our business on the environment and strive to operate in an environmentally sustainable manner. Our environmental initiatives include the following:

| Electricity | As of December 31, 2022, approximately 910 of our properties, representing 83% of the properties in our portfolio, have LED lighting. We have also installed motion sensors for the operation of lighting systems at a majority of our facilities, which drives reduced energy consumption, greenhouse gas emissions and energy bills. |

||||

| Water | Our self storage facilities inherently require minimal water to operate. However, we look for ways to further minimize water consumption, including through the use of water-saving plumbing features and landscaping features that require minimal amounts of water. | ||||

| Waste | We have an ongoing initiative to right size our waste containers and reduce the frequency of pick-ups, which minimizes our impact on the environment and reduces costs. | ||||

| Solar | As of December 31, 2022, we had 20 properties equipped with solar installations, which were generating renewable energy that was used in the operation of our facilities or delivered into the power grid. We are also evaluating other opportunities to expand our solar installations. |

||||

| Usage Monitoring | In 2022, we engaged a utilities bill pay aggregator and expect to transition the vast majority of our stores to the aggregator's platform in 2023. Once this process is completed, we will have improved measurement and reporting of energy and water utilization across our portfolio. We also began reporting to the Global ESG Benchmark for Real Assets ("GRESB") in 2022 by submitting the management portion of the GRESB assessment. We plan to begin reporting information to GRESB regarding our energy utilization in 2023. |

||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

11 |

||||

CORPORATE GOVERNANCE HIGHLIGHTS

We have a strong corporate governance framework which we believe is important to promoting the long-term interests of our shareholders and other stakeholders. We are also committed to promoting diversity among our management, board of trustees and employees. Our corporate governance framework includes the following elements:

| ü | 7 of 10 trustee nominees are independent | ü | Equityholders may amend bylaws | ||||||||

| ü | Separate chair and chief executive officer roles | ü | Majority voting in uncontested elections | ||||||||

| ü | Experienced and dedicated lead independent trustee | ü | Robust minimum equity ownership guidelines | ||||||||

| ü | No staggered board of trustees; annual election of all trustees | ü | Active shareholder outreach program | ||||||||

| ü | Diversity of age, race, gender, tenure, skills and experience among trustees | ü | No poison pill | ||||||||

| ü | Clawback policy for previously paid executive compensation | ü | Prohibition against hedging the value of Company securities | ||||||||

| ü | Two Audit Committee financial experts | ü | Limitations on pledging of Company securities by Named Executive Officers and trustees | ||||||||

| ü |

No excise tax gross-ups on payments made in connection with a change of control | ü |

Opted out of Maryland's unsolicited takeover act (which we may not opt into without shareholder approval) and control share acquisition statute | ||||||||

Other highlights of our corporate governance framework include:

| Diversity |

As of December 31, 2022:

•Approximately 62% of our employees were women;

•Approximately 33% self identified as racially or ethnically diverse;

•Approximately 42% of our senior management team (director level and above) are women; and

•Approximately 50% of our field employee leaders (regional managers and area managers) are women.

In addition, 30% of our trustee nominees are diverse based on gender or race.

In 2022, we formed a Diversity, Equity, Inclusion and Belonging committee comprised of both field and corporate employees. This cross-functional committee is intended to identify and evaluate initiatives to enhance diversity, equity, inclusion and belonging in our company.

In addition, in 2022, we donated $50,000 to the National Association of Real Estate Investment Trusts' ("Nareit") Dividends through Diversity, Equity and Inclusion program, which promotes actionable and sustainable plans that support the recruitment, inclusion, development, and advancement of diverse individuals in REITs and the publicly traded real estate industry. Tamara D. Fischer, our executive chair and former chief executive officer, was also a member of the CEO Council for this program.

|

||||

| Vendor Code of Conduct | We strive to conduct our business in an ethical manner that benefits our stakeholders and which is intended to mitigate our overall impact on the environment. We expect our vendors to operate in a similar manner, as set forth in our Vendor Code of Conduct. | ||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

12 |

||||

SOCIAL HIGHLIGHTS

We care about the well-being of our employees and customers and want to give back to the communities in which we operate. Our social initiatives include the following:

| NSA Employees | We are committed to treating our team members as family. Our team members enjoy an exceptional benefits package including a fully funded healthcare option, a 401(k) Retirement Savings Plan with an employer contribution that currently matches a portion of each eligible employee's contributions, and for our corporate and managerial team members, a performance-based bonus incentive plan. Our team members also enjoy employee discount programs, a wellness reimbursement benefit, and an employee assistance program. We also have a learning platform to supplement our employee's professional development and have created leadership book clubs to support the growth of our emerging leaders. In addition, in 2022 we have launched a women's leadership forum for our corporate mid-level and senior female leaders. In 2023, we are rolling out a leadership boot camp aimed at developing comprehensive business acumen and situational leadership skills for our field leadership team. |

||||

| Customers | We are focused on continuously enhancing customer satisfaction through our customer service center of excellence, as improving our customers' experience is integral to what we do. |

||||

| Community |

We regularly donate storage units for charitable use. In 2022, we donated storage units to a number of charities, including the 4H, American Cancer Society, American Red Cross, Autism Awareness Wichita Falls, Bikes for Tykes, St. Louis Blues Blind Hockey Club, Kids on the Block, and a number of local fire departments, police departments and schools in the areas in which we operate.

We seek to give back to the communities in which we operate and help those in need of assistance. Examples include partnering with Feeding America, through which in 2022 we committed to donate the equivalent of over 1,500,000 meals annually to assist in ending food insecurity in America. Our corporate office supported the Children's Hospital of Colorado for the 2022 holiday season. As part of the program, our corporate employees donated toys and gifts for children. Through the donations of our employees, and the matching donations from the Company and our executive management team, we donated over $9,000 of toys and gifts. In addition, we sponsored more than 35 members of our corporate office in the Hot Chocolate Run supporting St. Jude Children’s Research Hospital.

In 2022, we, together with members of our executive management team, donated approximately $40,000 to ACE Scholarships, which provides children of low-income families with scholarships to private schools in grades K-12 and advocates for expanded school choice. In addition, together with Arlen D. Nordhagen, our former executive chairman and current vice chair, we have funded $500,000 toward a college scholarship endowment for self storage sector employees through the Self Storage Association Foundation.

|

||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

13 |

||||

| GENERAL MEETING INFORMATION | ||

We are providing this Proxy Statement on behalf of the board of trustees of National Storage Affiliates Trust, a Maryland real estate investment trust (the "Company," "we," "our" or "us"), to solicit your proxies for use at the Annual Meeting. Our common shares of beneficial interest, par value $0.01 per share (the "Common Shares"), are listed on the New York Stock Exchange (the "NYSE") under the symbol "NSA".

This Proxy Statement, the Notice of Annual Meeting of Shareholders and the related proxy card are first being made available to shareholders on or about April 7, 2023.

VOTING INFORMATION

Meeting Date, Time and Location

The Annual Meeting will be a virtual meeting held on May 22, 2023, at 11:00 a.m., Mountain Daylight Time (MDT), or at any postponements or adjournments thereof. You will only be able to attend the Annual Meeting via live webcast by visiting www.virtualshareholdermeeting.com/NSA2023. The virtual meeting has been designed to provide the same rights to participate as you would have had at an in-person meeting.

During the Annual Meeting, you may ask questions and will be able to vote your shares electronically from your home or any remote location with Internet connectivity. We will allocate up to fifteen minutes to answer questions that we deem appropriate and that are pertinent to the Company and the business conducted at the Annual Meeting, and we intend to respond to as many such inquiries at the Annual Meeting as time allows. We request that each shareholder submit no more than two questions, and we may combine similar questions and answer them at once, so that we may have an opportunity to respond to as many questions as possible in the allotted time. If a shareholder has a question that is not appropriate for general discussion, you may contact our Investor Relations team at (720) 630-2600.

If you plan to attend the Annual Meeting via the live webcast, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials. The Annual Meeting will begin promptly at 11:00 a.m., MDT. Online check-in will begin at 10:45 a.m., MDT, and you should allow ample time for the online check-in procedures.

If you experience technical difficulties with connecting to the live webcast, please contact Broadridge by telephone at 1-844-986-0822 (toll-free in the U.S. and Canada) or at 1-303-562-9302 (for international participants).

Record Date

The record date is March 23, 2023.

Who Can Vote

Holders of our Common Shares as of the close of business on the record date are entitled to vote. For all matters submitted for a vote at the Annual Meeting, each Common Share is entitled to one vote. As of the close of business on March 23, 2023, we had 88,296,370 Common Shares that are issued, outstanding and entitled to vote at the Annual Meeting (including unvested restricted Common Shares).

Proxy Materials Provided Through Internet

Pursuant to the rules adopted by the Securities and Exchange Commission (the "SEC"), we have provided access to our proxy materials over the Internet, and we are sending a Notice of Internet Availability of Proxy Materials (the "Notice") to our common shareholders of record who are entitled to vote at the Annual Meeting. We believe that posting these materials on the Internet enables us to provide shareholders with the information that they need more quickly. It also lowers our costs of printing and delivering these materials and reduces the environmental

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

14 |

||||

impact of the Annual Meeting. The Notice and this Proxy Statement summarize the information you need to know to vote by proxy or electronically at the Annual Meeting.

Shareholders of Record and Holders in "Street Name"

If you are a registered holder of Common Shares as of the close of business on the record date, the Notice was sent directly to you and you may vote your Common Shares electronically at the Annual Meeting or by proxy. If you hold Common Shares in "street name" through a brokerage firm, bank, broker-dealer or other intermediary, you are a beneficial owner, and the Notice was forwarded to you by that intermediary and you must follow the instructions provided by the intermediary regarding how to instruct the intermediary to vote your Common Shares. In the absence of specific instructions from you on how to vote your shares, your broker, bank, broker-dealer or other intermediary may not be able to vote your shares on certain matters.

Recommendations of our Board of Trustees

Our board of trustees recommends that you vote:

| ü | FOR the Election of the Ten Nominees Named in this Proxy Statement to Serve on our Board of Trustees | ||||

| ü | FOR the Ratification of KPMG LLP as our Independent Registered Public Accounting Firm for 2023 |

||||

| ü | FOR the Advisory Approval of our Executive Compensation | ||||

The board of trustees knows of no other matters that may properly be brought before the Annual Meeting. If other matters are properly introduced, the persons named in the proxy as the proxy holders will vote on such matters in their discretion.

Quorum Required

The presence at the Annual Meeting, via live webcast or by proxy, of holders of Common Shares entitled to cast a majority of all the votes entitled to be cast on any matter to be considered at the Annual Meeting or at any postponement or adjournment thereof shall constitute a quorum. Abstentions and broker non-votes are each included in the determination of the number of shares present at the Annual Meeting for the purpose of determining whether a quorum is present.

A broker non-vote occurs when a brokerage firm, bank, broker-dealer or other intermediary holding shares for a beneficial owner delivers a properly-executed proxy but does not vote on a particular proposal because the intermediary does not have discretionary voting power for that particular matter and has not received instructions from the beneficial owner.

Vote Required

If a quorum is present, then the affirmative vote required to approve the proposals described in this Proxy Statement are as follows:

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

15 |

||||

| Proposal | Vote Required | ||||

| Election of a Trustee |

A majority of votes cast for and against the election of such nominee(1)

|

||||

Ratification of KPMG LLP as our Independent Registered Public Accounting Firm for 2023 |

A majority of votes cast on the proposal | ||||

| Non-Binding Vote to Approve Executive Compensation | A majority of votes cast on the proposal | ||||

(1) For more information regarding the election of a trustee, please see "Corporate Governance–Majority Vote and Trustee Resignation Policy" herein.

The vote on compensation is advisory and not binding on our board of trustees. However, our board of trustees and the Compensation, Nominating and Corporate Governance Committee of our board of trustees (our "CNCG Committee") value all shareholder feedback and will continue to consider the outcome of the vote in reviewing executive compensation each year.

How Proxies will be Voted

Common Shares represented by properly submitted proxies received by us prior to or at the Annual Meeting will be voted according to the instructions specified on those proxies.

If you are a registered holder of Common Shares as of the close of business on the record date and have given a properly authorized proxy without specifying any voting instructions, and the proxy is not revoked prior to the Annual Meeting, then the Common Shares represented by such proxy will be voted:

•FOR the election of the ten trustee nominees named in this Proxy Statement as trustees;

•FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023; and

•FOR the advisory approval of the compensation of the Named Executive Officers as described in this Proxy Statement.

As to any other business which may properly come before the Annual Meeting or any postponements or adjournments thereof, the persons named as proxy holders on your proxy card will vote the Common Shares represented by properly submitted proxies in their discretion.

If you hold your Common Shares in "street name" through a brokerage firm, bank, broker-dealer or other intermediary, then under NYSE rules, your intermediary may vote your Common Shares without receiving instructions from you only with respect to the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. All other matters that are to be voted upon at the Annual Meeting are considered to be "non-routine" matters. If you hold your shares in street name and do not give the intermediary specific voting instructions on the election of trustees or the advisory vote regarding the compensation of our Named Executive Officers, your shares will not be voted on those items, and a broker non-vote will occur. Broker non-votes and abstentions will have no effect on the voting results for any of the proposals.

How to Vote

You can vote in any of the following ways:

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

16 |

||||

| : |

By Internet: To use the Internet to transmit your voting instructions and for electronic delivery of information, have your proxy card in hand when you access the website at www.proxyvote.com, and follow the instructions to obtain your records and to create an electronic voting instruction form. If you hold your shares in street name, follow the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. Voting instructions transmitted by Internet must be received by 11:59 P.M. Eastern Time on May 21, 2023.

|

||||

| ( |

By Phone: To transmit your voting instructions by telephone, use any touch-tone telephone to dial 1-800-690-6903. Have your proxy card in hand when you call and then follow the instructions. If you hold your shares in street name, follow the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. Voting instructions transmitted by telephone must be received by 11:59 P.M. Eastern Time on May 21, 2023.

|

||||

| * |

By Mail: To transmit your voting instructions by mail, mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717. If you hold your shares in street name, follow the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. Your proxy card must be received by May 21, 2023.

|

||||

| ! |

In Person at the Annual Meeting via the Live Webcast: If you are a registered holder of Common Shares and attend the Annual Meeting via the live webcast, you may vote electronically at the Annual Meeting. You may also vote electronically at the Annual Meeting if you hold your Common Shares in street name by following the instructions provided by your brokerage firm, bank, broker-dealer or other intermediary. To vote electronically at the Annual Meeting, you will need the 16-digit control number included in your Notice, on your proxy card or on the instructions that accompany your proxy materials.

|

||||

Even if you plan to attend the Annual Meeting via the live webcast, your plans may change, so we recommend you vote in advance of the meeting.

How to Revoke a Proxy

Any common shareholder of record submitting a proxy retains the power to revoke such proxy at any time prior to its exercise at the Annual Meeting by (i) delivering at or prior to the Annual Meeting a written notice of revocation to our corporate secretary at National Storage Affiliates Trust, 8400 East Prentice Avenue, 9th Floor, Greenwood Village, CO 80111, (ii) submitting a later-dated proxy or (iii) voting electronically at the Annual Meeting. Attending the Annual Meeting via the live webcast will not automatically revoke your previously submitted proxy unless you vote electronically at the Annual Meeting. If your shares are held in “street name” through a brokerage firm, bank, broker-dealer or other intermediary and you desire to change your vote, you should contact your brokerage firm, bank, broker-dealer or other intermediary for instructions on how to do so.

ANNUAL REPORT

This Proxy Statement is accompanied by our annual report to shareholders (our "Annual Report to Shareholders"), which includes our Form 10-K for the year ended December 31, 2022 (our "Form 10-K").

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

17 |

||||

| PROPOSAL 1: ELECTION OF TRUSTEES | ||

BOARD OF TRUSTEES

Our board of trustees was recently reduced from eleven trustees to ten trustees following the unexpected passing of George L. Chapman, who served as one of our independent trustees since the closing of our IPO in April 2015, including as the chair of the CNCG Committee. Rebecca Steinfort has been appointed as the chair of the CNCG Committee in his place and Mr. Hylbert has been appointed as a member of the CNCG Committee. J. Timothy Warren, one of our current trustees, has decided to not stand for re-election to the board at the Annual Meeting. Accordingly, our board of trustees has nominated our other current trustees for re-election, and has also nominated David G. Cramer, our president and chief executive officer, to stand for election at the Annual Meeting. As a result, the trustee nominees standing for re-election or election, as the case may be, at the Annual Meeting are listed below.

| Tamara D. Fischer | Steven G. Osgood | ||||

| Arlen D. Nordhagen | Dominic M. Palazzo |

||||

| David G. Cramer | Rebecca L. Steinfort |

||||

| Paul W. Hylbert, Jr. | Mark Van Mourick |

||||

Chad L. Meisinger |

Charles F. Wu |

||||

Each trustee elected will hold office until our next annual meeting of shareholders and until a successor has been duly elected and qualifies, or until the trustee's earlier resignation, death or removal.

We seek highly qualified trustee candidates from diverse business, professional and educational backgrounds who combine a broad spectrum of experience and expertise with a reputation for the highest personal and professional ethics, integrity and values. The CNCG Committee considers diversity of gender, race, age, experience and skills as important factors in choosing the most qualified candidates. We believe that, as a group, the nominees bring a broad range of perspectives that contribute to the effectiveness of our board of trustees as a whole. The procedures and considerations of the CNCG Committee in recommending qualified trustee candidates are described below under "Corporate Governance–Identification of Trustee Candidates" in this Proxy Statement. The CNCG Committee and our board of trustees concluded that each of our trustee nominees should be nominated for election based on the qualifications and experience described in the biographical information below under "–Information Regarding Nominees for Election as Trustees."

It is intended that the Common Shares represented by properly submitted proxies will be voted by the persons named therein as proxy holders FOR the election of Messrs. Nordhagen, Cramer, Hylbert, Meisinger, Osgood, Palazzo, Van Mourick, and Wu and Mss. Fischer and Steinfort as trustees, unless otherwise instructed. If the candidacy of any trustee nominee should, for any reason, be withdrawn prior to the Annual Meeting, the proxies will be voted by the proxy holders in favor of such substituted candidates (if any) as shall be nominated by our board of trustees. Our board of trustees has no reason to believe that, if elected, any of the nominees will be unable or unwilling to serve as a trustee.

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

18 |

||||

INFORMATION REGARDING NOMINEES FOR ELECTION AS TRUSTEES

The following information is furnished as of March 15, 2023 regarding the nominees for re-election or election as trustees, as the case may be.

|

TAMARA D. FISCHER

Age: 67

Executive Chair of the Board of Trustees (formerly Chief Executive Officer)

|

Ms. Fischer currently serves as our executive chair and served as our chief executive officer from January 2020 until March 31, 2023 and as our president from July 1, 2018 through June 30, 2022. Effective April 1, 2023, Ms. Fischer resigned as chief executive officer and was elevated to the position of executive chair. Prior to January 1, 2020, Ms. Fischer served as our chief financial officer since our inception in 2013. Prior to this role, from 2004 to 2008, Ms. Fischer served as the executive vice president and chief financial officer of Vintage Wine Trust, Inc., a triple net lease real estate investment trust focused on real estate assets related to the U.S. domestic wine industry. From 1993 to 2003, Ms. Fischer served as the executive vice president and chief financial officer of Chateau Communities, Inc., one of the largest real estate investment trusts in the manufactured home community sector. In addition, Ms. Fischer served on the board of directors of Duke Realty Corporation from February 2020 until its acquisition by Prologis, Inc. in October 2022. Ms. Fischer also serves on Nareit's Executive Board and is the chairman of the board of the National Self Storage Association. We believe that Ms. Fischer's extensive knowledge of the REIT industry and of our Company, as well as her financial expertise, qualify her to serve as one of our trustees. |

||||

|

ARLEN D. NORDHAGEN

Age: 66

Vice Chair of the Board (formerly Executive Chairman of the Board)

|

Mr. Nordhagen currently serves as our vice chair, is the founder of our Company, and served as our chief executive officer from our inception in 2013 until January 2020 when he was elevated to executive chairman and as our chairman from the closing of our IPO in April 2015 through March 31, 2023. Effective April 1, 2023, Mr. Nordhagen resigned as executive chairman and became vice chair. Prior to the closing of our IPO, he was the chairman of the board of managers of our Company's sole trustee. He also served as president and chief executive officer of SecurCare Self Storage, Inc. ("SecurCare"), which he co-founded in 1988, from 2000 to 2014. Since Mr. Nordhagen became president of SecurCare in 1999, the company rapidly grew to over 150 self storage properties. SecurCare was one of our PROs until March 31, 2020. In addition, Mr. Nordhagen was a founder of MMM Healthcare, Inc., the largest provider of Medicare Advantage health insurance in Puerto Rico. He has also served as managing member of various private investment funds and held various managerial positions at DuPont and Synthetech, Inc. Mr. Nordhagen graduated with high distinction from Harvard University with a masters in business administration and graduated summa cum laude from the University of North Dakota with a bachelor of science degree in chemical engineering. Mr. Nordhagen has over 30 years of experience in the self storage industry. We believe that Mr. Nordhagen will continue to bring to our board of trustees valuable perspective as the founder and former chief executive officer of our Company and that his experience, leadership skills and extensive knowledge of our Company and the self storage industry qualify him to serve as one of our trustees. | ||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

19 |

||||

|

DAVID G. CRAMER

Age: 58

President and Chief Executive Officer

|

Mr. Cramer has served as our president since July 1, 2022 and as our chief executive officer since April 1, 2023. Previously, he served as our executive vice president and chief operating officer since April 1, 2020. Prior to that time, Mr. Cramer served as the president and chief executive officer of SecurCare since 2014. Prior to that, Mr. Cramer served as chief operating officer and director of operations of SecurCare and has more than twenty-five years of experience in the self storage industry since he joined SecurCare in 1998. He has also served on the Company's PRO advisory committee and has led the Company's Technology and Best Practices Group as its chairman since the Company's formation. Mr. Cramer was a founding board member of FindLocalStorage.com, an industry digital marketing consortium. Mr. Cramer also serves as a member of the board of directors of SBOA TI Reinsurance Ltd., a Cayman Islands exempted company, in which the Company has an approximate 6% ownership interest. We believe that Mr. Cramer's extensive knowledge of the self storage industry, our Company and our PROs, as well as his significant acquisitions and operations experience, qualify him to serve as one of our trustees. | ||||

|

PAUL W. HYLBERT, JR.

Age: 78

Lead Independent Trustee

|

Mr. Hylbert currently serves as NSA's lead independent trustee, presiding over the regularly scheduled executive sessions of the independent trustees and has served as one of our independent trustees since the closing of our IPO in April 2015. Mr. Hylbert has also served as an officer and/or director of a number of companies over the past 40 years. Mr. Hylbert has served since 2011 and continues to serve as chairman of Kodiak Building Partners, LLC, a building products distribution platform, and was the chief executive officer from 2011 to 2014. Prior to this role, from 2007 to 2010, Mr. Hylbert served as the president and chief executive officer of ProBuild Holdings Inc., a national fabricator and distributor of building products and a subsidiary of Fidelity Capital. From 2000 until 2006, Mr. Hylbert served as the president and chief executive officer of Lanoga Corporation, one of the top U.S. retailers of lumber and building materials, until it was acquired by Fidelity Capital. Mr. Hylbert also served as the president and co-chief executive officer of PrimeSource Building Products, a national fabricator, packager and distributor of building products from 1991 to 1997, after which the company was sold and Mr. Hylbert served as president from 1997 to 2000. Earlier in his career, Mr. Hylbert served as the chief executive officer of the Wickes Europe, Wickes Lumber, and Sequoia Supply subsidiaries of Wickes, Inc. before leading a leveraged buy-out of Sequoia Supply to form PrimeSource Building Products in 1987. Mr. Hylbert graduated from the University of Michigan with a masters in business administration and graduated from Denison University with a bachelor of arts degree. We believe Mr. Hylbert's extensive experience in synergistic corporate acquisitions and "roll-ups" in the building products industry will continue to bring valuable perspective to our board of trustees and that his experience and leadership qualify him to serve as one of our trustees. | ||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

20 |

||||

|

CHAD L. MEISINGER

Age: 55

|

Mr. Meisinger has served as one of our independent trustees since the closing of our IPO in April 2015. Mr. Meisinger is the chief executive officer of Over The Top (OTT) Marketing, which he founded in 2006. OTT Marketing provides multi-location businesses with large scale, inbound digital customer acquisition services that are delivered through a proprietary software platform. Mr. Meisinger was the president and chief executive officer of IP Dynamx, which he founded in 2015, until 2017. In addition, Mr. Meisinger co-founded Thinique Medical Weight Loss in 2013 and built it to over 200 franchised units within a year before selling ownership interests to one of his co-founders. Mr. Meisinger also had the regional development rights for The Joint Corp. between 2011 and 2014, where he was developing more than 40 chiropractic clinics throughout Los Angeles County. Prior to founding OTT, Mr. Meisinger served as head of affiliate sales and marketing for Google Radio from 2006 to 2009. He joined Google Radio after serving as a key investor and chief marketing officer of dMarc Broadcasting, which was acquired by Google Radio in February of 2006 for $1.2 billion in cash and performance incentives. Mr. Meisinger also served as co-founder, chairman and chief executive officer of First MediaWorks from 1999 to 2005, which provided the radio industry with a proprietary software platform and marketing services to help increase ratings and revenue. First MediaWorks was sold to Mediaspan in 2005. Beginning in 1995, Mr. Meisinger served as co-founder, chief executive officer and board trustee of First Internet Franchise Corporation, the first Internet Service Providers (ISP) franchisor in the world with hundreds of franchise territories licensed worldwide. We believe Mr. Meisinger's unique experiences in digital marketing, technology, cybersecurity, and franchising, along with his strong entrepreneurial character, will continue to bring valuable perspective to our board of trustees and that his leadership, experiences, and unique business knowledge qualify him to serve as one of our trustees. | ||||

|

STEVEN G. OSGOOD

Age: 66

Chair of Finance Committee

|

Mr. Osgood has served as one of our independent trustees since the closing of our IPO in April 2015. Mr. Osgood currently serves on the board of directors of Hannon Armstrong Sustainable Infrastructure Capital, Inc. as an independent director and chair of the audit committee. In addition, he serves on the compensation committee. He has also served as the chief executive officer of Square Foot Companies, LLC, a Cleveland, Ohio based private real estate company focused on single tenant properties since 2008. Mr. Osgood was a manager of All Stor Storage, LLC, a company that has been liquidated. From 2007 to 2008, Mr. Osgood served as chief financial officer of DuPont Fabros Technology, Inc., a Washington, DC based real estate investment trust that owned, operated and developed data center properties, which merged with Digital Realty Trust Inc. in 2017. From 2006 to 2007 Mr. Osgood served as chief financial officer of Global Signal, Inc., a Sarasota, Florida based real estate investment trust that was acquired by Crown Castle International Corp. in 2007. Prior to Global Signal, Mr. Osgood served as president and chief financial officer of U-Store-It Trust (now CubeSmart), a Cleveland based self storage real estate investment trust, from the company's initial public offering in 2004 through 2006. Mr. Osgood served as chief financial officer of the Amsdell Companies, the predecessor of U-Store-It, from 1993 until 2004. Mr. Osgood also serves as a board member of the Alzheimer's Impact Movement. Mr. Osgood is a former Certified Public Accountant and was a member of the audit staff of Touche Ross & Co. from 1978 to 1982. Mr. Osgood graduated from the University of San Diego with a masters in business administration and graduated from Miami University with a bachelor of science degree. We believe Mr. Osgood will continue to bring valuable experience to our board of trustees and that his real estate, self storage, and public company experience qualify him to serve as one of our trustees. | ||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

21 |

||||

|

DOMINIC M. PALAZZO

Age: 67

Chair of Audit Committee

|

Mr. Palazzo has served as one of our independent trustees since the closing of our IPO in April 2015, including as the chairman of the Audit Committee (as defined below). Mr. Palazzo has more than 34 years of combined experience in public accounting and industry, including 29 years at PricewaterhouseCoopers LLC ("PwC"). Mr. Palazzo most recently held the position of audit partner at PwC until his retirement in 2011. While at PwC Mr. Palazzo was responsible for the real estate practice in their Denver, Colorado office. His expertise is in due diligence, mergers and acquisitions, public equity and debt offerings, corporate restructurings and financings. While at PwC his clients included Chateau Communities, Affordable Residential Communities, and other private real estate companies. He also served real estate clients that developed a number of different types of real estate assets, including multi-family, office, hotels and resort properties. As a partner at PwC he was responsible for the initial public offering of Affordable Residential Communities in 2004. In addition, Mr. Palazzo served in the PwC National Accounting and SEC Directorate in New York City where he performed technical accounting consultations and research for PwC. Mr. Palazzo was also the past president of the Executive Real Estate Roundtable and a former member of the Colorado Society of CPAs and the American Institute of Certified Public Accountants. Mr. Palazzo graduated from DePaul University with a bachelor of science degree in accounting. We believe Mr. Palazzo's public accounting experience with PwC will continue to provide valuable experience and perspective to our board of trustees and that his experience and knowledge of real estate public accounting qualify him to serve as one of our trustees. | ||||

|

REBECCA L. STEINFORT

Age: 53

Chair of the CNCG Committee

|

Ms. Steinfort has served as one of our independent trustees since May 2018. Between July 2017 and January 2019, she served as an independent director on the board of Milacron Holdings Corp. (NYSE: MCRN), a leading industrial technology company serving the plastics processing industry, where she also was a member of the audit committee. Additionally, Ms. Steinfort served on the board of directors of Nature’s Sunshine Products, Inc. (NASD: NATR) as an independent director from February 2015 to May 2018, where she chaired the compliance committee and served as a member of the audit committee. Ms. Steinfort was the Chief Executive Officer of Eating Recovery Center/Pathlight Behavioral Health ("ERC Pathlight"), a national healthcare services provider focused on treating patients suffering from behavioral health conditions until January 2023. Prior to joining ERC Pathlight in March 2018, she served as the Chief Executive Officer of Hero Management LLC, a leading provider of healthcare practice management services for dental, orthodontic and vision care practices that serve the pediatric Medicaid population, from 2015 to 2016. Prior to joining Hero Management LLC in 2015, Ms. Steinfort held various positions at DaVita Healthcare Partners ("DaVita") beginning in 2009, including Co-Founder and Chief Operating Officer of DaVita's primary-care subsidiary and Chief Strategy and Marketing Officer of DaVita's dialysis business unit. Ms. Steinfort held various leadership positions at QIP Holder, LLC (parent company of Quiznos, a multinational sandwich franchise, "Quiznos") between 2007 and 2009, including Chief Marketing Officer. Prior to Quiznos, Ms. Steinfort held various senior executive positions at Level 3 Communications, LLC from 2001 to 2006 and served as a consultant at Bain & Company from 1997 to 1999. Ms. Steinfort graduated from Harvard University with a masters in business administration and graduated from Princeton University with a bachelor of arts degree. We believe that her valuable experience in marketing, technology and strategic planning will continue to bring valuable experience and perspective to our board of trustees and that her experience and knowledge qualify her to serve as one of our trustees. | ||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

22 |

||||

|

MARK VAN MOURICK

Age: 66

|

Mr. Van Mourick has served as one of our trustees since the closing of our IPO in April 2015. Mr. Van Mourick is a co-owner of Optivest Properties, LLC ("Optivest"), one of our PROs, which he co-founded in 2007. He is also the founder, and was the chief executive officer until 2018, of Optivest Wealth Management, an SEC registered wealth management firm serving wealthy families in southern California since 1987. In addition, Mr. Van Mourick currently serves as the chairman of the board of Optivest Foundation and serves on the board of Northrise University. Mr. Van Mourick has been a principal, general partner, managing member and/or agent in more than 80 real estate syndications since 1991. Prior to founding Optivest and Optivest Wealth Management, Mr. Van Mourick was a senior vice president and principal at Smith Barney, Harris, Upham. Mr. Van Mourick graduated from the University of Southern California with a dual bachelor of science degree in international finance and management. We believe his unique combination of real estate, self storage and financial experience will continue to bring valuable perspective to our board of trustees and that his experience and knowledge qualify him to serve as one of our trustees. | ||||

|

CHARLES F. WU

Age: 65

|

Mr. Wu has served as one of our independent trustees since February 2021. Mr. Wu is currently an Executive Fellow at Harvard University’s Graduate School of Business, where he has taught since 2015. In 2015, he retired from his role as Managing Director of BayNorth Capital, a Boston-based private real estate equity firm, which he co-founded in July 2004. Prior to co-founding BayNorth Capital, Mr. Wu co-founded the private equity firm Charlesbank Capital Partners in July 1998 and served as Managing Director for 6 years. Prior to co-founding Charlesbank Capital Partners, he served for 3 years as a Managing Director of its predecessor firm, Harvard Private Capital Group, the private equity and real estate investment unit of Harvard Management Company. Prior to this role, Mr. Wu was a Managing Director at Aldrich Eastman & Waltch (“AEW”), where he directed the restructuring group and was a portfolio manager. Prior to AEW, Mr. Wu worked at Morgan Stanley in their corporate finance department. Mr. Wu currently serves as a Trustee for the University of Massachusetts and is also a Board member of the University of Massachusetts Building Authority. He is the Vice-Chair of Newton-Wellesley Hospital. Mr. Wu was a founding board member of the Rose Kennedy Greenway Conservancy, a past President of the Newton Schools Foundation, and a former member of Harvard University’s Facilities and Planning Committee. Mr. Wu has a Masters of Business Administration, with distinction, and a Bachelor of Arts, magna cum laude and Phi Beta Kappa, from Harvard University. The Company believes that Mr. Wu’s valuable experience as a seasoned real estate investor and senior lecturer of business administration, as well as his expertise in private equity investments, capital markets and mergers and acquisitions, will bring valuable experience and perspective to the Board and that his experience and knowledge qualify him to serve as one of the Company's trustees. |

||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

23 |

||||

Our trustee nominees represent a mix of independence, age, race, gender, tenure, skills and experience, as shown below.

| Trustee Nominee Demographics | ||||||||||||||||||||||||||||||||

| Fischer | Nordhagen | Cramer | Hylbert | Meisinger | Osgood | Palazzo | Steinfort | Van Mourick | Wu | |||||||||||||||||||||||

Age(1)

|

67 | 66 | 58 | 78 | 55 | 66 | 67 | 53 | 66 | 65 | ||||||||||||||||||||||

| Average Age | 64 | |||||||||||||||||||||||||||||||

Years of Tenure(1)

|

3 | 8 | 0 | 8 | 8 | 8 | 8 | 5 | 8 | 2 | ||||||||||||||||||||||

| Average Tenure | 5.8 | |||||||||||||||||||||||||||||||

| Gender Diversity | ü |

ü |

||||||||||||||||||||||||||||||

| Racial or Ethnic Diversity | ü |

|||||||||||||||||||||||||||||||

(1) Age and tenure as of April 1, 2023.

| Trustee Nominee Skills | ||||||||||||||||||||||||||||||||

| Fischer | Nordhagen | Cramer | Hylbert | Meisinger | Osgood | Palazzo | Steinfort | Van Mourick | Wu | |||||||||||||||||||||||

| Self Storage | ò |

ò |

ò |

ò |

ò |

ò |

||||||||||||||||||||||||||

| REIT | ò |

ò |

ò |

|||||||||||||||||||||||||||||

| Public Company or Board | ò |

ò |

ò |

ò |

ò |

ò |

ò |

ò |

||||||||||||||||||||||||

| Private Equity or Investment | ò |

ò |

ò |

ò |

ò |

ò |

ò |

ò |

ò |

|||||||||||||||||||||||

| Real Estate Investment or Management | ò |

ò |

ò |

ò |

ò |

ò |

ò |

|||||||||||||||||||||||||

| Business Strategy or Operations | ò |

ò |

ò |

ò |

ò |

ò |

ò |

ò |

ò |

|||||||||||||||||||||||

| Technology or Cybersecurity | ò |

ò |

ò |

|||||||||||||||||||||||||||||

| Financial | ò |

ò |

ò |

ò |

||||||||||||||||||||||||||||

| Mergers and Acquisitions or Capital Markets | ò |

ò |

ò |

ò |

ò |

ò |

ò |

ò |

||||||||||||||||||||||||

| Digital Marketing | ò |

ò |

ò |

|||||||||||||||||||||||||||||

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

24 |

||||

Our board of trustees recommends a vote FOR the election of Messrs. Nordhagen, Cramer, Hylbert, Meisinger, Osgood, Palazzo, Van Mourick, and Wu and Mss. Fischer and Steinfort as trustees.

We have not received notice of any additional candidates to be nominated for election as trustees at the Annual Meeting and the deadline for notice of additional candidates has passed. Consequently, the election of trustees will be an uncontested election and the provisions of our Second Amended and Restated Bylaws (the "Bylaws") providing for majority voting in uncontested elections will apply. See "Corporate Governance–Majority Vote and Trustee Resignation Policy" below. Under majority voting, to be elected as a trustee, a nominee must receive votes "FOR" his or her election constituting a majority of the total votes cast for and against such nominee at the Annual Meeting at which a quorum is present. If a nominee who currently is serving as a trustee does not receive sufficient "FOR" votes to be re-elected, Maryland law provides that the trustee would continue to serve on our board of trustees as a "holdover" trustee. Under our Bylaws and corporate governance guidelines (the "Guidelines"), he or she must submit his or her resignation to our board of trustees. Our CNCG Committee will consider such tendered resignation and recommend to our board of trustees whether to accept it. Our board of trustees will decide whether to accept any such resignation within 90 days after certification of the election results and will publicly disclose its decision. If the resignation is not accepted, the trustee will continue to serve until the trustee's successor is duly elected and qualifies or until the trustee's earlier death, resignation, retirement or removal. If a trustee’s offer to resign is accepted by our board of trustees, or if a nominee for trustee is not elected and the nominee is not an incumbent trustee, then our board of trustees, in its sole discretion, may fill any resulting vacancy pursuant to the Bylaws. Proxies solicited by our board of trustees will be voted FOR Messrs. Nordhagen, Cramer, Hylbert, Meisinger, Osgood, Palazzo, Van Mourick, and Wu and Mss. Fischer and Steinfort, unless otherwise instructed. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

In accordance with our declaration of trust (the "Declaration of Trust") and our Bylaws, any vacancies occurring on our board of trustees, including vacancies occurring as a result of the death, resignation, or removal of a trustee, or due to an increase in the size of the board of trustees, may be filled only by the affirmative vote of a majority of the remaining trustees in office, even if the remaining trustees do not constitute a quorum, and any trustee elected to fill a vacancy will serve for the remainder of the full term of the trusteeship in which the vacancy occurred and until a successor is duly elected and qualifies.

There is no familial relationship, as defined under SEC regulations, among any of the trustees or our Named Executive Officers, other than with respect to Mr. Cramer, who is our president, chief executive officer and one of our trustee nominees, and Mr. Nordhagen, our vice chair of the board of trustees. Messrs. Nordhagen and Cramer are brothers-in-law. See "Corporate Governance–Trustee Independence."

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

25 |

||||

PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

| ||

The audit committee of our board of trustees (the "Audit Committee") has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. Our board of trustees is requesting that our shareholders ratify this appointment of KPMG LLP.

KPMG LLP has audited our consolidated financial statements since the Company's formation. KPMG LLP has also provided certain other services to us.

Neither our Bylaws nor other governing documents or law require shareholder ratification of the Audit Committee's appointment of KPMG LLP as our independent registered public accounting firm. However, our board of trustees is submitting the appointment of KPMG LLP to the shareholders for ratification as a matter of good corporate practice. If the ratification of this appointment is not approved at the Annual Meeting, the Audit Committee will review its future selection of our independent registered public accounting firm. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if it determines that such a change would be in our best interests.

Representatives of KPMG LLP are expected to be present at the Annual Meeting via the live webcast and will be provided with an opportunity to make a statement if so desired and to respond to appropriate inquiries from shareholders.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES

The following table summarizes the aggregate fees billed to us for professional services provided by KPMG LLP for the years ended December 31, 2022 and 2021.

| 2022 | 2021 |

||||||||||

Audit Fees(1)

|

$ | 1,015,000 | $ | 1,180,000 | |||||||

Audit-Related Fees |

- | - | |||||||||

Tax Fees |

- | - | |||||||||

All Other Fees |

- | - | |||||||||

Total |

$ | 1,015,000 | $ | 1,180,000 | |||||||

(1) Audit Fees include fees related to the annual audit of the Company included in our annual report on Form 10-K, the review of the consolidated financial statements included in our quarterly reports on Form 10-Q, accounting consultations attendant to the audit, and for services associated with our public offerings, including review of registration statements and prospectuses and related issuances of comfort letters and consents and other services related to SEC matters. Audit Fees associated with the review of registration statements and issuance of comfort letters included above are $135,000 for 2022 and $200,000 for 2021. Audit Fees also include costs related to the audit of the Company’s internal control over financial reporting based on criteria established in 2013 by the Committee of Sponsoring Organizations of the Treadway Commission.

In accordance with the Audit Committee charter, the Audit Committee reviews and pre-approves the engagement fees and the terms of all audit and non-audit services to be provided by the external auditors and evaluates the effect thereof on the independence of the external auditors.

A majority of all of the votes cast on this proposal at the Annual Meeting is required for its approval. Proxies solicited by our board of trustees will be voted FOR this proposal, unless otherwise instructed. Abstentions and broker non-votes, if any, will not be counted as votes cast and will have no effect on the result of the vote, although they will be considered present for the purpose of determining the presence of a quorum.

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

26 |

||||

Our board of trustees recommends a vote FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2023.

NATIONAL STORAGE AFFILIATES 2023 PROXY STATEMENT |

27 |

||||

| PROPOSAL 3: NON-BINDING VOTE ON EXECUTIVE COMPENSATION | ||

We are requesting that our shareholders approve, on an advisory (non-binding) basis, the compensation of our Named Executive Officers as disclosed in this Proxy Statement.

We believe that our compensation policies and practices are strongly aligned with the long-term interests of our shareholders. Shareholders are urged to read the Compensation Discussion and Analysis section of this Proxy Statement, which discusses our compensation philosophy and how our compensation policies and practices implement our philosophy.

As described more fully in that discussion, our compensation programs are designed to attract and retain the best executive talent in a way that allows us to align the interests of our Named Executive Officers with those of our shareholders. We seek to encourage the achievement of our business strategies, the creation of company growth, and the retention of our Named Executive Officers in a manner that is consistent with appropriate risk-taking and based on sound corporate governance practices.

In furtherance of this philosophy, the CNCG Committee has implemented a pay for performance compensation framework to compensate our Named Executive Officers for favorable shareholder returns, the Company’s competitive position within its segment of the real estate industry and each Named Executive Officer's contributions to the Company.

We are requesting your non-binding vote on the following resolution:

"RESOLVED, that our shareholders approve, on an advisory basis, the compensation of our Named Executive Officers as described in this Proxy Statement for the 2023 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis, the Summary Compensation Table and the other related tables and narrative disclosure."

Because your vote is advisory, it will not be binding upon us or our board of trustees. However, the CNCG Committee, which is responsible for designing and administering our executive compensation programs, values your opinion and has and will continue to take into account the outcome of the vote when considering future executive compensation arrangements.