S-11/A: Registration statement for securities to be issued by real estate companies

Published on April 13, 2015

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

As filed with the Securities and Exchange Commission on April 13, 2015

Registration Statement No. 333-202113

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF CERTAIN REAL ESTATE COMPANIES

National Storage Affiliates Trust

(Exact name of registrant as specified in its governing instruments)

National Storage Affiliates Trust

5200 DTC Parkway

Suite 200

Greenwood Village, Colorado 80111

(720) 630-2600

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant's Principal Executive Offices)

Arlen D. Nordhagen

Chief Executive Officer

National Storage Affiliates Trust

5200 DTC Parkway

Suite 200

Greenwood Village, Colorado 80111

(720) 630-2600

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

| Copies to: | ||

|

Jay L. Bernstein, Esq. Andrew S. Epstein, Esq. Clifford Chance US LLP 31 West 52nd Street New York, New York 10019 Tel (212) 878-8000 Fax (212) 878-8375 |

Julian Kleindorfer, Esq. Lewis Kneib, Esq. Latham & Watkins LLP 355 South Grand Avenue Los Angeles, California 90071 Tel (213) 485-1234 Fax (213) 891-8763 |

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o |

Non-accelerated filer ý (Do not check if a smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

||||

|

Title of each class of securities to be registered |

Proposed maximum aggregate offering price(1)(2) |

Amount of registration fee(3) |

||

|---|---|---|---|---|

Common shares, $0.01 par value per share |

$391,000,000 | $45,434.20 | ||

|

||||

- (1)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (2)

- Includes

the offering price of common shares that may be sold if the option to purchase additional shares granted by the Registrant to the underwriters is

exercised.

- (3)

- Of this amount, $11,620 was previously paid in connection with this Registration Statement on February 13, 2015. The additional registration fee payable in connection with the additional $291,000,000 aggregate initial offering price of securities registered hereunder, calculated pursuant to Rule 457(o) of the Securities Act of 1933, as amended, is $33,814.20, and is being paid contemporaneously with the filing of this Registration Statement.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these common shares until the registration statement filed with the Securities and Exchange Commission becomes effective. This preliminary prospectus is not an offer to sell these common shares and it is not soliciting an offer to buy these common shares in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus, dated April 13, 2015

PROSPECTUS

20,000,000 Shares

National Storage Affiliates Trust

Common Shares of Beneficial Interest

This is our initial public offering. We are offering 20,000,000 common shares of beneficial interest, $0.01 par value per share. We expect the initial public offering price of our common shares to be between $15.00 and $17.00 per share. Prior to this offering, there has been no public market for our common shares. Our common shares have been approved for listing on the New York Stock Exchange, subject to official notice of issuance, under the symbol "NSA."

We are an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012.

We intend to elect and qualify to be taxed as a real estate investment trust, or a REIT, for U.S. federal income tax purposes, commencing with our taxable year ending December 31, 2015. To assist us in qualifying as a REIT, among other purposes, shareholders are generally restricted from owning more than 9.8% by value or number of shares, whichever is more restrictive, of our aggregate outstanding shares of all classes and series, the outstanding shares of any class or series of our preferred shares or our outstanding common shares. Our declaration of trust contains various other restrictions on the ownership and transfer of our shares, see "Description of Shares of Beneficial InterestRestrictions on Ownership and Transfer."

Investing in our common shares involves risks that are described in the "Risk Factors" section beginning on page 31 of this prospectus.

|

||||

|

|

Per share |

Total |

||

|---|---|---|---|---|

Initial public offering price |

$ | $ | ||

Underwriting discount |

$ | $ | ||

Proceeds, before expenses,(1) to us |

$ | $ | ||

|

||||

- (1)

- See "Underwriting" for a detailed description of compensation payable to the underwriters.

We have granted the underwriters the option to purchase up to 3,000,000 additional common shares from us at the initial public offering price, less the underwriting discount, within 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these shares or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares sold in this offering will be ready for delivery on or about , 2015.

| Jefferies | Morgan Stanley | Wells Fargo Securities | ||

|

KeyBanc Capital Markets |

||||

| Baird | RBC Capital Markets | SunTrust Robinson Humphrey | Capital One Securities |

The date of this prospectus is , 2015

You should rely only on the information contained in this prospectus, any free writing prospectus prepared by us or information to which we have referred you. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, our common shares only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common shares.

i

MARKET AND INDUSTRY DATA AND FORECASTS

Certain market and industry data included in this prospectus has been obtained from third-party sources that we believe to be reliable. Market estimates are calculated by using independent industry publications, government publications and third-party forecasts in conjunction with our assumptions about our markets. We have not independently verified such third-party information. While we are not aware of any misstatements regarding any market, industry or similar data presented herein, such data involves risks and uncertainties and is subject to change based on various factors, including those discussed under the headings "Forward-Looking Statements" and "Risk Factors" in this prospectus.

Except where the context suggests otherwise, references in this prospectus to (1) "NSA," "our company," "we," "us" and "our" refer to National Storage Affiliates Trust, a Maryland real estate investment trust, together with its subsidiaries, (2) "our operating partnership" or "our operating partnership subsidiary" refer to NSA OP, LP, a Delaware limited partnership, together with its subsidiaries, and (3) "our predecessor" refer to the combined subsidiaries of SecurCare Self Storage, Inc. In addition, unless the context otherwise requires, the following terms used throughout this prospectus have the following meanings:

common shares |

our company's common shares of beneficial interest, $0.01 par value per share | |

contributed portfolio |

with respect to each PRO, the portfolio of properties that such PRO manages on our behalf, which were (i) contributed by such PRO to us or (ii) sourced by such PRO from a third-party seller and acquired by us | |

DownREIT partnerships |

limited partnership subsidiaries of our operating partnership that issue units of limited partner interest intended to be economically equivalent to the OP units and subordinated performance units issued by our operating partnership | |

exclusive MSA |

an MSA granted to a PRO wherein our operating partnership has agreed not to acquire additional self-storage properties in such MSA without first offering such PRO the opportunity to co-invest in, and manage, such properties | |

Guardian |

Guardian Storage Centers, LLC and its controlled affiliates | |

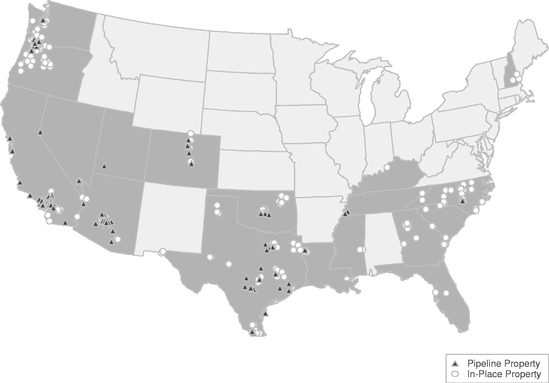

in-place portfolio |

246 self-storage properties, which includes 225 properties that we currently own, 16 properties that we expect to acquire prior to or concurrently with the completion of this offering, and five properties that we expect to acquire upon the receipt of lender consents, which may occur prior to, concurrently with, or following the completion of this offering. These properties comprise approximately 13.7 million rentable square feet and are diversified across 16 states in more than 100,000 storage units | |

LTIP units |

long-term incentive plan units in our operating partnership | |

Move It |

Move It Self Storage, LP and its controlled affiliates | |

MSA |

metropolitan statistical area | |

NOI |

net operating income | |

non-exclusive MSA |

an MSA granted to a PRO that may in the future, at the option of our operating partnership, become a shared MSA | |

Northwest |

Kevin Howard Real Estate Inc., d/b/a Northwest Self Storage and its controlled affiliates |

ii

operating partnership agreement |

the Third Amended and Restated Limited Partnership Agreement of our operating partnership | |

Optivest |

Optivest Properties, LLC and its controlled affiliates | |

OP units |

common equity interests in our operating partnership or DownREIT partnerships | |

pipeline |

114 self-storage properties, comprising approximately 7.3 million rentable square feet. Of these, one is a property that our company has under contract to acquire, 30 are properties in which our PROs have a controlling ownership interest that we have a right to acquire (i) in the event that our PRO seeks to transfer such interest or (ii) upon maturity of outstanding indebtedness encumbering such property so long as the occupancy of such property is consistent with average local market levels at such time, 20 are properties in which our PROs currently have an ownership interest but do not control, and 63 are properties that our PROs manage without an ownership interest. With respect to the 113 properties in our pipeline that are not under contract to be acquired, there can be no assurance that definitive agreements relating to the acquisition of these properties will be entered into by our company and the current property owner(s). All such pipeline properties are subject to additional due diligence by our company, the determination by us to pursue the acquisition of the property and the decision of the current owner(s) to contribute the property to our company. There can be no assurance that we will be able to acquire any of the properties in our pipeline | |

PROs |

our participating regional operators, which currently consist of Guardian, Move It, Northwest, Optivest and SecurCare, and will, upon the completion of this offering and the formation transactions, also include Storage Solutions | |

same store portfolio |

properties owned and operated for the entirety of the applicable periods presented | |

SecurCare |

SecurCare Self Storage, Inc. and its controlled affiliates | |

shared MSA |

an MSA granted to more than one PRO wherein our operating partnership has agreed not to acquire additional self-storage properties in such MSA without first offering one of the PROs, in our operating partnership's discretion, the opportunity to co-invest in, and manage, such properties, and if such first PRO declines, our operating partnership must offer the same opportunity to a different PRO assigned to the shared MSA | |

subordinated performance units |

subordinated performance units in our operating partnership or DownREIT partnerships | |

Storage Solutions |

Arizona Mini Storage Management Company d/b/a Storage Solutions and its controlled affiliates |

iii

This summary highlights some of the information in this prospectus. It does not contain all of the information that you should consider before investing in our common shares. You should carefully read the more detailed information set forth under "Risk Factors" and the other information included in this prospectus. Certain technical and other terms used in this prospectus are defined under the heading "Certain Defined Terms" on p. ii above.

Unless otherwise indicated, the information contained in this prospectus assumes that (1) the formation transactions described under "The Formation and Structure of our Company" have been completed, (2) the common shares to be sold in the offering are sold at $16.00 per share, which is the mid-point of the initial public offering price range shown on the cover page of this prospectus, and (3) the underwriters' option to purchase additional shares is not exercised.

Company Overview

Our Company

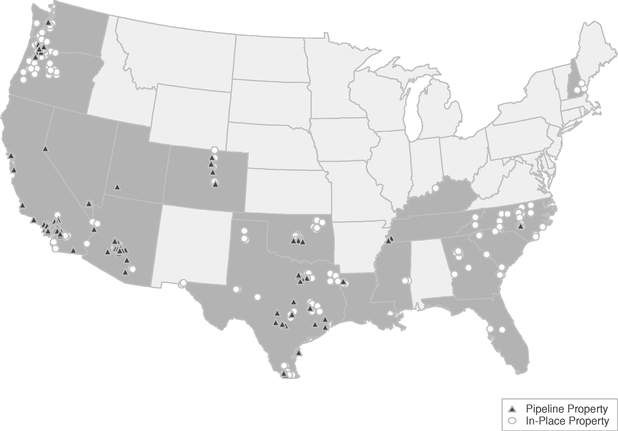

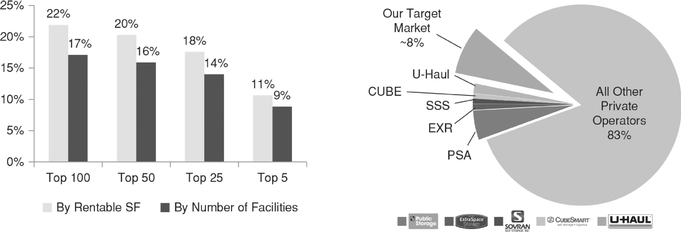

National Storage Affiliates Trust is a Maryland real estate investment trust focused on the ownership, operation, and acquisition of self-storage properties located within the top 100 metropolitan statistical areas, or MSAs, throughout the United States. According to the 2014 Self-Storage Almanac, we are the sixth largest owner and operator of self-storage properties and the largest privately-owned operator of self-storage properties in the United States based on number of properties, units, and rentable square footage. Upon the completion of this offering and the formation transactions, our in-place portfolio of 246 self-storage properties will comprise approximately 13.7 million rentable square feet and will be diversified across 16 states in more than 100,000 storage units. In addition, we have a pipeline of potential additional acquisitions consisting of 114 properties, comprising approximately 7.3 million rentable square feet.

Our chief executive officer, Arlen D. Nordhagen, co-founded SecurCare Self Storage, Inc. in 1988 to invest in and manage self-storage properties. While growing SecurCare to over 150 self-storage properties, Mr. Nordhagen recognized a market opportunity for a differentiated public self-storage REIT that would leverage the benefits of national scale by integrating multiple experienced regional self-storage operators with local operational focus and expertise. We believe that his vision, which is the foundation of our company, aligns the interests of regional self-storage operators with those of public shareholders by allowing the operators to participate alongside shareholders in the financial performance of our company and their contributed portfolios. A key component of this strategy is to capitalize on the local market expertise and knowledge of regional self-storage operators by maintaining the continuity of their roles as property managers.

We believe that our structure creates the right financial incentives to accomplish these objectives. We require our participating regional operators, or PROs, to exchange the self-storage properties they contribute to our company for a combination of common equity interests, or OP units, and subordinated performance units in our operating partnership or DownREIT partnerships. OP units, which are economically equivalent to our common shares, create alignment with the performance of our company as a whole. Subordinated performance units, which are linked to the performance of specific contributed portfolios, incentivize our PROs to drive operating performance and support the sustainability of the operating cash flow, generated by the contributed self-storage properties that they continue to manage on our behalf. Because subordinated performance unit holders receive distributions only after portfolio-specific minimum performance thresholds are satisfied, subordinated performance units play a key role in aligning the interests of our PROs with us and our shareholders. Our structure thus offers PROs a unique opportunity to serve as regional property managers for their contributed properties and directly participate in the potential upside of those properties while simultaneously diversifying their investment to include a broader portfolio of self-storage properties. We believe our

1

structure provides us with a competitive growth advantage over self-storage companies that do not offer property owners the ability to participate in the performance and potential future growth of their contributed portfolios.

We believe that our national platform has significant potential for external and internal growth. We seek to expand our platform by recruiting additional established self-storage operators, while integrating our operations through the implementation of centralized initiatives, including management information systems, revenue enhancement, and cost optimization programs. We are currently engaged in preliminary discussions with additional self-storage operators and believe that we could add several additional PROs over the next two to three years. These additional operators will enhance our existing geographic footprint and allow us to enter regional markets in which we currently have limited or no market share. In addition, we believe that the implementation of best practices across our portfolio and leveraging economies of scale will allow us to more effectively grow internally through increased occupancy, rents, and margins, which will drive cash flow growth across our portfolio. As of December 31, 2014, our occupancy rate across our in-place portfolio was approximately 85%.

We are organized as a Maryland real estate investment trust and intend to elect to be taxed as a real estate investment trust for U.S. federal income tax purposes, or REIT, commencing with our taxable year ending December 31, 2015. We generally will not be subject to U.S. federal income tax on our net taxable income to the extent that we distribute annually all of our net taxable income to our shareholders and maintain our intended qualification as a REIT. We serve as the sole general partner of, and operate our business through, our operating partnership subsidiary, NSA OP, LP, a Delaware limited partnership. Our operating partnership enables us to facilitate additional tax deferred acquisitions using both OP units and subordinated performance units as currency for these transactions.

Our PROs

SecurCare has been operating since 1988 and, in connection with the launch of our company in April 2013, was joined by two additional PROs: Northwest, which has been operating since 1977, and Optivest, which has been operating since 2007. Guardian, which has been operating since 1999, joined our company as a PRO in February 2014. In July 2014, Move It was added as our fifth PRO. Upon the completion of this offering and the formation transactions, Storage Solutions will become our sixth PRO. Our PROs have collectively contributed the vast majority of their properties to our company as part of the formation transactions.

We believe our structure allows our PROs to optimize their established property management platforms while addressing financial and operational hurdles. Before joining us, our PROs faced challenges in securing low cost capital and had to manage multiple investors and lending relationships, making it difficult to compete with larger competitors, including public REITs, for acquisition and investment opportunities. Our PROs were also limited in their ability to raise growth capital through the sale of assets, a portfolio refinancing, or capital contributions from new equity partners. Serving as our on-the-ground acquisition teams, our PROs now have access to our broader financing sources and lower cost of capital while our national platform allows them to benefit from our economies of scale to drive operating efficiencies in a rapidly evolving, technology-driven industry.

We benefit from the local market knowledge and active presence of our PROs, allowing us to build and foster important customer and industry relationships. These local relationships provide attractive off-market acquisition opportunities that we believe will continue to fuel additional external growth. Newly acquired properties are integrated into our national platform and managed by our PROs.

2

The following table summarizes the properties in our in-place portfolio by PRO as of December 31, 2014:

|

|

In-Place Portfolio | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

PRO

|

Properties | Units | Rentable Square Feet(1) |

Occupancy(2) | |||||||||

SecurCare(3) |

116 | 44,963 | 5,788,150 | 86% | |||||||||

Northwest |

63 | 24,191 | 3,039,286 | 89% | |||||||||

Optivest |

27 | 13,824 | 1,832,921 | 77% | |||||||||

Guardian |

26 | 16,104 | 1,828,940 | 86% | |||||||||

Move It(4) |

11 | 6,564 | 1,059,084 | 77% | |||||||||

Storage Solutions(5) |

3 | 1,375 | 178,955 | 87% | |||||||||

| | | | | | | | | | | | | | |

Total/Weighted Average(6) |

246 | (7) | 107,021 | 13,727,336 | 85% | ||||||||

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

- (1)

- Rentable

square feet includes all enclosed self-storage units but excludes commercial, residential, and covered parking space of over 440,000 square feet in

our in-place portfolio.

- (2)

- Represents

total occupied rentable square feet divided by total rentable square feet.

- (3)

- Includes

17 properties not owned by us as of the date of this prospectus, containing 7,642 units with 1,065,655 rentable square feet and occupancy of 87%.

- (4)

- Move

It is currently a manager of these properties pursuant to an agreement with SecurCare, which is the contributor of these properties. See "The Formation

and Structure of our CompanyProperty ContributionsSecurCare and Move It Contributions." Includes one property not owned by us as of the date of this prospectus, containing

332 units with 51,629 rentable square feet and occupancy of 79%.

- (5)

- None

of these properties are owned by us as of the date of this prospectus.

- (6)

- Four

properties in our in-place portfolio will be held as long-term leasehold interests with remaining lease terms, including extension options, ranging

from 19 to 60 years.

- (7)

- Of the 246 self-storage properties in our in-place portfolio, there are 219 that we acquired as of December 31, 2014, six that we acquired between January 1, 2015 and the date of this prospectus, 16 that we expect to acquire prior to or concurrently with the completion of this offering, and five that we expect to acquire upon the receipt of lender consents, which may occur prior to, concurrently with, or following the completion of this offering. Of the 21 properties that we expect to acquire, 17 are in SecurCare's contributed portfolio, one is in Move It's contributed portfolio, and three are in Storage Solution's contributed portfolio.

To capitalize on their recognized and established local brands, our PROs will continue to function as property managers for their contributed properties under their existing brands (which include various brands in addition to those appearing below). Over the long-run, we may seek to brand or co-brand each location as part of NSA.

3

|

SecurCare is one of our PROs responsible for covering the mountain and southeast regions. SecurCare provides property management services to 116 of our properties located in 11 states, including California, Colorado, Florida, Georgia, Kentucky, Louisiana, Mississippi, North Carolina, Oklahoma, South Carolina and Texas. Prior to contributing properties to us, SecurCare was ranked by the 2013 Self-Storage Almanac as the sixth largest operator of self-storage properties in the United States. Headquartered in Lone Tree, Colorado, SecurCare was founded in 1988 and is currently managed by David Cramer, who has worked in the self-storage industry for more than 17 years. Mr. Cramer is our mountain and southeast regional president and also leads our Technology and Best Practices Group, which is described under "Business and PropertiesOur Technology and Best Practices." | |

|

Northwest is our PRO responsible for covering the northwest region. Northwest provides property management services to 63 of our properties located in Oregon and Washington. Prior to contributing properties to us, Northwest was ranked by the 2014 Self-Storage Almanac as the 16th largest operator of self-storage properties in the United States. Headquartered in Portland, Oregon, Northwest is run by Kevin Howard, who founded the company over 30 years ago. Mr. Howard is our northwest regional president and is recognized in the industry for his successful track record as a self-storage specialist in the areas of design and development, operation and property management, consultation, and brokerage. |

|

|

|

Optivest is one of our PROs responsible for covering the southwest region. Based in Dana Point, California, Optivest currently manages 27 of our properties across five states, including Arizona, California, Nevada, New Hampshire and Texas. Prior to contributing properties to us, Optivest was ranked by the 2014 Self-Storage Almanac as the 21st largest operator of self-storage properties in the United States. Optivest is run by its co-founder, Warren Allan, who has more than 25 years of financial and operational management experience in the self-storage industry. Mr. Allan is our southwest regional president and is recognized as a self-storage acquisition and development specialist. |

|

|

Guardian Storage Centers |

Guardian is one of our PROs responsible for covering portions of the southern California region and the Arizona market. Based in Irvine, California, Guardian currently manages 26 of our properties located in California and Arizona. Prior to contributing properties to us, according to guidance from Guardian, if the 2014 Self-Storage Almanac had reported its size, it would have been ranked as the 36th largest operator of self-storage properties in the United States. This operator is led by John Minar, who has over 30 years of self-storage acquisition and operational management experience. Mr. Minar is our southern California regional president and brings close to 40 years of real estate acquisition, rehabilitation, ownership, and development experience to our company. |

4

|

|

Move It is one of our PROs responsible for covering certain portions of the Texas market. Based in Addison, Texas, Move It currently manages 11 of our properties in Texas. Prior to contributing properties to us, Move It was ranked by the 2014 Self-Storage Almanac as the 34th largest operator of self-storage properties in the United States. This operator is led by its founder, Tracy Taylor, who has more than 40 years of experience in self-storage development, acquisition and management. Mr. Taylor is our Texas market executive vice president and is currently on the board of directors for the Large Owners Council of the Self Storage Association. | |

|

|

Storage Solutions, upon the completion of this offering and the formation transactions, will be our PRO responsible for covering most of the Arizona market. Based in Chandler, Arizona, Storage Solutions manages three of our properties in Arizona. Prior to contributing properties to us, Storage Solutions was ranked by the 2014 Self-Storage Almanac as the 29th largest operator of self-storage properties in the United States. This operator is led by its founder, Bill Bohannan, who is one of the largest operators in Phoenix and has more than 34 years of self-storage acquisition, development and management experience. Mr. Bohannan is our Arizona market executive vice president and is recognized in the industry as a self-storage acquisition, development and management specialist. |

Each PRO representative who serves as regional president or executive vice president of our company receives no compensation from us for serving in these roles.

Our Competitive Strengths

We believe our unique PRO structure allows us to differentiate ourselves from other self-storage operators, and the following competitive strengths enable us to effectively compete against our industry peers:

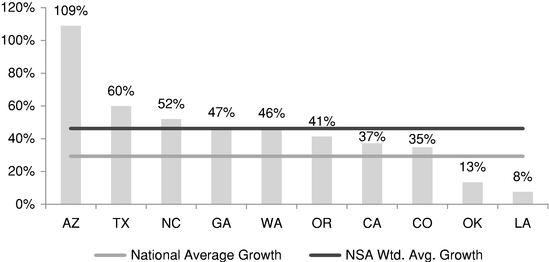

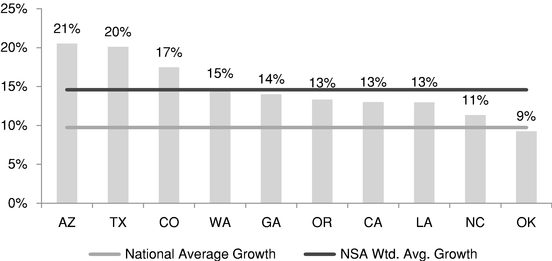

High Quality Properties in Key Growth Markets. Upon the completion of this offering and the formation transactions, we expect to own a large, geographically diversified portfolio of 246 self-storage properties, which includes 225 properties that we currently own, 16 properties that we expect to acquire prior to or concurrently with the completion of this offering, and five properties that we expect to acquire upon the receipt of lender consents, which may occur prior to, concurrently with, or following the completion of this offering. These 246 properties are located in 16 states and over 50 MSAs. Over 75% of our in-place portfolio is located in the top 100 MSAs based on our 2014 pro forma net operating income, or NOI. We believe that these properties are primarily located in high quality growth markets that have attractive supply and demand characteristics and are less sensitive to the fluctuations of the general economy. The U.S. Department of Labor's Bureau of Labor Statistics expects our top 10 states (which we determined based on our property count for our in-place portfolio), to grow approximately 50% faster than the national average for population and job growth. These 10 states accounted for over 95% of the 2014 pro forma NOI for our in-place portfolio. Many of these markets have multiple barriers to entry against increased supply, including zoning restrictions against new construction and new construction costs that we believe are higher than our properties' fair market value. We seek to own properties that are well located in high quality sub-markets with highly accessible street access, providing our properties with strong and stable cash flows. Furthermore, we

5

believe that our significant size and the overall geographic diversification of our portfolio reduces risks associated with specific local or regional economic downturns or natural disasters.

Differentiated, Growth Oriented Strategy Focused on Established Operators. We are a self-storage REIT with a unique structure that supports our differentiated external growth strategy. Our structure appeals to operators who are looking for access to growth capital while maintaining an economic stake in the self-storage properties that each has contributed to our company and continues to manage on our behalf. These attributes entice operators to join our company rather than sell their properties for cash consideration. Our strategy is to attract operators who are confident in the future performance of their properties and desire to participate in the growth of our company. We are focused on recruiting established institutional operators across the United States with a history of efficient property management and a track record of successful acquisitions. Our structure and differentiated strategy have enabled us to build a substantial pipeline from existing operators as well as potentially create external growth from the recruitment of additional PROs.

Integrated Platform Utilizing Advanced Technology for Enhanced Operational Performance and Best Practices. Our national platform allows us to capture cost savings through integration and centralization, thereby eliminating redundancies and utilizing economies of scale across the property management platforms of our PROs. As compared to a stand-alone operator, our national platform has greater access to lower-cost capital, reduced Internet marketing costs per customer lead, discounted property insurance expense, and reduced overhead costs. In addition, our company has sufficient scale for national and bulk purchasing and has centralized various functions, including financial reporting, call center operations, marketing, information technology, legal support, and capital market functions, to achieve substantial cost savings over smaller, individual operators.

Our national platform utilizes advanced technology for Internet marketing, call center operations, financial and property analytic dashboards, revenue optimization analytics and expense management tools to enhance operational performance. These centralized programs, which are run through our Technology and Best Practices Group, are positively impacting our business performance, and we believe that they will be a driver of organic growth going forward. We will utilize our Technology and Best Practices Group to help us benefit from the collective sharing of key operating strategies among our PROs in areas like human resource management, local marketing and operating procedures.

Aligned Incentive Structure with Shareholder Downside Protection. Our structure promotes operator accountability as subordinated performance units issued to our PROs in exchange for the contribution of their properties are entitled to distributions only after those properties satisfy minimum performance thresholds. In the event of a material reduction in operating cash flow, distributions on our subordinated performance units will be reduced before distributions on our common shares held by our common shareholders. In addition, we expect our PROs will generally co-invest subordinated equity in the form of subordinated performance units in each acquisition that they source, and the value of these subordinated performance units will fluctuate with the performance of their contributed properties. Therefore, our PROs are incentivized to select acquisitions that are expected to exceed minimum performance thresholds, thereby increasing the value of their subordinated equity stake. We expect that our shareholders will benefit from the higher levels of property performance that our PROs are incentivized to deliver.

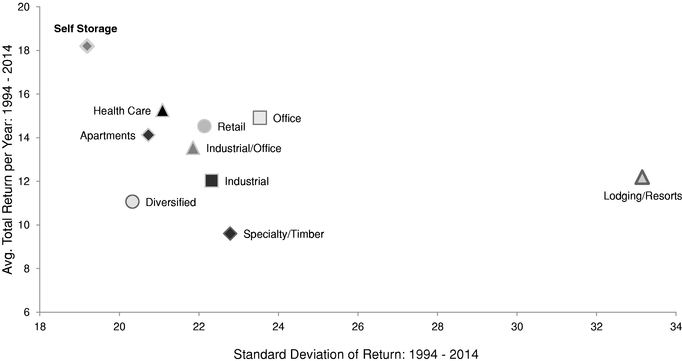

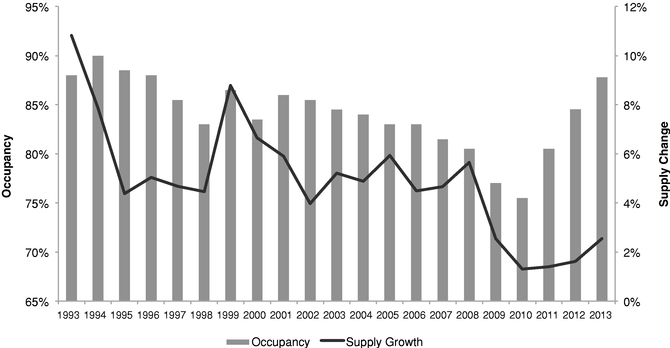

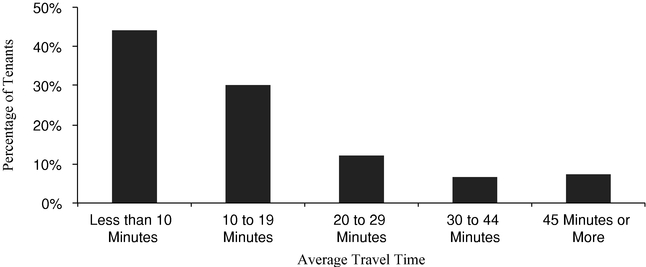

Attractive Sector with Strong Underlying Fundamentals and Historic Outperformance. Self-storage industry fundamentals are robust, with many properties operating at optimal revenue-producing occupancy and favorable industry dynamics resulting in pricing power for self-storage operators. Operators are able to achieve high same store occupancy levels through a diverse base of customer demand from individuals as well as businesses. Based on these favorable supply and demand dynamics, we believe that disciplined self-storage operators will generate revenue growth in the near term and will continue to drive revenue performance throughout various economic cycles. We believe that overhead costs and maintenance capital

6

expenditures are considerably lower in the self-storage industry as compared to other real estate sectors, and as a result, self-storage companies are able to achieve comparatively higher operating and cash flow margins. The self-storage sector's fundamentals have consistently established it as one of the strongest performing sectors among all classes of real estate over the last twenty years. The National Association of Real Estate Investment Trusts, or NAREIT, has tracked total return performance of the real estate equity sector since 1994, and from that time through December 31, 2014, the self-storage equity REIT sector has returned an average of over 18% on an annual total return basis compared to the average annual total return of approximately 13% for all other equity REIT sectors.

Experienced Senior Management Team with Deep Operating and Public Company Experience. Our senior management team has an established executive leadership track record, aided by their extensive knowledge of the self-storage sector and experience in the ownership, management, and development of self-storage properties. Our chief executive officer, Arlen D. Nordhagen, and chief financial officer, Tamara D. Fischer, bring accomplished backgrounds with an average of 25 years of experience in multiple management capacities at both public and private companies. As a successful entrepreneur involved in the start-up and growth of several public and private companies, Mr. Nordhagen was one of the founders of SecurCare in 1988 and led the company through a period of rapid growth. In addition to SecurCare, Mr. Nordhagen was a founder of MMM Healthcare, Inc., the largest provider of Medicare Advantage health insurance in Puerto Rico. He has also served as managing member of various private investment funds and held various managerial positions at E. I. DuPont De Nemours and Company, or DuPont, and Synthetech, Inc. Ms. Fischer also brings substantial managerial and public company experience to us. Prior to joining us, Ms. Fischer was executive vice president and chief financial officer of Vintage Wine Trust Inc., a REIT formed for the purpose of providing triple-net lease financing to owners and operators of wineries, vineyards, and other wine-related facilities. Ms. Fischer also served as executive vice president and chief financial officer of Chateau Communities Inc., one of the largest public REITs in the manufactured home community sector. In that capacity, Ms. Fischer oversaw the company's initial public offering, multiple merger and acquisition transactions, as well as ongoing capital markets activities, investor relations, financial reporting, and administrative responsibilities. Ms. Fischer remained at Chateau through its sale to Hometown America LLC in 2003.

Our seasoned PROs also have highly experienced management teams averaging over 30 years of industry experience as well as deep industry knowledge of key markets and extensive national networks of industry relationships.

-

-

David Cramer, a principal of SecurCare, joined the company in 1998, and has more than 17 years of experience in

the self-storage industry, growing SecurCare's portfolio from 11 properties to over 150 properties during his tenure. He is an active member of the Large Owners Council of the Self Storage

Association and is a board member of FindLocalStorage.com, an industry digital marketing consortium.

-

-

Kevin Howard, a principal of Northwest, founded the company in 1977 and built it into one of the largest privately-owned

portfolios of self-storage properties in the Pacific Northwest. He was one of the earliest members of the Self Storage Association in the mid-1970s, serving on its board of directors during several of

the early years of its existence.

-

-

Warren Allan, principal of Optivest, has over 25 years of financial and operational management experience, during

which time he helped structure over 25 real estate partnerships to acquire self-storage properties in various regions nationwide. Prior to founding Optivest in 2007, Mr. Allan served as both

chief operating officer and chief financial officer of another self-storage management company, Platinum Storage, since its founding in 2000.

-

- John Minar, principal of Guardian, has been involved in the self-storage industry since 1984. Mr. Minar formed Guardian in 1999 and is the owner and manager of Guardian's portfolio,

7

-

-

Tracy Taylor, principal of Move It, has been involved in the self-storage industry for more than 40 years. He

founded Move It and is the manager of Move It's portfolio, which has properties in Texas, Tennessee and North Carolina. He served on the board of directors of the Self Storage Association from 2006

through 2011, serving as chairman of the board in 2010. He has also served on the board of directors for the Large Owners Council of the Self Storage Association since 2012.

-

- Bill Bohannan, principal of Storage Solutions, has been involved in the self-storage industry for more than 30 years and is one of the largest operators of self-storage properties in the Phoenix, Arizona MSA. A recognized industry expert, Mr. Bohannan has been a speaker, and has instructed various courses, for the Self Storage Association for several years.

which has properties located in southern California and Arizona. Mr. Minar has been involved in the acquisition, rehabilitation, ownership, and development of real estate since 1977, and is active in the Large Owners Council of the Self Storage Association.

We believe our deep and cohesive management structure has the relevant skills and experience necessary to effectively grow our company. Upon the completion of this offering and the formation transactions, we expect that our senior management team, including our chief executive officer, key representatives of our PROs, and our chief financial officer, will own approximately 45% of our equity on a fully diluted basis (assuming the conversion of subordinated performance units into OP units on a one-for-one basis).

Our Business and Growth Strategies

By capitalizing on our competitive strengths, we seek to increase scale, achieve optimal revenue-producing occupancy and rent levels, and increase long-term shareholder value by achieving sustainable long-term growth. Our business and growth strategies to achieve these objectives are as follows:

Increase Occupancy of In-Place Portfolio. Existing public self-storage REITs were operating with a weighted average occupancy level of approximately 91% as of December 31, 2014, which we believe is at or near optimal revenue-producing occupancy. Our in-place portfolio occupancy was approximately 85% as of December 31, 2014, reflecting a gap of approximately 6% compared to the average occupancy of the existing public self-storage REITs. Through utilization of our centralized call centers, integrated Internet marketing strategies and best practices protocols, we expect our PROs will be able to increase rental conversion rates resulting in increasing occupancy levels. Based on pro forma results of operations for the year ended December 31, 2014, we believe that a 1% improvement in our occupancy for our in-place portfolio would have translated into an approximate $1.2 million improvement in pro forma rental revenue for the period. We would expect a similar increase in NOI subject to marginal increases in operating expenses.

Maximize Property Level Cash Flow. We strive to maximize the cash flows at our properties by leveraging the economies of scale provided by our national platform, including through the implementation of new ideas derived from our Technology and Best Practices Group. We believe that our unique PRO structure, centralized infrastructure and efficient national platform will enable us to achieve optimal market rents and occupancy, reduce operating expenses and increase the sale of ancillary products and services, including tenant insurance, rental moving equipment and packing supplies.

Acquire Built-in Pipeline of Target Properties from Existing PROs. We have an attractive, high quality pipeline of 114 self-storage properties, one of which is a development property under contract comprising approximately 20,000 rentable square feet that we expect to acquire in late 2016 once occupancy reaches average local market levels and financial performance is acceptable. The other 113 properties in our pipeline represent potential acquisitions, comprising approximately 7.3 million rentable square feet, that we anticipate will drive our future growth. We consider a property to be in

8

our pipeline if (i) it is under a management service agreement with one of our PROS, (ii) it meets the property quality criteria described under "The Formation and Structure of our CompanyValuation Methodology for Contributed Portfolios," and (iii) it is either required to be offered to us under the applicable facilities portfolio management agreement or a PRO has a reasonable basis to believe that the owner of the property intends to sell the property in the next seven years.

The following table summarizes the properties in our pipeline by PRO as of December 31, 2014:

|

|

Pipeline | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

PRO

|

Properties | Units | Rentable Square Feet(1) |

|||||||

SecurCare |

25 | 12,351 | 1,539,671 | |||||||

Northwest |

7 | 2,170 | 269,579 | |||||||

Optivest |

24 | 13,528 | 1,632,792 | |||||||

Guardian |

9 | 6,657 | 762,920 | |||||||

Move-It |

21 | 9,377 | 1,367,578 | |||||||

Storage Solutions |

28 | 16,017 | 1,752,220 | |||||||

| | | | | | | | | | | |

Total(2) |

114 | 60,100 | 7,324,760 | |||||||

| | | | | | | | | | | |

| | | | | | | | | | | |

- (1)

- Rentable

square feet includes all enclosed self-storage units but excludes commercial, residential, and covered parking space of over 250,000 square feet in

our pipeline.

- (2)

- Three properties in our pipeline, if acquired, would be held as long-term leasehold interests.

Our PROs have management service agreements with all of the properties in our pipeline and hold controlling ownership interests in 30 of these properties and non-controlling ownership interests in 20 of these properties. With respect to each property in our pipeline in which a PRO holds a controlling ownership interest, such PRO has agreed that it will not transfer (or permit the transfer of, to the extent possible) any interest in such self-storage property without first offering or causing to be offered (if permissible) such interest to us. In addition, upon maturity of the outstanding mortgage indebtedness encumbering such property or if no such indebtedness is in place, so long as occupancy is consistent with or exceeds average local market levels, which we determine in our sole discretion, such PRO has agreed to offer or cause to be offered (if permissible) such interest to us. With respect to pipeline properties in which our PROs have a non-controlling ownership interest or no ownership interest, each PRO has agreed to use commercially reasonable good faith efforts to facilitate our purchase of such property. We preserve the discretion to accept or reject any of the properties that our PROs are required to, or elect to, offer (or cause to be offered) to us. See "The Formation and Structure of Our CompanyFacilities Portfolio and Asset Management AgreementsControlled Properties Purchase Option Upon PRO Determination to Transfer" and "Non-Controlled Properties Notice and Facilitation."

9

The following table summarizes, by each category of property in our pipeline, the years in which we expect to either acquire, have an offer to acquire, or make an offer to acquire such properties.

|

|

Pipeline | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

Under Contract |

PRO Controlling Ownership Interest(1) |

PRO Non- controlling Ownership Interest |

PRO without Ownership Interest |

Total | |||||||||||

2015 |

| 3 | 15 | 17 | 35 | |||||||||||

2016 |

1 | 8 | 5 | 39 | 53 | |||||||||||

2017 |

| 9 | | 5 | 14 | |||||||||||

2018 and beyond |

| 10 | | 2 | 12 | |||||||||||

| | | | | | | | | | | | | | | | | |

Total |

1 | 30 | 20 | 63 | 114 | |||||||||||

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

- (1)

- Three properties in our pipeline, if acquired, would be held as long-term leasehold interests.

We have organized our pipeline into annual time periods in the above table based on our assessment of (i) the pending maturity dates of the mortgages encumbering such properties or when pre-payment of such mortgage is economical, (ii) our PROs' understanding, as managers of these properties, as to when the owners of the controlling interests in these properties might be interested in selling, and/or (iii) a particular property having occupancy consistent with average local market levels, along with acceptable financial performance. For 24 of the 30 properties in which our PROs have a controlling ownership interest, properties are organized into annual time periods based primarily on the pending maturity dates of the underlying mortgages. The remaining six of these 30 properties, including four development properties, are included in annual time periods based on our estimate as to when each such property is expected to have occupancy consistent with average local market levels and acceptable financial performance.

With respect to the 83 pipeline properties in which our PROs have a non-controlling ownership interest or no ownership interest, we have included 44 of such properties into annual time periods based primarily on the pending maturity dates of their underlying mortgages and one such development property in an annual time period based on our estimate as to when such property is expected to have occupancy consistent with average local market levels and acceptable financial performance. The annual time periods for the remaining 38 properties are based largely on our PROs' understanding as to when the owners of the controlling interests in these properties might be interested in selling their properties.

For all of the 113 potential acquisitions in our pipeline, we have not entered into negotiations with the respective owners and there can be no assurance as to whether we will acquire any of these properties or the actual timing of any such acquisitions. Each pipeline property is subject to additional due diligence and the determination by us to pursue the acquisition of the property. In addition, with respect to the 83 pipeline properties in which our PROs have a non-controlling ownership interest or no ownership interest, the current owner of each property is not required to offer such property to us and there can be no assurance that we will acquire these properties.

Access Additional Off-Market Acquisition Opportunities. Our PROs and their "on-the-ground" personnel have established an extensive network of industry relationships and contacts in their respective markets. Through these local connections, our PROs are able to access acquisition opportunities that are not publicly marketed or sold through auctions. Our structure incentivizes our PROs to source acquisitions in their markets and consolidate these properties into our company. Other public self-storage companies generally have acquisition teams located at their central offices, which in many instances are far removed from regional and local markets. We believe our operators' networks and close familiarity with the other operators in their markets provide us clear competitive advantages in identifying and selecting attractive acquisition opportunities. Our PROs have already sourced

10

47 acquisitions since our inception, comprising approximately 3.2 million rentable square feet within our in-place portfolio.

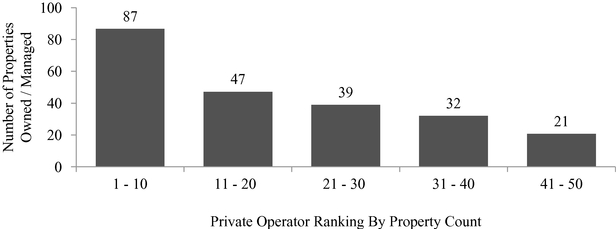

Recruit New PROs in Target Markets. We intend to continue to execute on our external growth strategy through additional acquisitions and contributions from future PROs in key markets. With the approximately 50,000 total self-storage properties in the United States owned by over 30,000 operators, we believe there is significant opportunity for growth through consolidation of the highly fragmented composition of the market. We believe that future operators will be attracted to our unique structure, providing them with lower cost of capital, better economies of scale, and greater operational and overhead efficiencies while preserving their existing property management platforms. Over ten private operators, each with portfolios of over 20 properties, have expressed interest in exploring the possibility of joining our company as future PROs. We have not entered into any agreements with these operators in respect of them joining our company or contributing their properties to us and there can be no assurance that we will enter into any such agreements in the future. We intend to add additional PROs to complement our existing geographic footprint and to achieve our goal of creating a highly diversified nationwide portfolio of properties in the top 100 MSAs. When considering a PRO candidate, we consider various factors, including the size of the potential PRO's portfolio, the quality and location of its properties, its market exposure, its operating expertise, its ability to grow its business, and its reputation with industry participants. Following our inception, we recruited an additional three PROs who manage 106 self-storage properties across six states, 40 of which are part of our in-place portfolio. For example, we recruited Move It, which manages 37 self-storage properties in three states. This PRO manages 11 properties in our in-place portfolio and 21 in our pipeline.

Our Technology and Best Practices

Our technology and best practices programs, which are overseen by our Technology and Best Practices Group, are designed to take advantage of the scale and sophistication afforded to a large national storage operator while benefiting from the local expertise and relationships of experienced PROs. These programs deliver value for us and our PROs through a number of methods, tools, and platforms: (1) a common data platform for financial, operational, and marketing data collection, reporting, analysis and dissemination, (2) a common online marketing platform to deliver economies of scale for Internet search rankings and customer lead generation, (3) a centralized call center supporting property operations, (4) a joint purchasing program for products such as property insurance, retail merchandise, office supplies, merchant credit and debit card processing, and online auction services in order to achieve economies of scale, and (5) a forum for sharing management techniques and engaging in high-level collaboration across decentralized operations.

Our unique structure allows for effective best practices collaboration among our experienced PROs. We provide the methods, tools, and platforms for our PROs to share management techniques and resources with each other in order to promote greater experimentation, faster iteration, and a level of flexibility not easily achieved by large competitors operating in a more monolithic fashion. These techniques span the spectrum of property management from employee training, sourcing, and retention to operational audits, selling techniques, data analytics, document digitization, and the pursuit of additional revenue streams such as rooftop solar and cellular antenna contracts. We believe that over time, the open sharing of best practices will deliver consistent, incremental organic improvements and drive better financial results throughout our portfolio.

The Formation and Structure of Our Company

Upon the completion of this offering and the formation transactions, our in-place portfolio will consist of 246 self-storage properties located in 16 states, comprising approximately 13.7 million rentable square feet. Of these properties, four will be held as long-term leasehold interests with remaining lease terms, including extension options, ranging from 19 to 60 years.

11

Acquisition of In-Place Portfolio. For our in-place portfolio, pursuant to separate contribution agreements described under "The Formation and Structure of our CompanyContribution Agreements," we have issued or expect to issue in connection with the formation transactions an aggregate of 19.2 million OP units in our operating partnership, 1.4 million OP units in our DownREIT partnerships, 8.9 million subordinated performance units in our operating partnership, and 3.7 million subordinated performance units in our DownREIT partnerships. The properties included in our in-place portfolio by our PROs were or will be contributed pursuant to a policy adopted by our board of trustees that standardizes the methodology that we use for valuing self-storage properties that are contributed to us by our PROs. See "The Formation and Structure of our CompanyValuation Methodology for Contributed Portfolios." In connection with these transactions, we assumed or will assume an aggregate of approximately $65.8 million of mortgage indebtedness. In addition, we have acquired or will acquire an aggregate of 47 properties, which were sourced by our PROs, pursuant to purchase and sale agreements with certain third-party owners for $147.5 million in cash and 1.2 million OP units. In addition, in connection with these acquisitions, our PROs who sourced them received 277,000 subordinated performance units. In connection with these acquisitions, we assumed or will assume an aggregate of approximately $35.1 million of mortgage indebtedness. As of December 31, 2014, our operating partnership had also granted approximately 2.5 million LTIP units (522,900 of which vest only upon the future contribution of properties by PROs) to our PROs, representatives of our PROs, trustee nominees, officers and certain employees under the Prior Incentive Plan (see "Our Management2015 Equity Incentive PlanPrior Incentive Plan") and we have granted, or expect to grant, in connection with the formation transactions, approximately 260,000 LTIP units to individuals associated with a third-party consultant.

PRO Sharing in Operating Cash Flow Generated by their Managed Portfolio. As a means of incentivizing our PROs to drive operating performance and support the sustainability of the operating cash flow from their contributed properties that they continue to manage on our behalf, we issued each PRO subordinated performance units aimed at aligning the interests of our PROs with our interests and those of our shareholders. In furtherance of this key objective, under our operating partnership agreement, our PROs, as holders of subordinated performance units, share in the operating cash flow generated by their managed portfolios to the extent that we, as the general partner of our operating partnership, determine to make distributions out of such operating cash flow. In general, the operating cash flow generated by their managed portfolio is an amount determined by us, as general partner of our operating partnership, equal to the excess of property revenues over property related expenses from such portfolio (together with allocations of general and administrative expenses, debt, reserves and other company wide expenses and liabilities). To the extent we determine to make distributions of such operating cash flow, we are required to first allocate to holders of OP units (to be used or distributed by us in any manner we determine) an amount sufficient to provide such holders with a cumulative preferred allocation on the unreturned capital we have invested in the portfolio sufficient to allocate to such holders a 6% preferred return on such invested capital. After such amounts have been allocated for holders of OP units, any excess in an amount sufficient to provide the holders of subordinated performance units associated with such portfolio with a 6% subordinated return on their invested capital in the portfolio is then distributed to such holders. Thereafter, 50% of any excess operating cash flow generated by the portfolio is allocated for holders of OP units, while the balance is distributed to subordinated performance unit holders. Although the subordinated allocation for the subordinated performance units is non-cumulative from period to period, if the operating cash flow from a property portfolio related to a series of subordinated performance units is sufficient, in our judgment as general partner of our operating partnership, (with the approval of a majority of our independent trustees), to fund distributions to the holders of such series of subordinated performance units, but we, as general partner of our operating partnership, decline to make distributions to subordinated performance unit holders, the amount available but not paid as distributions will be added to the subordinated allocation corresponding to such series of subordinated performance units. As

12

described in more detail under "Limited Partnership Agreement of Our Operating PartnershipDistributions," our PROs also share in capital transaction proceeds available from the facilities portfolio they manage.

Following the allocation described above, the general partner will generally cause our operating partnership to distribute the amounts allocated to the relevant series of subordinated performance units to the holders of such series of subordinated performance units. The general partner may cause our operating partnership to distribute the amounts allocated to holders of the OP units or may cause our operating partnership to retain such amounts to be used by our operating partnership for any purpose. Any operating cash flow that is attributable to amounts retained by our operating partnership pursuant to the preceding sentence will generally be available to be allocated as an additional capital contribution to the various property portfolios.

The foregoing allocation of operating cash flow between the OP unit holders and subordinated performance unit holders is for purposes of determining distributions to holders of subordinated performance units but does not necessarily represent the operating cash flow that will be distributed to holders of OP units (or paid as dividends to holders of our common shares). Any distribution of operating cash flow allocated to the holders of OP units will be made at our discretion (and paid as dividends to holders of our common shares at the discretion of our board of trustees).

Facilities Portfolio and Asset Management Agreements. Each self-storage property that was contributed to our operating partnership or one of its subsidiaries by a PRO will continue to be managed by the PRO that contributed the property. Each PRO has entered into a facilities portfolio management agreement and a sales commission agreement with us with respect to its contributed portfolio together with asset management agreements for each property. We believe this consistency in post-contribution portfolio and property management, together with our technology and best practices programs, will allow us to fully leverage each PRO's local market knowledge and expertise and mitigate transitional disruptions to operations. Pursuant to the asset management agreements, the PROs receive reimbursements for certain expenses and a market rate supervisory and administrative fee for their services, which in total will be not less than 5% nor more than 6% of gross revenue generated by each property that they manage for us. In addition, pursuant to the sales commission agreements, the PROs receive reimbursements for certain expenses and a market rate sales commission for their services, which in total will be not less than 5% nor more than 6% of net sales revenue generated by the sale of merchandise at the properties that they manage for us. Each facilities portfolio management agreement also contains a number of terms relating to, among other things, exclusivity and non-competition, management and retirement (including the "Key Person Standards" described below under "Key Person Standards"), and performance. For a further description of the terms of the facilities portfolio and asset management agreements, see "The Formation and Structure of Our CompanyFacilities Portfolio and Asset Management Agreements."

Assignment of PRO Territories. Our company plans to primarily rely on our PROs to source acquisitions of self-storage properties from third-party sellers that operate in the same regional and local markets as our PROs. However, under some circumstances, we may learn about an acquisition opportunity from a source other than a PRO within an exclusive MSA or non-exclusive MSA granted to such PRO. In such circumstances, pursuant to the facilities portfolio management agreements, our operating partnership has agreed not to acquire additional self-storage properties without first offering such PRO the opportunity to co-invest in, and manage, the property in its assigned MSA. In shared MSAs, where more than one PRO is assigned, the operating partnership is permitted to choose the PRO that will get the co-investment and management opportunity. This permits us to reward a PRO that sources an acquisition for us. In the event that a PRO determines not to accept a co-investment and management opportunity, our operating partnership must offer the same opportunity to a different PRO assigned to the shared MSA. If all PROs in an MSA decline the opportunity, we are free to enter into alternative co-investment and management arrangements.

13

-

-

SecurCare is assigned 18 exclusive MSAs within Colorado, Georgia, Louisiana, North Carolina, Oklahoma, South Carolina,

and Texas, five shared MSAs within California and Texas, and one non-exclusive MSA within Georgia.

-

-

Northwest is assigned five exclusive MSAs within Oregon and one non-exclusive MSA in Washington.

-

-

Optivest is assigned two exclusive MSAs within Arizona and New Hampshire and seven shared MSAs within Arizona,

California, Nevada, and Texas.

-

-

Guardian is assigned one exclusive MSA within California and three shared MSAs within Arizona and California.

-

-

Move It is assigned four exclusive MSAs within Texas, five shared MSAs within Texas, and one non-exclusive MSA within

Tennessee.

-

- Storage Solutions is assigned two shared MSAs within Arizona and Nevada.

Each PRO is prohibited from entering into new agreements or arrangements for self-storage properties that they do not currently own or manage without our operating partnership's prior written consent. In addition to the reimbursements of expenses and fees paid under the asset management agreements, we also pay our PROs an insignificant underwriting and due diligence fee in connection with the sourcing of third-party acquisitions. We do not intend to pay our PROs any other fees.

Company Lock-out Periods. We utilize a number of different lock-out periods with respect to our PROs' equity interests in order to maintain their long-term incentive to continue to improve and grow the portfolio of properties that they contributed to us.

-

-

Subordinated Performance Unit Conversion. PROs are

restricted from converting any of their subordinated performance units into OP units for a minimum of two years from the later of the completion of this offering or the initial contribution of their

properties to us. Following such two-year period, other than at our election in connection with a retirement event or certain qualifying terminations, a PRO may only convert subordinated performance

units into OP units upon the achievement of certain performance thresholds and at a specified conversion discount. See "Limited Partnership Agreement of our Operating

PartnershipConversion of Subordinated Performance Units into OP Units."

-

-

Retirement. PROs are prevented from "retiring" for a

minimum of two years from the later of completion of this offering or the initial contribution of their properties to us. Upon certain retirement events, the management of the properties in such PRO's

contributed portfolio will be transferred to us (or our designee) in exchange for OP units with a value equal to four times the average of the normalized annual EBITDA from the management contracts

related to such PRO's contributed portfolio over the immediately preceding 24-month period. See "Formation and Structure of our CompanyFacilities Portfolio and Asset Management

AgreementsManagement and Retirement."

-

- Redemption. Existing holders of OP units in our operating partnership, including our PROs, are restricted from redeeming their OP units for a minimum of one year from the completion of this offering. See "Limited Partnership Agreement of our Operating PartnershipRedemption of OP Units." Existing holders of OP units in our DownREIT partnerships have a longer lock-out period before they can redeem. See "The Formation and Structure of our CompanyDownREIT Partnerships."

Key Person Standards. Each facilities portfolio management agreement contains provisions, which we refer to as the "Key Person Standards," which relate to each PRO's key persons (as defined in each facilities portfolio management agreement). Our operating partnership, in its sole discretion, may

14

consent to changes in the key persons designated with respect to each PRO from time to time. Pursuant to the facilities portfolio management agreements, each PRO's key persons are required to remain active in and devote a sufficient portion of each such person's business time to the business and affairs of the PRO with respect to such PRO's contributed portfolio which is consistent with past practice. In addition, other than as a result of death or legal incapacity, at least 50% of the subordinated performance units issued in respect of each PRO's contributed portfolio are required to be beneficially owned by such PRO's key persons and such key persons are required to collectively own at least 50% of the beneficial interest in and control the management company relating to the contributed portfolio. We may elect to terminate our facilities portfolio and asset management agreements and transfer property management responsibilities over the properties managed by a PRO to us (or our designee), if, subject to specified cure provisions, a PRO breaches its Key Person Standards. Upon termination of the facilities portfolio management agreement for a PRO in the case of breach of Key Person Standards, we will be permitted to require that the subordinated performance units issued in respect of such PRO's contributed portfolio be converted into OP units applying a specified conversion penalty on the terms described herein under "Limited Partnership Agreement of our Operating PartnershipConversion of Subordinated Performance Units into OP Units." See "The Formation and Structure of our CompanyFacilities Portfolio and Asset Management AgreementsManagement and Retirement" and "Facilities Portfolio and Asset Management AgreementsPerformance."

Registration Rights Agreements. We have granted registration rights to those persons who will be eligible to receive common shares issuable upon exchange of OP units (or securities convertible into or exchangeable for OP units) issued in our formation transactions. The registration rights agreement requires that as soon as practicable after the date on which we first become eligible to register the resale of securities of our company pursuant to Form S-3 under the Securities Act, but in no event later than 60 calendar days thereafter, we file a shelf registration statement registering the offer and resale of the common shares issuable upon exchange of OP units (or securities convertible into or exchangeable for OP units) issued in our formation transactions on a delayed or continuous basis. See "Shares Eligible for Future SaleRegistration Rights Agreement."

15

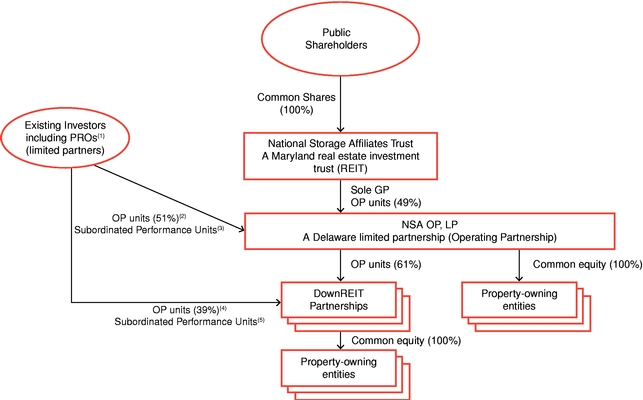

Our Structure

The following diagram illustrates our anticipated structure upon the completion of this offering and the formation transactions:

- (1)

- In addition to PROs, various third-party investors who do not manage the properties and certain of our trustees and

officers will own OP units and subordinated performance units in our operating partnership.

- (2)

- OP

units in our operating partnership are redeemable for cash or, at our option, exchangeable for common shares on a one-for-one basis, subject to certain

adjustments. The diagram above excludes 2.7 million OP units issuable upon conversion of 2.7 million outstanding LTIP units, 522,900 of which vest only upon the future contribution of properties by

PROs.

- (3)

- After giving effect to the completion of the formation transactions, our operating partnership will have 12.8 million subordinated performance units outstanding. As disclosed under "Limited Partnership Agreement of our Operating PartnershipConversion of Subordinated Performance Units into OP Units," subordinated performance units are only convertible into OP units, beginning two years following the completion of this offering and then (i) at the holder's election only upon the achievement of certain performance thresholds relating to the properties to which such subordinated performance units relate or (ii) at our election upon a retirement event of a PRO that holds such subordinated performance units or upon certain qualifying terminations. Consequently, we have not included such subordinated performance units in the percentage calculations included in the above chart. However, we estimate, notwithstanding the two-year lock out period on conversions referred to above, that if such subordinated performance units were convertible into OP units as of December 31, 2014, each subordinated performance unit would on average convert into 0.85 OP units or into an aggregate of 11.0 million OP units. This estimate is based on dividing the average cash available for distribution, or CAD, per subordinated performance unit on a pro forma basis over the one-year period ended December 31, 2014 by 110% of the CAD per OP unit on a pro forma basis over the same period. We anticipate that as our CAD grows over time, the conversion ratio will also grow, including to levels that may exceed one-to-one. For example, we estimate that (assuming this offering prices at the mid-point of the initial public offering price range shown on the cover page of this prospectus, no further issuances of OP units or subordinated performance units and a conversion penalty of 110%) if our CAD to our OP unit holders and subordinated performance unit holders and shareholders were to grow at annual rate of 1.0%, 3.0% and 5.0% per annum above the 2014 level in each of the three following years, each subordinated performance unit would on average be convertible into 0.91, 1.02, and 1.12 OP units, respectively, as of December 31, 2017. These estimates are provided for illustrative purposes only. The actual number of OP units into which such subordinated performance units will become convertible after the completion of this offering may vary significantly from these estimates and will depend upon the applicable conversion penalty and the actual CAD to the OP units and the actual CAD to the

16

converted subordinated performance units in the one-year period ending prior to conversion. See "Limited Partnership Agreement of Our Operating PartnershipConversion of Subordinated Performance Units into OP Units."

- (4)

- OP

units in our DownREIT partnerships are redeemable for cash or, at our option, exchangeable for OP units in our operating partnership on a one-for-one

basis, subject to certain adjustments.

- (5)

- Subordinated performance units in our DownREIT partnerships are exchangeable for subordinated performance units in our operating partnership on a one-for-one basis on the terms set forth in the DownREIT partnership's organizational documents, which are then convertible into OP units in our operating partnership as specified in note 3 to this chart above.

We believe that our structure provides meaningful advantages, including the strong alignment of financial incentives between PROs and shareholders, accelerated acquisition growth opportunities and a disciplined approach to new acquisitions.

Our Properties