EXHIBIT 10.9

Published on November 10, 2015

Exhibit 10.9

FIRST AMENDMENT TO CREDIT AGREEMENT, TERMINATION, RELEASE AND CONSENT

This FIRST AMENDMENT TO CREDIT AGREEMENT, TERMINATION, RELEASE AND CONSENT (this “First Amendment”) is made and entered into as of the 13th day of August, 2015, by and among NSA OP, LP, a Delaware limited partnership (the “Parent Borrower”), certain of the Parent Borrower’s Subsidiaries (together with the Parent Borrower, the “Borrowers”), NATIONAL STORAGE AFFILIATES TRUST, a Maryland real estate investment trust (the “REIT”), and NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, a Delaware limited liability company and each other Guarantor signatory hereto (collectively, the “Guarantors” and together with the Borrowers, collectively, the “Loan Parties”), KEYBANK NATIONAL ASSOCIATION, as the Administrative Agent (the “Administrative Agent”), and the financial institutions which are a party to the Credit Agreement (defined below) as lenders (collectively, the “Lenders”).

WHEREAS, the Loan Parties, certain of the Lenders and the Administrative Agent are parties to that certain Credit Agreement, dated as of April 1, 2014 (as amended, modified, supplemented or restated and in effect from time to time, the “Credit Agreement”), pursuant to which the Lenders have extended credit to the Borrowers on the terms set forth therein;

WHEREAS, contemporaneously with this First Amendment, the Borrowers have requested that the Revolving Commitments and Term Loan made under the Credit Agreement be further increased by an aggregate amount equal to $125,000,000.00 (the “Increase”), with such Increase being allocated $69,557,823.13 to the Revolving Commitments and $55,442,176.87 to the Term Loan, so that after giving effect to the Increase, the aggregate Revolving Commitments will equal $350,000,000.00 and the aggregate Term Loan will equal $200,000,000.00. The increase to the Term Loan will constitute an Incremental Term Loan under the Credit Agreement;

WHEREAS, in connection with the Increase, certain additional financial institutions are becoming new Lenders under the Credit Agreement pursuant to an Increase Agreement and separate Augmenting Lender Agreements being entered into contemporaneously herewith and one or more of the existing Lenders is reducing its Revolving Commitment and Term Loan amount;

WHEREAS, an updated Schedule 1.1, after giving effect to the Increase and the reallocation of certain Commitments and Term Loan amounts, is attached hereto as Annex 1;

WHEREAS, the Capital Event (as defined in the Credit Agreement) occurred on April 28, 2015 in respect of the REIT, as contemplated in Section 13.19 of the Credit Agreement;

WHEREAS, the Borrowers have requested that each of the Lenders agree, and the requisite Lenders under the terms of the Credit Agreement (after giving effect to the Increase on the date hereof) are willing to agree, on the terms and subject to the conditions set forth herein, to

1

make certain amendments to the Credit Agreement and provide certain consents, acknowledgments and releases, all as more particularly set forth herein;

NOW, THEREFORE, in consideration of the foregoing, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.Definitions; Loan Document. Capitalized terms used herein without definition shall have the meaning assigned to such terms in the Credit Agreement. This First Amendment shall constitute a Loan Document for all purposes of the Credit Agreement and the other Loan Documents.

2. Amendments to Section 1.1 (Definitions) of the Credit Agreement. Section 1.1 of the Credit Agreement is hereby amended by:

(i) Inserting the following definitions in the appropriate alphabetical order:

““Campus Pt. Guarantor” means Colton Campus Pt., L.P., a California limited partnership.”

““Encinitas Guarantor” means Colton Encinitas, L.P., a California limited partnership.”

““First Amendment” means that certain First Amendment to Credit Agreement and Consent, dated as of August 13, 2015, among the Borrowers, the Guarantors, the Administrative Agent and Lenders signatory thereto.”

““First Amendment Date” means August 13, 2015.”

““Irvine Guarantor” means GSC Irvine/Main LP, a California limited partnership, successor-in-interest to SSD, LLC, a Nevada limited liability company.”

““Joinder Document” means each joinder agreement, each allonge and any other document required by the Administrative Agent to be entered into by any Subsidiary of the Parent Borrower in connection with its becoming a Loan Party.”

““Subsidiary Guarantor” means each of (i) the Irvine Guarantor, (ii) the Encinitas Guarantor, (iii) the Campus Pt. Guarantor and (iv) each other Subsidiary of the Parent Borrower which is approved by the Requisite Lenders as a Subsidiary Guarantor from time to time.”

2

(ii) Amending and restating the definition of “Applicable Unused Fee” in its entirety as follows:

““Applicable Unused Fee” means, for any day, the applicable rate per annum set forth below, based on the percentage of the Revolving Commitments in use on such date (with usage calculated in accordance with Section 3.6(a)):

Usage |

Unused Fee |

≤ 50% |

0.25% |

> 50% |

0.20%” |

(iii) Amending the definition of “Borrowing Base Value” (i) by deleting the reference to “10%” contained therein; and (ii) by inserting in place thereof the following: “20%”.

(iv) Amending and restating the definition of “California Partnerships” in its entirety as follows:

““California Partnerships” means, collectively, (a) the Irvine Guarantor, (b) the Encinitas Guarantor, (c) the Campus Pt. Guarantor, and (d) any similar limited partnerships or limited liability companies formed from time to time after the Effective Date, the Equity Interests of which are not wholly-owned by the Parent Borrower or a Subsidiary Borrower that is a Wholly-Owned Subsidiary; provided, that any such limited partnership or limited liability company identified or described in the foregoing clauses (a) through (d) shall be considered a “California Partnership” only if and for so long as (x) the Parent Borrower or such Subsidiary Borrower is (i) the general partner of such limited partnership or (ii) the sole manager or sole managing member of such limited liability company and, in each case, Controls the management of such limited partnership or limited liability company, as applicable, and its assets (including, for the avoidance of doubt, the ability to grant first-mortgage Liens on, and to sell or otherwise dispose of, the Borrowing Base Properties owned by such California Partnership without the consent of the limited partners of such limited partnership or any other member of such limited liability company or any other party), (y) the Parent Borrower or such Subsidiary Borrower shall have pledged (i) its general partner and any limited partner interests in such limited partnership and (ii) its member interests in such limited liability company as Collateral, and the other equity owners of such limited partnership or limited liability company shall have pledged their economic interests in such limited partnership or limited liability company, as applicable as Collateral, in each case in form and substance satisfactory to the Administrative Agent, and (z) such Real Estate Assets are located only in California and/or Arizona.”

3

(v) Amending and restating the definition of “Collateral Documents” in its entirety as follows:

““Collateral Documents” means, collectively, the Pledge Agreement and each other agreement, instrument or document that creates or purports to create a Lien in favor of the Administrative Agent for the benefit of itself, the Lenders and the Specified Derivatives Providers (including, but not limited to, any mortgage, deed of trust, ground lease mortgage or similar instrument entered into by any California Partnerships or Subsidiary Guarantors and any pledge agreement related thereto).”

(vi) Amending clause (a) contained in the definition of “Eligible Property” to read in its entirety as follows:

“(a) such Real Estate Asset is wholly owned, or leased under a Ground Lease, by a Wholly-Owned Subsidiary organized under the laws of a State of the United States, which Subsidiary is or will become a Subsidiary Borrower,”

(vii) Amending and restating the definition of “Guarantor” in its entirety as follows:

““Guarantor” means each of (i) the REIT, (ii) the REIT Parent, and (iii) each Subsidiary Guarantor, each in its capacity as a guarantor under a Guaranty.”

(viii) Amending and restating the definition of “Loan Document” in its entirety as follows:

““Loan Document” means this Agreement, each Note, each Letter of Credit Document, each Collateral Document, each Guaranty, the Intercreditor Agreement, the Fee Letter, the Post-Closing Letter, each Joinder Document, and each other document or instrument now or hereafter executed and delivered by a Loan Party in connection with, pursuant to or relating to this Agreement (other than any Specified Derivatives Contract) (including, but not limited to, any guaranty entered into by any California Partnership).”

(ix) Amending and restating the definition of “Subsidiary Borrower” in its entirety as follows:

““Subsidiary Borrower” has the meaning set forth in the introductory paragraph hereof, and shall include each California Partnership that becomes a Borrower hereunder so long as such California Partnership satisfies the requirements of the definition thereof.”

3. Amendment to Section 5.1(b) (Additional Borrowing Base Properties) of the Credit Agreement. Section 5.1(b)(v) of the Credit Agreement is amended to read in its entirety as follows:

4

“(v) Conditions Precedent to Effectiveness. A Borrowing Base Property Request that has been approved pursuant to Section 5.1(b)(iv) shall become effective upon the receipt and approval by the Administrative Agent of each of the following:

(A) if the Eligible Property is not owned by an existing Borrower, a joinder agreement substantially in the form of Annex 2 to the First Amendment, and with such modifications as are approved by the Administrative Agent, duly authorized, executed and delivered by each new Subsidiary Borrower pursuant to which the Subsidiary (or, as applicable, California Partnership), that owns such Eligible Property (as well as each other direct or indirect parent of such Subsidiary that is not already a Borrower) becomes a Subsidiary Borrower hereunder;

(B) if the Eligible Property is not owned by an existing Borrower, allonges to the Revolving Notes, Term Notes and Swingline Note, in form and substance reasonably satisfactory to the Administrative Agent, duly authorized, executed and delivered by each new Subsidiary Borrower;

(C) If the Eligible Property is owned by a Subsidiary Borrower which is also a California Partnership:

(a) |

new pledge agreements and/or a supplement to the Pledge Agreement, in form and substance reasonably satisfactory to the Administrative Agent, reflecting the pledge of Equity Interests of such new Subsidiary Borrower as additional Collateral; |

(b) |

new and/or supplemented perfection certificates, reflecting such pledged Equity Interests of such new Subsidiary Borrower; |

(c) |

certificates and instruments representing the Equity Interests of such new Subsidiary Borrower pledged as Collateral pursuant to the Pledge Agreement, accompanied by undated stock powers or instruments of transfer executed in blank; and |

(d) |

the deliverables described in Sections 6.1(a)(v) - (viii) with respect to the Subsidiary that owns such Eligible Property and the owners of such Subsidiary

|

(D) A Borrowing Base Certificate calculated as of the end of the then most recently ended Reference Period for which a Borrowing Base Certificate has been delivered pursuant to Section 9.4 (giving pro forma effect to the addition of such Eligible Property as a Borrowing Base Property), and

5

certifying that each Borrowing Base Property (including any new Eligible Property which is the subject of the Borrowing Base Property Request) meets the requirements of an Eligible Property;

(E) Evidence of satisfactory insurance relating to each proposed new Borrowing Base Property and a copy of a satisfactory Owner’s Title Policy (or a pro forma of the Owner’s Title Policy to be issued to the new Subsidiary Borrower along with an executed Escrow Letter with the title company issuing such policy) evidencing the applicable Borrower’s clear title to such property, free of any Liens except for Permitted Liens otherwise permitted on Eligible Properties;

(F) all documentation and other information required by bank regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including USA PATRIOT Act, and a properly completed and signed IRS Form W-8 or W-9, as applicable, for each such new Subsidiary Borrower; and

(G) such other documents, agreements and instruments as the Administrative Agent on behalf of the Lenders may reasonably request.”

4. Amendment to Section 6.1(a) (Initial Conditions Precedent) of the Credit Agreement. Each of Section 6.1(a)(xi), (xii) and (xiii) of the Credit Agreement is amended to insert the phrase “prior to the occurrence of the Capital Event” at the beginning of such section.

5. Amendment to Section 10.10 (Modification of Organizational Documents) of the Credit Agreement. Section 10.10 of the Credit Agreement is amended to add the following parenthetical at the end thereof:

“(but, in no event shall the Loan Parties amend, supplement, restate or otherwise modify any provisions related to or in connection with Control contained in the articles or certificate of incorporation, bylaws, operating agreement, declaration of trust, partnership agreement or other applicable organizational document of a California Partnership without the prior written consent of the Administrative Agent).”

6. Amendment to Section 11.1 (Events of Default) of the Credit Agreement. Section 11.1(l)(ii) of the Credit Agreement is hereby amended (i) by deleting the parenthetical contained therein in its entirety and (ii) by inserting in place thereof the following:

“(together with any new directors whose election by such board or whose nomination for election by the shareholders of the REIT Parent or the REIT, as the case may be, was approved by a vote of at least two-thirds of the directors then still in office who were either directors at the beginning of such period or whose election or nomination for election was previously so approved)”.

6

7. Amendment to Schedule 1.1 (Lender Commitments) to the Credit Agreement. Schedule 1.1 to the Credit Agreement is hereby amended and restated in its entirety as set forth on Annex 1.

8. Amendment to Exhibit M of the Credit Agreement. Exhibit M to the Credit Agreement is hereby amended and restated in its entirety as set forth on Annex 3.

9. Collateral Fallaway. The Borrowers hereby confirm that the Capital Event occurred on April 28, 2015 (the “Collateral Fallaway Date”). The Borrowers further confirm that (a) immediately prior to the Collateral Fallaway Date and immediately after giving effect thereto, no Default or Event of Default existed, (b) immediately prior to the Collateral Fallaway Date and immediately after giving effect thereto, the representations and warranties made or deemed made by the Borrowers and each other Loan Party in the Loan Documents to which any of them is a party were true and correct in all material respects on and as of the Collateral Fallaway Date with the same force and effect as if made on and as of such date, except to the extent that such representations and warranties expressly relate solely to an earlier date (in which case such representations and warranties were true and correct in all material respects on and as of such earlier date), (c) immediately following the occurrence of the Capital Event, and giving pro forma effect thereto and the repayment of Indebtedness in connection therewith, the Loan Parties will be in compliance with the covenants set forth in Section 10.1, 10.2 and 10.4, and (d) attached hereto as Annex 4 is a certificate from the chief executive officer or chief financial officer of the Borrowers certifying (with supporting calculations reasonably acceptable to the Administrative Agent) the matters referred to in the immediately preceding clauses (a) through (c). Therefore, pursuant to Section 13.19 of the Credit Agreement, the Administrative Agent hereby confirms that, except with respect to the Equity Interest pledges and the other items of Collateral in connection with the California Partnerships, the Subsidiary Guarantors and/or the Ground Lease Consents (as defined below), (i) all Liens created pursuant to the Collateral Documents (except for such Liens related to the California Partnerships, the Subsidiary Guarantors and/or the Ground Lease Consents) are hereby released and all rights to the Collateral so released shall revert to the applicable Pledgor (as defined in the Pledge Agreement), (iii) it will promptly return to the Borrower all share certificates, instruments and other possessory Collateral previously delivered to the Administrative Agent and, at the Borrowers’ expense, file any necessary UCC termination statements to reflect the release and termination described in this Section 8, and (v) it will execute and deliver to the Borrowers, at the Borrowers’ expense, such other documents and take such other reasonable action as the Borrowers shall reasonably request to evidence such release and termination.

10. Consent in connection with the Irvine Ground Lease, Encinitas Lease and Campus Pt. Lease; Consent in connection with certain Transfers and Dissolutions.

(i) As more particularly described in the Consent dated as of January 30, 2015 among the Loan Parties, the Administrative Agent and the Lenders (the “Irvine Consent”), a copy of which is attached hereto as Annex 5, the Lenders have agreed, subject to the conditions set forth therein, to include the Irvine Guarantor as a California Partnership notwithstanding that it does not satisfy certain of the requirements set forth in

7

the definition of California Partnership and to include the Irvine Property as an Eligible Property, all subject to the terms of the Irvine Consent. The Borrower has requested that the Lenders permit the Irvine Property to continue to be considered an Eligible Property notwithstanding that the Borrowers did not deliver the Landlord Consent referred to in the Irvine Consent, so long as the other conditions of the Irvine Consent (such conditions other than the delivery of the Landlord Consent, collectively, the “Irvine Conditions”) continue to be satisfied, including that the Irvine Guarantor continue to guaranty the Obligations and the collateral pledged pursuant to the Irvine Consent remains in place, including, but not limited to, a first priority Ground Lease Mortgage (as defined in the Irvine Consent). Subject to the Irvine Conditions at all times continuing to be met and to the Irvine Property otherwise meeting the conditions of an Eligible Property, the Lenders hereby consent thereto.

(ii) As described in the Consent dated as of December 31, 2014 among the Loan Parties, the Administrative Agent and the Lenders (the “Ground Lease Term Consent”), a copy of which is attached hereto as Annex 6, the Lenders have agreed, subject to the conditions set forth therein, to the characterization each of the Leases (as defined in the Ground Lease Term Consent) as a “Ground Lease,” as defined in the Credit Agreement, all subject to the terms of the Ground Lease Term Consent.

(iii) The Borrowers have requested that the Lenders consent to Colton Campus Pt., L.P., a California limited partnership (the “Campus Pt. Guarantor”) and Colton Encinitas, L.P., a California limited partnership (the “Encinitas Guarantor” and together with Campus Pt. Guarantor, the “CP Guarantors”) being treated for all purposes as a California Partnership under (and as defined in) the Credit Agreement and to the Guarantor Property (as defined below), in turn, constituting an Eligible Property for all purposes, including for determining Borrowing Base Availability. The Encinitas Guarantor is the tenant under that certain lease dated February 11, 1999 (as amended), by and between M&H Realty Partners III L.P. (the “Encinitas Landlord”), and Encinitas Guarantor, for certain premises located in Encinitas, California more particularly described therein (as amended, the “Encinitas Lease”; and the premises ground leased to the Encinitas Guarantor pursuant to the Encinitas Lease, the “Encinitas Property”) and pursuant to that certain Contribution Agreement dated as of February 9, 2015 (the “Encinitas Contribution Agreement”) among the Lamb Family Trust and J.M. Trust (the “Minar Trust” and together with the Lamb Trust, in such capacities, the “Encinitas Contributing LPs”), the Parent Borrower and NSA Colton DR GP, LLC (the “Encinitas Parent”), the Encinitas Contributing LPs have contributed 30% of the limited partnership interests in the Encinitas Guarantor to the Encinitas Parent. The Campus Pt. Guarantor is the tenant under that certain lease dated June 26, 2001, by and between Keystone Land Partners, LLC (the “Campus Pt. Landlord”), and the Campus Pt. Guarantor for certain premises located in San Diego, California more particularly described therein (as amended, the “Campus Pt. Lease” and together with the Encinitas Lease, the “Guarantor Lease”; and the premises leased to the Campus Pt. Guarantor pursuant to the Campus Pt. Lease, the “Campus Pt. Property” and together with the Encinitas Property, the “Guarantor Property”) and pursuant to that certain Contribution Agreement dated as of

8

February 9, 2015 (the “Campus Pt. Contribution Agreement”) among the Lamb Trust and the Minar Trust (collectively, in such capacities, the “Campus Pt. Contributing LPs” and together with the Encinitas Contributing LPs, the “Contributing LPs”), the Parent Borrower and NSA Colton DR GP, LLC (in such capacity, the “Campus Pt. Parent” and together with Encinitas Parent, the “Parent Subsidiary Borrower”), the Campus Pt. Contributing LPs have contributed 30% of the limited partnership interests in the Campus Pt. Guarantor to the Campus Pt. Parent. Notwithstanding the fact that neither CP Guarantor meets the requirements set forth in the definition of California Partnership set forth in the Credit Agreement and each CP Guarantor will become a Guarantor under the Credit Agreement rather than a Subsidiary Borrower, the Lenders hereby consent (i) to Encinitas Guarantor (the “Encinitas Consent”) and Campus Pt. Guarantor (the “Campus Pt. Consent” and together with Encinitas Consent, the “CP Guarantor Consents”, and together with Irvine Consent and Ground Lease Term Consent, the “Ground Lease Consents”) being treated for all purposes as a California Partnership, (ii) to the Guarantor Property ground-leased by such CP Guarantor constituting an Eligible Property for all purposes, including for determining Borrowing Base Availability, and (iii) to the Guarantor Lease of such CP Guarantor constituting a “Ground Lease” within the definition set forth in the Credit Agreement (as more fully set forth in the Ground Lease Term Consent), in each case upon the applicable CP Guarantor satisfying the conditions set forth in Annex 7 to the reasonable satisfaction of the Administrative Agent.

(iv) The Borrowers have requested that the Lenders consent (i) to the transfer of certain Real Property Assets by Washington Murrieta III, LLC (“WM III”) to NSA-G Holdings, LLC, an existing Subsidiary Borrower, notwithstanding the fact that WM III has been dissolved as of the date hereof and (ii) to the waiver of certain Defaults or Events of Default arising as a result of the winding up and dissolution of WM III prior to the transfer of such Real Property Assets. The Borrowers hereby represent and warrant that (i) all Real Property Assets owned by WM III immediately prior to its dissolution have been transferred to and are wholly-owned by NSA-G Holdings, LLC and, upon such transfer, all such Real Property Assets satisfy all of the requirements to be an Eligible Property, (ii) immediately prior to the consummation of the transfer to NSA-G Holdings LLC, each Real Property Asset was a Borrowing Base Property, (iii) upon and following the consummation of the transfer to NSA-G Holdings, LLC, each Real Property Asset will continue to be a Borrowing Base Property, and (iv) the transfer is permitted pursuant to Section 10.7(c) of the Credit Agreement. The Lenders hereby (x) consent to the transfer of the Real Property Assets owned by WM III to NSA-G Holdings, LLC and to the winding up and dissolution of WM III and (y) waive any Defaults or Events of Default arising as a result of the winding up and dissolution of WM III prior to the transfer of such Real Property Assets to NSA-G Holdings, LLC, in each case effective only upon the satisfaction of the conditions set forth in Paragraph 12 to the reasonable satisfaction of the Administrative Agent.

(v) Notwithstanding the 30 days prior written notice requirement under Section 5.2(c) of the Credit Agreement, the Parent Borrower hereby requests (i) that Colton Hawaiian Gardens, LP, GSC Montclair, LP, GSC AllSafe Riv-1, LP, GSC Leave It

9

Riv-2, LP, Colton Riverside, L.P., Colton VB, L.P and Washington Murrieta III, LLC, each a Subsidiary Borrower, cease to be a Borrower and be released from its Obligations under the Loan Documents, and (ii) that the Administrative Agent’s Lien on the Equity Interests of such Subsidiary Borrower be released (clauses (i) and (ii), collectively, the “Release”), and the Parent Borrower hereby represents, warrants and certifies to the Administrative Agent and the Lenders that as of the date of the Release: (i) except for the Defaults or Events of Defaults described in Section 10(iv) above, no Default or Event of Default exists or will exist immediately after giving effect to the Release; and (ii) no Subsidiary Borrower that is being released owns (A) any Borrowing Base Properties or (B) any Real Estate Assets that are disqualified as Borrowing Base Properties pursuant to Section 5.2(b) of the Credit Agreement or (C) any Equity Interests (directly or indirectly) in any other Subsidiary Borrower (other than another Subsidiary Borrower that is being released simultaneously pursuant to this Paragraph 10(v)). The Administrative Agent, based upon the representations, warranties and certifications set forth in the preceding sentence, grants the Release and waives the 30-day prior written notice requirement set forth above and the Lenders consent thereto.

11. No Waiver. Nothing contained herein shall be deemed to (i) constitute, except as stated in Paragraph 10(iv), a waiver of any Default or Event of Default that may heretofore or hereafter occur or have occurred and be continuing or to otherwise modify any provision of the Credit Agreement or any other Loan Document, or (ii) give rise to any defenses or counterclaims to the Administrative Agent’s or any Lender’s right to compel payment of the Obligations when due or to otherwise enforce their respective rights and remedies under the Credit Agreement and the other Loan Documents.

12. Conditions to Effectiveness. This First Amendment shall become effective as of the date when each of the following conditions is satisfied:

(a) The Administrative Agent’s receipt of the following, each of which shall be originals or telecopies (followed promptly by originals) unless otherwise specified, each dated as of the date hereof and each in form and substance satisfactory to the Administrative Agent unless otherwise specified:

(i) counterparts of this First Amendment, properly executed by a Responsible Officer of each of the Loan Parties and the requisite Lenders under the terms of the Credit Agreement, in each case sufficient in number for distribution to each party hereto; and

(ii) such other assurances, certificates, documents, consents or opinions as the Administrative Agent reasonably may require.

13. Representations and Warranties. The Loan Parties jointly and severally represent and warrant to the Administrative Agent and the Lenders as follows:

(a) The execution, delivery and performance of this First Amendment and the transactions contemplated hereby (i) are within the corporate (or the equivalent limited liability company or partnership) authority of each of the Loan Parties, (ii) have been duly authorized by

10

all necessary corporate, limited liability company or partnership (or other) proceedings of the applicable Loan Party, (iii) do not conflict with or result in any material breach or contravention of any provision of any Applicable Law applicable to any Loan Party or of any judgment, order, writ, injunction, license or permit applicable to any of the Loan Parties, (iv) conflict with, result in a breach of or constitute a default under the organizational documents of any Loan Party, or any material indenture, agreement or other instrument to which any Loan Party or any of their respective Subsidiaries is a party or by which any of them or any of their respective properties may be bound, and (v) do not require any Governmental Approval.

(b) This First Amendment has been duly executed and delivered by each of the Loan Parties and constitutes the valid and legally binding obligations of each of the Loan Parties enforceable against each in accordance with the respective terms and provisions hereof, except as the same may be limited by bankruptcy, insolvency, and other similar laws affecting the rights of creditors generally and the availability of equitable remedies for the enforcement of certain obligations (other than the payment of principal) contained herein or therein and as may be limited by equitable principles generally. The Obligations are not subject to any offsets, defenses or counterclaims.

(c) The representations and warranties contained in Article VII of the Credit Agreement are true and correct in all material respects (or in all respects to the extent that such representations and warranties are already subject to concepts of materiality) on and as of the date hereof with the same force and effect as if made on and as of such date except to the extent that such representations and warranties expressly relate solely to an earlier date (in which case such representations and warranties shall have been true and correct in all material respects on and as of such earlier date). For purposes of this Paragraph 13(c), the representations and warranties contained in Section 7.11 of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant to Sections 9.1 and 9.2 of the Credit Agreement.

(d) Both before and after giving effect to this First Amendment, no Default or Event of Default under the Credit Agreement has occurred and is continuing.

14. Ratification, etc. Except as expressly amended hereby, the Credit Agreement, the other Loan Documents and all documents, instruments and agreements related thereto are hereby ratified and confirmed in all respects and shall continue in full force and effect. This First Amendment and the Credit Agreement shall hereafter be read and construed together as a single document, and all references in the Credit Agreement, any other Loan Document or any agreement or instrument related to the Credit Agreement shall hereafter refer to the Credit Agreement as amended by this First Amendment. Each Loan Party hereby ratifies the Credit Agreement and acknowledges and reaffirms (a) that it is bound by all terms of the Credit Agreement applicable to it and (b) that it is responsible for the observance and full performance of its respective Obligations.

15. Further Assurances. The Loan Parties agree to promptly take such action, upon the request of the Administrative Agent, as is necessary to carry out the intent of this First Amendment.

11

16. No Actions, Claims, etc. As of the date hereof, each of the Loan Parties hereby acknowledges and confirms that it has no knowledge of any actions, causes of action, claims, demands, damages and liabilities of whatever kind or nature, in law or in equity, against the Administrative Agent, the Lenders, or the Administrative Agent’s or the Lenders’ respective officers, employees, representatives, agents, counsel or directors arising from any action by such Persons, or failure of such Persons to act under the Credit Agreement or other Loan Documents on or prior to the date hereof.

17. GOVERNING LAW. THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS EXECUTED, AND TO BE FULLY PERFORMED, IN SUCH STATE.

18. Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

19. Consent to Jurisdiction; Venue; Waiver of Jury Trial. The jurisdiction, venue and waiver of jury trial provisions set forth in Section 13.4 of the Credit Agreement are hereby incorporated by reference, mutatis mutandis

20. Counterparts. This First Amendment may be executed in any number of counterparts and by different parties hereto on separate counterparts, each of which when so executed and delivered shall be an original, but all of which counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment or any other document required to be delivered hereunder, by fax transmission or e-mail transmission (e.g. “pdf” or “tif”) shall be effective as delivery of a manually executed counterpart of this Agreement. Without limiting the foregoing, upon the request of any party, such fax transmission or e-mail transmission shall be promptly followed by such manually executed counterpart.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

12

IN WITNESS WHEREOF, each of the undersigned has duly executed this First Amendment to Credit Agreement and Consent as a sealed instrument as of the date first set forth above.

BORROWERS:

NSA OP, LP, as Borrower

By: |

NATIONAL STORAGE AFFILIATES TRUST, its general partner |

By: /s/ Tamara D. Fischer

Name: Tamara Fischer

Title: Authorized Signatory

SECURCARE OKLAHOMA I, LLC

SECURCARE OKLAHOMA II, LLC

SECURCARE COLORADO III, LLC

SECURCARE PROPERTIES I, LLC

SECURCARE PROPERTIES II, LLC

NSA-OPTIVEST ACQUISITION HOLDINGS, LLC

NSA NORTHWEST HOLDINGS II, LLC

SECURCARE PORTFOLIO HOLDINGS, LLC

AMERICAN MINI STORAGE-SAN ANTONIO, LLC

SECURCARE OF COLORADO SPRINGS #602 GP, LLC

BANKS STORAGE, LLC

ABC RV AND MINI STORAGE, L.L.C.

PORTLAND MINI STORAGE, LLC

HPRH STORAGE, LLC

BAUER NW STORAGE, LLC

S AND S STORAGE, LLC

FREEWAY SELF STORAGE, L.L.C.

ABERDEEN MINI STORAGE, L.L.C.

VANCOUVER MINI STORAGE, LLC

SALEM SELF STOR, LLC

BULLHEAD FREEDOM STORAGE, L.L.C.

SECURCARE OF COLORADO SPRINGS 602, LTD.

EAST BANK STORAGE, L.L.C.

NSA-C HOLDINGS, LLC

Signature Pages to First Amendment

NSA-COLTON HOLDINGS, LLC

NSA-G HOLDINGS, LLC

NSA-GSC HOLDINGS, LLC

DAMASCUS MINI STORAGE LLC

SHERWOOD STORAGE, LLC

GRESHAM MINI & RV STORAGE, LLC

WILSONVILLE JUST STORE IT, LLC

TUALATIN STORAGE, LLC

ICDC II, LLC

GAK, LLC

WCAL, LLC

STOREMORE SELF STORAGE – PECOS ROAD, LLC

SECURCARE MOVEIT MCALLEN, LLC

WASHINGTON MURRIETA II, LLC

HOOD RIVER MINI STORAGE, LLC

CANYON ROAD STORAGE, LLC

NSA GSC DR GP, LLC

WASHINGTON MURRIETA IV, LLC, each as a Subsidiary Borrower

By: /s/ Tamara D. Fischer

Name: Tamara Fischer

Title: Authorized Signatory

Signature Pages to First Amendment

REAFFIRMATION OF GUARANTORS:

Each of the undersigned Guarantors hereby absolutely and unconditionally reaffirms its continuing obligations to the Administrative Agent and the Lenders under its respective Guaranty and agrees that the transactions contemplated by the First Amendment shall not in any way affect the validity and enforceability of its Guaranty or reduce, impair or discharge the obligations of any Guarantor thereunder.

ACKNOWLEDGED AND AGREED AS OF

August 13, 2015:

NATIONAL STORAGE AFFILIATES TRUST, as Guarantor

By: /s/ Tamara D. Fischer

Name: Tamara Fischer

Title: Authorized Signatory

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, as Guarantor

By: /s/ Tamara D. Fischer

Name: Tamara Fischer

Title: Authorized Signatory

GSC IRVINE/MAIN LP, as Guarantor

By: NSA GSC DR GP, LLC, its General Partner

By: /s/ Tamara D. Fischer

Name: Tamara D. Fischer

Title: Authorized Signatory

Signature Pages to First Amendment

KEYBANK NATIONAL ASSOCIATION,

as Administrative Agent and Lender

By: /s/ Michael P. Szuba

Name: Michael P. Szuba

Title: Vice President

Signature Pages to First Amendment

U.S. BANK NATIONAL ASSOCIATION, a national banking association as a Lender

By: /s/ James Payne

Name: James Payne

Title: Vice President

Signature Pages to First Amendment

SUNTRUST BANK,

as a Lender

By: /s/ Francine Glandt

Name: Francine Glandt

Title: Senior Vice President

Signature Pages to First Amendment

Regions Bank,

as a Lender

By: /s/ Paul E. Burgan

Name: Paul E. Burgan

Title: Vice President

Signature Pages to First Amendment

BANK OF THE WEST, a California banking corporation

By: /s/ Cris Galvez

Name: Cris Galvez

Title: Vice President

Signature Pages to First Amendment

WELLS FARGO BANK N.A., as a Lender

By: /s/ J. Derek Evans

Name: J. Derek Evans

Title: Senior Vice President

Signature Pages to First Amendment

PNC BANK, NATIONAL ASSOCIATION, as a Lender

By: /s/ James A. Harmann

Name: James A. Harmann

Title: Senior Vice President

Signature Pages to First Amendment

MORGAN STANLEY SENIOR FUNDING, INC, as a Lender

By: /s/ Michael King

Name: Michael King

Title: Vice President

Signature Pages to First Amendment

THE HUNTINGTON NATIONAL BANK, as a Lender

By: /s/ Florentina Djulvezan

Name: Florentina Djulvezan

Title: Assistant Vice President

Signature Pages to First Amendment

CAPTIAL ONE, NATIONAL ASSOCIATION, as a Lender

By: /s/ Frederick H. Denecke

Name: Frederick H. Denecke

Title: Senior Vice President

Signature Pages to First Amendment

ROYAL BANK OF CANADA, as a Lender

By: /s/ Brian Gross

Name: Brian Gross

Title: Authorized Signatory

Signature Pages to First Amendment

ANNEX 1

(Updated Schedule of Commitments)

SCHEDULE 1.1

Lender Commitments

Annex 1 to First Amendment

Lender |

Revolving Commitment Amount |

Revolving Percentage |

Term Loan Commitment Amount |

Term Loan Percentage |

KeyBank National Association |

$49,489,795.93 |

14.1399416900% |

$25,510,204.07 |

12.7551020400% |

PNC Bank, National Association |

$54,438,775.51 |

15.5539358600% |

$28,061,224.49 |

14.0306122500% |

Wells Fargo Bank, National Association |

$54,438,775.51 |

15.5539358600% |

$28,061,224.49 |

14.0306122500% |

U.S. Bank National Association |

$44,518,576.66 |

12.7195933300% |

$30,481,423.34 |

15.2407116700% |

The Huntington National Bank |

$32,993,197.28 |

9.4266277940% |

$17,006,802.72 |

8.5034013610% |

Capital One, National Association |

$23,095,238.10 |

6.5986394560% |

$11,904,761.90 |

5.9523809520% |

Morgan Stanley Senior Funding, Inc. |

$20,775,335.78 |

5.9358102220% |

$14,224,664.22 |

7.1123321120% |

Bank of the West |

$19,795,918.37 |

5.6559766760% |

$10,204,081.63 |

5.1020408160% |

Regions Bank |

$23,743,240.87 |

6.7837831100% |

$16,256,759.13 |

8.1283795570% |

SunTrust Bank |

$17,807,430.66 |

5.0878373330% |

$12,192,569.34 |

6.0962846680% |

Royal Bank of Canada |

$8,903,715.33 |

2.5439186660% |

$6,096,284.67 |

3.0481423340% |

TOTAL |

$350,000,000.00 |

100% |

$200,000,000.00 |

100% |

Annex 1 to First Amendment

ANNEX 2

FORM OF JOINDER AGREEMENT

This JOINDER AGREEMENT (this “Agreement”) dated as of ______ ___, 20__ is executed by ___________, a ______________ (the “New Borrower”) having an address at ___________; and KEYBANK NATIONAL ASSOCIATION, a national banking association, having an address at 127 Public Square, Cleveland, Ohio 44114, in its capacity as administrative agent under that certain Credit Agreement dated as of April 1, 2014, by and among the Borrowers party thereto, the Guarantors party thereto, the Lenders party thereto and the Administrative Agent, as amended by that certain First Amendment to Credit Agreement, Termination, Release and Consent, dated as of August 11, 2015, (as further amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”). Capitalized terms not otherwise defined herein are being used herein as defined in the Credit Agreement.

WHEREAS, the Credit Agreement contemplates that the Loans made to the Borrowers under the Credit Agreement shall be evidenced by the Notes; and

WHEREAS, each of the Borrowers (including the New Borrower), will be jointly and severally liable for all of the Loans and other Obligations (as defined in the Credit Agreement) of all of the Borrowers under the Credit Agreement, and the other loan documents, and is effectively a guarantor of all such Loans and other Obligations of all such other Borrowers;

NOW THEREFORE, in consideration of the premises and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the New Borrower hereby agrees as follows:

1. The New Borrower assumes all the obligations of a Subsidiary Borrower and a Borrower under the Credit Agreement and agrees it is a Subsidiary Borrower and a Borrower and is bound as a Subsidiary Borrower and a Borrower under the terms of the Credit Agreement, as if it had been an original signatory to the Credit Agreement. The New Borrower acknowledges that such terms include, without limitation, the joint and several liability provisions contained in Section 13.18 of the Credit Agreement, the expense and indemnification provisions contained in Sections 13.2 and 13.9 of the Credit Agreement, the waiver of jury trial provision contained in Section 13.4 of the Credit Agreement, and the governing law provision contained in Section 13.12 of the Credit Agreement.

2. The New Borrower hereby makes to the Administrative Agent, for the benefit of the Lenders, the representations and warranties set forth in the Credit Agreement and confirms that such representations and warranties are true and correct after giving effect to this Agreement. The New Borrower further agrees to the covenants set forth in the Credit Agreement applicable to it as a Subsidiary Borrower and a Borrower thereunder. Such representations, warranties and covenants are incorporated herein by this reference as if fully set forth herein.

3. The New Borrower further represents and warrants that each Real Estate Asset which the New Borrower proposes to make a Borrowing Base Property is an Eligible Property.

Annex 2 to First Amendment

4. The New Borrower further represents and warrants that it is a [insert jurisdiction of entity] [insert type of entity], in good standing with the [insert jurisdiction of entity] and is qualified to transact business in each state where each Real Estate Asset which the New Borrower proposes to make a Borrowing Base Property is located and/or any other state where the New Borrower is required to be so qualified.

5. In connection with the New Borrower becoming a Subsidiary Borrower under the Credit Agreement, the New Borrower will enter into this Agreement, allonges to the Notes and any other Loan Documents to which the New Borrower is a party. The New Borrower represents and warrants that the New Borrower is authorized to prepare, enter into, execute, deliver and perform the obligations under the this Agreement, the Credit Agreement, the Notes, the other Loan Documents and any and all other documents, instruments, agreements, guarantees, letters, deeds, certificates, loan agreements, intercreditor agreements, deeds of trust, mortgages (including deeds of trust and mortgages at the future times and under the future circumstances specifically contemplated by the Credit Agreement), promissory notes, consents, waivers, notices, authorizations, indemnifications, certifications and other documents as may be necessary or appropriate in connection with the Loans (the “Transaction Documents”), and to borrow the Loans and incur the other Obligations under the Transaction Documents, including effectively guarantying the Loans borrowed and the other Obligations incurred by the other Borrowers, and to do or to cause to be done any and all such other actions as may be necessary or appropriate in connection with the transactions contemplated by the Transaction Documents. The New Borrower further represents that the Transaction Documents are duly authorized, executed and delivered.

Further, each of the following persons holds a position indicated next to such person's name below as of the date hereof, and is authorized to execute the this Agreement and the other Transaction Documents on behalf of the New Borrower and incumbency signatures for each of the following persons are on file with the Administrative Agent:

Name: |

Position: |

Tamara Fischer |

Authorized Signatory |

[Insert Additional - TBD] |

|

6. No action or proceeding has been taken or commenced, or is currently threatened, by or against the New Borrower to dissolve the New Borrower, to revoke its [Certificate of Limited Partnership][Articles of Organization][Certificate of Formation] or to discontinue its business; no receiver, liquidator or trustee has been or is proposed to be appointed for the New Borrower or any of its properties; the New Borrower has not been, nor is it proposed to be adjudged bankrupt or insolvent; and no arrangement or reorganization for the benefit of creditors relating to the New Borrower has occurred or is proposed.

7. This Agreement shall be deemed to be part of, and a modification to, the Credit Agreement and shall be governed by all the terms and provisions of the Credit Agreement, which terms are incorporated herein by reference, are ratified and confirmed and shall continue in full

Annex 2 to First Amendment

force and effect as valid and binding agreements of the New Borrower and enforceable against the New Borrower.

8. This Agreement may be executed in several counterparts, each of which when executed and delivered is an original, but all of which together shall constitute one instrument. In making proof of this Agreement, it shall not be necessary to produce or account for more than one such counterpart which is executed by the party against whom enforcement of such agreement is sought. Receipt by telecopy or other electronic transmission (including “PDF”) of any executed signature page to this Agreement shall constitute effective delivery of such signature page.

9. This Agreement shall in all respects be governed, construed, applied and enforced in accordance with the laws of the State of New York pursuant to Section 5-1401 of The General Obligations Laws of the State of New York without regard to principles of conflicts of law.

[Signatures on Following Pages]

Annex 2 to First Amendment

[INSERT BORROWER SIGNATURE BLOCK]

By: ________________________________

Name: ______________________________

Its __________________________________

Hereunto duly authorized

Annex 2 to First Amendment

ACKNOWLEDGED AND ACCEPTED:

KEYBANK NATIONAL ASSOCIATION

as Administrative Agent

By: __________________________________

Name:

Title:

Annex 2 to First Amendment

ANNEX 3

EXHIBIT M

FORM OF BORROWING BASE CERTIFICATE

, 20__

KeyBank National Association, as Administrative Agent

127 Public Square

Cleveland, Ohio

Attn: Real Estate Capital

Each of the Lenders party to the Credit Agreement

referred to below

Ladies and Gentlemen:

Reference is made to that certain Credit Agreement dated as of April 1, 2014, as amended by that certain First Amendment to Credit Agreement, Termination, Release and Consent dated as of August __, 2015 (as further amended, modified, supplemented or restated and in effect from time to time, the “Loan Agreement”), by and among NSA OP, LP, a limited partnership formed under the laws of the State of Delaware (the “Parent Borrower”), certain Subsidiaries of the Parent Borrower from time to time party thereto (the “Subsidiary Borrowers”, and together with the Parent Borrower, collectively, the “Borrowers”), NATIONAL STORAGE AFFILIATES TRUST, a Maryland real estate investment trust (the “REIT”), NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, a Delaware limited liability company (the “REIT Parent”), the Lenders from time to time party thereto, and KEYBANK NATIONAL ASSOCIATION, as Administrative Agent.

Capitalized terms used herein, and not otherwise defined herein, have their respective meanings given them in the Loan Agreement.

Pursuant to Sections 5.1(b) and 9.4 of the Credit Agreement, the undersigned hereby certify to the Administrative Agent and the Lenders as follows:

(1) The undersigned are the of the REIT, the _____________ of the Parent Borrower and the ______________ of the REIT Parent.

(2) The undersigned have examined the books and records of the REIT and the Parent Borrower and has conducted such other examinations and investigations as are reasonably necessary to provide this Compliance Certificate.

(3) Both immediately before and immediately after giving effect to the Borrowing Base Property Request sent by the Parent Borrower to Administrative Agent on [Insert Date] (the “Request Date”): (A) no Default or Event of Default exists, (B) the representations and

Annex 3 to First Amendment

warranties made or deemed made by each Loan Party in the Loan Documents to which it is a party are true and correct in all material respects (or in all respects to the extent that such representations and warranties are already subject to concepts of materiality) on and as of the Request Date with the same force and effect as if made on and as of the Request Date, except to the extent that such representations and warranties expressly relate solely to an earlier date (in which case such representations and warranties are true and correct in such respects on and as of such earlier date), and (C) each Eligible Property described in the Request satisfies the requirements of an “Eligible Property” set forth in the definition thereof;

(4) Attached hereto as Schedule 1 are reasonably detailed calculations establishing Borrowing Base Availability as of __________, 20__ [INSERT LAST DAY OF MOST RECENT REFERENCE PERIOD].

A.Borrowing Base Availability: $__________. [From Schedule 1]

B.Aggregate Revolving Commitment of all Lenders as of the date hereof: $__________.

C.Aggregate principal amount of all outstanding Loans, together with the aggregate amount of all Letter of Credit Liabilities, as of the date hereof: $__________.

D.Aggregate principal amount of all outstanding Revolving Loans and Swingline Loans, together with the aggregate amount of all Letter of Credit Liabilities, as of the date hereof: $__________.

E.[Aggregate Revolving Commitment deficiency: $__________. [Difference between Line (3)(b) and Line (3)(d), if Line (3)(d) is greater than Line (3)(b)]]

F.[Borrowing base deficiency: $__________. [Difference between Line (3)(a) and Line (3)(c), if Line (3)(c) is greater than Line (3)(a)]]

G.[Remaining borrowing availability under aggregate Revolving Commitment: $__________. [Lesser of (A) Line (3)(b) - Line (3)(d) and (B) Line (3)(a) - Line (3)(c), if both (A) and (B) are positive numbers]]

[Signature pages to follow]

Annex 3 to First Amendment

IN WITNESS WHEREOF, the undersigned has executed this certificate as of the date first above written.

PARENT BORROWER:

NSA OP, LP, a Delaware limited partnership

By: |

NATIONAL STORAGE AFFILIATES TRUST, its general partner |

By: |

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, its trustee |

By: ______________________________

Name:

Title:

Annex 3 to First Amendment

REIT:

NATIONAL STORAGE AFFILIATES TRUST, a Maryland real estate investment trust

By: |

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, its trustee |

By: ______________________________

Name:

Title:

REIT PARENT:

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, a Delaware limited liability company

By: ______________________________

Name:

Title:

Annex 3 to First Amendment

Schedule 1

Reference Period ending __________, 20__

A. Borrowing Base Value [Line A.2 + Line A.3][1] |

$__________ |

1. Aggregate Property NOI from all Borrowing Base Properties for such Reference Period (excluding Property NOI from Stabilized Properties purchased from unaffiliated third parties during such Reference Period) [Line A.1.a – Line A.1.b] |

$__________ |

a. Property rental and other income (after adjusting for straight-lining of rents and excluding the rents from tenants in default or bankruptcy) earned in the ordinary course and attributable to such Borrowing Base Properties |

$__________ |

b. Expenses incurred in connection with and directly attributable to the ownership and operation of such Borrowing Base Properties, including, without limitation, Property Management Fees and amounts accrued for the payment of real estate taxes and insurance premiums, but excluding Interest Expense or other debt service charges and any non-cash charges such as depreciation or amortization of financing costs |

$__________ |

2. [Line A.1 divided by 7.00%] |

$__________ |

3. Aggregate Acquisition Price[2] for all Borrowing Base Properties that are Stabilized Properties purchased from unaffiliated third parties during such Reference Period |

$__________ |

B. [Line A multiplied by 60%] |

$__________ |

C. Aggregate outstanding principal amount of all Unsecured Indebtedness (other than the Obligations) of the REIT and its Subsidiaries |

$__________ |

D. [Line B – Line C] |

$__________ |

E. Implied Unsecured Interest Coverage Value[3] [Attach schedule showing the calculations of such Implied Unsecured Interest Coverage Value] |

$__________ |

F. Borrowing Base Availability [Lesser of Line D and Line E] |

$__________ |

G. Borrowing Base Value attributable to Borrowing Base Properties held by California Partnerships |

$__________ |

H. Average Occupancy Rate of the Borrowing Base Properties [minimum required is 75%] |

_____% |

|

1 The Borrowing Base Value attributable to Borrowing Base Properties held by California Partnerships shall not exceed 20% of the total Borrowing Base Value.

| |

|

2 The purchase price paid by the Parent Borrower, any of its Subsidiaries or any of their Partially-Owned Entities, as applicable, for such Real Estate Asset less closing costs and any amounts paid by such Person as a purchase price adjustment, to be held in escrow, to be retained as a contingency reserve, or other similar amounts.

| |

3 The maximum principal of Unsecured Indebtedness amount that could be outstanding that yields an unsecured interest coverage ratio of not less than 2.00 to 1.00. The foregoing unsecured interest coverage ratio shall be calculated by dividing (a) the portion of Adjusted NOI generated by all Borrowing Base Properties for such Reference Period by (b) Unsecured Interest Expense for such Reference Period (giving pro forma effect to such maximum principal amount, to the extent not actually outstanding during such Reference Period, at an imputed interest rate equal to the highest actual interest rate applicable to the Loans outstanding on such date of determination). | |

Annex 3 to First Amendment

ANNEX 4

Officer's Certificate

[See Attached]

Annex 4 to First Amendment

May 22, 2015

KeyBank National Association, as Administrative Agent

127 Public Square

Cleveland, Ohio

Attn: Real Estate Capital

Re: Collateral Fallaway – Pledge Release

Each of the Lenders party to the Credit Agreement

referred to below

Ladies and Gentlemen:

Reference is made to that certain Credit Agreement (the “Loan Agreement”) dated as of April 1, 2014, by and among NSA OP, LP, a limited partnership formed under the laws of the State of Delaware (the “Parent Borrower”), certain Subsidiaries of the Parent Borrower from time to time party thereto (the “Subsidiary Borrowers”, and together with the Parent Borrower, collectively, the “Borrowers”), NATIONAL STORAGE AFFILIATES TRUST, a Maryland real estate investment trust (the “REIT”), NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, a Delaware limited liability company (the “REIT Parent”), the Lenders from time to time party thereto, and KEYBANK NATIONAL ASSOCIATION, as Administrative Agent. Capitalized terms used herein, and not otherwise defined herein, have their respective meanings given them in the Loan Agreement.

Pursuant to Section 13.19 (a) of the Loan Agreement, Borrowers request the release of Liens under the Collateral Documents and return to Borrowers any equity certificates held as Collateral. Borrowers certify that:

1.) |

immediately prior to the Collateral Fallaway and immediately after giving effect thereto, no Default or Event of Default exists |

2.) |

immediately prior to the Collateral Fallaway and immediately after giving effect thereto, the representations and warranties made or deemed made by the Borrowers and each other Loan Party in the Loan Documents are true and correct in all material respects on and as of the date of the Collateral Fallaway with the same force and effect as if made on and as of such date, except to the extent that such representations and warranties expressly relate solely to an earlier date (in which case such representations and warranties were true and correct in all material respects on and as of such earlier date) |

3.) |

immediately following the occurrence of the Capital Event, and giving pro forma effect thereto and the repayment of Indebtedness in connection therewith, the Loan Parties will be in compliance with the covenants set forth in Section 10.1, 10.2 and 10.4 of the Loan Agreement |

[Signature pages to follow]

Annex 4 to First Amendment

IN WITNESS WHEREOF, the undersigned have executed this certificate as of the date first above written.

PARENT BORROWER:

NSA OP, LP, a Delaware limited partnership

By: |

NATIONAL STORAGE AFFILIATES TRUST, its general partner |

By: |

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, its trustee |

By: /s/ Tamara Fischer_____________

Name: Tamara D. Fischer

Title: Chief Financial Officer

Annex 4 to First Amendment

REIT:

NATIONAL STORAGE AFFILIATES TRUST, a Maryland real estate investment trust

By: |

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, its trustee |

By: /s/ Tamara Fischer______________

Name: Tamara D. Fischer

Title: Chief Financial Officer

REIT PARENT:

NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, a Delaware limited liability company

By: /s/ Tamara Fischer______________

Name: Tamara D. Fischer

Title: Chief Financial Officer

Annex 4 to First Amendment

Schedule 1

Reference Period ending March 31, 2015 – Pro Forma Post Capital Event

I. Section 10.1(a) – Maximum Total Leverage Ratio | |

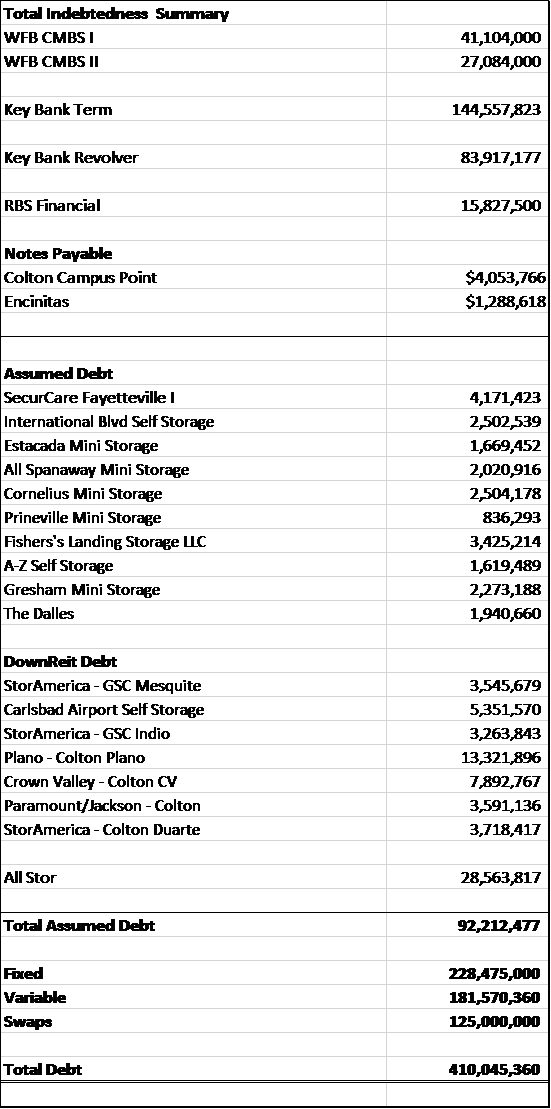

A. Consolidated Indebtedness of the REIT and its Subsidiaries |

$410,045,360 |

B. Gross Asset Value [sum of Lines I.B.1 through I.B.5]

|

$1,083,776,883 |

1. Operating Property Value [Line I.B.1.b + Line I.B.1.c + Line I.B.1.e]

|

$1,075,448,982 |

a. Aggregate Property NOI from all Stabilized Properties of the REIT and its Subsidiaries during such Reference Period (excluding Property NOI from Stabilized Properties received by way of contribution during such Reference Period) [Line I.B.1.a.i – Line I.B.1.a.ii]

|

$20,311,104 |

i. Property rental and other income (after adjusting for straight-lining of rents and excluding the rents from tenants in default or bankruptcy) earned in the ordinary course and attributable to such Stabilized Properties |

$33,014,082 |

ii. Expenses incurred in connection with and directly attributable to the ownership and operation of such Stabilized Properties, including, without limitation, Property Management Fees and amounts accrued for the payment of real estate taxes and insurance premiums, but excluding Interest Expense or other debt service charges and any non-cash charges such as depreciation or amortization of financing costs |

$12,702,978 |

b. [Line I.B.1.a divided by 7.00%]

|

$290,158,626 |

c. Aggregate Acquisition Price for all Stabilized Properties of the REIT and its Subsidiaries purchased during such Reference Period |

$163,037,500 |

d. Aggregate net operating income from all Stabilized Properties received by way of contribution during such Reference Period (in each case calculated in a manner consistent with the definition of “Property NOI”, using financial statements of the predecessor owner of such property for the portion of such Reference Period prior to contribution, which calculations and supporting financial statements shall be reasonably satisfactory to the Administrative Agent) [Line I.B.1.d.i – Line I.B.1.d.ii]

|

$43,557,700 |

Annex 4 to First Amendment

i. Property rental and other income (after adjusting for straight-lining of rents and excluding the rents from tenants in default or bankruptcy) earned in the ordinary course and attributable to such Stabilized Properties |

$69,885,553 |

ii. Expenses incurred in connection with and directly attributable to the ownership and operation of such Stabilized Properties, including, without limitation, Property Management Fees and amounts accrued for the payment of real estate taxes and insurance premiums, but excluding Interest Expense or other debt service charges and any non-cash charges such as depreciation or amortization of financing costs |

$26,327,853 |

e. [Line I.B.1.d divided by 7.00%]

|

$622,252,856 |

2. Cost Basis Value of all Construction-in-Process |

$0 |

3. Cost Basis Value of all Unimproved Land |

$0 |

4. Book value (determined in accordance with GAAP) of all Mortgage Notes |

$0 |

5. Unrestricted and unencumbered cash and Cash Equivalents of the REIT and its Subsidiaries |

$8,327,901 |

C. Total Leverage Ratio [Line I.A divided by Line I.B]

|

0.378 to 1.00 |

D. Maximum Total Leverage Ratio permitted by Section 10.1(a) |

0.600 to 1.00 |

E. Compliance? |

[Pass] |

II. Section 10.1(b) – Minimum Fixed Charge Coverage Ratio | |

A. Adjusted EBITDA for such Reference Period [Line II.A.1 – Line II.A.2]

|

$46,883,717 |

1. EBITDA for such Reference Period [Line II.A.1.a + Line II.A.1.b – Line II.A.1.c]

|

$48,804,000 |

a. Net Income of the REIT and its Subsidiaries for such Reference Period |

$(16,323,867) |

b. Sum of the following, without duplication and to the extent deducted in computing such Net Income: |

$66,554,290 |

i. Interest Expense |

$21,758,104 |

ii. Losses attributable to the sale or other disposition of assets or debt restructurings |

$0 |

iii. Real estate depreciation and amortization |

$29,825,000 |

Annex 4 to First Amendment

iv. Acquisition costs related to the acquisition of Real Estate Assets that were capitalized prior to FAS 141-R which do not represent a recurring cash item in such period or in any future period |

$11,118,000 |

v. Other non-cash charges |

$3,853,186 |

c. To the extent included in Net Income for such Reference Period, all gains attributable to the sale or other disposition of assets |

$1,426,423 |

2. Reserves for Capital Expenditures for all Real Estate Assets (excluding Construction-in-Process) as of the last day of such Reference Period [Line II.A.2.a multiplied by $0.15]

|

$1,920,283 |

a. Aggregate leasable square footage of all completed space of such Real Estate Assets |

12,801,887 square feet |

B. Fixed Charges for such Reference Period [Sum of Lines II.B.1 through II.B.3]

|

$22,578,994 |

1. Interest Expense for such Reference Period |

$21,758,104 |

2. All regularly scheduled payments made during such Reference Period on account of principal of Indebtedness of the REIT or any of its Subsidiaries (but excluding (i) balloon, bullet or similar principal payments due upon the stated maturity of any Indebtedness and (ii) payments of principal of the Loans) |

$820,890 |

3. Preferred Dividends payable by the REIT or any of its Subsidiaries during such Reference Period |

$0 |

C. Fixed Charge Coverage Ratio [Line II.A divided by Line II.B]

|

2.08 to 1.00 |

D. Minimum Fixed Charge Coverage Ratio required by Section 10.1(b) |

1.50 to 1.00 |

E. Compliance? |

[Pass] |

III. Section 10.1(c) – Minimum Net Worth | |

A. Net Worth [Line III.A.1 – Line III.A.2]

|

$673,731,523 |

1. Gross Asset Value [From Line I.B]

|

$1,083,776,883 |

2. Indebtedness of the REIT and its Subsidiaries |

$410,045,360 |

B. Minimum Net Worth required by Section 10.1(c) |

$505,790,706 |

C. Compliance? |

[Pass] |

IV. Section 10.1(e) – Maximum Unhedged Variable Rate Indebtedness | |

Annex 4 to First Amendment

A. Unhedged Variable Rate Indebtedness of the REIT and its Subsidiaries |

$103,775,000 |

B. Gross Asset Value [From Line I.B]

|

$1,083,776,883 |

C. [Line IV.A divided by Line IV.B]

|

0.096 to 1.00 |

D. Maximum ratio permitted by Section 10.1(e) |

0.25 to 1.00 (after the Capital Event) |

E. Compliance? |

[Pass] |

V. Section 10.2 – Restricted Payments | |

A. Cash distributions declared or made by Parent Borrower to the REIT and the Parent Borrower’s limited partners during such Reference Period |

$21,153,422 |

B. Cash distributions declared or made by the California Partnerships to their third-party limited partners (i.e., other than the applicable Borrower owning Equity Interests therein) during such Reference Period |

$1,666,209 |

C. Funds From Operations of the REIT [Line V.C.1 minus (or plus) Line V.C.2 plus Line V.C.3]

|

$26,880,473 |

1. Net income (loss) determined on a consolidated basis for such Reference Period |

$(16,323,867) |

2. Gains (or losses) from debt restructuring, mark-to-market adjustments on interest rate swaps, and sales of property during such Reference Period |

$1,811,993 |

3. Sum of each of the following to the extent deducted in determining such net income and without duplication: |

$45,016,333 |

a. Depreciation with respect to Real Estate Assets and amortization (other than amortization of deferred financing costs) for such Reference Period, all after adjustment for unconsolidated partnerships and joint ventures |

$29,825,000 |

b. All non-cash charges for such Reference Period related to deferred financing costs and deferred acquisition costs |

$4,216,333 |

c. Non-recurring costs and expenses incurred in connection with acquisitions of Real Estate Assets, to the extent such costs and expenses cannot be capitalized in accordance with GAAP |

$9,975,000 |

Annex 4 to First Amendment

d. To the extent reasonably approved by the Administrative Agent, non-recurring costs and expenses (i) incurred on or prior to the Capital Event and directly related to preparation for the Capital Event or (ii) incurred prior to or within 90 days after the Effective Date in connection with the formation of the REIT and its Subsidiaries, in each case to the extent such costs and expenses cannot be capitalized in accordance with GAAP |

$1,000,000 |

D. [Line V.C multiplied by 95.0%]

|

$25,536,449 |

Compliance with respect to Parent Borrower: | |

E. Amount required to be distributed by the REIT to remain in compliance with Section 8.12 of the Credit Agreement

|

N/A |

F. [Line V.D – Line V.B]

|

$23,870,240 |

G. Maximum cash distributions permitted under Section 10.2(a) [Greater of Line V.E and Line V.F]

|

$23,870,240 |

H. Compliance? [Line V.A shall be less than or equal to Line V.G]

|

[Pass] |

Compliance with respect to the California Partnerships: | |

I. Maximum cash distributions permitted under Section 10.2(b) [Line V.D – Line V.A]

|

$4,383,027 |

J. Compliance? [Line V.B shall be less than or equal to Line V.I]

|

[Pass] |

VI. Section 10.4(a) – Investments in Partially-Owned Entities and any other Persons that are not Subsidiaries | |

A. Aggregate value (determined in accordance with GAAP) of Investments in Partially-Owned Entities and any other Persons that are not Subsidiaries |

$0 |

B. Maximum permitted under Section 10.4(a) [Line I.B multiplied by 10.0%]

|

$108,377,688 |

C. Compliance? |

[Pass] |

VII. Section 10.4(b) – Investments in Unimproved Land | |

A. Cost Basis Value of all Unimproved Land |

$0 |

B. Maximum permitted under Section 10.4(b) [Line I.B multiplied by 5.0%]

|

$54,188,844 |

C. Compliance? |

[Pass] |

VIII. Section 10.4(c) – Investments in Construction-in-Process | |

Annex 4 to First Amendment

A. Cost Basis Value of all Construction-in-Process |

$0 |

B. Maximum permitted under Section 10.4(c) [Line I.B multiplied by 5.0%]

|

$54,188,844 |

C. Compliance? |

[Pass] |

IX. Section 10.4(d) – Investments in Mortgage Notes | |

A. Aggregate book value (determined in accordance with GAAP) of all Mortgage Notes |

$0 |

B. Maximum permitted under Section 10.4(d) [Line I.B multiplied by 5.0%]

|

$54,188,844 |

C. Compliance? |

[Pass] |

X. Section 10.4 – Aggregate Cap on Certain Permitted Investments | |

A. Aggregate Cost Basis Value or book value, as applicable, of all of the items subject to the limitations in Sections 10.4(a) through 10.4(d) |

$0 |

B. Maximum permitted under Section 10.4 [Line I.B multiplied by 20.0%]

|

$216,755,377 |

C. Compliance? |

[Pass] |

1 Adjusted to include the REIT and its Subsidiaries’ Pro Rata Share of the Operating Property Value (and the items comprising the Operating Property Value) attributable to any Partially-Owned Entity. | |

2 Adjusted to include the REIT and its Subsidiaries’ Pro Rata Share of the Cost Basis Value of all Construction-in-Process of any Partially Owned Entity. | |

3 Adjusted to include the REIT and its Subsidiaries’ Pro Rata Share of the Cost Basis Value of all Unimproved Land owned by a Partially-Owned Entity. | |

4 Adjusted to include the REIT and its Subsidiaries’ Pro Rata Share of the book value (determined in accordance with GAAP) of all Mortgage Notes held by a Partially-Owned Entity. | |

5 Adjusted to include the REIT and its Subsidiaries’ Pro Rata Share of the value of all unrestricted and unencumbered cash and Cash Equivalents owned by any Partially-Owned Entity. | |

6 The REIT’s and its Subsidiaries’ Pro Rata Share of the items comprising EBITDA of any Partially-Owned Entity shall be included in EBITDA, calculated in a manner consistent with the treatment for the REIT and its Subsidiaries. | |

7 Consolidated net income (or loss), determined on a consolidated basis in accordance with GAAP (excluding the adjustment of rent to straight-line rent), calculated without regard to gains or losses on early retirement of debt or debt restructuring, debt modification charges and prepayment premiums. | |

8 The REIT’s and its Subsidiaries’ Pro Rata Share of the expenses and payments referred to in the definition of “Fixed Charges” of any Partially-Owned Entity of the REIT or any of its Subsidiaries shall be included in Fixed Charges, calculated in a manner consistent with the treatment for the REIT and its Subsidiaries. | |

9 For the avoidance of doubt, the calculation of consolidated Indebtedness of the REIT and its Subsidiaries shall, without duplication, include their Pro Rata Share of Indebtedness of all Partially-Owned Entities of the REIT and its Subsidiaries. | |

10 Sum of (i) $133,320,707plus (ii) 75% of the Net Proceeds of all Equity Issuances by the REIT and its Subsidiaries after the Effective Date (other than Equity Issuances to the REIT or any of its Subsidiaries). | |

11 The aggregate amount added back pursuant to this paragraph shall not exceed $1,000,000 for all periods taken together. | |

Annex 4 to First Amendment

Schedule 2

Reference Period ending March 31, 2015 - Pro Forma Post Capital Event

Annex 4 to First Amendment

ANNEX 5

ACKNOWLEDGMENT AND CONSENT

This ACKNOWLEDGMENT AND CONSENT (this “Consent”) is made and entered into as of January 30, 2015, by and among NSA OP, LP, a Delaware limited partnership (the “Parent Borrower”), certain of the Parent Borrower’s Subsidiaries party to the Credit Agreement (defined below), including NSA GSC DR GP, LLC, a Delaware limited liability company (the “Irvine GSC LLC”) (all such Subsidiaries, together with the Parent Borrower, the “Borrowers”), NATIONAL STORAGE AFFILIATES TRUST, a Maryland real estate investment trust (the “REIT”), NATIONAL STORAGE AFFILIATES HOLDINGS, LLC, a Delaware limited liability company (the “REIT Parent”) and GSC Irvine/Main, LP, a California limited partnership, successor-in-interest to SSD, LLC, a Nevada limited liability company (the “Irvine Guarantor” or “Tenant”; and together with the REIT and the REIT Parent, collectively, the “Guarantors” and the Guarantors, together with the Borrowers, collectively, the “Loan Parties”), KEYBANK NATIONAL ASSOCIATION, as the Administrative Agent (the “Administrative Agent”), and the financial institutions which are a party to the Credit Agreement as lenders (collectively, the “Lenders”). Capitalized terms used herein without definition shall have the respective meanings provided therefor in the Credit Agreement.

WHEREAS, certain of the Loan Parties, the Lenders and the Administrative Agent are parties to that certain Credit Agreement, dated as of April 1, 2014 (as amended, modified, supplemented or restated and in effect from time to time, the “Credit Agreement”), pursuant to which the Lenders have extended credit to the Borrowers on the terms set forth therein;

WHEREAS, the Irvine Guarantor, as successor-in-interest to SSD, LLC, is the tenant under that certain Option Agreement dated August 15, 1997 by and between Southern California Edison Company, as optionor (the “Landlord”), and SSD, LLC (predecessor to the Irvine Guarantor), as optionee, for certain premises located in Irvine, California more particularly described therein (as amended, the “Irvine Lease”; and the premises ground leased to the Irvine Guarantor pursuant to the Irvine Lease, the “Irvine Property”);

WHEREAS, pursuant to that certain Contribution Agreement dated as of January 1, 2015 (the “Irvine Contribution Agreement”) among Guardian Storage Centers, LLC (“Guardian”) and the Minar Living Trust (the “Minar Trust”, and together with Guardian, the “Irvine Contributing LPs”), the Parent Borrower and the Irvine GSC LLC, the Irvine Contributing LPs have contributed 30.04% of the limited partnership interests in the Irvine Guarantor to the Irvine GSC LLC;

WHEREAS, it is intended by the Irvine Guarantor, the Irvine Contributing LPs, the Irvine GSC LLC and the Parent Borrower that they use all commercially reasonable efforts to obtain the consent of the Landlord to, without limitation, (i) consent to the Parent Borrower or the Irvine GSC LLC becoming the general partner of the Irvine Guarantor, (ii) consent (to the extent required under the Irvine Lease) to the pledge of the limited partner and general partner interests in the Irvine Guarantor to the Administrative Agent, and to a subsequent transferee of the Administrative Agent in connection with its exercise of remedies under the applicable Pledge Agreement or other Collateral Document, and (iii) any other matter reasonably requested by the Administrative Agent in connection with the Irvine Lease, all in form and substance reasonably satisfactory to the Administrative Agent (collectively, the “Landlord Consent”);

WHEREAS, the Irvine Guarantor, the Irvine Contributing LPs, the Irvine GSC LLC and the Parent Borrower have each agreed that, in consideration of the agreements of the Lenders set forth herein, (i) the Irvine Guarantor will guaranty the Obligations and the Specified Derivatives Obligations (such guaranty, the “Irvine Subsidiary Guaranty”), and will secure its obligations under the Irvine Subsidiary Guaranty with

Annex 5 to First Amendment