THIRD QUARTER EARNINGS RELEASE DATED OCTOBER 30, 2019

Published on October 30, 2019

Table of Contents

Page |

|

Earnings Release |

|

Consolidated Statements of Operations |

|

Consolidated Balance Sheets |

|

Schedule 1 - Funds From Operations and Core Funds From Operations |

|

Schedule 2 - Other Non-GAAP Financial Measurements |

|

Schedule 3 - Portfolio Summary |

|

Schedule 4 - Debt and Equity Capitalization |

|

Schedule 5 - Summarized Information for Unconsolidated Real Estate Ventures |

|

Schedule 6 - Same Store Performance Summary By State |

|

Schedule 7 - Same Store Performance Summary By MSA |

|

Schedule 8 - Same Store Operating Data - Trailing Five Quarters |

|

Schedule 9 - Reconciliation of Same Store Data and Net Operating Income to Net Income |

|

Schedule 10 - Selected Financial Information |

|

Glossary |

|

October 30, 2019

National Storage Affiliates Trust Reports Third Quarter 2019 Results

GREENWOOD VILLAGE, Colo. - (BUSINESS WIRE) - National Storage Affiliates Trust (“NSA” or the "Company") (NYSE: NSA) today reported the Company’s third quarter 2019 results.

Third Quarter 2019 Highlights

• |

Reported net income of $16.5 million for the third quarter of 2019, a decrease of 1.9% compared to the third quarter of 2018. Reported loss per share of $0.20 for the third quarter of 2019, primarily relating to the HLBV method for allocating net income among the various classes of equity.

|

• |

Reported core funds from operations ("Core FFO") of $36.7 million, or $0.40 per share for the third quarter of 2019, an increase of 11.1% per share compared to the third quarter of 2018.

|

• |

Achieved same store net operating income ("NOI") growth of 4.2% for the third quarter of 2019 compared to the same period in 2018, driven by a 3.7% increase in same store total revenues and a 2.7% increase in same store property operating expenses.

|

• |

Acquired six wholly-owned self storage properties for $35.8 million during the third quarter of 2019. Consideration for these acquisitions included the issuance of approximately $1.0 million of OP equity.

|

• |

Issued $100.0 million of 3.98% senior unsecured notes due August 30, 2029 and $50.0 million of 4.08% senior unsecured notes due August 30, 2031 in the Company's inaugural debt private placement.

|

• |

Executed an agreement with lenders to extend maturities and increase the total borrowing capacity under the Company's credit facility by $255.0 million for a total credit facility of $1.275 billion.

|

Arlen Nordhagen, Chairman and Chief Executive Officer, commented, "Once again, our quarterly results were slightly ahead of expectations and included strong 4.2% same store NOI growth driven by a 3.7% increase in same store total revenues. These operating results combined with the acquisition of 62 self storage properties during the first three quarters of 2019 generated an excellent 11.1% increase in third quarter 2019 Core FFO per share."

Tamara Fischer, President and Chief Financial Officer, added, "With the amendment of our credit facility and the closing of a debt private placement during the third quarter, our balance sheet is well positioned to fund our long-term growth plans. We ended the third quarter with a weighted average cost of debt of 3.5%, a weighted average maturity of 6.2 years and the full borrowing capacity available under our $500.0 million revolving line of credit."

Ms. Fischer continued, "Given third quarter results were slightly ahead of expectations, and we expect fourth quarter operating expenses to be lower than prior forecasts, we are again increasing guidance for Core FFO per share and same store NOI growth assumptions for full-year 2019."

1

Financial Results

($ in thousands, except per share and unit data) |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||

2019 |

2018 |

Growth |

2019 |

2018 |

Growth |

||||||||||||||||

Net income |

$ |

16,514 |

$ |

16,829 |

(1.9 |

)% |

$ |

47,187 |

$ |

41,843 |

12.8 |

% |

|||||||||

Funds From Operations ("FFO")(1)

|

$ |

36,375 |

$ |

31,083 |

17.0 |

% |

$ |

102,933 |

$ |

84,177 |

22.3 |

% |

|||||||||

Add back acquisition costs |

321 |

141 |

127.7 |

% |

783 |

471 |

66.2 |

% |

|||||||||||||

Core FFO(1)

|

$ |

36,696 |

$ |

31,224 |

17.5 |

% |

$ |

103,716 |

$ |

84,648 |

22.5 |

% |

|||||||||

Earnings (loss) per share - basic and diluted |

$ |

(0.20 |

) |

$ |

0.03 |

(766.7 |

)% |

$ |

(0.32 |

) |

$ |

0.25 |

(228.0 |

)% |

|||||||

FFO per share and unit(1)

|

$ |

0.39 |

$ |

0.36 |

8.3 |

% |

$ |

1.14 |

$ |

1.01 |

12.9 |

% |

|||||||||

Core FFO per share and unit(1)

|

$ |

0.40 |

$ |

0.36 |

11.1 |

% |

$ |

1.15 |

$ |

1.01 |

13.9 |

% |

|||||||||

(1) Non-GAAP financial measures, including FFO, Core FFO and NOI, are defined in the Glossary in the supplemental financial information and, where appropriate, reconciliations of these measures and other non-GAAP financial measures to their most directly comparable GAAP measures are included in the Schedules to this press release and in the supplemental financial information.

Net income decreased $0.3 million for the third quarter of 2019 and increased $5.3 million for the nine months ended September 30, 2019 ("year-to-date") as compared to the same periods in 2018. The decrease for the third quarter of 2019 resulted from increases in depreciation and amortization, interest expense, general and administrative expenses and GAAP losses from the Company's unconsolidated real estate ventures substantially offset by additional NOI generated primarily from 69 wholly-owned self storage properties acquired between October 1, 2018 and September 30, 2019 and same store NOI growth. The year-to-date increase was the result of additional NOI generated primarily from 69 wholly-owned self storage properties acquired between October 1, 2018 and September 30, 2019, same store NOI growth and gain on sale of self storage properties, partially offset by increases in interest expense, depreciation and amortization, general and administrative expenses and GAAP losses from the Company's unconsolidated real estate ventures.

The increases in FFO and Core FFO for the third quarter of 2019 and year-to-date were primarily the result of incremental NOI from properties acquired between October 1, 2018 and September 30, 2019, same store NOI growth, and incremental FFO from the Company's unconsolidated real estate ventures, partially offset by higher interest expense, general and administrative expenses and increases in distributions to subordinated performance unitholders.

Same Store Operating Results (439 Stores)

($ in thousands, except per square foot data) |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||

2019 |

2018 |

Growth |

2019 |

2018 |

Growth |

||||||||||||||||

Total revenues |

$ |

76,015 |

$ |

73,300 |

3.7 |

% |

$ |

222,385 |

$ |

213,045 |

4.4 |

% |

|||||||||

Property operating expenses |

22,595 |

22,010 |

2.7 |

% |

66,931 |

65,557 |

2.1 |

% |

|||||||||||||

Net Operating Income (NOI) |

$ |

53,420 |

$ |

51,290 |

4.2 |

% |

$ |

155,454 |

$ |

147,488 |

5.4 |

% |

|||||||||

NOI Margin |

70.3 |

% |

70.0 |

% |

0.3 |

% |

69.9 |

% |

69.2 |

% |

0.7 |

% |

|||||||||

Average Occupancy |

90.2 |

% |

89.9 |

% |

0.3 |

% |

89.0 |

% |

88.7 |

% |

0.3 |

% |

|||||||||

Average Annualized Rental Revenue Per Occupied Square Foot |

$ |

12.06 |

$ |

11.68 |

3.3 |

% |

$ |

11.91 |

$ |

11.49 |

3.7 |

% |

|||||||||

Year-over-year same store total revenues increased 3.7% for the third quarter of 2019 and 4.4% year-to-date as compared to the same periods in 2018. The increases were driven primarily by a 3.3% increase in average annualized rental revenue per occupied square foot for the third quarter of 2019 and a 3.7% increase in average annualized rental revenue per occupied square foot year-to-date combined with a 30 basis point increase in average occupancy in both periods. Markets that generated above portfolio average same store total revenue growth include: Riverside-San

2

Bernardino, Atlanta, and Las Vegas. Markets that generated below portfolio average same store total revenue growth include: Portland, Dallas and Tulsa.

Year-over-year same store property operating expenses increased 2.7% for the third quarter of 2019 and 2.1% year-to-date as compared to the same periods in 2018. These increases primarily resulted from increases in property taxes, personnel costs and repairs and maintenance expenses partially offset by decreases in insurance costs.

Investment Activity

NSA acquired six wholly-owned self storage properties located across four states consisting of approximately 0.3 million rentable square feet configured in approximately 3,200 storage units during the third quarter of 2019. Total consideration for these acquisitions of $35.8 million included approximately $34.6 million of net cash, the issuance of approximately $1.0 million of subordinated performance units and the assumption of approximately $0.2 million of other working capital liabilities.

Balance Sheet

On July 29, 2019, NSA executed an agreement with a syndicated group of lenders to amend its credit facility, increasing the total capacity by $255.0 million for a total credit facility of $1.275 billion (the "amended credit facility"), which included an additional $100 million of revolving line of credit capacity and $155.0 million of additional term loan borrowings. The agreement also reduced the spread for the revolving line of credit by 10 basis points and the weighted average interest rate of the credit facility's term loan borrowings by 7 basis points, after taking into account the effect of interest rate swaps.

The Company's amended credit facility consists of the following components: (i) a revolving line of credit that matures in January 2024 which provides for a total borrowing commitment up to $500.0 million, (ii) a $125.0 million Term Loan A that matures in January 2023, (iii) a $250.0 million Term Loan B that matures in July 2024, (iv) a $225.0 million Term Loan C that matures in January 2025, and (v) a $175.0 million Term Loan D that matures in July 2026. The Company has an expansion option under the credit facility, which if fully exercised, would provide for a total borrowing capacity under the credit facility of $1.750 billion.

On August 30, 2019, the Company's operating partnership issued $100.0 million of 3.98% senior unsecured notes due August 30, 2029 and $50.0 million of 4.08% senior unsecured notes due August 30, 2031 (the "Senior Unsecured Notes") in a private placement to certain institutional accredited investors.

Common Share Dividends

On August 22, 2019, NSA's Board of Trustees declared a quarterly cash dividend of $0.32 per common share, which was paid on September 30, 2019 to shareholders of record as of September 13, 2019.

3

2019 Guidance

The following table outlines NSA's updated and prior FFO guidance estimates and related assumptions for the year ended December 31, 2019:

|

Current Ranges for

Full Year 2019

|

Prior Ranges for

Full Year 2019

|

||||||

Low |

High |

Low |

High |

||||

Core FFO per share(1)

|

$1.52 |

$1.54 |

$1.51 |

$1.54 |

|||

Same store operations (439 stores) |

|||||||

Total revenue growth |

3.5% |

4.0% |

3.5% |

4.0% |

|||

Property operating expenses growth |

2.25% |

2.75% |

2.75% |

3.25% |

|||

NOI growth |

4.25% |

4.75% |

3.5% |

4.5% |

|||

General and administrative expenses (as a percent of revenue) |

11.0% |

12.0% |

11.0% |

12.0% |

|||

General and administrative expenses (excluding equity-based compensation) |

10.0% |

10.5% |

10.0% |

10.5% |

|||

Equity-based compensation |

1.0% |

1.5% |

1.0% |

1.5% |

|||

Management fees and other revenue, in millions |

$20.0 |

$21.0 |

$20.0 |

$21.0 |

|||

Core FFO from unconsolidated real estate ventures, in millions |

$15.0 |

$16.0 |

$15.0 |

$16.0 |

|||

Subordinated performance unit distributions, in millions |

$33.0 |

$35.0 |

$33.0 |

$35.0 |

|||

Wholly-owned acquisitions, in millions |

$425.0 |

$475.0 |

$400.0 |

$500.0 |

|||

Joint venture acquisitions, in millions |

$— |

$25.0 |

$20.0 |

$100.0 |

|||

(1) The following table provides a reconciliation of the range of estimated earnings (loss) per share - diluted to estimated Core FFO per share and unit:

| |||||||

Current Ranges for Full Year 2019 |

Prior Ranges for Full Year 2019 |

||||||

Low |

High |

Low |

High |

||||

Earnings (loss) per share - diluted |

$(0.40) |

$(0.30) |

$(0.20) |

$(0.10) |

|||

Impact of the difference in weighted average number of shares and GAAP accounting for noncontrolling interests, two-class method and treasury stock method |

0.94 |

0.85 |

0.79 |

0.70 |

|||

Add real estate depreciation and amortization, including NSA's share of unconsolidated venture real estate depreciation and amortization |

1.36 |

1.39 |

1.30 |

1.34 |

|||

Subtract gain on sale of self storage properties |

(0.03) |

(0.03) |

(0.03) |

(0.03) |

|||

FFO attributable to subordinated unitholders |

(0.36) |

(0.38) |

(0.36) |

(0.38) |

|||

Add acquisition costs and NSA's share of unconsolidated real estate venture acquisition costs |

0.01 |

0.01 |

0.01 |

0.01 |

|||

Core FFO per share and unit |

$1.52 |

$1.54 |

$1.51 |

$1.54 |

|||

Supplemental Financial Information

The full text of this earnings release and supplemental financial information, including certain financial information referenced in this release, are available on NSA's website at http://ir.nationalstorageaffiliates.com/quarterly-reporting and as exhibit 99.1 to the Company's Form 8-K furnished to the SEC on October 30, 2019.

4

Non-GAAP Financial Measures & Glossary

This press release contains certain non-GAAP financial measures. These non-GAAP measures are presented because NSA's management believes these measures help investors understand NSA's business, performance and ability to earn and distribute cash to its shareholders by providing perspectives not immediately apparent from net income (loss). These measures are also frequently used by securities analysts, investors and other interested parties. The presentations of FFO, Core FFO and NOI in this press release are not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. In addition, NSA's method of calculating these measures may be different from methods used by other companies, and, accordingly, may not be comparable to similar measures as calculated by other companies that do not use the same methodology as NSA. These measures, and other words and phrases used herein, are defined in the Glossary in the supplemental financial information and, where appropriate, reconciliations of these measures and other non-GAAP financial measures to their most directly comparable GAAP measures are included in the Schedules to this press release and in the supplemental financial information.

Quarterly Teleconference and Webcast

The Company will host a conference call at 1:00pm Eastern Time on Thursday, October 31, 2019 to discuss its financial results. At the conclusion of the call, management will accept questions from certified financial analysts. All other participants are encouraged to listen to a webcast of the call by accessing the link found on the Company's website at www.nationalstorageaffiliates.com.

Conference Call and Webcast:

Date/Time: Thursday, October 31, 2019, 1:00pm ET

Webcast available at: www.nationalstorageaffiliates.com

Domestic (Toll Free US & Canada): 877.407.9711

International: 412.902.1014

Replay:

Domestic (Toll Free US & Canada): 877.660.6853

International: 201.612.7415

Conference ID: 13692161

A replay of the call will be available for one week through Thursday, November 7, 2019. A replay of the webcast will be available for 30 days on NSA's website at www.nationalstorageaffiliates.com.

Upcoming Industry Conferences

NSA management is scheduled to participate in the Nareit REITworld 2019 Annual Conference on November 12-14, 2019 in Los Angeles, California.

About National Storage Affiliates Trust

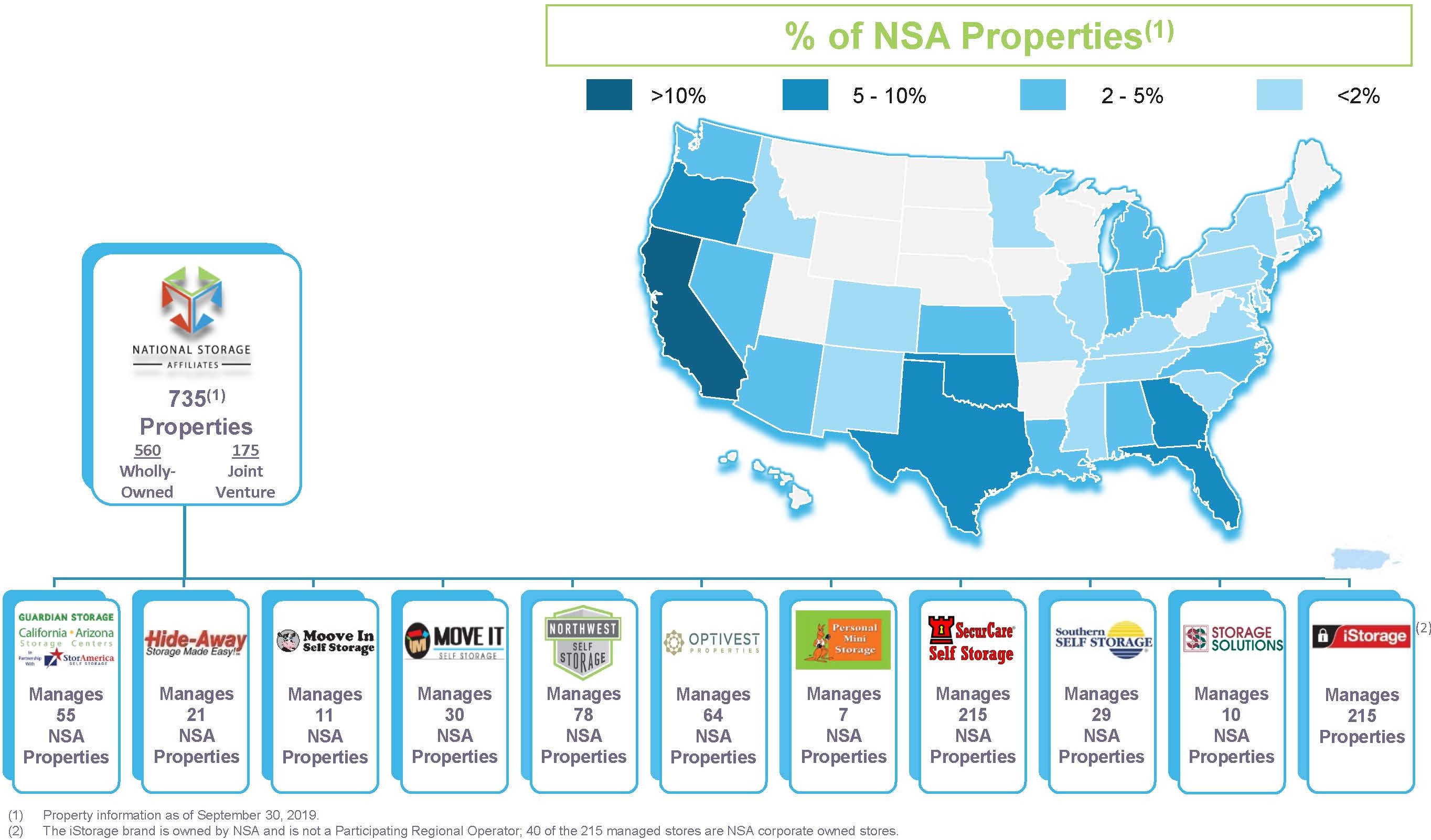

National Storage Affiliates Trust is a Maryland real estate investment trust focused on the ownership, operation and acquisition of self storage properties located within the top 100 metropolitan statistical areas throughout the United States. As of September 30, 2019, the Company held ownership interests in and operated 735 self storage properties located in 35 states and Puerto Rico with approximately 46.8 million rentable square feet. NSA is one of the largest owners and operators of self storage properties among public and private companies in the United States. For more information, please visit the Company’s website at www.nationalstorageaffiliates.com. NSA is included in the MSCI US REIT Index (RMS/RMZ), the Russell 2000 Index of Companies and the S&P SmallCap 600 Index.

5

NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this press release constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. These forward-looking statements include information about possible or assumed future results of the Company's business, financial condition, liquidity, results of operations, plans and objectives. Changes in any circumstances may cause the Company's actual results to differ significantly from those expressed in any forward-looking statement. When used in this release, the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in the Company's industry, interest rates, the debt and lending markets or the general economy; the Company's business and investment strategy; the acquisition of properties, including those under contract, our ability to execute on our acquisition pipeline; the timing of acquisitions under contract; and the Company's guidance estimates for the year ended December 31, 2019. For a further list and description of such risks and uncertainties, see the Company's most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, and the other documents filed by the Company with the Securities and Exchange Commission. The forward-looking statements, and other risks, uncertainties and factors are based on the Company's beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company. Forward-looking statements are not predictions of future events. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact:

National Storage Affiliates Trust

Investor/Media Relations

George Hoglund, CFA

Vice President - Investor Relations

720.630.2160

6

National Storage Affiliates Trust

Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

2019 |

2018 |

2019 |

2018 |

||||||||||||

REVENUE |

|||||||||||||||

Rental revenue |

$ |

92,746 |

$ |

79,547 |

$ |

262,776 |

$ |

226,577 |

|||||||

Other property-related revenue |

3,217 |

2,687 |

9,169 |

7,557 |

|||||||||||

Management fees and other revenue |

5,374 |

3,148 |

15,383 |

7,464 |

|||||||||||

Total revenue |

101,337 |

85,382 |

287,328 |

241,598 |

|||||||||||

OPERATING EXPENSES |

|||||||||||||||

Property operating expenses |

28,988 |

26,552 |

82,635 |

76,962 |

|||||||||||

General and administrative expenses |

12,039 |

8,848 |

33,975 |

25,614 |

|||||||||||

Depreciation and amortization |

27,598 |

22,469 |

77,776 |

66,226 |

|||||||||||

Total operating expenses |

68,625 |

57,869 |

194,386 |

168,802 |

|||||||||||

OTHER (EXPENSE) INCOME |

|||||||||||||||

Interest expense |

(14,432 |

) |

(10,656 |

) |

(41,590 |

) |

(30,763 |

) |

|||||||

Equity in (losses) earnings of unconsolidated real estate ventures |

(1,214 |

) |

242 |

(4,962 |

) |

290 |

|||||||||

Acquisition costs |

(321 |

) |

(141 |

) |

(783 |

) |

(471 |

) |

|||||||

Non-operating (expense) income |

(8 |

) |

153 |

(275 |

) |

69 |

|||||||||

Gain on sale of self storage properties |

— |

— |

2,814 |

391 |

|||||||||||

Other expense |

(15,975 |

) |

(10,402 |

) |

(44,796 |

) |

(30,484 |

) |

|||||||

Income before income taxes |

16,737 |

17,111 |

48,146 |

42,312 |

|||||||||||

Income tax expense |

(223 |

) |

(282 |

) |

(959 |

) |

(469 |

) |

|||||||

Net income |

16,514 |

16,829 |

47,187 |

41,843 |

|||||||||||

Net income attributable to noncontrolling interests |

(25,374 |

) |

(12,435 |

) |

(56,292 |

) |

(21,098 |

) |

|||||||

Net (loss) income attributable to National Storage Affiliates Trust |

(8,860 |

) |

4,394 |

(9,105 |

) |

20,745 |

|||||||||

Distributions to preferred shareholders |

(3,272 |

) |

(2,588 |

) |

(9,117 |

) |

(7,763 |

) |

|||||||

Net (loss) income attributable to common shareholders |

$ |

(12,132 |

) |

$ |

1,806 |

$ |

(18,222 |

) |

$ |

12,982 |

|||||

Earnings (loss) per share - basic and diluted |

$ |

(0.20 |

) |

$ |

0.03 |

$ |

(0.32 |

) |

$ |

0.25 |

|||||

Weighted average shares outstanding - basic and diluted |

59,278 |

55,722 |

57,835 |

52,189 |

|||||||||||

7

National Storage Affiliates Trust

Consolidated Balance Sheets

(dollars in thousands, except per share amounts)

(unaudited)

September 30, |

December 31, |

||||||

2019 |

2018 |

||||||

ASSETS |

|||||||

Real estate |

|||||||

Self storage properties |

$ |

3,055,597 |

$ |

2,637,723 |

|||

Less accumulated depreciation |

(313,694 |

) |

(246,261 |

) |

|||

Self storage properties, net |

2,741,903 |

2,391,462 |

|||||

Cash and cash equivalents |

44,749 |

13,181 |

|||||

Restricted cash |

5,457 |

3,182 |

|||||

Debt issuance costs, net |

3,464 |

1,260 |

|||||

Investment in unconsolidated real estate ventures |

228,446 |

245,125 |

|||||

Other assets, net |

63,271 |

75,053 |

|||||

Operating lease right-of-use assets |

23,507 |

— |

|||||

Total assets |

$ |

3,110,797 |

$ |

2,729,263 |

|||

LIABILITIES AND EQUITY |

|||||||

Liabilities |

|||||||

Debt financing |

$ |

1,533,936 |

$ |

1,278,102 |

|||

Accounts payable and accrued liabilities |

78,849 |

33,130 |

|||||

Operating lease liabilities |

24,777 |

— |

|||||

Deferred revenue |

16,029 |

15,732 |

|||||

Total liabilities |

1,653,591 |

1,326,964 |

|||||

Equity |

|||||||

Preferred shares of beneficial interest, par value $0.01 per share. 50,000,000 authorized, 8,727,119 and 6,900,000 issued and outstanding at September 30, 2019 and December 31, 2018, respectively, at liquidation preference |

218,178 |

172,500 |

|||||

Common shares of beneficial interest, par value $0.01 per share. 250,000,000 shares authorized, 59,328,388 and 56,654,009 shares issued and outstanding at September 30, 2019 and December 31, 2018, respectively |

593 |

567 |

|||||

Additional paid-in capital |

901,530 |

844,276 |

|||||

Distributions in excess of earnings |

(187,305 |

) |

(114,122 |

) |

|||

Accumulated other comprehensive (loss) income |

(17,294 |

) |

13,618 |

||||

Total shareholders' equity |

915,702 |

916,839 |

|||||

Noncontrolling interests |

541,504 |

485,460 |

|||||

Total equity |

1,457,206 |

1,402,299 |

|||||

Total liabilities and equity |

$ |

3,110,797 |

$ |

2,729,263 |

|||

8

Supplemental Schedule 1 |

|||||||||||||||

Funds From Operations and Core Funds From Operations | |||||||||||||||

(in thousands, except per share and unit amounts) (unaudited) | |||||||||||||||

Reconciliation of Net Income to FFO and Core FFO | |||||||||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

2019 |

2018 |

2019 |

2018 |

||||||||||||

Net income |

$ |

16,514 |

$ |

16,829 |

$ |

47,187 |

$ |

41,843 |

|||||||

Add (subtract): |

|||||||||||||||

Real estate depreciation and amortization |

27,279 |

22,164 |

76,816 |

65,332 |

|||||||||||

Company's share of unconsolidated real estate venture real estate depreciation and amortization |

5,197 |

1,954 |

16,126 |

4,709 |

|||||||||||

Gain on sale of self storage properties |

— |

— |

(2,814 |

) |

(391 |

) |

|||||||||

Company's share of unconsolidated real estate venture loss on sale of properties |

— |

205 |

202 |

205 |

|||||||||||

Distributions to preferred shareholders and unitholders |

(3,515 |

) |

(2,711 |

) |

(9,729 |

) |

(8,106 |

) |

|||||||

FFO attributable to subordinated performance unitholders(1)

|

(9,100 |

) |

(7,358 |

) |

(24,855 |

) |

(19,415 |

) |

|||||||

FFO attributable to common shareholders, OP unitholders, and LTIP unitholders |

36,375 |

31,083 |

102,933 |

84,177 |

|||||||||||

Add: |

|||||||||||||||

Acquisition costs |

321 |

141 |

783 |

471 |

|||||||||||

Core FFO attributable to common shareholders, OP unitholders, and LTIP unitholders |

$ |

36,696 |

$ |

31,224 |

$ |

103,716 |

$ |

84,648 |

|||||||

Weighted average shares and units outstanding - FFO and Core FFO:(2)

|

|||||||||||||||

Weighted average shares outstanding - basic |

59,278 |

55,722 |

57,835 |

52,189 |

|||||||||||

Weighted average restricted common shares outstanding |

27 |

29 |

29 |

30 |

|||||||||||

Weighted average OP units outstanding |

30,483 |

28,910 |

30,217 |

29,009 |

|||||||||||

Weighted average DownREIT OP unit equivalents outstanding |

1,848 |

1,835 |

1,848 |

1,835 |

|||||||||||

Weighted average LTIP units outstanding |

535 |

715 |

605 |

689 |

|||||||||||

Total weighted average shares and units outstanding - FFO and Core FFO |

92,171 |

87,211 |

90,534 |

83,752 |

|||||||||||

FFO per share and unit |

$ |

0.39 |

$ |

0.36 |

$ |

1.14 |

$ |

1.01 |

|||||||

Core FFO per share and unit |

$ |

0.40 |

$ |

0.36 |

$ |

1.15 |

$ |

1.01 |

|||||||

(1) Amounts represent distributions declared for subordinated performance unitholders and DownREIT subordinated performance unitholders for the periods presented. | |||||||||||||||

(2) NSA combines OP units and DownREIT OP units with common shares because, after the applicable lock-out periods, OP units in the Company's operating partnership are redeemable for cash or, at NSA's option, exchangeable for common shares on a one-for-one basis and DownREIT OP units are also redeemable for cash or, at NSA's option, exchangeable for OP units in the Company's operating partnership on a one-for-one basis, subject to certain adjustments in each case. Subordinated performance units, DownREIT subordinated performance units and LTIP units may also, under certain circumstances, be convertible into or exchangeable for common shares (or other units that are convertible into or exchangeable for common shares). See footnote(3) for additional discussion of subordinated performance units, DownREIT subordinated performance units, and LTIP units in the calculation of FFO and Core FFO per share and unit.

| |||||||||||||||

9

Supplemental Schedule 1 (continued) |

|||||||||||||||

Funds From Operations and Core Funds From Operations | |||||||||||||||

(in thousands, except per share and unit amounts) (unaudited) | |||||||||||||||

Reconciliation of Earnings (Loss) Per Share - Diluted to FFO and Core FFO Per Share and Unit | |||||||||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

2019 |

2018 |

2019 |

2018 |

||||||||||||

Earnings (loss) per share - diluted |

$ |

(0.20 |

) |

$ |

0.03 |

$ |

(0.32 |

) |

$ |

0.25 |

|||||

Impact of the difference in weighted average number of shares(3)

|

0.07 |

— |

0.11 |

(0.10 |

) |

||||||||||

Impact of GAAP accounting for noncontrolling interests, two-class method and treasury stock method(4)

|

0.26 |

0.14 |

0.62 |

0.25 |

|||||||||||

Add real estate depreciation and amortization |

0.30 |

0.25 |

0.85 |

0.78 |

|||||||||||

Add Company's share of unconsolidated real estate venture real estate depreciation and amortization |

0.06 |

0.02 |

0.18 |

0.06 |

|||||||||||

Subtract gain on sale of self storage properties |

— |

— |

(0.03 |

) |

— |

||||||||||

FFO attributable to subordinated performance unitholders |

(0.10 |

) |

(0.08 |

) |

(0.27 |

) |

(0.23 |

) |

|||||||

FFO per share and unit |

0.39 |

0.36 |

1.14 |

1.01 |

|||||||||||

Add acquisition costs |

0.01 |

— |

0.01 |

— |

|||||||||||

Core FFO per share and unit |

$ |

0.40 |

$ |

0.36 |

$ |

1.15 |

$ |

1.01 |

|||||||

(3) Adjustment accounts for the difference between the weighted average number of shares used to calculate diluted earnings per share and the weighted average number of shares used to calculate FFO and Core FFO per share and unit. Diluted earnings per share is calculated using the two-class method for the company's restricted common shares and the treasury stock method for certain unvested LTIP units, and assumes the conversion of vested LTIP units into OP units on a one-for-one basis and the hypothetical conversion of subordinated performance units, and DownREIT subordinated performance units into OP units, even though such units may only be convertible into OP units (i) after a lock-out period and (ii) upon certain events or conditions. For additional information about the conversion of subordinated performance units and DownREIT subordinated performance units into OP units, see Note 10 to the Company's most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission. The computation of weighted average shares and units for FFO and Core FFO per share and unit includes all restricted common shares and LTIP units that participate in distributions and excludes all subordinated performance units and DownREIT subordinated performance units because their effect has been accounted for through the allocation of FFO to the related unitholders based on distributions declared. | |||||||||||||||

(4) Represents the effect of adjusting the numerator to consolidated net income (loss) prior to GAAP allocations for noncontrolling interests, after deducting preferred share and unit distributions, and before the application of the two-class method and treasury stock method, as described in footnote(3).

| |||||||||||||||

10

Supplemental Schedule 2 |

|||||||||||||||

Other Non-GAAP Financial Measurements |

|||||||||||||||

(dollars in thousands) (unaudited) |

|||||||||||||||

Net Operating Income |

|||||||||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

2019 |

2018 |

2019 |

2018 |

||||||||||||

Net income |

$ |

16,514 |

$ |

16,829 |

$ |

47,187 |

$ |

41,843 |

|||||||

(Subtract) add: |

|||||||||||||||

Management fees and other revenue |

(5,374 |

) |

(3,148 |

) |

(15,383 |

) |

(7,464 |

) |

|||||||

General and administrative expenses |

12,039 |

8,848 |

33,975 |

25,614 |

|||||||||||

Depreciation and amortization |

27,598 |

22,469 |

77,776 |

66,226 |

|||||||||||

Interest expense |

14,432 |

10,656 |

41,590 |

30,763 |

|||||||||||

Equity in losses (earnings) of unconsolidated real estate ventures |

1,214 |

(242 |

) |

4,962 |

(290 |

) |

|||||||||

Acquisition costs |

321 |

141 |

783 |

471 |

|||||||||||

Income tax expense |

223 |

282 |

959 |

469 |

|||||||||||

Gain on sale of self storage properties |

— |

— |

(2,814 |

) |

(391 |

) |

|||||||||

Non-operating expense (income) |

8 |

(153 |

) |

275 |

(69 |

) |

|||||||||

Net Operating Income |

$ |

66,975 |

$ |

55,682 |

$ |

189,310 |

$ |

157,172 |

|||||||

EBITDA and Adjusted EBITDA |

|||||||||||||||

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||||||

2019 |

2018 |

2019 |

2018 |

||||||||||||

Net income |

$ |

16,514 |

$ |

16,829 |

$ |

47,187 |

$ |

41,843 |

|||||||

Add: |

|||||||||||||||

Depreciation and amortization |

27,598 |

22,469 |

77,776 |

66,226 |

|||||||||||

Company's share of unconsolidated real estate venture depreciation and amortization |

5,197 |

1,954 |

16,126 |

4,709 |

|||||||||||

Interest expense |

14,432 |

10,656 |

41,590 |

30,763 |

|||||||||||

Income tax expense |

223 |

282 |

959 |

469 |

|||||||||||

EBITDA |

63,964 |

52,190 |

183,638 |

144,010 |

|||||||||||

Add (subtract): |

|||||||||||||||

Acquisition costs |

321 |

141 |

783 |

471 |

|||||||||||

Gain on sale of self storage properties |

— |

— |

(2,814 |

) |

(391 |

) |

|||||||||

Company's share of unconsolidated real estate venture loss on sale of properties |

— |

205 |

202 |

205 |

|||||||||||

Equity-based compensation expense |

1,153 |

1,022 |

3,373 |

2,808 |

|||||||||||

Adjusted EBITDA |

$ |

65,438 |

$ |

53,558 |

$ |

185,182 |

$ |

147,103 |

|||||||

11

Supplemental Schedule 3 | ||||||||||||||||||||||||||

Portfolio Summary | ||||||||||||||||||||||||||

As of September 30, 2019 | ||||||||||||||||||||||||||

(dollars in thousands) (unaudited) | ||||||||||||||||||||||||||

Wholly-Owned Store Data by State (Consolidated) |

Total Operated Store Data by State (Consolidated & Unconsolidated) |

|||||||||||||||||||||||||

State/Territories |

Stores |

Units |

Rentable Square Feet |

Occupancy at Period End |

State/Territories |

Stores |

Units |

Rentable Square Feet |

Occupancy at Period End |

|||||||||||||||||

California |

83 |

49,607 |

6,227,213 |

89.9 |

% |

California |

93 |

55,804 |

6,981,567 |

89.6 |

% |

|||||||||||||||

Texas |

70 |

29,006 |

4,159,442 |

88.1 |

% |

Texas |

74 |

31,341 |

4,436,231 |

87.6 |

% |

|||||||||||||||

Oregon |

61 |

24,498 |

3,105,159 |

84.5 |

% |

Florida |

69 |

43,175 |

4,566,339 |

86.0 |

% |

|||||||||||||||

Georgia |

43 |

18,480 |

2,459,489 |

90.9 |

% |

Oregon |

61 |

24,498 |

3,105,159 |

84.5 |

% |

|||||||||||||||

Florida |

42 |

27,798 |

2,844,274 |

87.8 |

% |

Georgia |

54 |

24,621 |

3,331,797 |

90.2 |

% |

|||||||||||||||

North Carolina |

33 |

15,379 |

1,885,479 |

94.2 |

% |

Oklahoma |

36 |

16,093 |

2,196,964 |

89.4 |

% |

|||||||||||||||

Arizona |

31 |

16,896 |

1,927,092 |

89.0 |

% |

Arizona |

33 |

17,905 |

2,036,922 |

88.8 |

% |

|||||||||||||||

Oklahoma |

30 |

13,849 |

1,903,042 |

88.9 |

% |

North Carolina |

33 |

15,379 |

1,885,479 |

94.2 |

% |

|||||||||||||||

Louisiana |

26 |

12,348 |

1,539,774 |

85.6 |

% |

Louisiana |

26 |

12,348 |

1,539,774 |

85.6 |

% |

|||||||||||||||

Indiana |

16 |

8,783 |

1,134,830 |

91.9 |

% |

Michigan |

24 |

15,622 |

1,977,623 |

88.4 |

% |

|||||||||||||||

Kansas |

16 |

5,716 |

763,249 |

88.8 |

% |

Ohio |

22 |

12,424 |

1,526,139 |

88.5 |

% |

|||||||||||||||

Washington |

14 |

4,497 |

578,723 |

82.5 |

% |

New Jersey |

18 |

11,962 |

1,417,062 |

89.4 |

% |

|||||||||||||||

Nevada |

13 |

6,677 |

844,761 |

90.6 |

% |

Nevada |

17 |

8,295 |

1,096,918 |

89.7 |

% |

|||||||||||||||

Colorado |

11 |

5,050 |

615,468 |

89.8 |

% |

Indiana |

16 |

8,783 |

1,134,830 |

91.9 |

% |

|||||||||||||||

New Hampshire |

11 |

4,667 |

571,045 |

90.6 |

% |

Kansas |

16 |

5,716 |

763,249 |

88.8 |

% |

|||||||||||||||

Ohio |

8 |

3,640 |

461,393 |

90.3 |

% |

Alabama |

15 |

6,297 |

937,091 |

87.6 |

% |

|||||||||||||||

Other(1)

|

52 |

25,654 |

3,128,429 |

88.5 |

% |

Washington |

14 |

4,497 |

578,723 |

82.5 |

% |

|||||||||||||||

Total |

560 |

272,545 |

34,148,862 |

88.8 |

% |

Massachusetts |

11 |

7,800 |

836,596 |

88.7 |

% |

|||||||||||||||

Colorado |

11 |

5,050 |

615,468 |

89.8 |

% |

|||||||||||||||||||||

New Hampshire |

11 |

4,667 |

571,045 |

90.6 |

% |

|||||||||||||||||||||

Other(2)

|

81 |

43,387 |

5,228,815 |

86.3 |

% |

|||||||||||||||||||||

Total |

735 |

375,664 |

46,763,791 |

88.2 |

% |

|||||||||||||||||||||

(1) Other states and territories in NSA's owned portfolio as of September 30, 2019 include Alabama, Idaho, Illinois, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, New Mexico, Pennsylvania, South Carolina, Virginia and Puerto Rico. | ||||||

(2) Other states and territories in NSA's operated portfolio as of September 30, 2019 include Delaware, Idaho, Illinois, Kentucky, Maryland, Minnesota, Mississippi, Missouri, New Mexico, New York, Pennsylvania, Rhode Island, South Carolina, Tennessee, Virginia and Puerto Rico. | ||||||

12

Supplemental Schedule 3 (continued) | |||||||||||||||||||||||

Portfolio Summary |

|||||||||||||||||||||||

(dollars in thousands) (unaudited) |

|||||||||||||||||||||||

2019 Acquisition Activity |

|||||||||||||||||||||||

|

Self Storage Properties Acquired

During the Quarter Ended:

|

Summary of Investment |

||||||||||||||||||||||

Stores |

Units |

Rentable Square Feet |

Cash and Acquisition Costs |

Value of OP Equity |

Other Liabilities |

Total |

|||||||||||||||||

March 31, 2019 |

32 |

14,952 |

1,745,495 |

$ |

160,531 |

$ |

33,356 |

$ |

674 |

$ |

194,561 |

||||||||||||

June 30, 2019 |

24 |

12,327 |

1,762,895 |

168,442 |

15,515 |

1,378 |

185,335 |

||||||||||||||||

September 30, 2019 |

6 |

3,193 |

329,002 |

34,624 |

950 |

197 |

35,771 |

||||||||||||||||

Total Acquisitions(3)

|

62 |

30,472 |

3,837,392 |

$ |

363,597 |

$ |

49,821 |

$ |

2,249 |

$ |

415,667 |

||||||||||||

2019 Disposition & Divestiture Activity |

||||||||||||

Dispositions Closed During the Quarter Ended: |

Stores |

Units |

Rentable Square Feet |

Gross Proceeds |

||||||||

June 30, 2019(4)

|

1 |

453 |

45,273 |

$ |

6,500 |

|||||||

Unconsolidated Real Estate Ventures (at 100%)(5)

|

||||||||||||

March 31, 2019(6)

|

1 |

318 |

40,930 |

4,075 |

||||||||

Total 2019 Divestitures(5)

|

2 |

771 |

86,203 |

$ |

10,575 |

|||||||

(3) NSA acquired self storage properties located in Arizona (2), Florida (8), Georgia (9), Idaho (3), Louisiana (12), Maryland (1), Massachusetts (2), New Hampshire (1), New Jersey (3), New Mexico (4), Oregon (1), Pennsylvania (6) and Texas (10). | ||||||

(4) NSA disposed of a self storage property located in Washington during 2019. | ||||||

(5) Values represent entire unconsolidated real estate ventures at 100%, not NSA's proportionate share. NSA's ownership in each of the unconsolidated real estate ventures is 25%. | ||||||

(6) The divestiture completed during the quarter ended March 31, 2019 was a sale from one of NSA's unconsolidated real estate ventures into the consolidated portfolio of NSA. | ||||||

13

Supplemental Schedule 4 |

|||||||||||||||||||||||||||||||||||||||||

Debt and Equity Capitalization |

|||||||||||||||||||||||||||||||||||||||||

As of September 30, 2019 |

|||||||||||||||||||||||||||||||||||||||||

(unaudited) |

|||||||||||||||||||||||||||||||||||||||||

Debt Summary (dollars in thousands)

|

|||||||||||||||||||||||||||||||||||||||||

Effective Interest Rate(1)

|

Basis of Rate |

Maturity Date |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

Thereafter |

Total |

||||||||||||||||||||||||||||||

Credit Facility: |

|||||||||||||||||||||||||||||||||||||||||

Revolving line of credit |

3.32% |

Variable(2)

|

January 2024 |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

$ |

— |

||||||||||||||||||||

Term loan - Tranche A |

3.74% |

Swapped To Fixed |

January 2023 |

— |

— |

— |

— |

125,000 |

— |

— |

— |

125,000 |

|||||||||||||||||||||||||||||

Term loan - Tranche B |

2.91% |

Swapped To Fixed |

July 2024 |

— |

— |

— |

— |

— |

250,000 |

— |

— |

250,000 |

|||||||||||||||||||||||||||||

Term loan - Tranche C |

2.80% |

Swapped To Fixed |

January 2025 |

— |

— |

— |

— |

— |

— |

225,000 |

— |

225,000 |

|||||||||||||||||||||||||||||

Term loan - Tranche D |

3.57% |

Swapped To Fixed |

July 2026 |

— |

— |

— |

— |

— |

— |

— |

175,000 |

175,000 |

|||||||||||||||||||||||||||||

Term loan facility - 2023 |

2.83% |

Swapped To Fixed |

June 2023 |

— |

— |

— |

— |

175,000 |

— |

— |

— |

175,000 |

|||||||||||||||||||||||||||||

Term loan facility - 2028 |

4.62% |

Swapped To Fixed |

December 2028 |

— |

— |

— |

— |

— |

— |

— |

75,000 |

75,000 |

|||||||||||||||||||||||||||||

Term loan facility - 2029 |

4.27% |

Swapped To Fixed |

April 2029 |

— |

— |

— |

— |

— |

— |

— |

100,000 |

100,000 |

|||||||||||||||||||||||||||||

2029 Senior Unsecured Notes |

3.98% |

Fixed |

August 2029 |

— |

— |

— |

— |

— |

— |

— |

100,000 |

100,000 |

|||||||||||||||||||||||||||||

2031 Senior Unsecured Notes |

4.08% |

Fixed |

August 2031 |

— |

— |

— |

— |

— |

— |

— |

50,000 |

50,000 |

|||||||||||||||||||||||||||||

Fixed rate mortgages payable |

4.18% |

Fixed |

October 2020 - October 2031 |

— |

35,669 |

3,683 |

— |

82,349 |

20,311 |

— |

122,311 |

264,323 |

|||||||||||||||||||||||||||||

Total Principal/Weighted Average |

3.53% |

6.17 years |

$ |

— |

$ |

35,669 |

$ |

3,683 |

$ |

— |

$ |

382,349 |

$ |

270,311 |

$ |

225,000 |

$ |

622,311 |

$ |

1,539,323 |

|||||||||||||||||||||

Unamortized debt issuance costs and debt premium, net |

(5,387 |

) |

|||||||||||||||||||||||||||||||||||||||

Total Debt |

$ |

1,533,936 |

|||||||||||||||||||||||||||||||||||||||

Debt Ratios |

|||||

Covenant |

Amount |

||||

Net Debt to Annualized Current Quarter Adjusted EBITDA |

n/a |

5.7x |

|||

Trailing Twelve Month Fixed Charge Coverage Ratio |

> 1.5x |

3.1x |

|||

Total Leverage Ratio |

< 60.0% |

41.6% |

|||

(1) Effective interest rate incorporates the stated rate plus the impact of interest rate cash flow hedges and discount and premium amortization, if applicable. | |||||

(2) For the $500 million revolving line of credit, the effective interest rate is calculated based on one month LIBOR plus an applicable margin of 1.30% and excludes fees which range from 0.15% to 0.20% for unused borrowings. | |||||

14

Supplemental Schedule 4 (continued) |

|||||

Debt and Equity Capitalization |

|||||

As of September 30, 2019 |

|||||

(unaudited) |

|||||

Preferred Shares and Units |

|||||

Outstanding |

|||||

6.000% Series A cumulative redeemable preferred shares of beneficial interest |

8,727,119 |

||||

6.000% Series A-1 cumulative redeemable preferred units |

642,982 |

||||

Common Shares and Units |

|||||

Outstanding |

If Converted |

||||

Common shares of beneficial interest |

59,302,037 |

59,302,037 |

|||

Restricted common shares |

26,351 |

26,351 |

|||

Total shares outstanding |

59,328,388 |

59,328,388 |

|||

Operating partnership units |

30,458,558 |

30,458,558 |

|||

DownREIT operating partnership unit equivalents |

1,848,261 |

1,848,261 |

|||

Total operating partnership units |

32,306,819 |

32,306,819 |

|||

Long-term incentive plan units(3)

|

536,173 |

536,173 |

|||

Total shares and Class A equivalents outstanding |

92,171,380 |

92,171,380 |

|||

Subordinated performance units(4)

|

10,961,146 |

15,893,662 |

|||

DownREIT subordinated performance unit equivalents(4)

|

4,371,622 |

6,338,852 |

|||

Total subordinated partnership units |

15,332,768 |

22,232,514 |

|||

Total common shares and units outstanding |

107,504,148 |

114,403,894 |

|||

(3) Balances exclude 224,000 long-term incentive plan ("LTIP") units which only vest and participate in dividend distributions upon the future contribution of properties from the PROs. | |||

(4) If converted balance assumes that each subordinated performance unit (including each DownREIT subordinated performance unit) is convertible into OP units, notwithstanding the two-year lock-out period on conversions for certain series of subordinated performance units, and that each subordinated performance unit would on average convert on a hypothetical basis into an estimated 1.45 OP units based on historical financial information for the trailing twelve months ended September 30, 2019. The hypothetical conversions are calculated by dividing the average cash available for distribution, or CAD, per subordinated performance unit by 110% of the CAD per OP unit over the same period. The Company anticipates that as CAD grows over time, the conversion ratio will also grow, including to levels that may exceed these amounts.

| |||

15

Supplemental Schedule 5 | ||||||||

Summarized Information for Unconsolidated Real Estate Ventures | ||||||||

(dollars in thousands) (unaudited) |

||||||||

Combined Balance Sheet Information | ||||||||

Total Ventures at 100%(1)

|

September 30, 2019 |

December 31, 2018 |

||||||

ASSETS |

||||||||

Self storage properties, net |

$ |

1,849,177 |

$ |

1,894,412 |

||||

Other assets |

27,632 |

50,915 |

||||||

Total assets |

$ |

1,876,809 |

$ |

1,945,327 |

||||

LIABILITIES AND EQUITY |

||||||||

Debt financing |

$ |

947,678 |

$ |

956,357 |

||||

Other liabilities |

23,559 |

16,516 |

||||||

Equity |

905,572 |

972,454 |

||||||

Total liabilities and equity |

$ |

1,876,809 |

$ |

1,945,327 |

||||

Combined Operating Information |

||||||||||||||||

Three Months Ended September 30, 2019 |

Nine Months Ended September 30, 2019 |

|||||||||||||||

Total Ventures at 100%(1)

|

NSA Proportionate Share (Ventures at 25%)(2)

|

Total Ventures at 100%(1)

|

NSA Proportionate Share (Ventures at 25%)(2)

|

|||||||||||||

Total revenue |

$ |

41,600 |

$ |

10,400 |

$ |

122,253 |

$ |

30,563 |

||||||||

Property operating expenses |

12,727 |

3,182 |

37,815 |

9,454 |

||||||||||||

Net operating income |

28,873 |

7,218 |

84,438 |

21,109 |

||||||||||||

Supervisory, administrative and other expenses |

(2,750 |

) |

(688 |

) |

(8,109 |

) |

(2,027 |

) |

||||||||

Depreciation and amortization |

(20,788 |

) |

(5,197 |

) |

(64,502 |

) |

(16,126 |

) |

||||||||

Interest expense |

(9,934 |

) |

(2,484 |

) |

(29,895 |

) |

(7,474 |

) |

||||||||

Loss on sale of self storage properties |

— |

— |

(806 |

) |

(202 |

) |

||||||||||

Acquisition and other expenses |

(314 |

) |

(79 |

) |

(1,141 |

) |

(285 |

) |

||||||||

Net loss |

$ |

(4,913 |

) |

$ |

(1,230 |

) |

$ |

(20,015 |

) |

$ |

(5,005 |

) |

||||

Add (subtract): |

||||||||||||||||

Equity in earnings adjustments related to amortization of basis differences |

16 |

43 |

||||||||||||||

Company's share of unconsolidated real estate venture real estate depreciation and amortization |

5,197 |

16,126 |

||||||||||||||

Company's share of unconsolidated real estate venture loss on sale of properties |

— |

202 |

||||||||||||||

Company's share of FFO and Core FFO from unconsolidated real estate ventures |

$ |

3,983 |

$ |

11,366 |

||||||||||||

(1) Values represent entire unconsolidated real estate ventures at 100%, not NSA's proportionate share. NSA's ownership in each of the unconsolidated real estate ventures is 25%. | |||||||

(2) NSA's proportionate share of its unconsolidated real estate ventures is derived by applying NSA's 25% ownership interest to each line item in the GAAP financial statements of the unconsolidated real estate ventures to calculate NSA's share of that line item. NSA believes this information offers insights into the financial performance of the Company, although the presentation of such information, and its combination with NSA's consolidated results, may not accurately depict the legal and economic implications of holding a noncontrolling interest in the unconsolidated real estate ventures. The operating agreements of the unconsolidated real estate ventures provide for the distribution of net cash flow to the unconsolidated real estate ventures' investors no less than monthly, generally in proportion to the investors’ respective ownership interests, subject to a promoted distribution to NSA upon the achievement of certain performance benchmarks by the non-NSA investor. | |||||||

16

Supplemental Schedule 6 |

||||||||||||||||||||||||||||||||||||||||||||

Same Store Performance Summary By State |

||||||||||||||||||||||||||||||||||||||||||||

(dollars in thousands, except per square foot data) (unaudited) |

||||||||||||||||||||||||||||||||||||||||||||

Three Months Ended September 30, 2019 compared to Three Months Ended September 30, 2018 | ||||||||||||||||||||||||||||||||||||||||||||

Total Revenue |

Property Operating Expenses |

Net Operating Income |

Net Operating Income Margin |

|||||||||||||||||||||||||||||||||||||||||

State |

Stores |

3Q 2019 |

3Q 2018 |

Growth |

3Q 2019 |

3Q 2018 |

Growth |

3Q 2019 |

3Q 2018 |

Growth |

3Q 2019 |

3Q 2018 |

Growth |

|||||||||||||||||||||||||||||||

California |

80 |

$ |

19,584 |

$ |

18,787 |

4.2 |

% |

$ |

5,222 |

$ |

5,180 |

0.8 |

% |

$ |

14,362 |

$ |

13,607 |

5.5 |

% |

73.3 |

% |

72.4 |

% |

0.9 |

% |

|||||||||||||||||||

Oregon |

58 |

9,897 |

9,844 |

0.5 |

% |

2,500 |

2,409 |

3.8 |

% |

7,397 |

7,435 |

(0.5 |

)% |

74.7 |

% |

75.5 |

% |

(0.8 |

)% |

|||||||||||||||||||||||||

Texas |

58 |

7,635 |

7,361 |

3.7 |

% |

2,812 |

2,704 |

4.0 |

% |

4,823 |

4,657 |

3.6 |

% |

63.2 |

% |

63.3 |

% |

(0.1 |

)% |

|||||||||||||||||||||||||

Georgia |

33 |

4,394 |

4,106 |

7.0 |

% |

1,323 |

1,297 |

2.0 |

% |

3,071 |

2,809 |

9.3 |

% |

69.9 |

% |

68.4 |

% |

1.5 |

% |

|||||||||||||||||||||||||

Oklahoma |

30 |

3,735 |

3,632 |

2.8 |

% |

1,195 |

1,149 |

4.0 |

% |

2,540 |

2,483 |

2.3 |

% |

68.0 |

% |

68.4 |

% |

(0.4 |

)% |

|||||||||||||||||||||||||

North Carolina |

29 |

4,336 |

4,116 |

5.3 |

% |

1,259 |

1,231 |

2.3 |

% |

3,077 |

2,885 |

6.7 |

% |

71.0 |

% |

70.1 |

% |

0.9 |

% |

|||||||||||||||||||||||||

Florida |

28 |

6,756 |

6,584 |

2.6 |

% |

2,056 |

2,052 |

0.2 |

% |

4,700 |

4,532 |

3.7 |

% |

69.6 |

% |

68.8 |

% |

0.8 |

% |

|||||||||||||||||||||||||

Arizona |

16 |

3,318 |

3,169 |

4.7 |

% |

957 |

878 |

9.0 |

% |

2,361 |

2,291 |

3.1 |

% |

71.2 |

% |

72.3 |

% |

(1.1 |

)% |

|||||||||||||||||||||||||

Indiana |

16 |

2,588 |

2,530 |

2.3 |

% |

825 |

833 |

(1.0 |

)% |

1,763 |

1,697 |

3.9 |

% |

68.1 |

% |

67.1 |

% |

1.0 |

% |

|||||||||||||||||||||||||

Louisiana |

14 |

1,932 |

1,865 |

3.6 |

% |

687 |

675 |

1.8 |

% |

1,245 |

1,190 |

4.6 |

% |

64.4 |

% |

63.8 |

% |

0.6 |

% |

|||||||||||||||||||||||||

Washington |

13 |

1,788 |

1,816 |

(1.5 |

)% |

474 |

472 |

0.4 |

% |

1,314 |

1,344 |

(2.2 |

)% |

73.5 |

% |

74.0 |

% |

(0.5 |

)% |

|||||||||||||||||||||||||

Nevada |

11 |

2,042 |

1,867 |

9.4 |

% |

569 |

554 |

2.7 |

% |

1,473 |

1,313 |

12.2 |

% |

72.1 |

% |

70.3 |

% |

1.8 |

% |

|||||||||||||||||||||||||

Colorado |

11 |

1,810 |

1,820 |

(0.5 |

)% |

619 |

558 |

10.9 |

% |

1,191 |

1,262 |

(5.6 |

)% |

65.8 |

% |

69.3 |

% |

(3.5 |

)% |

|||||||||||||||||||||||||

New Hampshire |

10 |

1,625 |

1,543 |

5.3 |

% |

505 |

454 |

11.2 |

% |

1,120 |

1,089 |

2.8 |

% |

68.9 |

% |

70.6 |

% |

(1.7 |

)% |

|||||||||||||||||||||||||

Other(1)

|

32 |

4,575 |

4,260 |

7.4 |

% |

1,592 |

1,564 |

1.8 |

% |

2,983 |

2,696 |

10.6 |

% |

65.2 |

% |

63.3 |

% |

1.9 |

% |

|||||||||||||||||||||||||

Total/Weighted Average |

439 |

$ |

76,015 |

$ |

73,300 |

3.7 |

% |

$ |

22,595 |

$ |

22,010 |

2.7 |

% |

$ |

53,420 |

$ |

51,290 |

4.2 |

% |

70.3 |

% |

70.0 |

% |

0.3 |

% |

|||||||||||||||||||

(1) Other states in NSA's same store portfolio include Alabama, Illinois, Kansas, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Mexico, Ohio, South Carolina and Virginia. | ||||||

17

Supplemental Schedule 6 (continued) |

|||||||||||||||||||||||||||||||||

Same Store Performance Summary By State |

|||||||||||||||||||||||||||||||||

(dollars in thousands, except per square foot data) (unaudited) |

|||||||||||||||||||||||||||||||||

Three Months Ended September 30, 2019 compared to Three Months Ended September 30, 2018 | |||||||||||||||||||||||||||||||||

Rentable Square Feet |

Occupancy at Period End |

Average Occupancy |

Average Annualized Rental Revenue per Occupied Square Foot |

||||||||||||||||||||||||||||||

State |

Units |

3Q 2019 |

3Q 2018 |

Growth |

3Q 2019 |

3Q 2018 |

Growth |

3Q 2019 |

3Q 2018 |

Growth |

|||||||||||||||||||||||

California |

48,068 |

6,074,740 |

90.3 |

% |

90.7 |

% |

(0.4 |

)% |

91.0 |

% |

91.8 |

% |

(0.8 |

)% |

$ |

13.56 |

$ |

12.90 |

5.1 |

% |

|||||||||||||

Oregon |

23,660 |

2,989,234 |

84.5 |

% |

85.8 |

% |

(1.3 |

)% |

85.9 |

% |

87.3 |

% |

(1.4 |

)% |

15.08 |

14.75 |

2.2 |

% |

|||||||||||||||

Texas |

23,230 |

3,296,551 |

90.0 |

% |

89.6 |

% |

0.4 |

% |

91.0 |

% |

90.6 |

% |

0.4 |

% |

9.90 |

9.62 |

2.9 |

% |

|||||||||||||||

Georgia |

13,619 |

1,847,885 |

91.8 |

% |

88.7 |

% |

3.1 |

% |

91.8 |

% |

88.8 |

% |

3.0 |

% |

10.04 |

9.68 |

3.7 |

% |

|||||||||||||||

Oklahoma |

13,849 |

1,903,042 |

88.9 |

% |

86.2 |

% |

2.7 |

% |

89.3 |

% |

86.4 |

% |

2.9 |

% |

8.53 |

8.58 |

(0.6 |

)% |

|||||||||||||||

North Carolina |

13,083 |

1,599,504 |

94.4 |

% |

93.3 |

% |

1.1 |

% |

95.2 |

% |

92.7 |

% |

2.5 |

% |

10.93 |

10.65 |

2.6 |

% |

|||||||||||||||

Florida |

18,864 |

2,001,580 |

88.3 |

% |

88.6 |

% |

(0.3 |

)% |

88.5 |

% |

88.6 |

% |

(0.1 |

)% |

14.67 |

14.44 |

1.6 |

% |

|||||||||||||||

Arizona |

9,135 |

1,067,881 |

89.3 |

% |

87.7 |

% |

1.6 |

% |

89.5 |

% |

89.2 |

% |

0.3 |

% |

13.43 |

12.90 |

4.1 |

% |

|||||||||||||||

Indiana |

8,783 |

1,134,830 |

91.9 |

% |

91.4 |

% |

0.5 |

% |

92.1 |

% |

91.8 |

% |

0.3 |

% |

9.64 |

9.42 |

2.3 |

% |

|||||||||||||||

Louisiana |

6,325 |

858,719 |

87.0 |

% |

83.5 |

% |

3.5 |

% |

87.2 |

% |

84.6 |

% |

2.6 |

% |

10.10 |

10.06 |

0.4 |

% |

|||||||||||||||

Washington |

4,285 |

554,988 |

82.4 |

% |

87.9 |

% |

(5.5 |

)% |

84.7 |

% |

88.2 |

% |

(3.5 |

)% |

14.93 |

14.56 |

2.5 |

% |

|||||||||||||||

Nevada |

5,826 |

736,215 |

90.5 |

% |

94.3 |

% |

(3.8 |

)% |

90.8 |

% |

94.0 |

% |

(3.2 |

)% |

11.68 |

10.44 |

11.9 |

% |

|||||||||||||||

Colorado |

5,050 |

615,468 |

89.8 |

% |

90.6 |

% |

(0.8 |

)% |

91.6 |

% |

92.3 |

% |

(0.7 |

)% |

12.55 |

12.51 |

0.3 |

% |

|||||||||||||||

New Hampshire |

4,188 |

509,770 |

90.2 |

% |

91.3 |

% |

(1.1 |

)% |

91.6 |

% |

91.8 |

% |

(0.2 |

)% |

13.48 |

12.81 |

5.2 |

% |

|||||||||||||||

Other(1)

|

13,414 |

1,822,137 |

89.8 |

% |

90.4 |

% |

(0.6 |

)% |

90.8 |

% |

90.0 |

% |

0.8 |

% |

10.62 |

9.99 |

6.3 |

% |

|||||||||||||||

Total/Weighted Average |

211,379 |

27,012,544 |

89.4 |

% |

89.3 |

% |

0.1 |

% |

90.2 |

% |

89.9 |

% |

0.3 |

% |

$ |

12.06 |

$ |

11.68 |

3.3 |

% |

|||||||||||||

(1) Other states in NSA's same store portfolio include Alabama, Illinois, Kansas, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Mexico, Ohio, South Carolina and Virginia. | ||||||

18

Supplemental Schedule 6 (continued) |

||||||||||||||||||||||||||||||||||||||||||||

Same Store Performance Summary By State |

||||||||||||||||||||||||||||||||||||||||||||

(dollars in thousands, except per square foot data) (unaudited) |

||||||||||||||||||||||||||||||||||||||||||||

Nine Months Ended September 30, 2019 compared to Nine Months Ended September 30, 2018 | ||||||||||||||||||||||||||||||||||||||||||||

Total Revenue |

Property Operating Expenses |

Net Operating Income |

Net Operating Income Margin |

|||||||||||||||||||||||||||||||||||||||||

State |

Stores |

YTD 2019 |

YTD 2018 |

Growth |

YTD 2019 |

YTD 2018 |

Growth |

YTD 2019 |

YTD 2018 |

Growth |

YTD 2019 |

YTD 2018 |

Growth |

|||||||||||||||||||||||||||||||

California |

80 |

$ |

57,394 |

$ |

54,971 |

4.4 |

% |

$ |

15,481 |

$ |

15,366 |

0.7 |

% |

$ |

41,913 |

$ |

39,605 |

5.8 |

% |

73.0 |

% |

72.0 |

% |

1.0 |

% |

|||||||||||||||||||

Oregon |

58 |

28,856 |

28,533 |

1.1 |

% |

7,486 |

7,373 |

1.5 |

% |

21,370 |

21,160 |

1.0 |

% |

74.1 |

% |

74.2 |

% |

(0.1 |

)% |

|||||||||||||||||||||||||

Texas |

58 |

22,280 |

21,387 |

4.2 |

% |

8,328 |

8,131 |

2.4 |

% |

13,952 |

13,256 |

5.3 |

% |

62.6 |

% |

62.0 |

% |

0.6 |

% |

|||||||||||||||||||||||||

Georgia |

33 |

12,756 |

11,665 |

9.4 |

% |

4,147 |

3,809 |

8.9 |

% |

8,609 |

7,856 |

9.6 |

% |

67.5 |

% |

67.3 |

% |

0.2 |

% |

|||||||||||||||||||||||||

Oklahoma |

30 |

11,025 |

10,718 |

2.9 |

% |

3,512 |

3,395 |

3.4 |

% |

7,513 |

7,323 |

2.6 |

% |

68.1 |

% |

68.3 |

% |

(0.2 |

)% |

|||||||||||||||||||||||||

North Carolina |

29 |

12,600 |

11,944 |

5.5 |

% |

3,827 |

3,564 |

7.4 |

% |

8,773 |

8,380 |

4.7 |

% |

69.6 |

% |

70.2 |

% |

(0.6 |

)% |

|||||||||||||||||||||||||

Florida |

28 |

19,885 |

19,280 |

3.1 |

% |

6,021 |

6,053 |

(0.5 |

)% |

13,864 |

13,227 |

4.8 |

% |

69.7 |

% |

68.6 |

% |

1.1 |

% |

|||||||||||||||||||||||||

Arizona |

16 |

9,681 |

9,293 |

4.2 |

% |

2,759 |

2,647 |

4.2 |

% |

6,922 |

6,646 |

4.2 |

% |

71.5 |

% |

71.5 |

% |

— |

||||||||||||||||||||||||||

Indiana |

16 |

7,625 |

7,200 |

5.9 |

% |

2,279 |

2,314 |

(1.5 |

)% |

5,346 |

4,886 |

9.4 |

% |

70.1 |

% |

67.9 |

% |

2.2 |

% |

|||||||||||||||||||||||||

Louisiana |

14 |

5,629 |

5,490 |

2.5 |

% |

2,010 |

1,955 |

2.8 |

% |

3,619 |

3,535 |

2.4 |

% |

64.3 |

% |

64.4 |

% |

(0.1 |

)% |

|||||||||||||||||||||||||

Washington |

13 |

5,337 |

5,310 |

0.5 |

% |

1,427 |

1,467 |

(2.7 |

)% |

3,910 |

3,843 |

1.7 |

% |

73.3 |

% |

72.4 |

% |

0.9 |

% |

|||||||||||||||||||||||||

Nevada |

11 |

5,919 |

5,359 |

10.4 |

% |

1,646 |

1,700 |

(3.2 |

)% |

4,273 |

3,659 |

16.8 |

% |

72.2 |

% |

68.3 |

% |

3.9 |

% |

|||||||||||||||||||||||||

Colorado |

11 |

5,297 |

5,185 |

2.2 |

% |

1,782 |

1,682 |

5.9 |

% |

3,515 |

3,503 |

0.3 |

% |

66.4 |

% |

67.6 |

% |

(1.2 |

)% |

|||||||||||||||||||||||||

New Hampshire |

10 |

4,778 |

4,452 |

7.3 |

% |

1,564 |

1,459 |

7.2 |

% |

3,214 |

2,993 |

7.4 |

% |

67.3 |

% |

67.2 |

% |

0.1 |

% |

|||||||||||||||||||||||||

Other(1)

|

32 |

13,323 |

12,258 |

8.7 |

% |

4,662 |

4,642 |

0.4 |

% |

8,661 |

7,616 |

13.7 |

% |

65.0 |

% |

62.1 |

% |

2.9 |

% |

|||||||||||||||||||||||||

Total/Weighted Average |

439 |

$ |

222,385 |

$ |

213,045 |

4.4 |

% |

$ |

66,931 |

$ |

65,557 |

2.1 |

% |

$ |

155,454 |

$ |

147,488 |

5.4 |

% |

69.9 |

% |

69.2 |

% |

0.7 |

% |

|||||||||||||||||||

(1) Other states in NSA's same store portfolio include Alabama, Illinois, Kansas, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Mexico, Ohio, South Carolina and Virginia. | ||||||

19

Supplemental Schedule 6 (continued) |

|||||||||||||||||||||||||||||||||

Same Store Performance Summary By State |

|||||||||||||||||||||||||||||||||

(dollars in thousands, except per square foot data) (unaudited) |

|||||||||||||||||||||||||||||||||

Nine Months Ended September 30, 2019 compared to Nine Months Ended September 30, 2018 | |||||||||||||||||||||||||||||||||

Rentable Square Feet |

Occupancy at Period End |

Average Occupancy |

Average Annualized Rental Revenue per Occupied Square Foot |

||||||||||||||||||||||||||||||

State |

Units |

YTD 2019 |

YTD 2018 |

Growth |

YTD 2019 |

YTD 2018 |

Growth |

YTD 2019 |

YTD 2018 |

Growth |

|||||||||||||||||||||||

California |

48,068 |

6,074,740 |

90.3 |

% |

90.7 |

% |

(0.4 |

)% |

90.7 |

% |

91.6 |

% |

(0.9 |

)% |

$ |

13.28 |

$ |

12.60 |

5.4 |

% |

|||||||||||||

Oregon |

23,660 |

2,989,234 |

84.5 |

% |

85.8 |

% |

(1.3 |

)% |

84.5 |

% |

86.3 |

% |

(1.8 |

)% |

14.90 |

14.46 |

3.0 |

% |

|||||||||||||||

Texas |

23,230 |

3,296,551 |

90.0 |

% |

89.6 |

% |

0.4 |

% |

89.5 |

% |

89.0 |

% |

0.5 |

% |

9.79 |

9.46 |

3.5 |

% |

|||||||||||||||

Georgia |