SECOND QUARTER EARNINGS RELEASE DATED AUGUST 3, 2021

Published on August 3, 2021

Table of Contents

| Page | |||||

| Earnings Release | |||||

| Consolidated Statements of Operations | |||||

| Consolidated Balance Sheets | |||||

| Schedule 1 - Funds From Operations and Core Funds From Operations | |||||

| Schedule 2 - Other Non-GAAP Financial Measurements | |||||

| Schedule 3 - Portfolio Summary | |||||

| Schedule 4 - Debt and Equity Capitalization | |||||

| Schedule 5 - Summarized Information for Unconsolidated Real Estate Ventures | |||||

| Schedule 6 - Same Store Performance Summary By State | |||||

| Schedule 7 - Same Store Performance Summary By MSA | |||||

| Schedule 8 - Same Store Operating Data - Trailing Five Quarters | |||||

| Schedule 9 - Reconciliation of Same Store Data and Net Operating Income to Net Income | |||||

| Schedule 10 - Selected Financial Information | |||||

| Glossary | |||||

August 3, 2021

National Storage Affiliates Trust Reports Second Quarter 2021 Results

GREENWOOD VILLAGE, Colo. - (BUSINESS WIRE) - National Storage Affiliates Trust ("NSA" or the "Company") (NYSE: NSA) today reported the Company’s second quarter 2021 results.

Second Quarter 2021 Highlights

•Reported net income of $35.7 million for the second quarter of 2021, an increase of 100.6% compared to the second quarter of 2020. Reported diluted earnings per share of $0.25 for the second quarter of 2021 compared to $0.10 for the second quarter of 2020.

•Reported core funds from operations ("Core FFO") of $59.7 million, or $0.55 per share for the second quarter of 2021, an increase of 34.1% per share compared to the second quarter of 2020.

•Reported an increase in same store net operating income ("NOI") of 21.5% for the second quarter of 2021 compared to the same period in 2020, driven by a 16.3% increase in same store total revenues partially offset by an increase of 4.3% in same store property operating expenses.

•Reported same store period-end occupancy of 96.7% as of June 30, 2021, an increase of 720 basis points compared to June 30, 2020.

•Received approximately $103.7 million of net proceeds from the sale of 2,390,000 common shares under the Company's at the market (“ATM”) program during the second quarter of 2021.

•Issued the previously announced $55.0 million of 3.10% senior unsecured notes due May 4, 2033 in a private placement to certain institutional investors on May 26, 2021.

•Acquired 20 wholly-owned self storage properties for $269.4 million during the second quarter of 2021. Consideration for these acquisitions included the issuance of $24.1 million of OP equity.

Highlights Subsequent to Quarter-End

•Acquired seven wholly-owned self storage properties for approximately $68.6 million.

•Completed an underwritten public offering of 10,120,000 common shares resulting in net proceeds of approximately $497.4 million.

•Issued the previously announced $35.0 million of 2.16% senior unsecured notes due May 4, 2026 and $90.0 million of 3.00% senior unsecured notes due May 4, 2031 on July 26, 2021 in a private placement to certain institutional investors.

•Entered into an agreement on July 9, 2021 with a single lender for an $88.0 million interest-only secured debt financing that matures in July 2028 and has a fixed interest rate of 2.77%.

•Received commitments in July 2021 from a syndicated group of lenders to increase the total borrowing capacity under the Company's credit facility with the addition of a $100.0 million 5.5-year term loan tranche E.

Tamara Fischer, President and Chief Executive Officer, commented, "2021 continues to be an exceptional year for NSA on all fronts, delivering growth in second quarter same store NOI of 21.5% and investing nearly $270 million in the acquisition of 20 self storage properties. Our operational results and outlook for the remainder of 2021 give us the confidence to raise our 2021 guidance for Core FFO per share growth to 24.3% at the midpoint and increase our expected range of total acquisitions to be well over $1.0 billion. We've also taken several steps recently to further strengthen our balance sheet and maintain ample liquidity to fund NSA’s outsized growth."

1

Financial Results

($ in thousands, except per share and unit data) |

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||

| 2021 | 2020 | Growth | 2021 | 2020 | Growth | ||||||||||||||||||||||||||||||

| Net income | $ | 35,675 | $ | 17,787 | 100.6 | % | $ | 63,310 | $ | 33,550 | 88.7 | % | |||||||||||||||||||||||

Funds From Operations ("FFO")(1)

|

$ | 59,603 | $ | 41,009 | 45.3 | % | $ | 110,510 | $ | 77,287 | 43.0 | % | |||||||||||||||||||||||

Add back acquisition costs |

118 | 252 | (53.2) | % | 410 | 1,085 | (62.2) | % | |||||||||||||||||||||||||||

Core FFO(1)

|

$ | 59,721 | $ | 41,261 | 44.7 | % | $ | 110,920 | $ | 78,372 | 41.5 | % | |||||||||||||||||||||||

| Earnings (loss) per share - basic | $ | 0.33 | $ | 0.10 | 230.0 | % | $ | 0.58 | $ | 0.16 | (262.5) | % | |||||||||||||||||||||||

Earnings (loss) per share - diluted |

$ | 0.25 | $ | 0.10 | 150.0 | % | $ | 0.44 | $ | 0.16 | (175.0) | % | |||||||||||||||||||||||

FFO per share and unit(1)

|

$ | 0.55 | $ | 0.41 | 34.1 | % | $ | 1.03 | $ | 0.80 | 28.8 | % | |||||||||||||||||||||||

Core FFO per share and unit(1)

|

$ | 0.55 | $ | 0.41 | 34.1 | % | $ | 1.04 | $ | 0.81 | 28.4 | % | |||||||||||||||||||||||

(1) Non-GAAP financial measures, including FFO, Core FFO and NOI, are defined in the Glossary in the supplemental financial information and, where appropriate, reconciliations of these measures and other non-GAAP financial measures to their most directly comparable GAAP measures are included in the Schedules to this press release and in the supplemental financial information.

Net income increased $17.9 million for the second quarter of 2021 and $29.8 million for the six months ended June 30, 2021 ("year-to-date") as compared to the same periods in 2020. These increases resulted primarily from additional NOI generated from the 80 self storage properties acquired between July 1, 2020 and June 30, 2021 and same store NOI growth, partially offset by increases in depreciation and amortization.

The increases in FFO and Core FFO for the second quarter of 2021 and year-to-date were primarily the result of incremental NOI from properties acquired between July 1, 2020 and June 30, 2021 and same store NOI growth, partially offset by increases in subordinated performance unit distributions.

Same Store Operating Results (560 Stores)

($ in thousands, except per square foot data) |

Three Months Ended June 30, | Six Months Ended June 30, | |||||||||||||||||||||||||||||||||

| 2021 | 2020 | Growth | 2021 | 2020 | Growth | ||||||||||||||||||||||||||||||

Total revenues |

$ | 107,382 | $ | 92,327 | 16.3 | % | $ | 208,899 | $ | 186,201 | 12.2 | % | |||||||||||||||||||||||

Property operating expenses |

28,859 | 27,676 | 4.3 | % | 57,692 | 56,337 | 2.4 | % | |||||||||||||||||||||||||||

Net Operating Income (NOI) |

$ | 78,523 | $ | 64,651 | 21.5 | % | $ | 151,207 | $ | 129,864 | 16.4 | % | |||||||||||||||||||||||

| NOI Margin | 73.1 | % | 70.0 | % | 3.1 | % | 72.4 | % | 69.7 | % | 2.7 | % | |||||||||||||||||||||||

Average Occupancy |

95.4 | % | 87.8 | % | 7.6 | % | 94.0 | % | 87.4 | % | 6.6 | % | |||||||||||||||||||||||

Average Annualized Rental Revenue Per Occupied Square Foot |

$ | 12.78 | $ | 11.97 | 6.8 | % | $ | 12.62 | $ | 12.12 | 4.1 | % | |||||||||||||||||||||||

Year-over-year same store total revenues increased 16.3% for the second quarter of 2021 and 12.2% year-to-date as compared to the same periods in 2020. The increase for the second quarter of 2021 was driven primarily by a 760 basis point increase in average occupancy and a 6.8% increase in average annualized rental revenue per occupied square foot. The year-to-date increase was driven primarily by a 660 basis point increase in average occupancy and a 4.1% increase in average annualized rental revenue per occupied square foot. Markets which generated above portfolio average same store total revenue growth include: Portland, Phoenix, Sarasota and Las Vegas. Markets which generated below portfolio average same store total revenue growth include: Atlanta, Oklahoma City, Dallas and Tulsa.

Year-over-year same store property operating expenses increased 4.3% for the second quarter of 2021 and 2.4% year-to-date as compared to the same periods in 2020. The increases primarily resulted from increases in

2

personnel expense, property taxes and repairs and maintenance expense offset by decreases in marketing expense.

Investment Activity

During the second quarter, NSA invested approximately $269.4 million in the acquisition of 20 self storage properties consisting of approximately 1.7 million rentable square feet configured in approximately 13,700 storage units. Total consideration for these acquisitions included approximately $243.6 million of net cash, the issuance of approximately $9.3 million of OP units and $14.8 million of subordinated performance units and the assumption of approximately $1.7 million of other liabilities.

Balance Sheet

On April 8, 2021, Kroll Bond Rating Agency affirmed the issuer credit rating of the Company's operating partnership at BBB and revised its outlook to Positive from Stable.

During the second quarter, the Company entered into agreements to increase the aggregate capacity of its ATM program to $400.0 million and received approximately $103.7 million of net proceeds from the sale of 2,390,000 common shares under the ATM program, which included the issuance of common shares prior to the increase in the aggregate capacity of the ATM program. Subsequent to quarter end, the Company received approximately $40.0 million of net proceeds from the sale of 782,000 common shares under the ATM program. The Company used the net proceeds for self storage property acquisitions and to repay borrowings outstanding under its revolving line of credit. As of August 3, 2021, the Company has approximately $308.0 million of capacity remaining under its ATM program.

On May 3, 2021, the Company's operating partnership entered into an agreement to issue $180.0 million of senior unsecured notes, comprised of $35.0 million of 2.16% senior unsecured notes due May 4, 2026 (the "2026 Notes"), $90.0 million of 3.00% senior unsecured notes due May 4, 2031 (the "May 2031 Notes") and $55.0 million of 3.10% senior unsecured notes due May 4, 2033 (the "2033 Notes"). On May 26, 2021 the operating partnership issued the 2033 Notes and on July 26, 2021 the operating partnership issued the 2026 Notes and the May 2031 Notes. The Company used the proceeds to repay outstanding amounts on its revolving line of credit and for general corporate purposes.

On July 9, 2021, the Company entered into an agreement with a single lender for an $88.0 million debt financing secured by a first lien on eight of the Company's self storage properties. This interest-only loan matures in July 2028 and has a fixed interest rate of 2.77%. The Company used the proceeds to repay outstanding amounts on its revolving line of credit.

In July 2021, NSA completed an underwritten public offering of 10,120,000 common shares, including 1,320,000 common shares sold upon the exercise in full by the underwriters of their option to purchase additional common shares. The shares were issued at a price of $51.25 per share, resulting in net proceeds of approximately $497.4 million. The Company used or expects to use the proceeds for self storage property acquisitions, general corporate purposes and to repay borrowings outstanding under its revolving line of credit.

NSA received commitments in July 2021 from a syndicated group of lenders to partially exercise the expansion option under its credit facility by adding an additional $100.0 million 5.5-year term loan tranche E. The tranche E term loan is expected to close during the third quarter of 2021 and mature in early 2027. The Company plans to use the proceeds for self storage property acquisitions and for general corporate purposes.

Common Share Dividends

On May 27, 2021, NSA's Board of Trustees declared a quarterly cash dividend of $0.38 per common share, representing a 15.2% increase from the second quarter 2020. The second quarter 2021 dividend was paid on June 30, 2021 to shareholders of record as of June 15, 2021.

3

2021 Guidance

The following table outlines NSA's updated and prior FFO guidance estimates and related assumptions for the year ended December 31, 2021:

| Current Ranges for Full Year 2021 |

Prior Ranges for Full Year 2021 |

Actual Results for Full Year 2020 | |||||||||||||||||||||||||||

| Low | High | Low | High | ||||||||||||||||||||||||||

Core FFO per share(1)

|

$2.11 | $2.14 | $1.89 | $1.93 | $1.71 | ||||||||||||||||||||||||

| Same store operations | |||||||||||||||||||||||||||||

Total revenue growth |

11.75% | 12.75% | 5.5% | 6.5% | 1.7% | ||||||||||||||||||||||||

Property operating expenses growth |

2.5% | 3.5% | 3.5% | 4.5% | 0.5% | ||||||||||||||||||||||||

NOI growth |

15.0% | 17.0% | 6.0% | 8.0% | 2.2% | ||||||||||||||||||||||||

General and administrative expenses |

|||||||||||||||||||||||||||||

General and administrative expenses (excluding equity-based compensation), in millions |

$45.0 | $46.0 | $42.0 | $44.0 | $39.3 | ||||||||||||||||||||||||

| Equity-based compensation, in millions | $5.5 | $6.0 | $5.5 | $6.0 | $4.3 | ||||||||||||||||||||||||

Management fees and other revenue, in millions |

$24.0 | $25.0 | $22.0 | $23.0 | $23.0 | ||||||||||||||||||||||||

Core FFO from unconsolidated real estate ventures, in millions |

$19.0 | $20.0 | $17.0 | $18.0 | $15.6 | ||||||||||||||||||||||||

Subordinated performance unit distributions, in millions |

$43.0 | $45.0 | $37.0 | $39.0 | $29.7 | ||||||||||||||||||||||||

| Acquisitions of self storage properties, in millions | $1,100.0 | $1,300.0 | $500.0 | $650.0 | $543.3 | ||||||||||||||||||||||||

(1) The following table provides a reconciliation of the range of estimated earnings (loss) per share - diluted to estimated Core FFO per share and unit:

| |||||||||||||||||||||||

| Current Ranges for Full Year 2021 |

Prior Ranges for Full Year 2021 |

||||||||||||||||||||||

| Low | High | Low | High | ||||||||||||||||||||

| Earnings (loss) per share - diluted | $0.94 | $1.03 | $0.75 | $0.85 | |||||||||||||||||||

Impact of the difference in weighted average number of shares and GAAP accounting for noncontrolling interests, two-class method and treasury stock method |

0.15 | 0.06 | 0.13 | 0.03 | |||||||||||||||||||

Add real estate depreciation and amortization, including NSA's share of unconsolidated venture real estate depreciation and amortization |

1.39 | 1.43 | 1.34 | 1.39 | |||||||||||||||||||

FFO attributable to subordinated unitholders |

(0.38) | (0.40) | (0.34) | (0.36) | |||||||||||||||||||

Add acquisition costs and NSA's share of unconsolidated real estate venture acquisition costs |

0.01 | 0.02 | 0.01 | 0.02 | |||||||||||||||||||

Core FFO per share and unit |

$2.11 | $2.14 | $1.89 | $1.93 | |||||||||||||||||||

Supplemental Financial Information

The full text of this earnings release and supplemental financial information, including certain financial information referenced in this release, are available on NSA's website at http://ir.nationalstorageaffiliates.com/quarterly-reporting and as exhibit 99.1 to the Company's Form 8-K furnished to the SEC on August 3, 2021.

4

Non-GAAP Financial Measures & Glossary

This press release contains certain non-GAAP financial measures. These non-GAAP measures are presented because NSA's management believes these measures help investors understand NSA's business, performance and ability to earn and distribute cash to its shareholders by providing perspectives not immediately apparent from net income (loss). These measures are also frequently used by securities analysts, investors and other interested parties. The presentations of FFO, Core FFO and NOI in this press release are not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. In addition, NSA's method of calculating these measures may be different from methods used by other companies, and, accordingly, may not be comparable to similar measures as calculated by other companies that do not use the same methodology as NSA. These measures, and other words and phrases used herein, are defined in the Glossary in the supplemental financial information and, where appropriate, reconciliations of these measures and other non-GAAP financial measures to their most directly comparable GAAP measures are included in the Schedules to this press release and in the supplemental financial information.

Quarterly Teleconference and Webcast

The Company will host a conference call at 1:00 pm Eastern Time on Wednesday, August 4, 2021 to discuss its second quarter 2021 financial results. At the conclusion of the call, management will accept questions from certified financial analysts. All other participants are encouraged to listen to a webcast of the call by accessing the link found on the Company's website at www.nationalstorageaffiliates.com.

Conference Call and Webcast:

Date/Time: Wednesday, August 4, 2021, 1:00pm ET

Webcast available at: www.nationalstorageaffiliates.com

Domestic (Toll Free US & Canada): 877.407.9711

International: 412.902.1014

Replay:

Domestic (Toll Free US & Canada): 877.660.6853

International: 201.612.7415

Conference ID: 13692161

A replay of the call will be available for one week through Wednesday, August 11, 2021. A replay of the webcast will be available for 30 days on NSA's website at www.nationalstorageaffiliates.com.

Upcoming Industry Conferences

NSA management is scheduled to participate in the virtual BofA Securities 2021 Global Real Estate Conference, September 21 – 22, 2021 and the virtual Evercore 7th Annual Storage Symposium on September 28, 2021.

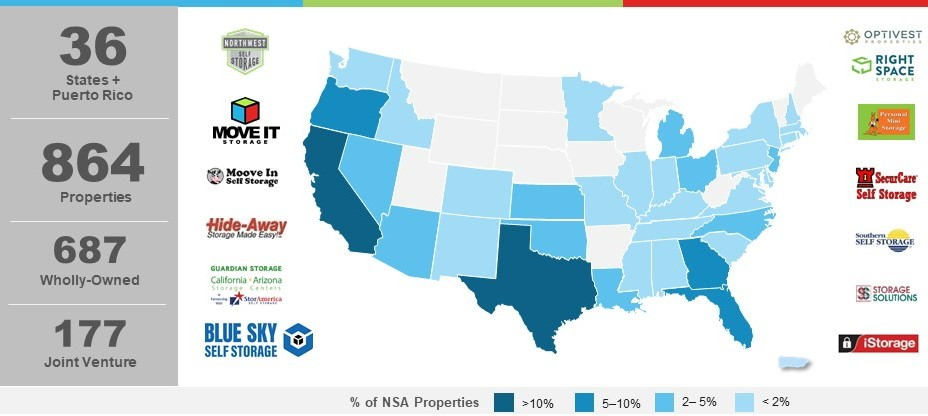

About National Storage Affiliates Trust

National Storage Affiliates Trust is a real estate investment trust headquartered in Denver, Colorado, focused on the ownership, operation and acquisition of self storage properties located within the top 100 metropolitan statistical areas throughout the United States. As of June 30, 2021, the Company held ownership interests in and operated 864 self storage properties located in 36 states and Puerto Rico with approximately 55.2 million rentable square feet. NSA is one of the largest owners and operators of self storage properties among public and private companies in the United States. For more information, please visit the Company’s website at www.nationalstorageaffiliates.com. NSA is included in the MSCI US REIT Index (RMS/RMZ), the Russell 2000 Index of Companies and the S&P MidCap 400 Index.

5

NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained in this press release constitute forward-looking statements as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. These forward-looking statements include information about possible or assumed future results of the Company's business, financial condition, liquidity, results of operations, plans and objectives. Changes in any circumstances may cause the Company's actual results to differ significantly from those expressed in any forward-looking statement. When used in this release, the words "believe," "expect," "anticipate," "estimate," "plan," "continue," "intend," "should," "may" or similar expressions are intended to identify forward-looking statements. Statements regarding the following subjects, among others, may be forward-looking: market trends in the Company's industry, interest rates, the debt and lending markets or the general economy; the Company's business and investment strategy; the acquisition of properties, including those under contract and the Company's ability to execute on its acquisition pipeline; the timing of acquisitions under contract; the internalization of retiring participating regional operators ("PROs") into the Company; negative impacts from the COVID-19 pandemic on the economy, the self storage industry, the broader financial markets, the Company's financial condition, results of operations and cash flows and the ability of the Company's tenants to pay rent; and the Company's guidance estimates for the year ended December 31, 2021. For a further list and description of such risks and uncertainties, see the Company's most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the Securities and Exchange Commission, and the other documents filed by the Company with the Securities and Exchange Commission. The forward-looking statements, and other risks, uncertainties and factors are based on the Company's beliefs, assumptions and expectations of its future performance, taking into account all information currently available to the Company. Forward-looking statements are not predictions of future events. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Contact:

National Storage Affiliates Trust

Investor/Media Relations

George Hoglund, CFA

Vice President - Investor Relations

720.630.2160

6

National Storage Affiliates Trust

Consolidated Statements of Operations

(in thousands, except per share amounts)

(unaudited)

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| REVENUE | |||||||||||||||||||||||

| Rental revenue | $ | 127,310 | $ | 95,302 | $ | 240,437 | $ | 190,704 | |||||||||||||||

| Other property-related revenue | 4,829 | 3,418 | 8,966 | 6,789 | |||||||||||||||||||

| Management fees and other revenue | 6,107 | 5,697 | 11,835 | 11,146 | |||||||||||||||||||

| Total revenue | 138,246 | 104,417 | 261,238 | 208,639 | |||||||||||||||||||

| OPERATING EXPENSES | |||||||||||||||||||||||

| Property operating expenses | 36,654 | 30,257 | 71,258 | 60,849 | |||||||||||||||||||

| General and administrative expenses | 12,450 | 10,329 | 23,688 | 21,423 | |||||||||||||||||||

| Depreciation and amortization | 36,051 | 29,309 | 68,475 | 58,414 | |||||||||||||||||||

| Other | 310 | 462 | 707 | 851 | |||||||||||||||||||

| Total operating expenses | 85,465 | 70,357 | 164,128 | 141,537 | |||||||||||||||||||

| OTHER (EXPENSE) INCOME | |||||||||||||||||||||||

| Interest expense | (17,339) | (15,513) | (34,131) | (31,141) | |||||||||||||||||||

Equity in earnings (losses) of unconsolidated real estate ventures |

1,174 | 52 | 1,933 | (288) | |||||||||||||||||||

| Acquisition costs | (118) | (252) | (410) | (1,085) | |||||||||||||||||||

| Non-operating expense | (148) | (317) | (321) | (509) | |||||||||||||||||||

| Other expense | (16,431) | (16,030) | (32,929) | (33,023) | |||||||||||||||||||

| Income before income taxes | 36,350 | 18,030 | 64,181 | 34,079 | |||||||||||||||||||

| Income tax expense | (675) | (243) | (871) | (529) | |||||||||||||||||||

| Net income | 35,675 | 17,787 | 63,310 | 33,550 | |||||||||||||||||||

Net income attributable to noncontrolling interests |

(6,957) | (7,365) | (13,754) | (16,480) | |||||||||||||||||||

| Net income attributable to National Storage Affiliates Trust | 28,718 | 10,422 | 49,556 | 17,070 | |||||||||||||||||||

Distributions to preferred shareholders |

(3,276) | (3,274) | (6,551) | (6,547) | |||||||||||||||||||

Net income attributable to common shareholders |

$ | 25,442 | $ | 7,148 | $ | 43,005 | $ | 10,523 | |||||||||||||||

| Earnings (loss) per share - basic | $ | 0.33 | $ | 0.10 | $ | 0.58 | $ | 0.16 | |||||||||||||||

| Earnings (loss) per share - diluted | $ | 0.25 | $ | 0.10 | $ | 0.44 | $ | 0.16 | |||||||||||||||

Weighted average shares outstanding - basic |

76,712 | 68,210 | 74,267 | 64,004 | |||||||||||||||||||

Weighted average shares outstanding - diluted |

129,578 | 68,210 | 126,396 | 64,004 | |||||||||||||||||||

7

National Storage Affiliates Trust

Consolidated Balance Sheets

(dollars in thousands, except per share amounts)

(unaudited)

| June 30, | December 31, | ||||||||||

| 2021 | 2020 | ||||||||||

| ASSETS | |||||||||||

| Real estate | |||||||||||

| Self storage properties | $ | 4,077,016 | $ | 3,639,192 | |||||||

| Less accumulated depreciation | (504,498) | (443,623) | |||||||||

| Self storage properties, net | 3,572,518 | 3,195,569 | |||||||||

| Cash and cash equivalents | 22,410 | 18,723 | |||||||||

| Restricted cash | 3,565 | 2,978 | |||||||||

| Debt issuance costs, net | 2,113 | 2,496 | |||||||||

| Investment in unconsolidated real estate ventures | 195,567 | 202,533 | |||||||||

| Other assets, net | 72,399 | 68,149 | |||||||||

| Operating lease right-of-use assets | 22,674 | 23,129 | |||||||||

| Total assets | $ | 3,891,246 | $ | 3,513,577 | |||||||

| LIABILITIES AND EQUITY | |||||||||||

| Liabilities | |||||||||||

| Debt financing | $ | 2,058,573 | $ | 1,916,971 | |||||||

| Accounts payable and accrued liabilities | 48,058 | 47,043 | |||||||||

| Interest rate swap liabilities | 53,638 | 77,918 | |||||||||

| Operating lease liabilities | 24,379 | 24,756 | |||||||||

| Deferred revenue | 19,072 | 16,414 | |||||||||

| Total liabilities | 2,203,720 | 2,083,102 | |||||||||

| Equity | |||||||||||

Preferred shares of beneficial interest, par value $0.01 per share. 50,000,000 authorized, 8,736,719 and 8,732,719 issued and outstanding at June 30, 2021 and December 31, 2020, respectively, at liquidation preference |

218,418 | 218,318 | |||||||||

Common shares of beneficial interest, par value $0.01 per share. 250,000,000 shares authorized, 77,708,831 and 71,293,117 shares issued and outstanding at June 30, 2021 and December 31, 2020, respectively |

777 | 713 | |||||||||

| Additional paid-in capital | 1,244,269 | 1,050,714 | |||||||||

| Distributions in excess of earnings | (263,117) | (251,704) | |||||||||

| Accumulated other comprehensive loss | (33,046) | (49,084) | |||||||||

| Total shareholders' equity | 1,167,301 | 968,957 | |||||||||

| Noncontrolling interests | 520,225 | 461,518 | |||||||||

| Total equity | 1,687,526 | 1,430,475 | |||||||||

| Total liabilities and equity | $ | 3,891,246 | $ | 3,513,577 | |||||||

8

| Supplemental Schedule 1 | |||||||||||||||||||||||

| Funds From Operations and Core Funds From Operations | |||||||||||||||||||||||

| (in thousands, except per share and unit amounts) (unaudited) | |||||||||||||||||||||||

| Reconciliation of Net Income to FFO and Core FFO | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net income | $ | 35,675 | $ | 17,787 | $ | 63,310 | $ | 33,550 | |||||||||||||||

| Add (subtract): | |||||||||||||||||||||||

| Real estate depreciation and amortization | 35,698 | 28,955 | 67,768 | 57,719 | |||||||||||||||||||

Company's share of unconsolidated real estate venture real estate depreciation and amortization |

3,840 | 3,811 | 7,721 | 7,598 | |||||||||||||||||||

Mark-to-market changes in value on equity securities |

— | — | — | 142 | |||||||||||||||||||

Distributions to preferred shareholders and unitholders |

(3,517) | (3,514) | (7,034) | (7,028) | |||||||||||||||||||

FFO attributable to subordinated performance unitholders(1)

|

(12,093) | (6,030) | (21,255) | (14,694) | |||||||||||||||||||

FFO attributable to common shareholders, OP unitholders, and LTIP unitholders |

59,603 | 41,009 | 110,510 | 77,287 | |||||||||||||||||||

| Add: | |||||||||||||||||||||||

| Acquisition costs | 118 | 252 | 410 | 1,085 | |||||||||||||||||||

Core FFO attributable to common shareholders, OP unitholders, and LTIP unitholders |

$ | 59,721 | $ | 41,261 | $ | 110,920 | $ | 78,372 | |||||||||||||||

Weighted average shares and units outstanding - FFO and Core FFO:(2)

|

|||||||||||||||||||||||

| Weighted average shares outstanding - basic | 76,712 | 68,210 | 74,267 | 64,004 | |||||||||||||||||||

| Weighted average restricted common shares outstanding | 33 | 34 | 29 | 29 | |||||||||||||||||||

Weighted average effect of forward offering agreement(3)

|

— | — | 199 | — | |||||||||||||||||||

Weighted average OP units outstanding |

29,963 | 29,720 | 29,858 | 30,215 | |||||||||||||||||||

Weighted average DownREIT OP unit equivalents outstanding |

1,925 | 1,925 | 1,925 | 1,887 | |||||||||||||||||||

Weighted average LTIP units outstanding |

536 | 534 | 561 | 576 | |||||||||||||||||||

Total weighted average shares and units outstanding - FFO and Core FFO |

109,169 | 100,423 | 106,839 | 96,711 | |||||||||||||||||||

| FFO per share and unit | $ | 0.55 | $ | 0.41 | $ | 1.03 | $ | 0.80 | |||||||||||||||

| Core FFO per share and unit | $ | 0.55 | $ | 0.41 | $ | 1.04 | $ | 0.81 | |||||||||||||||

| (1) Amounts represent distributions declared for subordinated performance unitholders and DownREIT subordinated performance unitholders for the periods presented. | |||||||||||||||||||||||

(2) NSA combines OP units and DownREIT OP units with common shares because, after the applicable lock-out periods, OP units in the Company's operating partnership are redeemable for cash or, at NSA's option, exchangeable for common shares on a one-for-one basis and DownREIT OP units are also redeemable for cash or, at NSA's option, exchangeable for OP units in the Company's operating partnership on a one-for-one basis, subject to certain adjustments in each case. Subordinated performance units, DownREIT subordinated performance units and LTIP units may also, under certain circumstances, be convertible into or exchangeable for common shares (or other units that are convertible into or exchangeable for common shares). See footnote(4) for additional discussion of subordinated performance units, DownREIT subordinated performance units, and LTIP units in the calculation of FFO and Core FFO per share and unit.

| |||||||||||||||||||||||

| (3) Represents the dilutive effect of the forward offering from the application of the treasury stock method. | |||||||||||||||||||||||

9

| Supplemental Schedule 1 (continued) | |||||||||||||||||||||||

| Funds From Operations and Core Funds From Operations | |||||||||||||||||||||||

| (in thousands, except per share and unit amounts) (unaudited) | |||||||||||||||||||||||

| Reconciliation of Earnings (Loss) Per Share - Diluted to FFO and Core FFO Per Share and Unit | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Earnings (loss) per share - diluted | $ | 0.25 | $ | 0.10 | $ | 0.44 | $ | 0.16 | |||||||||||||||

Impact of the difference in weighted average number of shares(4)

|

0.04 | (0.03) | 0.09 | (0.06) | |||||||||||||||||||

Impact of GAAP accounting for noncontrolling interests, two-class method and treasury stock method(5)

|

— | 0.07 | — | 0.17 | |||||||||||||||||||

| Add real estate depreciation and amortization | 0.33 | 0.29 | 0.63 | 0.60 | |||||||||||||||||||

Add Company's share of unconsolidated real estate venture real estate depreciation and amortization |

0.04 | 0.04 | 0.07 | 0.08 | |||||||||||||||||||

FFO attributable to subordinated performance unitholders |

(0.11) | (0.06) | (0.20) | (0.15) | |||||||||||||||||||

FFO per share and unit |

0.55 | 0.41 | 1.03 | 0.80 | |||||||||||||||||||

Add acquisition costs |

— | — | 0.01 | 0.01 | |||||||||||||||||||

Core FFO per share and unit |

$ | 0.55 | $ | 0.41 | $ | 1.04 | $ | 0.81 | |||||||||||||||

(4) Adjustment accounts for the difference between the weighted average number of shares used to calculate diluted earnings per share and the weighted average number of shares used to calculate FFO and Core FFO per share and unit. Diluted earnings per share is calculated using the two-class method for the company's restricted common shares and the treasury stock method for certain unvested LTIP units, and assumes the conversion of vested LTIP units into OP units on a one-for-one basis and the hypothetical conversion of subordinated performance units, and DownREIT subordinated performance units into OP units, even though such units may only be convertible into OP units (i) after a lock-out period and (ii) upon certain events or conditions. For additional information about the conversion of subordinated performance units and DownREIT subordinated performance units into OP units, see Note 10 to the Company's most recent Annual Report on Form 10-K, filed with the Securities and Exchange Commission. The computation of weighted average shares and units for FFO and Core FFO per share and unit includes all restricted common shares and LTIP units that participate in distributions and excludes all subordinated performance units and DownREIT subordinated performance units because their effect has been accounted for through the allocation of FFO to the related unitholders based on distributions declared. | |||||||||||||||||||||||

(5) Represents the effect of adjusting the numerator to consolidated net income (loss) prior to GAAP allocations for noncontrolling interests, after deducting preferred share and unit distributions, and before the application of the two-class method and treasury stock method, as described in footnote(4).

| |||||||||||||||||||||||

10

| Supplemental Schedule 2 | |||||||||||||||||||||||

| Other Non-GAAP Financial Measurements | |||||||||||||||||||||||

| (dollars in thousands) (unaudited) | |||||||||||||||||||||||

| Net Operating Income | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net income | $ | 35,675 | $ | 17,787 | $ | 63,310 | $ | 33,550 | |||||||||||||||

| (Subtract) add: | |||||||||||||||||||||||

| Management fees and other revenue | (6,107) | (5,697) | (11,835) | (11,146) | |||||||||||||||||||

| General and administrative expenses | 12,450 | 10,329 | 23,688 | 21,423 | |||||||||||||||||||

| Other | 310 | 462 | 707 | 851 | |||||||||||||||||||

| Depreciation and amortization | 36,051 | 29,309 | 68,475 | 58,414 | |||||||||||||||||||

| Interest expense | 17,339 | 15,513 | 34,131 | 31,141 | |||||||||||||||||||

Equity in (earnings) losses of unconsolidated real estate ventures |

(1,174) | (52) | (1,933) | 288 | |||||||||||||||||||

| Acquisition costs | 118 | 252 | 410 | 1,085 | |||||||||||||||||||

| Income tax expense | 675 | 243 | 871 | 529 | |||||||||||||||||||

| Non-operating expense | 148 | 317 | 321 | 509 | |||||||||||||||||||

Net Operating Income |

$ | 95,485 | $ | 68,463 | $ | 178,145 | $ | 136,644 | |||||||||||||||

| EBITDA and Adjusted EBITDA | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Net income | $ | 35,675 | $ | 17,787 | $ | 63,310 | $ | 33,550 | |||||||||||||||

| Add: | |||||||||||||||||||||||

| Depreciation and amortization | 36,051 | 29,309 | 68,475 | 58,414 | |||||||||||||||||||

Company's share of unconsolidated real estate venture depreciation and amortization |

3,840 | 3,811 | 7,721 | 7,598 | |||||||||||||||||||

| Interest expense | 17,339 | 15,513 | 34,131 | 31,141 | |||||||||||||||||||

| Income tax expense | 675 | 243 | 871 | 529 | |||||||||||||||||||

EBITDA |

93,580 | 66,663 | 174,508 | 131,232 | |||||||||||||||||||

| Add (subtract): | |||||||||||||||||||||||

| Acquisition costs | 118 | 252 | 410 | 1,085 | |||||||||||||||||||

| Equity-based compensation expense | 1,348 | 1,151 | 2,634 | 1,925 | |||||||||||||||||||

Adjusted EBITDA |

$ | 95,046 | $ | 68,066 | $ | 177,552 | $ | 134,242 | |||||||||||||||

11

| Supplemental Schedule 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Summary | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of June 30, 2021 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wholly-Owned Store Data by State (Consolidated) | Total Operated Store Data by State (Consolidated & Unconsolidated) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State/Territories | Stores | Units | Rentable Square Feet | Occupancy at Period End | State/Territories | Stores | Units | Rentable Square Feet | Occupancy at Period End | |||||||||||||||||||||||||||||||||||||||||||||||

| Texas | 120 | 50,516 | 7,198,828 | 96.1 | % | Texas | 124 | 52,841 | 7,476,117 | 96.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| California | 84 | 50,211 | 6,288,782 | 98.0 | % | California | 96 | 56,851 | 7,068,549 | 98.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 64 | 25,592 | 3,252,220 | 95.1 | % | Florida | 79 | 47,237 | 5,194,572 | 96.3 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Florida | 52 | 32,133 | 3,479,684 | 96.3 | % | Oregon | 64 | 25,592 | 3,252,220 | 95.1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 52 | 23,018 | 3,113,239 | 96.5 | % | Georgia | 63 | 29,151 | 3,985,471 | 96.6 | % | |||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 34 | 15,744 | 1,952,945 | 98.4 | % | Oklahoma | 39 | 17,615 | 2,449,347 | 96.1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 33 | 17,871 | 2,061,564 | 96.1 | % | Arizona | 35 | 18,868 | 2,171,544 | 96.1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 33 | 15,293 | 2,142,332 | 96.1 | % | North Carolina | 34 | 15,744 | 1,952,945 | 98.4 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 26 | 12,322 | 1,535,582 | 92.4 | % | Louisiana | 26 | 12,322 | 1,535,582 | 92.4 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 18 | 7,810 | 975,131 | 96.0 | % | Michigan | 24 | 15,612 | 1,979,423 | 96.2 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 18 | 6,351 | 885,440 | 97.1 | % | Ohio | 23 | 13,442 | 1,630,944 | 93.7 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 16 | 8,740 | 1,133,820 | 97.1 | % | New Jersey | 20 | 13,259 | 1,580,140 | 97.5 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Washington | 16 | 5,396 | 717,813 | 93.0 | % | Colorado | 18 | 7,810 | 975,131 | 96.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Puerto Rico | 14 | 12,376 | 1,337,011 | 97.9 | % | Kansas | 18 | 6,351 | 885,440 | 97.1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 13 | 6,722 | 843,396 | 97.7 | % | Nevada | 17 | 8,339 | 1,095,778 | 98.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 13 | 5,754 | 715,366 | 95.8 | % | Indiana | 16 | 8,740 | 1,133,820 | 97.1 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Pennsylvania | 11 | 5,410 | 635,881 | 94.8 | % | Washington | 16 | 5,396 | 717,813 | 93.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Missouri | 10 | 4,514 | 586,294 | 86.5 | % | Alabama | 15 | 6,282 | 937,583 | 96.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| Ohio | 9 | 4,050 | 506,398 | 94.5 | % | Puerto Rico | 14 | 12,376 | 1,337,011 | 97.9 | % | |||||||||||||||||||||||||||||||||||||||||||||

Other(1)

|

51 | 24,509 | 3,141,816 | 95.7 | % | Pennsylvania | 14 | 7,044 | 796,651 | 95.3 | % | |||||||||||||||||||||||||||||||||||||||||||||

Total |

687 | 334,332 | 42,503,542 | 96.2 | % | Massachusetts | 13 | 8,198 | 942,449 | 95.0 | % | |||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 13 | 5,754 | 715,366 | 95.8 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Other(2)

|

83 | 43,366 | 5,401,053 | 93.9 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

Total |

864 | 438,190 | 55,214,949 | 96.1 | % | |||||||||||||||||||||||||||||||||||||||||||||||||||

(1) Other states and territories in NSA's owned portfolio as of June 30, 2021 include Alabama, Connecticut, Idaho, Illinois, Kentucky, Maryland, Massachusetts, Minnesota, Mississippi, New Jersey, New Mexico, New York, South Carolina, Tennessee and Virginia. | ||||||||||||||||||||

(2) Other states and territories in NSA's operated portfolio as of June 30, 2021 include Connecticut, Delaware, Idaho, Illinois, Kentucky, Maryland, Minnesota, Mississippi, Missouri, New Mexico, New York, Rhode Island, South Carolina, Tennessee and Virginia. | ||||||||||||||||||||

12

| Supplemental Schedule 3 (continued) | ||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Summary | ||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||

2021 Acquisition Activity |

||||||||||||||||||||||||||||||||||||||||||||

|

Self Storage Properties Acquired

During the Quarter Ended:

|

Summary of Investment | |||||||||||||||||||||||||||||||||||||||||||

| Stores | Units | Rentable Square Feet | Cash and Acquisition Costs | Value of OP Equity | Other Liabilities | Total | ||||||||||||||||||||||||||||||||||||||

| March 31, 2021 | 23 | 11,313 | 1,510,111 | $ | 141,928 | $ | 22,897 | $ | 1,138 | $ | 165,963 | |||||||||||||||||||||||||||||||||

| June 30, 2021 | 20 | 13,736 | 1,702,137 | 243,580 | 24,102 | 1,711 | 269,393 | |||||||||||||||||||||||||||||||||||||

Total Acquisitions(3)

|

43 | 25,049 | 3,212,248 | $ | 385,508 | $ | 46,999 | $ | 2,849 | $ | 435,356 | |||||||||||||||||||||||||||||||||

(3) NSA acquired self storage properties located in Arizona (1), California (2), Colorado (2), Florida (3), Georgia (6), Illinois (3), Kentucky (1), Massachusetts (1), Minnesota (1), New Hampshire (2), New Jersey (1), Ohio (1), Oregon (1), Pennsylvania (3), Puerto Rico (8), Tennessee (1), Texas (5) and Virginia (1). | ||||||||||||||||||||

13

| Supplemental Schedule 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt and Equity Capitalization | BBB Rated | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| As of June 30, 2021 | (with Positive Outlook) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (unaudited) | by Kroll Bond Rating Agency | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Debt Summary (dollars in thousands)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Effective Interest Rate(1)

|

Basis of Rate | Maturity Date | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Credit Facility: | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Revolving line of credit |

1.40% |

Variable(2)

|

January 2024 | $ | — | $ | — | $ | — | $ | 265,500 | $ | — | $ | — | $ | — | $ | — | $ | 265,500 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Term loan - Tranche A |

3.74% | Swapped To Fixed | January 2023 | — | — | 125,000 | — | — | — | — | — | 125,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Term loan - Tranche B |

2.91% | Swapped To Fixed | July 2024 | — | — | — | 250,000 | — | — | — | — | 250,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Term loan - Tranche C |

2.91% | Swapped To Fixed | January 2025 | — | — | — | — | 225,000 | — | — | — | 225,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Term loan - Tranche D |

3.57% | Swapped To Fixed | July 2026 | — | — | — | — | — | 175,000 | — | — | 175,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term loan facility - 2023 | 2.83% | Swapped To Fixed | June 2023 | — | — | 175,000 | — | — | — | — | — | 175,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term loan facility - 2028 | 4.62% | Swapped To Fixed | December 2028 | — | — | — | — | — | — | — | 75,000 | 75,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term loan facility - 2029 | 4.27% | Swapped To Fixed | April 2029 | — | — | — | — | — | — | — | 100,000 | 100,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2029 Senior Unsecured Notes | 3.98% | Fixed | August 2029 | — | — | — | — | — | — | — | 100,000 | 100,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2030 Senior Unsecured Notes | 2.99% | Fixed | August 2030 | — | — | — | — | — | — | — | 150,000 | 150,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| August 2031 Senior Unsecured Notes | 4.08% | Fixed | August 2031 | — | — | — | — | — | — | — | 50,000 | 50,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2032 Senior Unsecured Notes | 3.09% | Fixed | August 2032 | — | — | — | — | — | — | — | 100,000 | 100,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2033 Senior Unsecured Notes | 3.10% | Fixed | May 2033 | — | — | — | — | — | — | — | 55,000 | 55,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fixed rate mortgages payable | 4.24% | Fixed | April 2023 - October 2031 | — | — | 78,414 | 20,156 | — | — | 84,900 | 34,571 | 218,041 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Principal/Weighted Average |

3.19% | 5.1 years | $ | — | $ | — | $ | 378,414 | $ | 535,656 | $ | 225,000 | $ | 175,000 | $ | 84,900 | $ | 664,571 | $ | 2,063,541 | |||||||||||||||||||||||||||||||||||||||||||||||||||

Unamortized debt issuance costs and debt premium, net |

(4,968) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Total Debt |

$ | 2,058,573 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debt Ratios | |||||||||||||||||

Covenant |

Amount |

||||||||||||||||

| Net Debt to Annualized Current Quarter Adjusted EBITDA | n/a | 5.4x | |||||||||||||||

Trailing Twelve Month Fixed Charge Coverage Ratio |

> 1.5x | 3.6x | |||||||||||||||

| Total Leverage Ratio | < 60.0% | 40.5% | |||||||||||||||

(1) Effective interest rate incorporates the stated rate plus the impact of interest rate cash flow hedges and discount and premium amortization, if applicable. | |||||||||||||||||

(2) For the $500 million revolving line of credit, the effective interest rate is calculated based on one month LIBOR plus an applicable margin of 1.30% and excludes fees which range from 0.15% to 0.20% for unused borrowings. | |||||||||||||||||

14

| Supplemental Schedule 4 (continued) | |||||||||||||||||

| Debt and Equity Capitalization | |||||||||||||||||

| As of June 30, 2021 | |||||||||||||||||

| (unaudited) | |||||||||||||||||

| Preferred Shares and Units | |||||||||||

| Outstanding | |||||||||||

| 6.000% Series A cumulative redeemable preferred shares of beneficial interest | 8,736,719 | ||||||||||

| 6.000% Series A-1 cumulative redeemable preferred units | 633,382 | ||||||||||

| Common Shares and Units | |||||||||||

| Outstanding | If Converted | ||||||||||

| Common shares of beneficial interest | 77,666,115 | 77,666,115 | |||||||||

| Restricted common shares | 42,716 | 42,716 | |||||||||

Total shares outstanding |

77,708,831 | 77,708,831 | |||||||||

| Operating partnership units | 30,069,539 | 30,069,539 | |||||||||

DownREIT operating partnership unit equivalents |

1,924,918 | 1,924,918 | |||||||||

Total operating partnership units |

31,994,457 | 31,994,457 | |||||||||

Long-term incentive plan units(3)

|

525,468 | 525,468 | |||||||||

Total shares and Class A equivalents outstanding |

110,228,756 | 110,228,756 | |||||||||

Subordinated performance units(4)

|

9,510,894 | 13,410,361 | |||||||||

DownREIT subordinated performance unit equivalents(4)

|

4,337,111 | 6,115,327 | |||||||||

Total subordinated partnership units |

13,848,005 | 19,525,688 | |||||||||

Total common shares and units outstanding |

124,076,761 | 129,754,444 | |||||||||

(3) Balances exclude 252,894 long-term incentive plan ("LTIP") units which only vest and participate in dividend distributions upon the future contribution of properties from the PROs or the completion of expansion projects. | |||||||||||

(4) If converted balance assumes that each subordinated performance unit (including each DownREIT subordinated performance unit) is convertible into OP units, notwithstanding the two-year lock-out period on conversions for certain series of subordinated performance units, and that each subordinated performance unit would on average convert on a hypothetical basis into an estimated 1.41 OP units based on historical financial information for the trailing twelve months ended June 30, 2021. The hypothetical conversions are calculated by dividing the average cash available for distribution, or CAD, per subordinated performance unit by 110% of the CAD per OP unit over the same period. The Company anticipates that as CAD grows over time, the conversion ratio will also grow, including to levels that may exceed these amounts. | |||||||||||

15

| Supplemental Schedule 5 | ||||||||||||||

| Summarized Information for Unconsolidated Real Estate Ventures | ||||||||||||||

| (dollars in thousands) (unaudited) | ||||||||||||||

| Combined Balance Sheet Information | ||||||||||||||

Total Ventures at 100%(1)

|

June 30, 2021 | December 31, 2020 | ||||||||||||

| ASSETS | ||||||||||||||

| Self storage properties, net | $ | 1,769,759 | $ | 1,799,522 | ||||||||||

| Other assets | 25,969 | 24,397 | ||||||||||||

| Total assets | $ | 1,795,728 | $ | 1,823,919 | ||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Debt financing | $ | 1,000,916 | $ | 1,000,464 | ||||||||||

| Other liabilities | 20,951 | 21,612 | ||||||||||||

| Equity | 773,861 | 801,843 | ||||||||||||

| Total liabilities and equity | $ | 1,795,728 | $ | 1,823,919 | ||||||||||

| Combined Operating Information | ||||||||||||||||||||||||||

| Three Months Ended June 30, 2021 | Six Months Ended June 30, 2021 | |||||||||||||||||||||||||

Total Ventures at 100%(1)

|

NSA Proportionate Share (Ventures at 25%)(2)

|

Total Ventures at 100%(1)

|

NSA Proportionate Share (Ventures at 25%)(2)

|

|||||||||||||||||||||||

| Total revenue | $ | 46,086 | $ | 11,522 | $ | 89,781 | $ | 22,445 | ||||||||||||||||||

| Property operating expenses | 12,523 | 3,131 | 24,311 | 6,078 | ||||||||||||||||||||||

| Net operating income | 33,563 | 8,391 | 65,470 | 16,367 | ||||||||||||||||||||||

Supervisory, administrative and other expenses |

(3,014) | (754) | (5,896) | (1,474) | ||||||||||||||||||||||

| Depreciation and amortization | (15,360) | (3,840) | (30,882) | (7,721) | ||||||||||||||||||||||

| Interest expense | (10,415) | (2,604) | (20,820) | (5,205) | ||||||||||||||||||||||

| Acquisition and other expenses | (136) | (34) | (257) | (64) | ||||||||||||||||||||||

| Net income | $ | 4,638 | $ | 1,159 | $ | 7,615 | $ | 1,903 | ||||||||||||||||||

| Add (subtract): | ||||||||||||||||||||||||||

Equity in earnings adjustments related to amortization of basis differences |

15 | 30 | ||||||||||||||||||||||||

Company's share of unconsolidated real estate venture real estate depreciation and amortization |

3,840 | 7,721 | ||||||||||||||||||||||||

Company's share of FFO and Core FFO from unconsolidated real estate ventures |

$ | 5,014 | $ | 9,654 | ||||||||||||||||||||||

(1) Values represent entire unconsolidated real estate ventures at 100%, not NSA's proportionate share. NSA's ownership in each of the unconsolidated real estate ventures is 25%. | |||||||||||||||||||||||

(2) NSA's proportionate share of its unconsolidated real estate ventures is derived by applying NSA's 25% ownership interest to each line item in the GAAP financial statements of the unconsolidated real estate ventures to calculate NSA's share of that line item. NSA believes this information offers insights into the financial performance of the Company, although the presentation of such information, and its combination with NSA's consolidated results, may not accurately depict the legal and economic implications of holding a noncontrolling interest in the unconsolidated real estate ventures. The operating agreements of the unconsolidated real estate ventures provide for the distribution of net cash flow to the unconsolidated real estate ventures' investors no less than monthly, generally in proportion to the investors’ respective ownership interests, subject to a promoted distribution to NSA upon the achievement of certain performance benchmarks by the non-NSA investor. | |||||||||||||||||||||||

16

| Supplemental Schedule 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Store Performance Summary By State | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands, except per square foot data) (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2021 compared to Three Months Ended June 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Revenue | Property Operating Expenses | Net Operating Income | Net Operating Income Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State | Stores | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | 81 | $ | 21,705 | $ | 18,864 | 15.1 | % | $ | 5,298 | $ | 5,143 | 3.0 | % | $ | 16,407 | $ | 13,721 | 19.6 | % | 75.6 | % | 72.7 | % | 2.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Texas | 69 | 10,713 | 9,286 | 15.4 | % | 3,518 | 3,397 | 3.6 | % | 7,195 | 5,889 | 22.2 | % | 67.2 | % | 63.4 | % | 3.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 61 | 11,711 | 9,542 | 22.7 | % | 2,575 | 2,584 | (0.3) | % | 9,136 | 6,958 | 31.3 | % | 78.0 | % | 72.9 | % | 5.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Florida | 45 | 11,290 | 9,483 | 19.1 | % | 3,128 | 2,942 | 6.3 | % | 8,162 | 6,541 | 24.8 | % | 72.3 | % | 69.0 | % | 3.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 44 | 6,714 | 5,930 | 13.2 | % | 1,909 | 1,833 | 4.1 | % | 4,805 | 4,097 | 17.3 | % | 71.6 | % | 69.1 | % | 2.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 33 | 5,526 | 4,902 | 12.7 | % | 1,405 | 1,380 | 1.8 | % | 4,121 | 3,522 | 17.0 | % | 74.6 | % | 71.8 | % | 2.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 31 | 6,529 | 5,528 | 18.1 | % | 1,667 | 1,606 | 3.8 | % | 4,862 | 3,922 | 24.0 | % | 74.5 | % | 70.9 | % | 3.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 30 | 4,121 | 3,702 | 11.3 | % | 1,137 | 1,090 | 4.3 | % | 2,984 | 2,612 | 14.2 | % | 72.4 | % | 70.6 | % | 1.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 26 | 3,999 | 3,579 | 11.7 | % | 1,267 | 1,153 | 9.9 | % | 2,732 | 2,426 | 12.6 | % | 68.3 | % | 67.8 | % | 0.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 16 | 2,875 | 2,529 | 13.7 | % | 800 | 848 | (5.7) | % | 2,075 | 1,681 | 23.4 | % | 72.2 | % | 66.5 | % | 5.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 16 | 2,397 | 2,151 | 11.4 | % | 799 | 775 | 3.1 | % | 1,598 | 1,376 | 16.1 | % | 66.7 | % | 64.0 | % | 2.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington | 14 | 2,051 | 1,772 | 15.7 | % | 516 | 525 | (1.7) | % | 1,535 | 1,247 | 23.1 | % | 74.8 | % | 70.4 | % | 4.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 13 | 2,686 | 2,210 | 21.5 | % | 625 | 594 | 5.2 | % | 2,061 | 1,616 | 27.5 | % | 76.7 | % | 73.1 | % | 3.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 11 | 1,926 | 1,702 | 13.2 | % | 609 | 563 | 8.2 | % | 1,317 | 1,139 | 15.6 | % | 68.4 | % | 66.9 | % | 1.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 10 | 1,925 | 1,621 | 18.8 | % | 534 | 508 | 5.1 | % | 1,391 | 1,113 | 25.0 | % | 72.3 | % | 68.7 | % | 3.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other(1)

|

60 | 11,214 | 9,526 | 17.7 | % | 3,072 | 2,735 | 12.3 | % | 8,142 | 6,791 | 19.9 | % | 72.6 | % | 71.3 | % | 1.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 560 | $ | 107,382 | $ | 92,327 | 16.3 | % | $ | 28,859 | $ | 27,676 | 4.3 | % | $ | 78,523 | $ | 64,651 | 21.5 | % | 73.1 | % | 70.0 | % | 3.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

2020 Same Store Pool(2)

|

496 | $ | 95,300 | $ | 82,231 | 15.9 | % | $ | 25,486 | $ | 24,459 | 4.2 | % | $ | 69,814 | $ | 57,772 | 20.8 | % | 73.3 | % | 70.3 | % | 3.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

2019 Same Store Pool(3)

|

434 | $ | 83,214 | $ | 71,795 | 15.9 | % | $ | 22,249 | $ | 21,399 | 4.0 | % | $ | 60,965 | $ | 50,396 | 21.0 | % | 73.3 | % | 70.2 | % | 3.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Other states and territories in NSA's same store portfolio include Alabama, Idaho, Illinois, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, New Mexico, Ohio, Pennsylvania, South Carolina, Virginia and Puerto Rico. | ||||||||||||||||||||

| (2) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2020. | ||||||||||||||||||||

| (3) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2019. | ||||||||||||||||||||

17

| Supplemental Schedule 6 (continued) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Store Performance Summary By State | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands, except per square foot data) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2021 compared to Three Months Ended June 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rentable Square Feet | Occupancy at Period End | Average Occupancy | Average Annualized Rental Revenue per Occupied Square Foot | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State | Units | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | 48,216 | 6,059,193 | 98.0 | % | 91.3 | % | 6.7 | % | 97.5 | % | 89.8 | % | 7.7 | % | $ | 14.00 | $ | 13.22 | 5.9 | % | ||||||||||||||||||||||||||||||||||||||||||

| Texas | 28,350 | 4,065,983 | 96.8 | % | 88.9 | % | 7.9 | % | 95.4 | % | 87.3 | % | 8.1 | % | 10.70 | 10.18 | 5.1 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 24,497 | 3,105,370 | 95.2 | % | 86.2 | % | 9.0 | % | 93.4 | % | 83.0 | % | 10.4 | % | 15.78 | 14.49 | 8.9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Florida | 26,693 | 2,941,569 | 96.8 | % | 87.3 | % | 9.5 | % | 95.4 | % | 86.3 | % | 9.1 | % | 15.40 | 14.48 | 6.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 19,013 | 2,547,009 | 97.5 | % | 88.8 | % | 8.7 | % | 95.7 | % | 87.7 | % | 8.0 | % | 10.65 | 10.31 | 3.3 | % | ||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 15,355 | 1,885,404 | 98.5 | % | 93.3 | % | 5.2 | % | 97.5 | % | 91.6 | % | 5.9 | % | 11.58 | 10.92 | 6.0 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 16,930 | 1,929,415 | 95.9 | % | 89.1 | % | 6.8 | % | 95.0 | % | 88.4 | % | 6.6 | % | 13.82 | 12.64 | 9.3 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 13,766 | 1,898,912 | 96.8 | % | 91.7 | % | 5.1 | % | 95.3 | % | 89.8 | % | 5.5 | % | 8.85 | 8.38 | 5.6 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 12,322 | 1,535,582 | 92.4 | % | 84.3 | % | 8.1 | % | 90.3 | % | 83.7 | % | 6.6 | % | 11.24 | 10.86 | 3.5 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 8,740 | 1,133,820 | 97.1 | % | 93.1 | % | 4.0 | % | 96.4 | % | 90.8 | % | 5.6 | % | 10.25 | 9.55 | 7.3 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 5,671 | 752,114 | 96.9 | % | 92.1 | % | 4.8 | % | 95.1 | % | 90.6 | % | 4.5 | % | 12.57 | 11.65 | 7.9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Washington | 4,494 | 578,723 | 92.6 | % | 84.2 | % | 8.4 | % | 91.0 | % | 81.6 | % | 9.4 | % | 15.26 | 14.76 | 3.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 6,722 | 843,396 | 97.7 | % | 92.1 | % | 5.6 | % | 96.3 | % | 90.6 | % | 5.7 | % | 12.56 | 11.00 | 14.2 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 5,035 | 614,106 | 97.0 | % | 89.9 | % | 7.1 | % | 96.1 | % | 87.4 | % | 8.7 | % | 12.78 | 12.36 | 3.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 4,452 | 542,116 | 96.7 | % | 93.7 | % | 3.0 | % | 95.5 | % | 91.8 | % | 3.7 | % | 14.46 | 12.75 | 13.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

Other(1)

|

28,358 | 3,526,325 | 96.5 | % | 89.1 | % | 7.4 | % | 94.9 | % | 87.5 | % | 7.4 | % | 12.91 | 11.99 | 7.7 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 268,614 | 33,959,037 | 96.7 | % | 89.5 | % | 7.2 | % | 95.4 | % | 87.8 | % | 7.6 | % | $ | 12.78 | $ | 11.97 | 6.8 | % | ||||||||||||||||||||||||||||||||||||||||||

2020 Same Store Pool(2)

|

238,409 | 30,070,796 | 96.8 | % | 89.8 | % | 7.0 | % | 95.5 | % | 88.1 | % | 7.4 | % | $ | 12.78 | $ | 11.98 | 6.7 | % | ||||||||||||||||||||||||||||||||||||||||||

2019 Same Store Pool(3)

|

208,279 | 26,645,388 | 96.8 | % | 89.9 | % | 6.9 | % | 95.6 | % | 88.1 | % | 7.5 | % | $ | 12.59 | $ | 11.81 | 6.6 | % | ||||||||||||||||||||||||||||||||||||||||||

| (1) Other states and territories in NSA's same store portfolio include Alabama, Idaho, Illinois, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, New Mexico, Ohio, Pennsylvania, South Carolina, Virginia and Puerto Rico. | ||||||||||||||||||||

| (2) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2020. | ||||||||||||||||||||

| (3) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2019. | ||||||||||||||||||||

18

| Supplemental Schedule 6 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Store Performance Summary By State | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands, except per square foot data) (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2021 compared to Six Months Ended June 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Revenue | Property Operating Expenses | Net Operating Income | Net Operating Income Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State | Stores | YTD 2021 | YTD 2020 | Growth | YTD 2021 | YTD 2020 | Growth | YTD 2021 | YTD 2020 | Growth | YTD 2021 | YTD 2020 | Growth | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | 81 | $ | 42,477 | $ | 38,085 | 11.5 | % | $ | 10,728 | $ | 10,572 | 1.5 | % | $ | 31,749 | $ | 27,513 | 15.4 | % | 74.7 | % | 72.2 | % | 2.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Texas | 69 | 20,810 | 18,741 | 11.0 | % | 7,005 | 6,730 | 4.1 | % | 13,805 | 12,011 | 14.9 | % | 66.3 | % | 64.1 | % | 2.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 61 | 22,617 | 19,176 | 17.9 | % | 5,174 | 5,148 | 0.5 | % | 17,443 | 14,028 | 24.3 | % | 77.1 | % | 73.2 | % | 3.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Florida | 45 | 21,949 | 19,239 | 14.1 | % | 6,112 | 5,910 | 3.4 | % | 15,837 | 13,329 | 18.8 | % | 72.2 | % | 69.3 | % | 2.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 44 | 12,975 | 11,981 | 8.3 | % | 3,875 | 3,788 | 2.3 | % | 9,100 | 8,193 | 11.1 | % | 70.1 | % | 68.4 | % | 1.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 33 | 10,791 | 9,905 | 8.9 | % | 2,822 | 2,825 | (0.1) | % | 7,969 | 7,080 | 12.6 | % | 73.8 | % | 71.5 | % | 2.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 31 | 12,720 | 11,085 | 14.7 | % | 3,316 | 3,183 | 4.2 | % | 9,404 | 7,902 | 19.0 | % | 73.9 | % | 71.3 | % | 2.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 30 | 8,053 | 7,421 | 8.5 | % | 2,269 | 2,275 | (0.3) | % | 5,784 | 5,146 | 12.4 | % | 71.8 | % | 69.3 | % | 2.5 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 26 | 7,781 | 7,208 | 7.9 | % | 2,469 | 2,313 | 6.7 | % | 5,312 | 4,895 | 8.5 | % | 68.3 | % | 67.9 | % | 0.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 16 | 5,592 | 5,069 | 10.3 | % | 1,645 | 1,644 | 0.1 | % | 3,947 | 3,425 | 15.2 | % | 70.6 | % | 67.6 | % | 3.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 16 | 4,634 | 4,301 | 7.7 | % | 1,629 | 1,564 | 4.2 | % | 3,005 | 2,737 | 9.8 | % | 64.8 | % | 63.6 | % | 1.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Washington | 14 | 3,976 | 3,544 | 12.2 | % | 1,034 | 1,061 | (2.5) | % | 2,942 | 2,483 | 18.5 | % | 74.0 | % | 70.1 | % | 3.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 13 | 5,218 | 4,554 | 14.6 | % | 1,261 | 1,253 | 0.6 | % | 3,957 | 3,301 | 19.9 | % | 75.8 | % | 72.5 | % | 3.3 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 11 | 3,727 | 3,405 | 9.5 | % | 1,174 | 1,121 | 4.7 | % | 2,553 | 2,284 | 11.8 | % | 68.5 | % | 67.1 | % | 1.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 10 | 3,762 | 3,257 | 15.5 | % | 1,133 | 1,075 | 5.4 | % | 2,629 | 2,182 | 20.5 | % | 69.9 | % | 67.0 | % | 2.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Other(1)

|

60 | 21,817 | 19,230 | 13.5 | % | 6,046 | 5,875 | 2.9 | % | 15,771 | 13,355 | 18.1 | % | 72.3 | % | 69.4 | % | 2.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 560 | $ | 208,899 | $ | 186,201 | 12.2 | % | $ | 57,692 | $ | 56,337 | 2.4 | % | $ | 151,207 | $ | 129,864 | 16.4 | % | 72.4 | % | 69.7 | % | 2.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

2020 Same Store Pool(2)

|

496 | $ | 185,462 | $ | 165,957 | 11.8 | % | $ | 50,878 | $ | 49,890 | 2.0 | % | $ | 134,584 | $ | 116,067 | 16.0 | % | 72.6 | % | 69.9 | % | 2.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

2019 Same Store Pool(3)

|

434 | $ | 161,933 | $ | 144,970 | 11.7 | % | $ | 44,590 | $ | 43,610 | 2.2 | % | $ | 117,343 | $ | 101,360 | 15.8 | % | 72.5 | % | 69.9 | % | 2.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| (1) Other states and territories in NSA's same store portfolio include Alabama, Idaho, Illinois, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, New Mexico, Ohio, Pennsylvania, South Carolina, Virginia and Puerto Rico. | ||||||||||||||||||||

| (2) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2020. | ||||||||||||||||||||

| (3) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2019. | ||||||||||||||||||||

19

| Supplemental Schedule 6 (continued) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Same Store Performance Summary By State | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands, except per square foot data) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2021 compared to Six Months Ended June 30, 2020 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Rentable Square Feet | Occupancy at Period End | Average Occupancy | Average Annualized Rental Revenue per Occupied Square Foot | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| State | Units | YTD 2021 | YTD 2020 | Growth | YTD 2021 | YTD 2020 | Growth | YTD 2021 | YTD 2020 | Growth | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| California | 48,216 | 6,059,193 | 98.0 | % | 91.3 | % | 6.7 | % | 96.8 | % | 89.4 | % | 7.4 | % | $ | 13.78 | $ | 13.42 | 2.7 | % | ||||||||||||||||||||||||||||||||||||||||||

| Texas | 28,350 | 4,065,983 | 96.8 | % | 88.9 | % | 7.9 | % | 93.5 | % | 87.1 | % | 6.4 | % | 10.59 | 10.27 | 3.1 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Oregon | 24,497 | 3,105,370 | 95.2 | % | 86.2 | % | 9.0 | % | 91.6 | % | 82.0 | % | 9.6 | % | 15.57 | 14.74 | 5.6 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Florida | 26,693 | 2,941,569 | 96.8 | % | 87.3 | % | 9.5 | % | 94.1 | % | 86.5 | % | 7.6 | % | 15.20 | 14.65 | 3.8 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Georgia | 19,013 | 2,547,009 | 97.5 | % | 88.8 | % | 8.7 | % | 94.0 | % | 87.6 | % | 6.4 | % | 10.48 | 10.42 | 0.6 | % | ||||||||||||||||||||||||||||||||||||||||||||

| North Carolina | 15,355 | 1,885,404 | 98.5 | % | 93.3 | % | 5.2 | % | 96.1 | % | 91.1 | % | 5.0 | % | 11.47 | 11.10 | 3.3 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Arizona | 16,930 | 1,929,415 | 95.9 | % | 89.1 | % | 6.8 | % | 93.7 | % | 87.9 | % | 5.8 | % | 13.67 | 12.74 | 7.3 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma | 13,766 | 1,898,912 | 96.8 | % | 91.7 | % | 5.1 | % | 94.1 | % | 88.9 | % | 5.2 | % | 8.75 | 8.50 | 2.9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Louisiana | 12,322 | 1,535,582 | 92.4 | % | 84.3 | % | 8.1 | % | 88.4 | % | 83.9 | % | 4.5 | % | 11.17 | 10.91 | 2.4 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Indiana | 8,740 | 1,133,820 | 97.1 | % | 93.1 | % | 4.0 | % | 95.3 | % | 90.3 | % | 5.0 | % | 10.09 | 9.64 | 4.7 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Kansas | 5,671 | 752,114 | 96.9 | % | 92.1 | % | 4.8 | % | 92.6 | % | 89.1 | % | 3.5 | % | 12.43 | 11.85 | 4.9 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Washington | 4,494 | 578,723 | 92.6 | % | 84.2 | % | 8.4 | % | 89.7 | % | 80.8 | % | 8.9 | % | 14.99 | 14.90 | 0.6 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Nevada | 6,722 | 843,396 | 97.7 | % | 92.1 | % | 5.6 | % | 95.3 | % | 90.4 | % | 4.9 | % | 12.33 | 11.36 | 8.5 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Colorado | 5,035 | 614,106 | 97.0 | % | 89.9 | % | 7.1 | % | 94.2 | % | 86.2 | % | 8.0 | % | 12.60 | 12.56 | 0.3 | % | ||||||||||||||||||||||||||||||||||||||||||||

| New Hampshire | 4,452 | 542,116 | 96.7 | % | 93.7 | % | 3.0 | % | 94.8 | % | 91.0 | % | 3.8 | % | 14.25 | 12.94 | 10.1 | % | ||||||||||||||||||||||||||||||||||||||||||||

Other(1)

|

28,358 | 3,526,325 | 96.5 | % | 89.1 | % | 7.4 | % | 93.3 | % | 87.4 | % | 5.9 | % | 12.83 | 12.13 | 5.8 | % | ||||||||||||||||||||||||||||||||||||||||||||

| Total/Weighted Average | 268,614 | 33,959,037 | 96.7 | % | 89.5 | % | 7.2 | % | 94.0 | % | 87.4 | % | 6.6 | % | $ | 12.62 | $ | 12.12 | 4.1 | % | ||||||||||||||||||||||||||||||||||||||||||

2020 Same Store Pool(2)

|

238,409 | 30,070,796 | 96.8 | % | 89.8 | % | 7.0 | % | 94.1 | % | 87.7 | % | 6.4 | % | $ | 12.62 | $ | 12.15 | 3.9 | % | ||||||||||||||||||||||||||||||||||||||||||

2019 Same Store Pool(3)

|

208,279 | 26,645,388 | 96.8 | % | 89.9 | % | 6.9 | % | 94.2 | % | 87.8 | % | 6.4 | % | $ | 12.42 | $ | 11.97 | 3.8 | % | ||||||||||||||||||||||||||||||||||||||||||

| (1) Other states and territories in NSA's same store portfolio include Alabama, Idaho, Illinois, Kentucky, Maryland, Massachusetts, Mississippi, Missouri, New Jersey, New Mexico, Ohio, Pennsylvania, South Carolina, Virginia and Puerto Rico. | ||||||||||||||||||||

| (2) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2020. | ||||||||||||||||||||

| (3) Represents the subset of properties included in the 2021 same store pool that were in NSA's same store pool reported in 2019. | ||||||||||||||||||||

20

| Supplemental Schedule 7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Same Store Performance Summary By MSA(1)

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands, except per square foot data) (unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2021 compared to Three Months Ended June 30, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Revenue | Property Operating Expenses | Net Operating Income | Net Operating Income Margin | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

MSA(1)

|

Stores | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | 2Q 2021 | 2Q 2020 | Growth | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portland-Vancouver-Hillsboro, OR-WA | 47 | $ | 8,871 | $ | 7,485 | 18.5 | % | $ | 1,979 | $ | 2,012 | (1.6) | % | $ | 6,892 | $ | 5,473 | 25.9 | % | 77.7 | % | 73.1 | % | 4.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Riverside-San Bernardino-Ontario, CA | 46 | 10,829 | 9,371 | 15.6 | % | 2,380 | 2,333 | 2.0 | % | 8,449 | 7,038 | 20.0 | % | 78.0 | % | 75.1 | % | 2.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Atlanta-Sandy Springs-Roswell, GA | 30 | 4,858 | 4,261 | 14.0 | % | 1,367 | 1,286 | 6.3 | % | 3,491 | 2,975 | 17.3 | % | 71.9 | % | 69.8 | % | 2.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Phoenix-Mesa-Scottsdale, AZ | 24 | 5,286 | 4,533 | 16.6 | % | 1,339 | 1,299 | 3.1 | % | 3,947 | 3,234 | 22.0 | % | 74.7 | % | 71.3 | % | 3.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Oklahoma City, OK | 17 | 2,312 | 2,057 | 12.4 | % | 664 | 636 | 4.4 | % | 1,648 | 1,421 | 16.0 | % | 71.3 | % | 69.1 | % | 2.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Dallas-Fort Worth-Arlington, TX | 16 | 2,142 | 1,925 | 11.3 | % | 814 | 790 | 3.0 | % | 1,328 | 1,135 | 17.0 | % | 62.0 | % | 59.0 | % | 3.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Indianapolis-Carmel-Anderson, IN | 16 | 2,875 | 2,529 | 13.7 | % | 800 | 848 | (5.7) | % | 2,075 | 1,681 | 23.4 | % | 72.2 | % | 66.5 | % | 5.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Los Angeles-Long Beach-Anaheim, CA | 14 | 5,387 | 4,745 | 13.5 | % | 1,322 | 1,303 | 1.5 | % | 4,065 | 3,442 | 18.1 | % | 75.5 | % | 72.5 | % | 3.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| North Port-Sarasota-Bradenton, FL | 13 | 3,596 | 2,958 | 21.6 | % | 957 | 886 | 8.0 | % | 2,639 | 2,072 | 27.4 | % | 73.4 | % | 70.0 | % | 3.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Orleans-Metairie, LA | 13 | 2,210 | 1,925 | 14.8 | % | 627 | 601 | 4.3 | % | 1,583 | 1,324 | 19.6 | % | 71.6 | % | 68.8 | % | 2.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tulsa, OK | 13 | 1,809 | 1,645 | 10.0 | % | 473 | 455 | 4.0 | % | 1,336 | 1,190 | 12.3 | % | 73.9 | % | 72.3 | % | 1.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Las Vegas-Henderson-Paradise, NV | 12 | 2,560 | 2,104 | 21.7 | % | 591 | 561 | 5.3 | % | 1,969 | 1,543 | 27.6 | % | 76.9 | % | 73.3 | % | 3.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||