EX-10.1

Published on May 5, 2022

Exhibit 10.1

THE SECURITIES WHICH ARE THE SUBJECT OF THIS AGREEMENT HAVE BEEN ACQUIRED FOR INVESTMENT AND NOT WITH A VIEW TO, OR IN CONNECTION WITH, THE SALE OR DISTRIBUTION THEREOF. NO SUCH SALE OR DISPOSITION MAY BE EFFECTED WITHOUT AN EFFECTIVE REGISTRATION STATEMENT RELATED THERETO OR AN OPINION OF COUNSEL SATISFACTORY TO THE COMPANY THAT SUCH REGISTRATION IS NOT REQUIRED UNDER THE SECURITIES ACT OF 1933.

National Storage Affiliates Trust

Form of LTIP Unit Award Agreement

1. Grant of LTIP Units.

[] (the “Grantee”), is hereby awarded [] LTIP Units (the “LTIP Units”) in NSA OP, LP (the “Partnership”), by National Storage Affiliates Trust, in its sole capacity as general partner of the Partnership, on the date hereof subject to the terms and conditions of this 20[] LTIP Unit Award Agreement (this “Agreement”) and subject to the provisions of the National Storage Affiliates Trust 2015 Equity Incentive Plan (the “Plan”) and the Third Amended and Restated Limited Partnership Agreement of the Partnership, dated as of April 28, 2015 (as amended, the “Partnership Agreement”). The Plan is hereby incorporated herein by reference as though set forth herein in its entirety. Definitions not included herein shall have the meaning set forth in the Plan and Partnership Agreement, as applicable.

2. Restrictions and Conditions.

The LTIP Units are subject to the following restrictions and conditions, in addition to any requirements or restrictions set forth with respect to LTIP Units in the Plan and the Partnership Agreement:

(a) [] LTIP Units shall vest as specified in Annex A attached hereto (the "Time Vested LTIP Units") and [] LTIP Units, representing the maximum number of LTIP Units that can vest based on performance, shall vest as specified in Annex B attached hereto (the "Performance Vested LTIP Units"). Subject to paragraph 5(b) below, during the period prior to the full vesting of any LTIP Unit (the "Vesting Period"), the Grantee shall not be permitted voluntarily or involuntarily to sell, transfer, pledge, anticipate, alienate, encumber or assign such LTIP Unit (or have such LTIP Unit attached or garnished).

(b) Except as provided in the foregoing paragraph (a), below in this paragraph (b) or in the Plan, the Grantee shall have, in respect of the LTIP Units, all of the rights of a holder of LTIP Units as set forth in the Partnership Agreement. Distributions and allocations with respect to the LTIP Units shall be made to the Grantee in accordance with the terms of the Partnership Agreement, except that the Grantee, during the Vesting Period, shall be entitled to receive distributions (1) with respect to each Time Vested LTIP Unit, equal to and concurrently with each distribution paid to a holder of a Class A OP Unit as distributions on Class A OP Units are made and (2) with respect to each Performance Vested LTIP Unit at the "Maximum Level" (as set forth on Annex B), equal to ten percent (10%) of the distributions payable with respect to each distribution paid to a holder of a Class A OP Unit as distributions on Class A OP Units are made (the "Interim Distributions"). Upon the completion of the Vesting Period, Grantee shall be entitled to receive an amount equal to (1) the distributions payable during the Vesting Period with respect to a number of Class A OP Units of the Company that is identical to the actual number of Performance Vested LTIP Units earned pursuant to Annex B, less (2) the amount of the Interim Distributions (such amount, the "Performance Distribution"). After the completion of the Vesting Period, Grantee shall be entitled to receive distributions on each vested LTIP Unit equal to distributions paid to a holder of a Class A OP Unit as distributions on Class A OP Units are made.

(c) Subject to paragraphs (d), (e) and (f) below, if the Grantee has a Termination of Service prior to the completion of the Vesting Period (i) without Cause (as defined in Grantee's employment

agreement with the Company dated [](the "Employment Agreement")), (ii) for Good Reason (as defined in the Employment Agreement), (iii) by reason of the Grantee's death or (iv) on account of the Grantee's Disability (as defined in the Employment Agreement) prior to the completion of the Vesting Period, then upon the completion of the Vesting Period, (1) the Grantee shall receive a prorated number of the Performance Vested LTIP Units calculated by multiplying the number of the Performance Vested LTIP Units that would have been awarded upon the completion of the Vesting Period if Grantee had not had a Termination of Service prior to the completion of the Vesting Period by a fraction (the "Termination Fraction") the numerator of which is (y) the number of calendar days that elapsed from the beginning of the Vesting Period to and including the date of the Grantee’s Termination of Service, and the denominator of which is (z) the number of calendar days in the Vesting Period, (2) the Grantee shall receive a prorated amount of the Performance Distribution calculated by multiplying the amount of the Performance Distribution that would have been paid upon the completion of the Vesting Period if Grantee had not had a Termination of Service prior to the completion of the Vesting Period (as calculated under paragraph 2(b) above) by the Termination Fraction, and (3) the outstanding Time Vested LTIP Units shall immediately vest. Notwithstanding the foregoing or any provisions of the Employment Agreement, in the event of such a Termination of Service following a Change of Control which occurs after June 30, 20[], then the number of Performance Vested LTIP Units that shall vest shall be calculated in the same manner as set forth in this paragraph (c) without being subject to proration.

(d) Upon the completion of the Vesting Period, or, if earlier, the Grantee's Termination of Service for any reason other than as specified above in paragraph (c), all LTIP Units granted hereunder that have not vested will be forfeited without payment of any consideration, and neither the Grantee nor his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such LTIP Units.

(e) If the Grantee commences or continues service as a director or consultant of the Company upon termination of employment, such continued service shall be treated as continued employment hereunder (and for purposes of the Plan), and the subsequent termination of service shall be treated as the applicable Termination of Service for purposes of this Agreement.

(f) If the Grantee's Employment Agreement provides that LTIP Units subject to restriction shall be subject to terms other than those set forth above, the terms of the Employment Agreement shall apply with respect to such LTIP Units granted hereby and shall, to the extent applicable, supersede the terms hereof.

(g) For purposes of this Agreement, a Termination of Service shall occur when the employee-employer relationship or trusteeship, or other service relationship, between the Grantee and the Company is terminated for any reason, including, but not limited to, any termination by resignation, discharge, death or retirement under the Employment Agreement. The Compensation Committee, in its absolute discretion, shall determine the effects of all matters and questions relating to termination of service. For this purpose, the service relationship shall be treated as continuing intact while the Grantee is on sick leave or other bona fide leave of absence (to be determined in the discretion of the Compensation Committee).

3. Certain Terms of LTIP Units.

(a) The Company may, but is not obligated to, issue to the Grantee (or its assignee or transferee, as applicable) a certificate in respect of the LTIP Units or may indicate such Grantee's ownership of LTIP Units on the Company's books and records. Such certificate, if any, shall be registered in the name of the Grantee (or such assignee or transferee). The certificates for LTIP Units issued hereunder may include any legend which the Committee deems appropriate to reflect any restrictions on transfer hereunder, or pursuant to any assignment or transfer by the Grantee, or as the Compensation Committee may otherwise deem appropriate, and, without limiting the generality of the foregoing, shall bear a legend referring to the terms, conditions, and restrictions applicable to such LTIP Units, substantially in the following form:

THE TRANSFERABILITY OF THIS CERTIFICATE AND THE LTIP UNITS REPRESENTED HEREBY ARE SUBJECT TO THE TERMS AND CONDITIONS OF THE NATIONAL STORAGE AFFILIATES TRUST 2015 EQUITY INCENTIVE PLAN, THE PARTNERSHIP AGREEMENT AND AN AWARD AGREEMENT APPLICABLE TO THE GRANT OF THE LTIP UNITS REPRESENTED BY THIS CERTIFICATE. COPIES OF SUCH PLAN, PARTNERSHIP AGREEMENT AND AWARD ARE ON FILE IN THE OFFICES OF NSA OP, LP.

(b) Certificates, if any, evidencing the LTIP Units granted hereby shall be held in custody by the Company until the restrictions have lapsed. If and when such restrictions so lapse, the certificates shall be delivered by the Company to the Grantee.

(c) So long as the Grantee holds any LTIP Units, the Grantee shall disclose to the Company in writing such information as may be reasonably requested with respect to ownership of LTIP Units and any conditions applicable thereto, as the Company, as applicable, may deem reasonably necessary, including in order to ascertain and establish compliance with provisions of the Internal Revenue Code of 1986, as amended (the “Code”), applicable to the Company or to comply with requirements of any other appropriate taxing or other regulatory authority.

4. Compliance with Securities laws.

The Grantee acknowledges that the LTIP Units have not been registered under the Securities Act or under any state securities or “blue sky” law or regulation (collectively, "Securities Laws") and hereby makes the following representations and covenants as a condition to the grant of LTIP Units:

(a) The Grantee has not taken, and covenants that it will not take, himself or herself or through any agent acting on his behalf, any action that would subject the issuance or sale of the LTIP Units to the registration provisions of the Securities Act or to the registration, qualification or other similar provisions of any Securities Laws, or breach any of the provisions of any Securities Laws, but, rather, that the Grantee shall at all times act with regard to the LTIP Units in full compliance with all Securities Laws;

(b) The Grantee has acquired and, to the extent applicable, is acquiring the LTIP Units for his or her own account for investment and with no present intention of distributing the LTIP Units or any part thereof;

(c) The Grantee is and shall be an “accredited investor” as defined in Section 2(15) and Rule 501(a) of Regulation D of the Securities Act;

(d) The Grantee is capable of evaluating the merits and risks of the acquisition and ownership of the LTIP Units and has obtained all information regarding the Company (and its applicable affiliates) and the LTIP Units as the Grantee deems appropriate, and has relied solely upon such information, and the Grantee's own knowledge, experience and investigation, and those of his advisors, and not upon any representations of the Company, in connection with his investment decision in acquiring the LTIP Units; and

(e) The Grantee and his or her professional advisors have had an opportunity to conduct, and have so conducted if so desired, a due diligence investigation of the Company in connection with the decision to acquire the LTIP Units and in such regard have done all things as the Grantee and they have deemed appropriate and have had an opportunity to ask questions of and receive answers from the Company, and have done so, as they have deemed appropriate.

5. Miscellaneous.

(a) THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE, WITHOUT REGARD TO ANY PRINCIPLES OF CONFLICTS OF LAW WHICH COULD CAUSE THE APPLICATION OF THE LAWS OF ANY JURISDICTION OTHER THAN THE STATE OF DELAWARE.

(b) Except as set forth in the Partnership Agreement, the Grantee shall not have the right to transfer all or any portion of the LTIP Units without the prior written consent of the General Partner (in its sole discretion); provided, however, that the Grantee may transfer all or any portion of the Grantee's vested LTIP Units for bona fide estate planning purposes to an immediate family member or the legal representative, estate, trustee or other successor in interest, as applicable, of the Grantee. Any transfer in violation of this Agreement or the Partnership Agreement, or which does not otherwise comply with the conditions of transfer imposed by the General Partner shall be void.

(c) The Grantee shall be responsible for filing with the Internal Revenue Service an election under Section 83(b) of the Code on a form substantially similar to the form attached hereto as Annex C and reasonably satisfactory to the Company (and will include a copy thereof with the applicable tax return) within 30 days after the date hereof. The Grantee shall be solely responsible for the filing of such election and all related filings.

(d) The captions of this Agreement are not part of the provisions hereof and shall have no force or effect. This Agreement may not be amended or modified except by a written agreement executed by the parties hereto or their respective successors and legal representatives. The invalidity or unenforceability of any provision of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement.

(e) The Compensation Committee may make such rules and regulations and establish such procedures for the administration of this Agreement as it deems appropriate. Without limiting the generality of the foregoing, the Compensation Committee may interpret the Plan and this Agreement, with such interpretations to be conclusive and binding on all persons and otherwise accorded the maximum deference permitted by law. In the event of any dispute or disagreement as to interpretation of the Plan or this Agreement or of any rule, regulation or procedure, or as to any question, right or obligation arising from or related to the Plan or this Agreement, the decision of the Compensation Committee shall be final and binding upon all persons.

(f) All notices hereunder shall be in writing, and if to the Company or the Compensation Committee, shall be delivered to the Company or mailed to its principal office, addressed to the attention of the Compensation Committee; and if to the Grantee, shall be delivered personally, sent by facsimile transmission or mailed to the Grantee at the address appearing in the records of the Company. Such addresses may be changed at any time by written notice to the other party given in accordance with this paragraph 5(f).

(g) The failure of the Grantee or the Company to insist upon strict compliance with any provision of this Agreement or the Plan, or to assert any right the Grantee or the Company, respectively, may have under this Agreement or the Plan, shall not be deemed to be a waiver of such provision or right or any other provision or right of this Agreement or the Plan.

(h) Nothing in this Agreement shall confer on the Grantee any right to continue in the employ or other service of the Company or interfere in any way with the right of the Company or its affiliates to terminate the Grantee’s employment or other service at any time.

(i) The terms of this Agreement shall be binding upon the Grantee and upon the Grantee's heirs, executors, administrators, personal representatives, transferees, assignees and successors in interest and upon the Company and its successors and assignees, subject to the terms of the Plan.

(j) Notwithstanding anything to the contrary contained in this Agreement, to the extent that the board of trustees of the Company (the "Board") determines that an LTIP Unit or the Plan is subject to Section 409A of the Code and fails to comply with the requirements of Section 409A of the Code, the Compensation Committee reserves the right (without any obligation to do so or to indemnify the Grantee for failure to do so), without the consent of the Grantee, to amend or terminate this Agreement and the Plan and/or amend, restructure, terminate or replace the LTIP Unit in order to cause the LTIP Unit to either not be subject to Section 409A of the Code or to comply with the applicable provisions of such section.

(k) If, in the opinion of the independent trustees of the Board, the Company's financial results are restated due in whole or in part to intentional fraud or misconduct by one or more of the Company's executive officers, the Company's independent trustees may, based upon the facts and circumstances surrounding the restatement, direct that the Company recover all or a portion of, or cancel, the awards granted under this Agreement.

(l) This Agreement, together with the Plan and Partnership Agreement, contain the entire agreement between the parties with respect to the subject matter hereof and supersedes all prior agreements, written or oral, with respect thereto.

IN WITNESS WHEREOF, the Company and the Grantee have executed this Agreement as of the []th day of [], 20[].

National Storage Affiliates Trust

By: __

Name: __

Title: __

GRANTEE

By: ___

Name: ___

Title: ___

ANNEX A

Time Vested LTIP Units

Subject to Section 2 of this Agreement, the [] Time Vested LTIP Units shall otherwise vest on the following dates:

| Percentage (Amount) of Time Vested LTIP Units Awarded Hereunder | Vesting Date | ||||||||||

| []% ([]) | January 1, 20[] | ||||||||||

| []% ([]) | January 1, 20[] | ||||||||||

| []% ([]) | January 1, 20[] | ||||||||||

ANNEX B

Performance Vested LTIP Units

Subject to Section 2 of this Agreement, the [] Performance Vested LTIP Units shall be subject to the following vesting rules during the period between January 1, 20[] and December 31, 20[] (the "Performance Period") and shall vest on January 1, 20[], subject to the achievement of certain performance criteria as set forth below:

1. As to [] of the Performance Vested LTIP Units Granted:

| 3-Year Relative TSR vs MSCI US REIT Index (RMS) | Vesting Percentage | Number of Performance Vested LTIP Units | |||||||||

| "Minimum Level" |

35th Percentile

|

[]% | [] | ||||||||

| "Target Level" |

55th Percentile

|

[]% | [] | ||||||||

| "Maximum Level" |

75th Percentile

|

[]% | [] | ||||||||

In the event the 3-Year Relative TSR vs. MSCI US REIT Index falls between the 35th and 55th percentile, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall be determined using a straight line linear interpolation between []% and []% and in the event that the 3-Year Relative TSR vs. MSCI US REIT Index falls between the 55th and 75th percentile, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall be determined using a straight line linear interpolation between []% and []%. In the event the 3-Year Relative TSR vs. MSCI US REIT Index is below the 35th percentile, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall equal 0% of the "Maximum Level" Performance Vested LTIP Units. In the event the 3-Year Relative TSR vs. MSCI US REIT Index exceeds the 75th percentile, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall equal []% of the "Maximum Level" Performance Vested LTIP Units.

2. As to [] of the Performance Vested LTIP Units Granted:

| 3-Year Relative TSR vs SS Peer Companies | Vesting Percentage | Number of Performance Vested LTIP Units | |||||||||

| "Minimum Level" |

4th Place

|

[]% | [] | ||||||||

| "Target Level" | 110% of SS Peer Companies’ Average TSR | []% | [] | ||||||||

| "Maximum Level" |

1st Place

|

[]% | [] | ||||||||

For purposes of determining the target level, in the event that the simple average of the SS Peer Companies’ TSR is a negative figure, the target level shall be the average of the SS Peer Companies’ TSR plus 10% of the absolute value of that average. In the event the 3-Year Relative TSR vs. the SS Peer Companies is 2nd or 3rd Place and less than the target level, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall be determined using a straight line linear interpolation between []% and []% and in the event that the 3-Year Relative TSR vs. the SS Peer Companies is 2nd or 3rd Place and greater than the target level, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall be determined using a straight line linear interpolation between []% and []%. In the event the 3-Year Relative TSR vs. the SS Peer Companies is below 4th Place, the Vesting Percentage and number of Performance Vested LTIP Units vesting shall equal 0% of the "Maximum Level" Performance Vested LTIP Units.

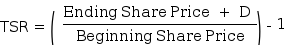

3. For purposes of this Annex B, TSR performance will be calculated as the compounded annual growth rate, expressed as a percentage (rounded to the nearest tenth of a percent (0.1%)), in the value per share of common stock during the Performance Period due to the appreciation in the price per share of common stock and dividends paid during the Performance Period, assuming dividends are reinvested. The Absolute TSR Percentage is calculated as follows:

Absolute TSR Percentage = (1*(1 + Cumulative TSR))^(1/3) -1

•Where "Cumulative TSR" = ((1*(1 + TSR Year 1)*(1 + TSR Year 2)*(1 + TSR Year 3)) -1)

•For purposes of the Cumulative TSR calculation, "TSR" for a given year shall be calculated as follows:

Where “D” is the amount of dividends paid to a shareholder of record with respect to one share of common stock during the Performance Period. For purposes of the calculation above, the "Ending Share Price" for the last year (third year) of performance shall be based on a 20 day trailing average closing stock price.

The Absolute TSR Percentage of National Storage Affiliates Trust will be compared with the Absolute TSR Percentage of each company in the MSCI US REIT Index and each SS Peer Company. The relative performance of National Storage Affiliates Trust versus the other companies in the MSCI US REIT Index will be expressed in terms of relative percentile ranking, which shall be applied as set forth in the table in

Section 1 above. The relative performance of National Storage Affiliates Trust versus the other SS Peer Companies will be expressed as a relative numerical ranking against the other SS Peer Companies, and if applicable comparison of relative TSR against 110% of SS Peer Companies’ Average TSR, in each case which shall be applied as set forth in the table in Section 2 above.

4. For purposes of Section 2 of this Annex B, the "SS Peer Companies" are:

•CubeSmart

•Extra Space Storage Inc.

•Life Storage, Inc.

•Public Storage

In order for a SS Peer Company to be included in the relative calculation for ascertaining the level of relative TSR performance under Section 2 of this Annex B, the SS Peer Company must be present for the entire Performance Period (i.e., a SS Peer Company that is, for example, acquired during the Performance Period, shall be entirely omitted from the calculation).

ANNEX C

[], 20[]

CERTIFIED MAIL RETURN

RECEIPT REQUESTED

Re: Section 83(b) Election

Dear Sir or Madam:

Pursuant to Section 83(b) of the Internal Revenue Code of 1986, as amended (the “Code”), and the Treasury Regulations promulgated thereunder, the undersigned (the “Taxpayer”) files the following statement for the purpose of making, with respect to the property described below, the election permitted by Section 83(b):

1. Name, address, taxpayer identification number and the taxable year of the Taxpayer:

Name: ___

Address: ___

___

T.I.N.: ___

Taxable Year: ___

2. Description of the property with respect to which this election is being made: ____ units (“LTIP Units”) of interest in certain allocations and distributions of National Storage Affiliates Trust, a Maryland real estate investment trust (the “Company”). ______ of such LTIP Units are subject to restriction.

3. The date on which the property was acquired by the Taxpayer and the taxable year for which the election is being made: The Taxpayer acquired the LTIP Units on ___________. The taxable year for which the election is made is the calendar year _____.

4. The nature of the restrictions to which the property is subject: LTIP Units are subject to time-based and performance vesting. LTIP Units are subject to forfeiture in the event of certain terminations of the Taxpayer’s service with the Company.

5. The fair market value at the time of the acquisition (determined without regard to any restriction other than a restriction which by its terms will never lapse) of the property with respect to which the election is being made: At the time of the acquisition, the LTIP Units had a fair market value of $[0] per unit.

6. The amount paid for such property: The LTIP Units were acquired for a purchase price of $[0] per unit.

7. Copies of this statement have been furnished to the person for whom the services are to be performed. Also, one copy of this statement will be submitted with the income tax return of the Taxpayer making this election for the taxable year in which the property was acquired.

Very truly yours,

______________